How to get URL link on X (Twitter) App

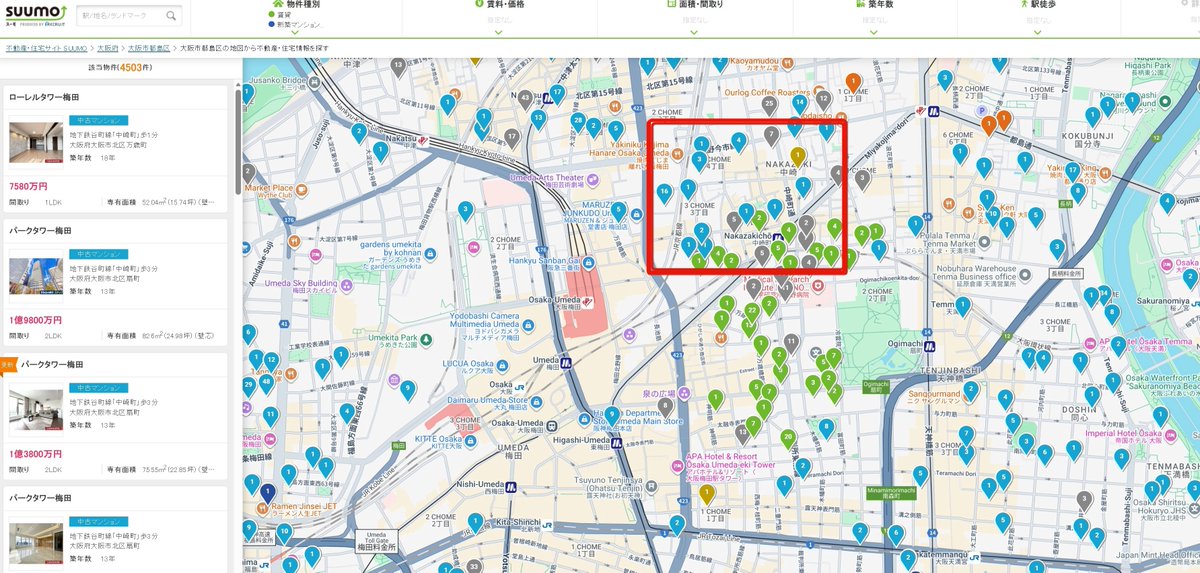

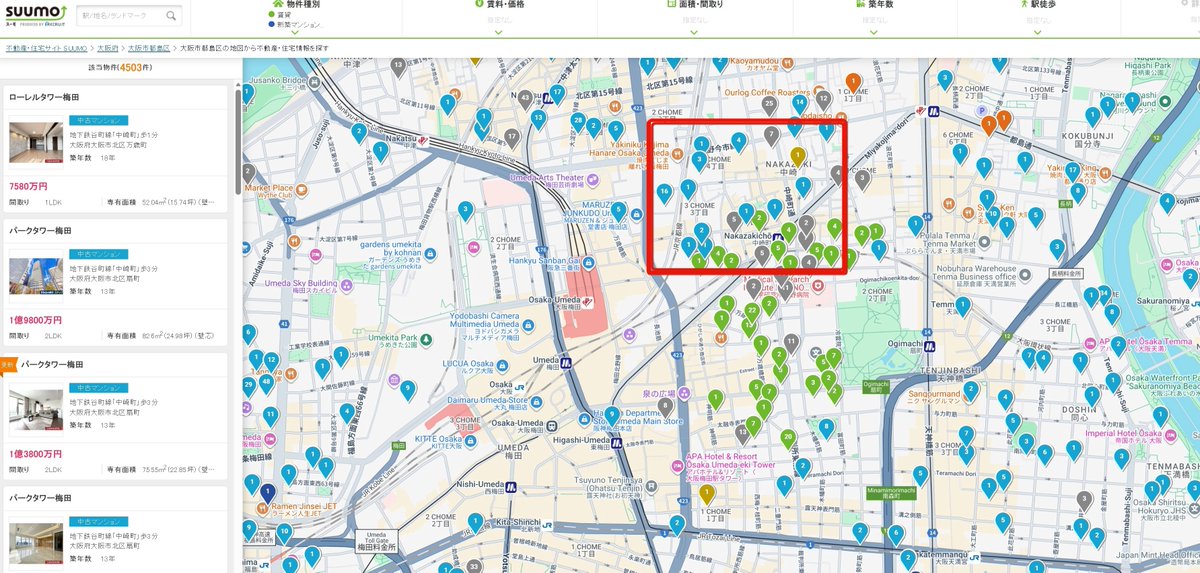

$300/month in an outstanding (truly) location. Tiny room, but good enough for a bed and desk.

$300/month in an outstanding (truly) location. Tiny room, but good enough for a bed and desk.

When one of these legacy marketing professionals tells you how to manage your own career, do not listen to them.

When one of these legacy marketing professionals tells you how to manage your own career, do not listen to them.

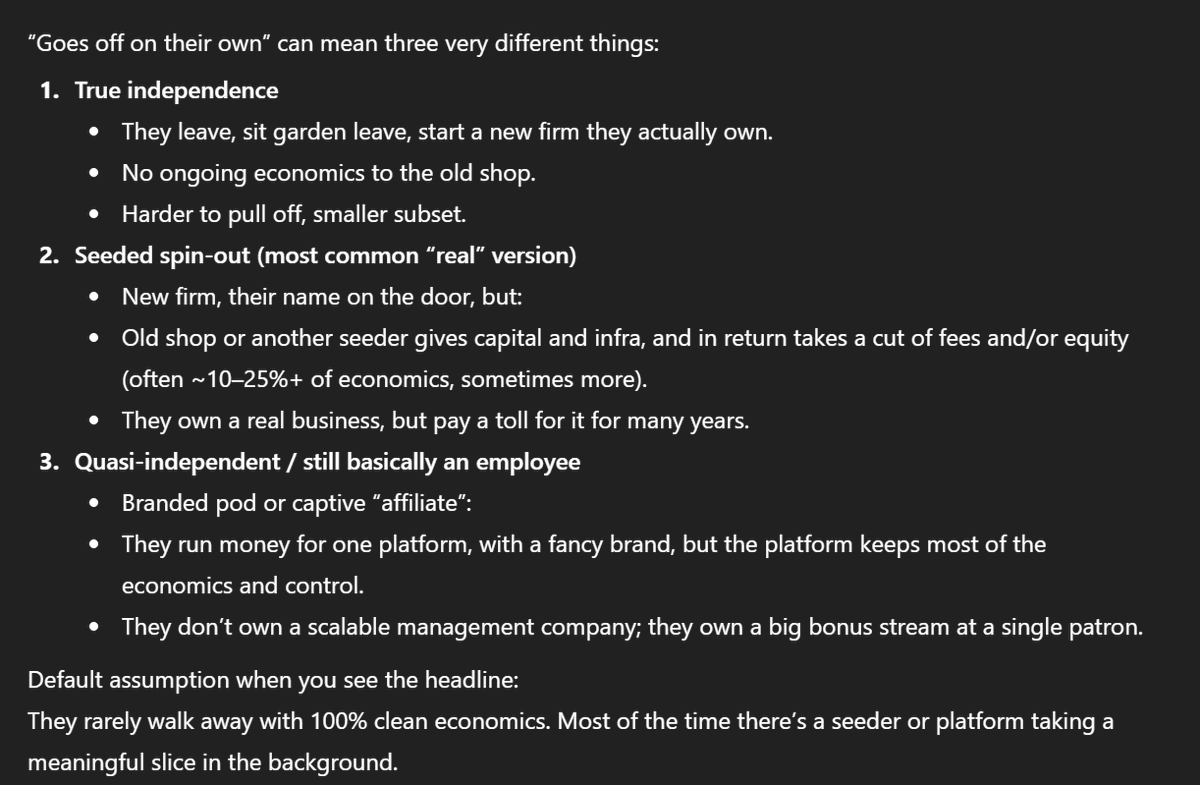

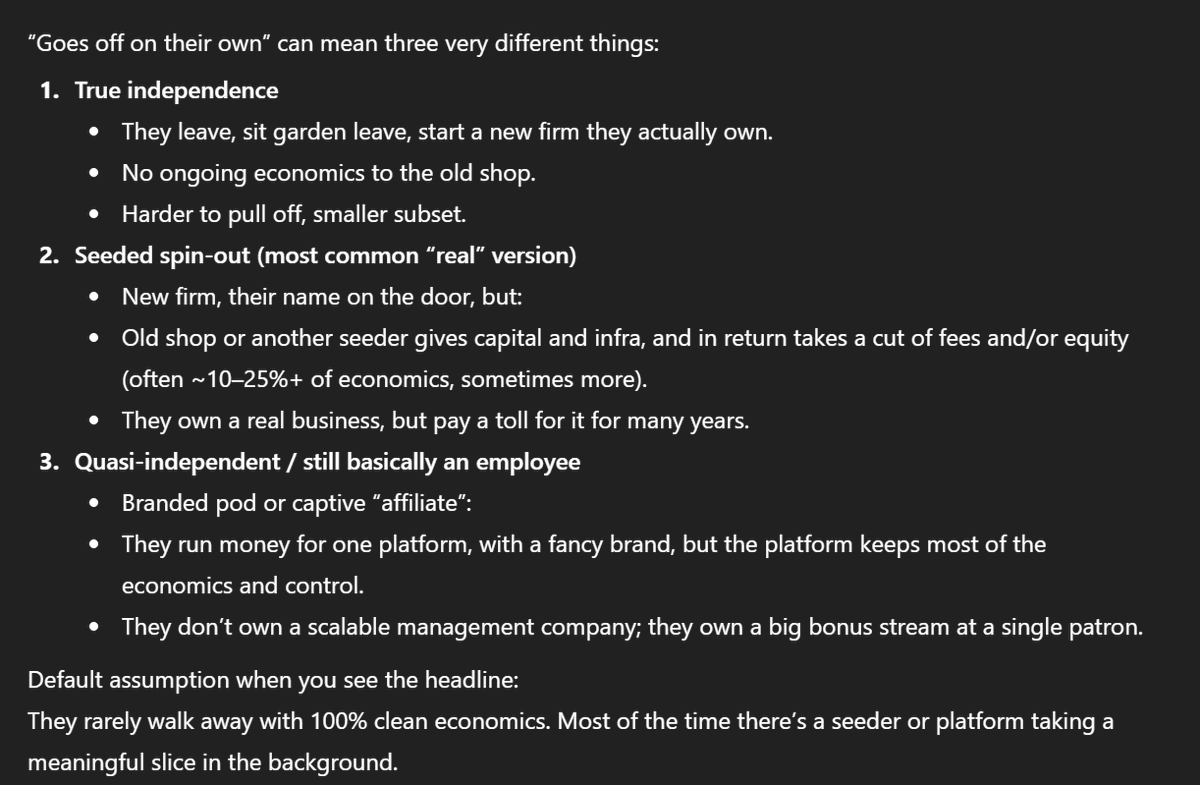

The major investing shops are psychopathic in how they operate.

The major investing shops are psychopathic in how they operate.

On the other hand, I've been shorting a diamond mine all year. Diamonds have kept going down. And I have been adding to that short.

On the other hand, I've been shorting a diamond mine all year. Diamonds have kept going down. And I have been adding to that short.

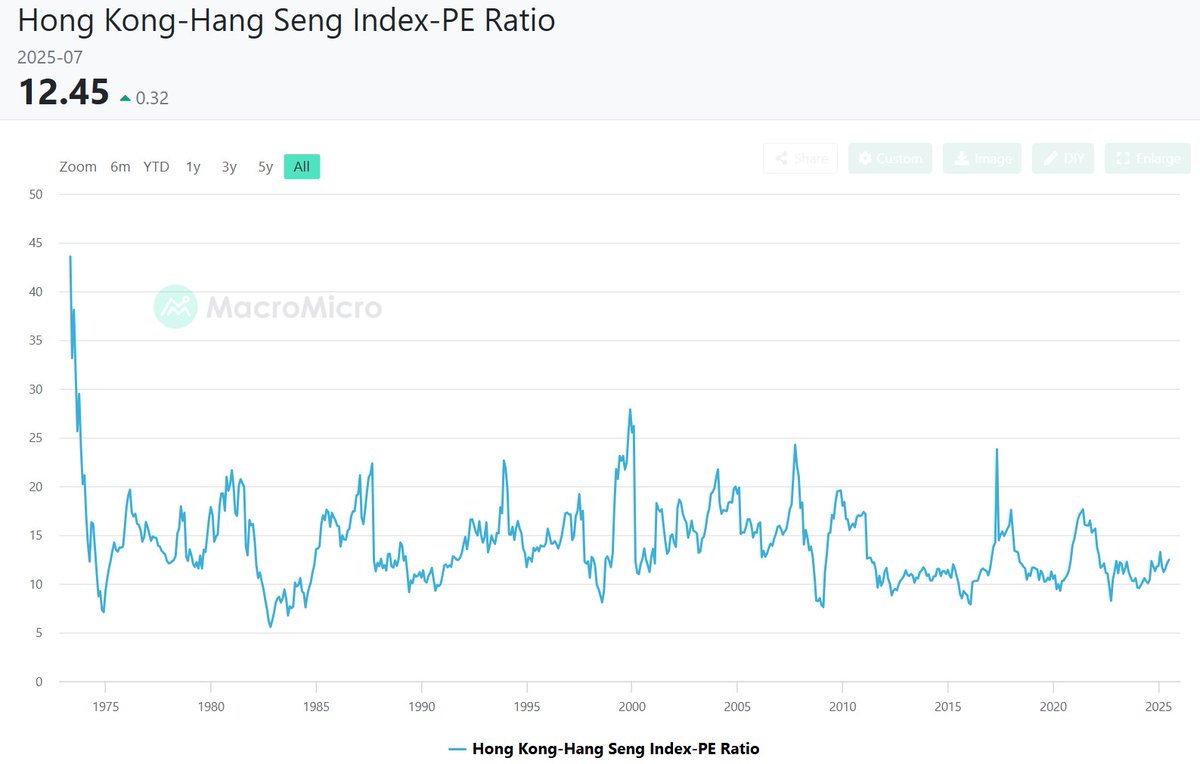

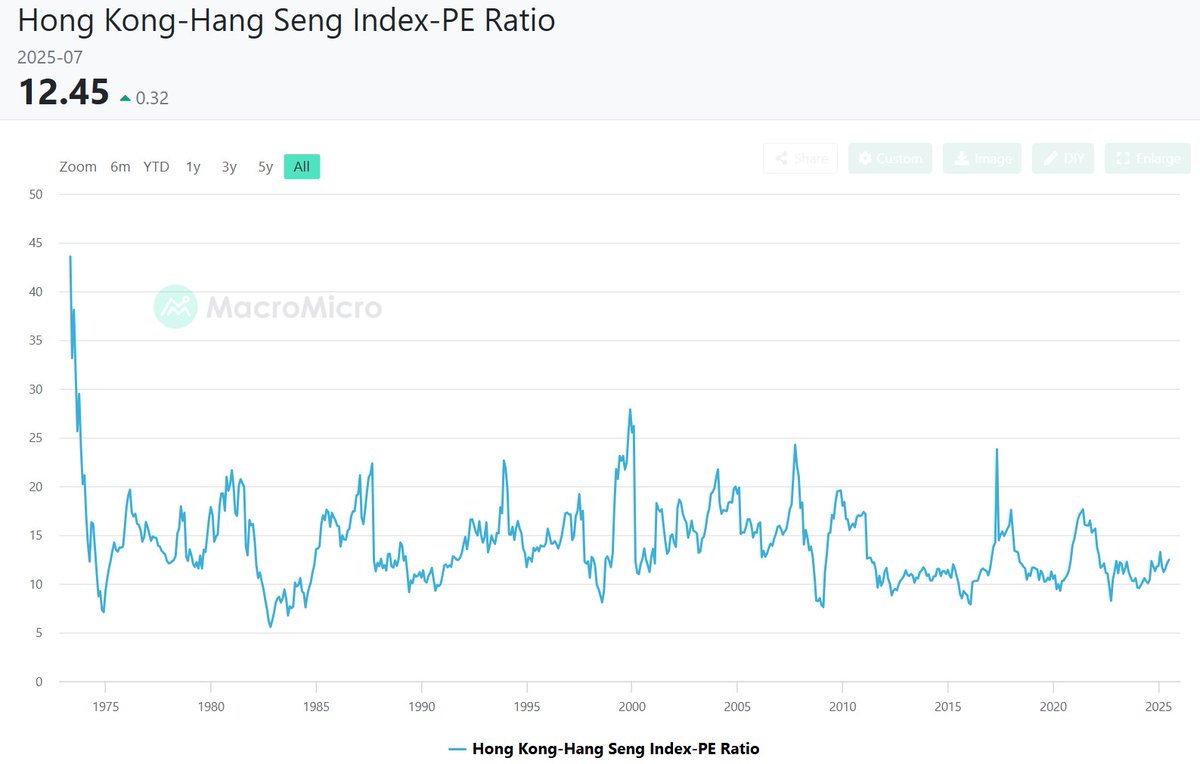

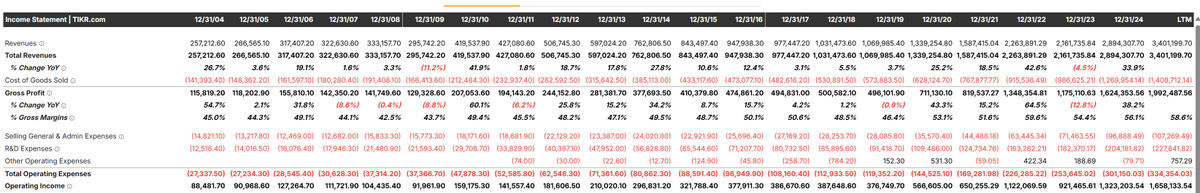

This post is really to say, of course, that China's rally seems very questionable. If last time shareholders got a terrible return at 12x earnings, why should the situation be different this time, if not worse?

This post is really to say, of course, that China's rally seems very questionable. If last time shareholders got a terrible return at 12x earnings, why should the situation be different this time, if not worse?

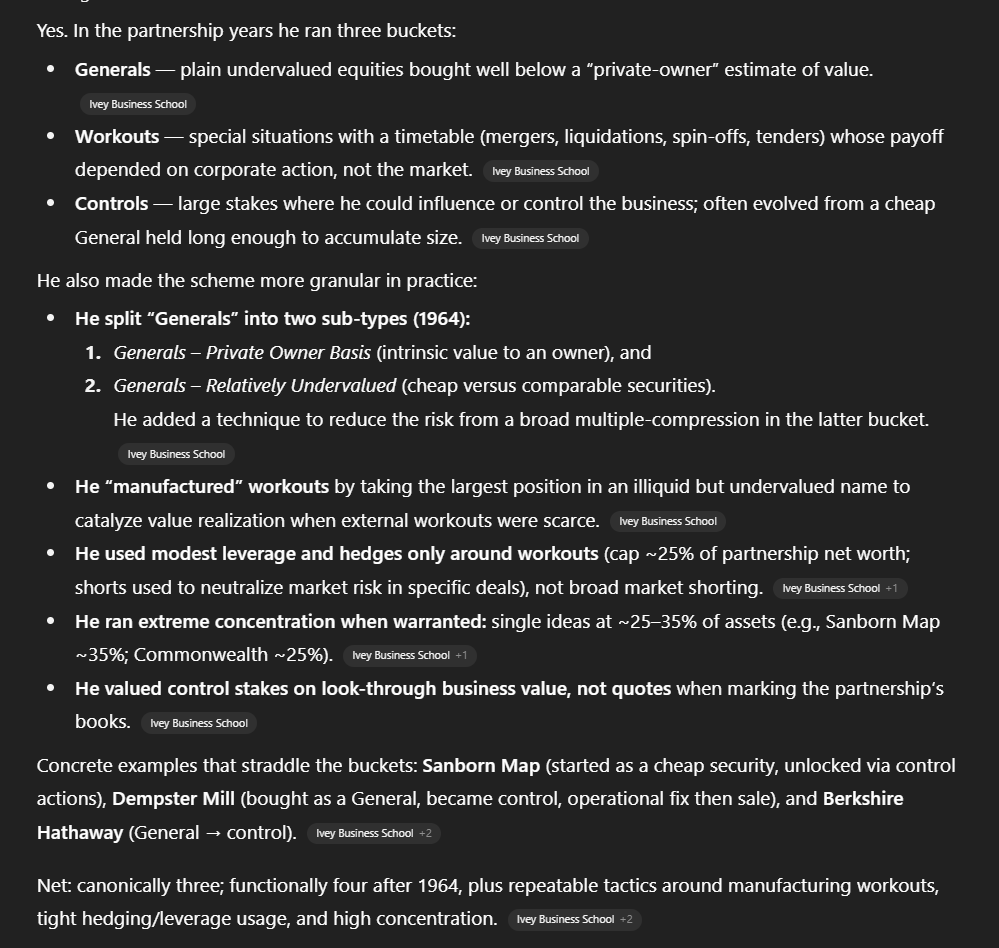

What do Bitcoin and Costco have in common? They're both considered the generals of their category.

What do Bitcoin and Costco have in common? They're both considered the generals of their category.

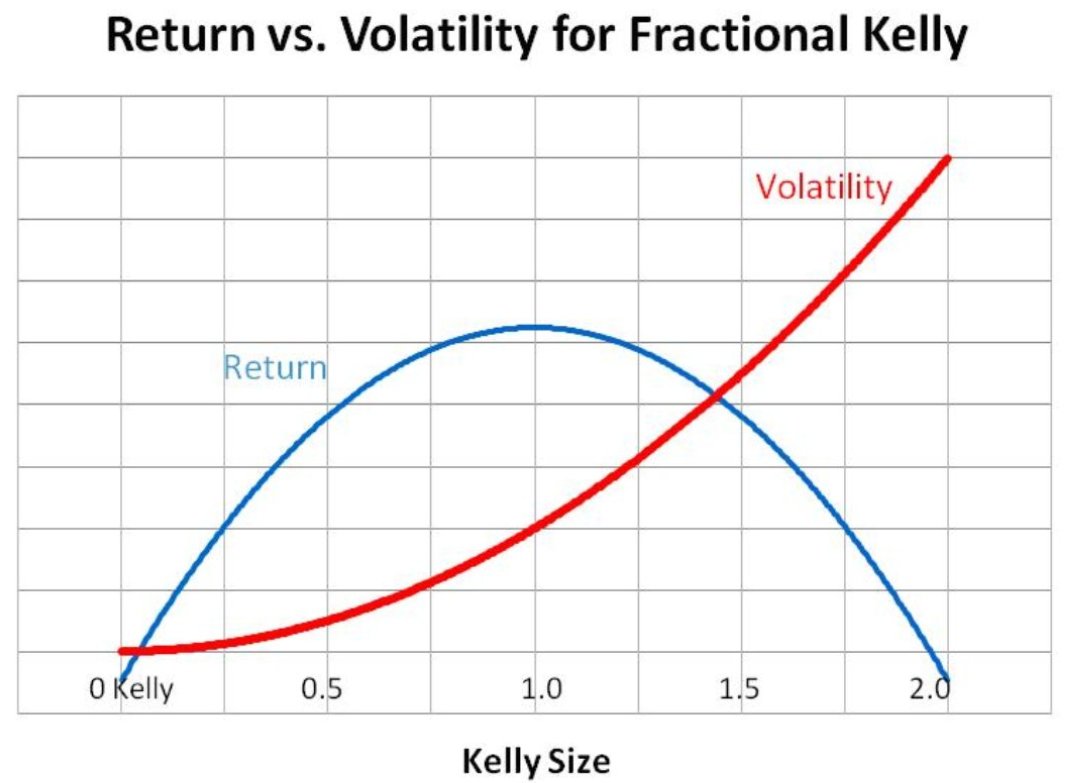

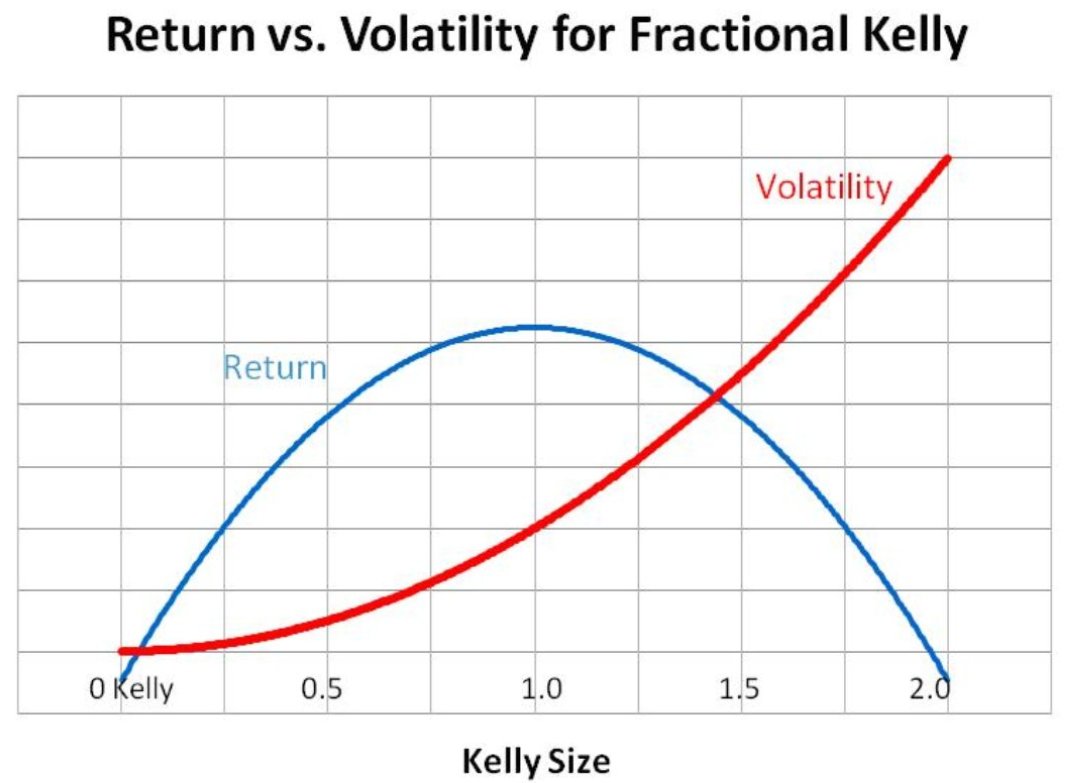

It's impossible to put a hard number on what the true Kelly size is. Edges on bets are not fully known. So is downside risk. Correlations between bets isn't even that clear. And all of this constantly changes.

It's impossible to put a hard number on what the true Kelly size is. Edges on bets are not fully known. So is downside risk. Correlations between bets isn't even that clear. And all of this constantly changes.

https://twitter.com/walt373/status/1941969351822717421This is the key way to use leverage well. If you're only 40% gross long - both in terms of beta adjusted and the raw gross - then you're so unlikely to drawdown even as much as the market generally during a meltdown. Never mind having a crazy blowup. The only way that's really even possible is concentration, which also does not mix with leverage.

From my Q3 2023 hedge fund letter,

From my Q3 2023 hedge fund letter,