Claims:

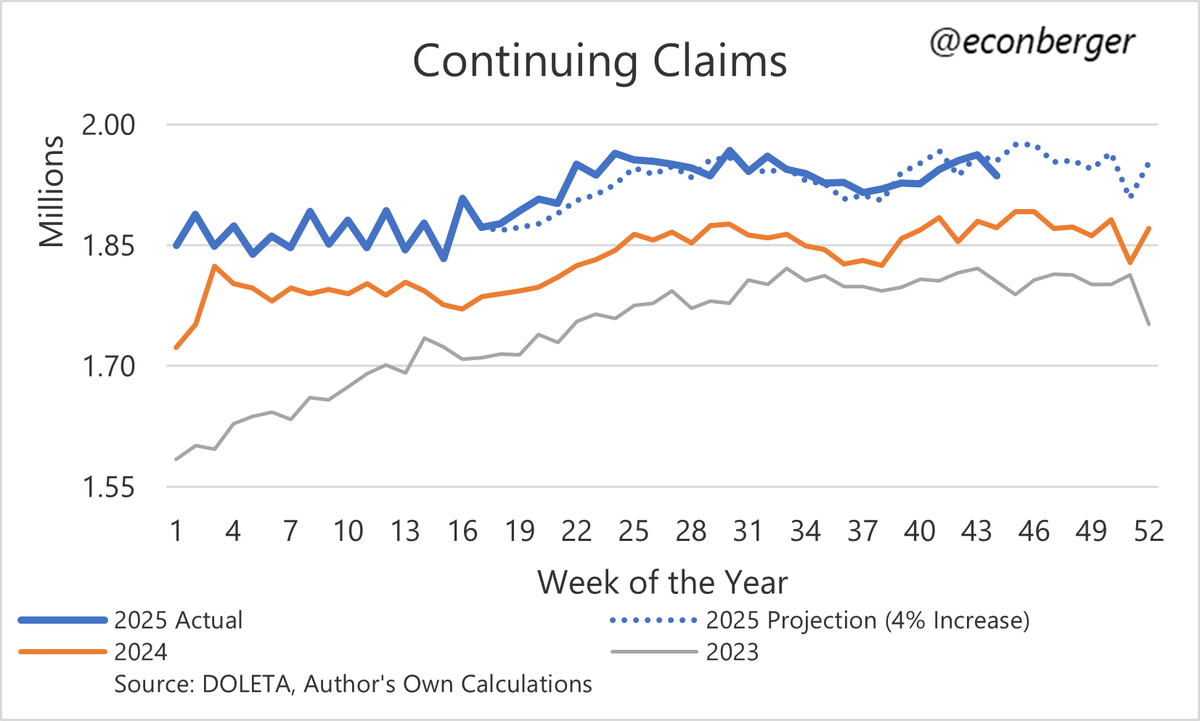

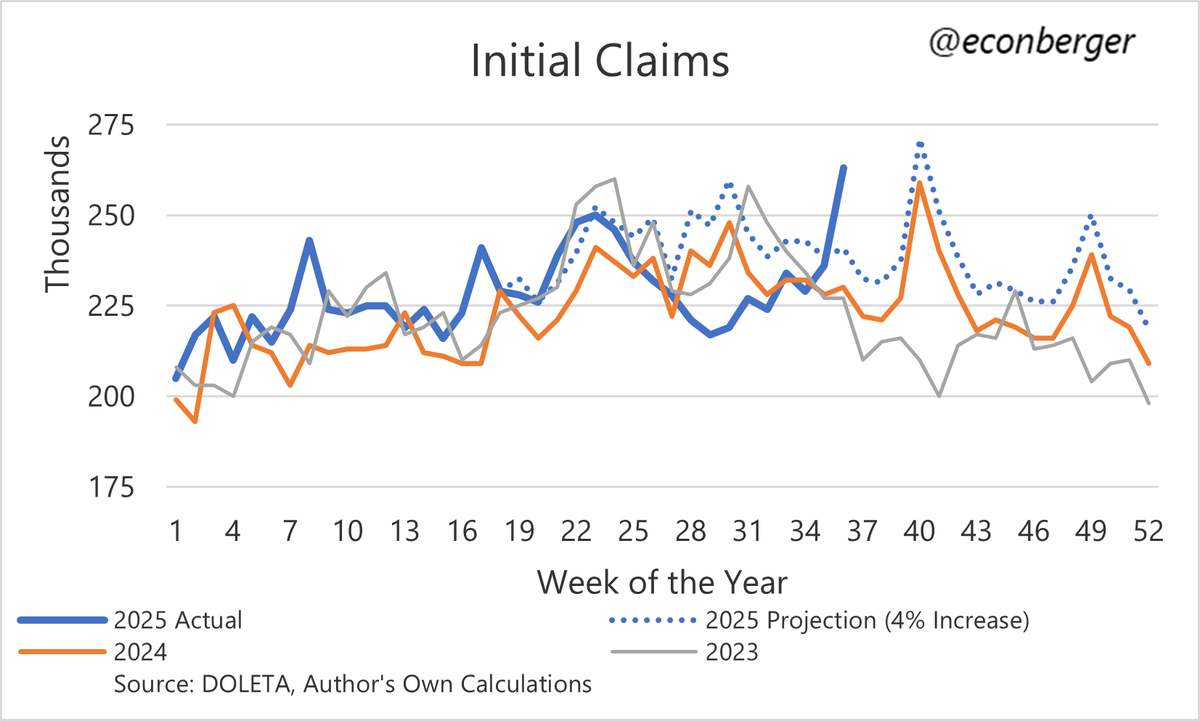

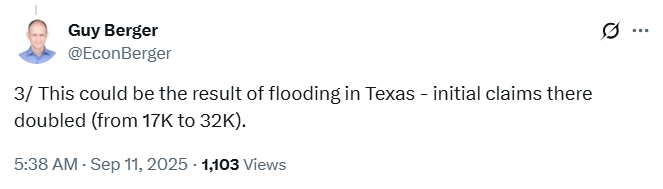

1/ Good news. The continuing claims scare of May/June faded further... continuing claims fell below my benchmark (which assumes a ~4% Y/Y increase).

They're likely to be (misleadingly) flattish for the remainder of the year, due to residual seasonality.

1/ Good news. The continuing claims scare of May/June faded further... continuing claims fell below my benchmark (which assumes a ~4% Y/Y increase).

They're likely to be (misleadingly) flattish for the remainder of the year, due to residual seasonality.

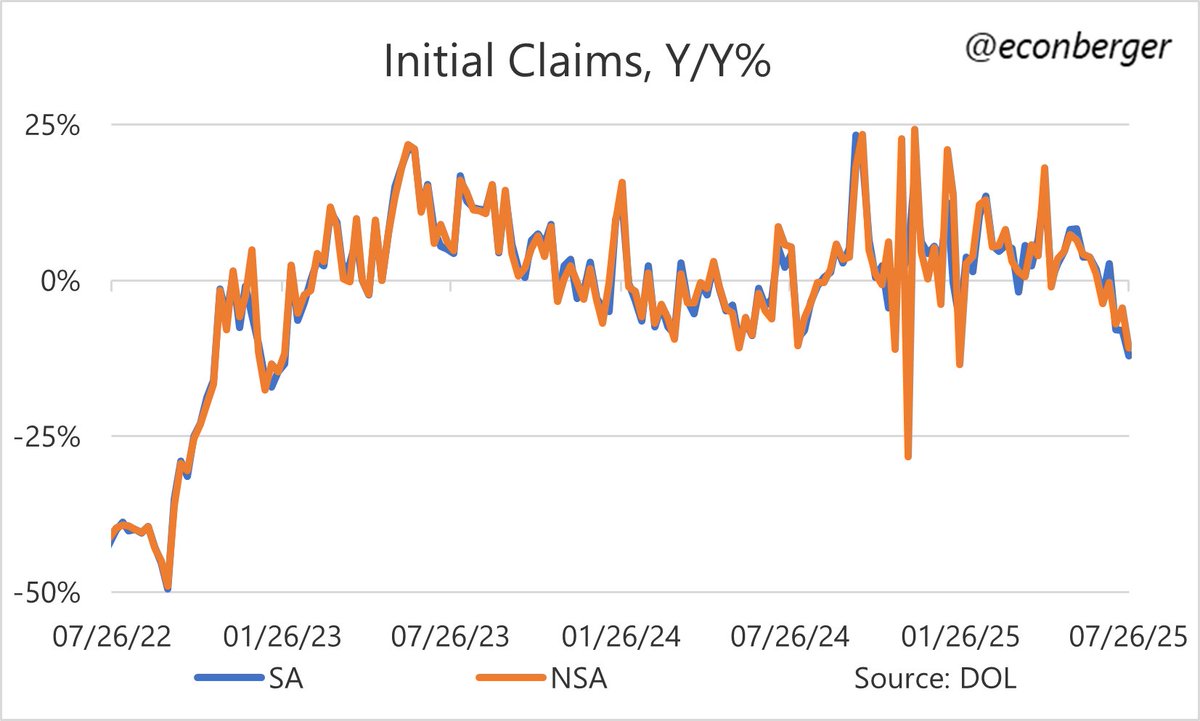

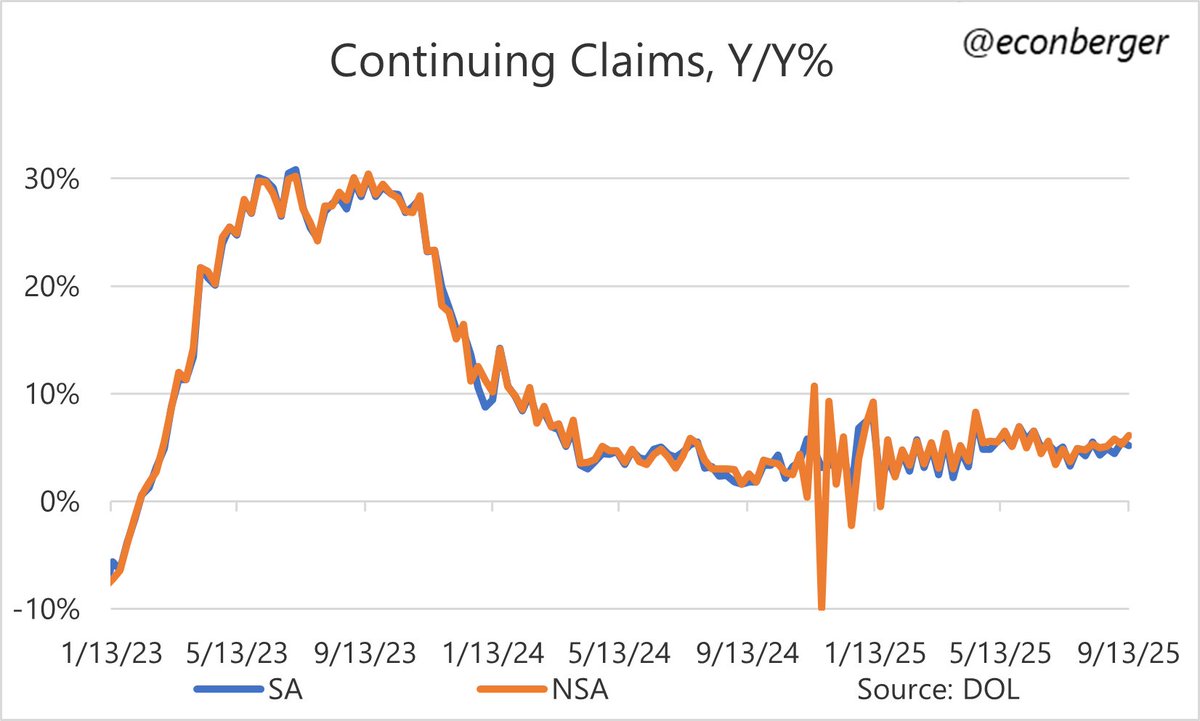

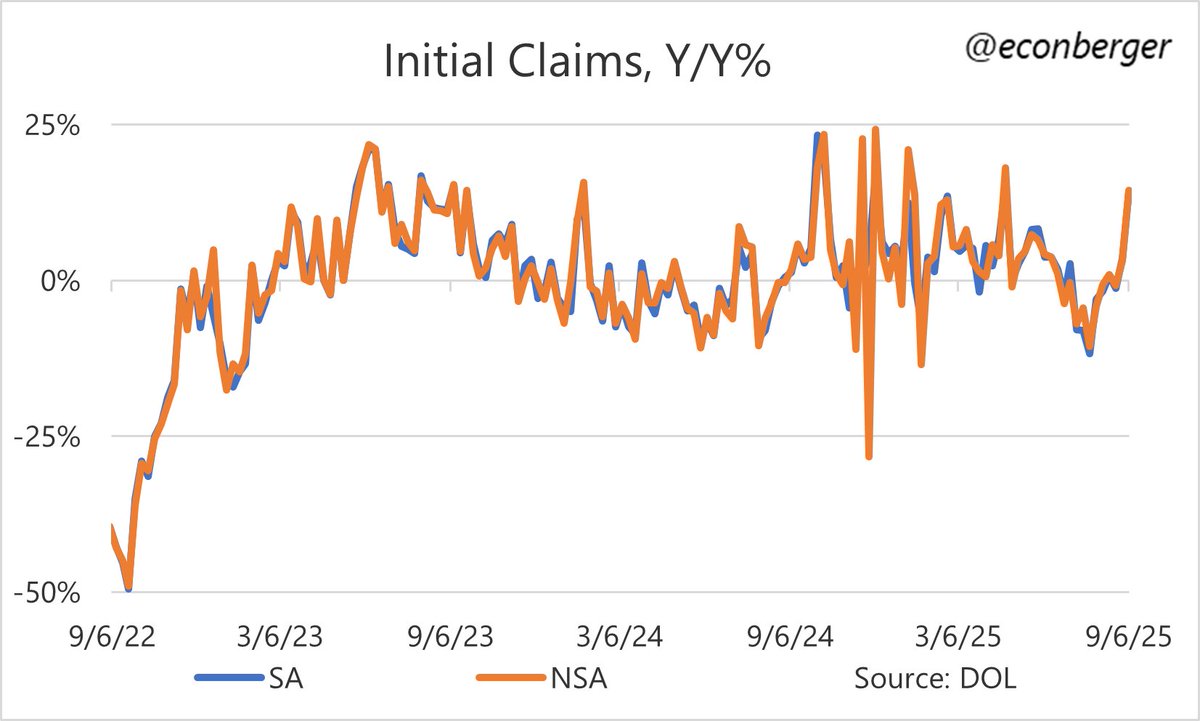

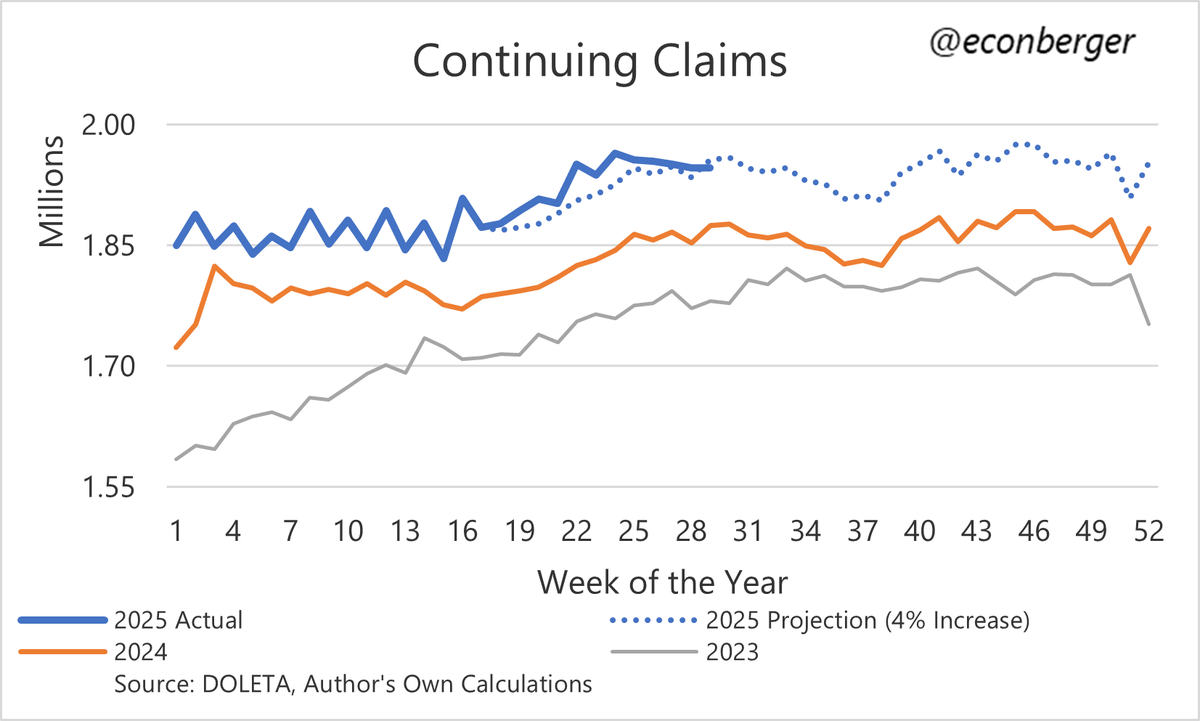

2/ Another way of seeing this: continuing claims were up about 4% Y/Y - comparable to before the scare.

That's still not *great*, reflecting a very mild ongoing deterioration. But that's not what got us worried two months ago.

That's still not *great*, reflecting a very mild ongoing deterioration. But that's not what got us worried two months ago.

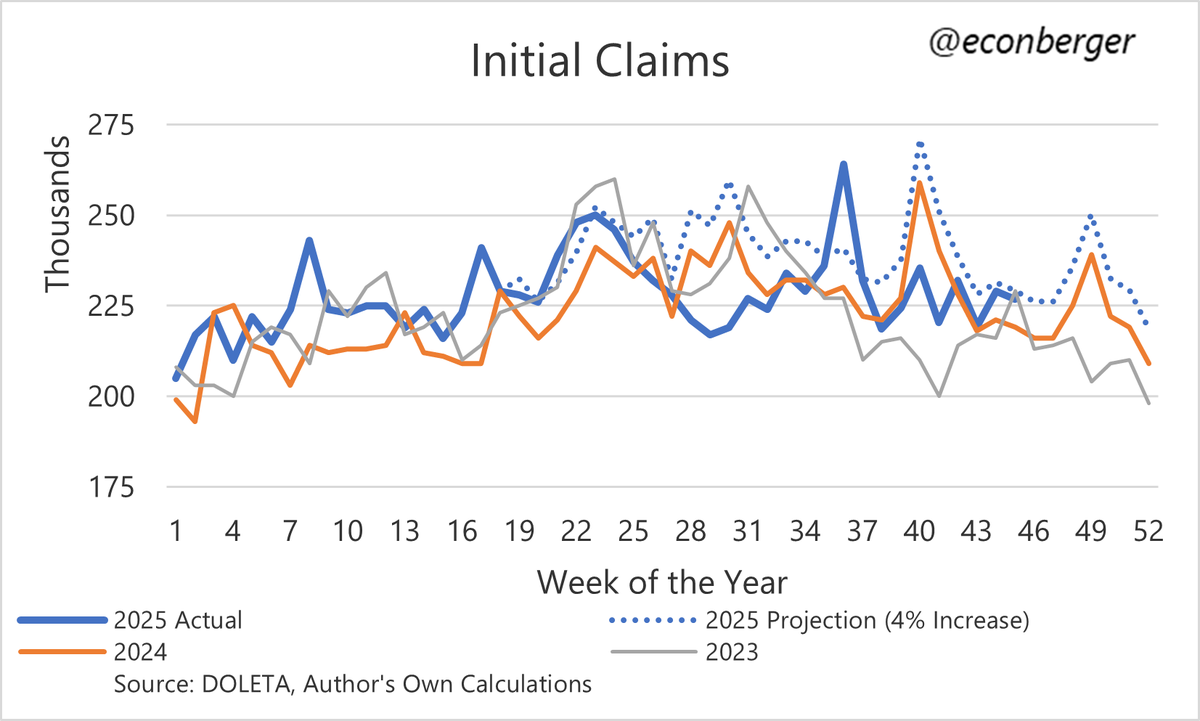

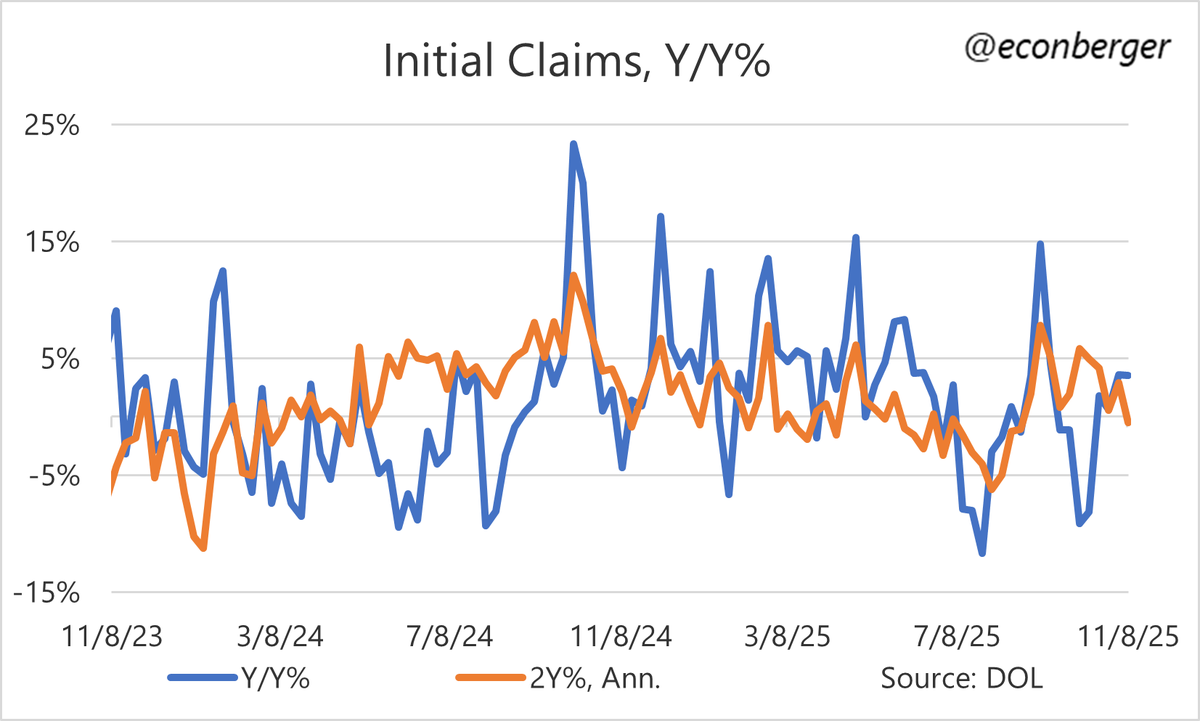

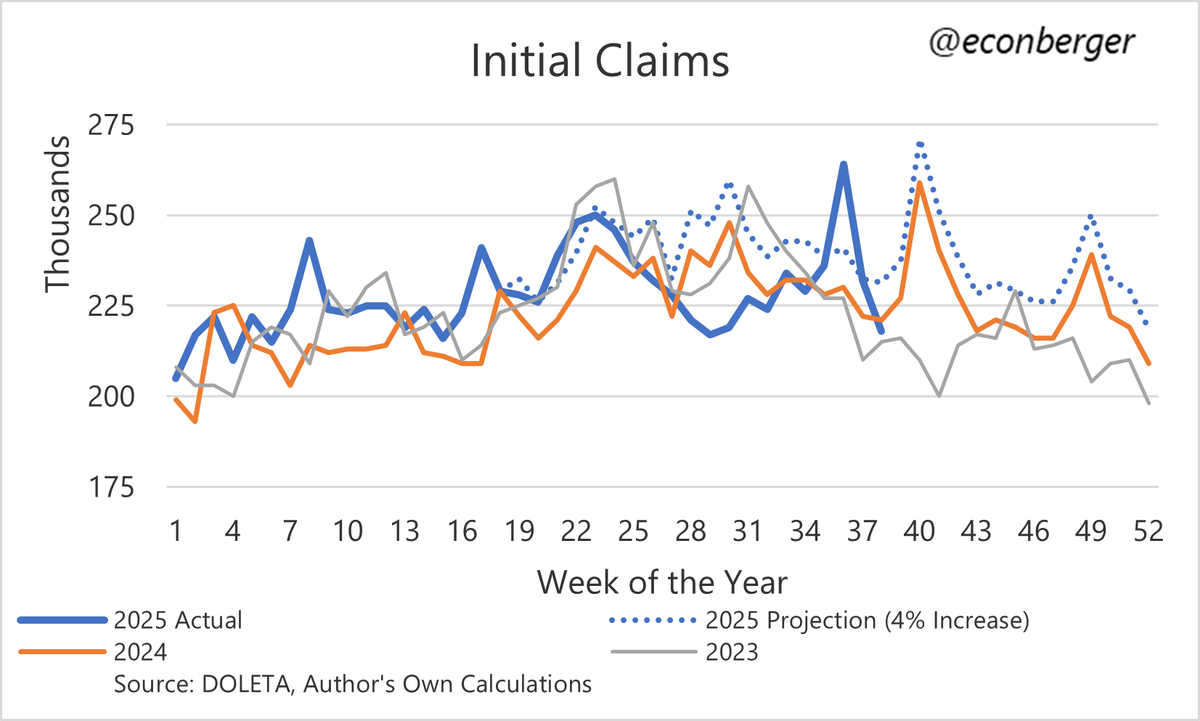

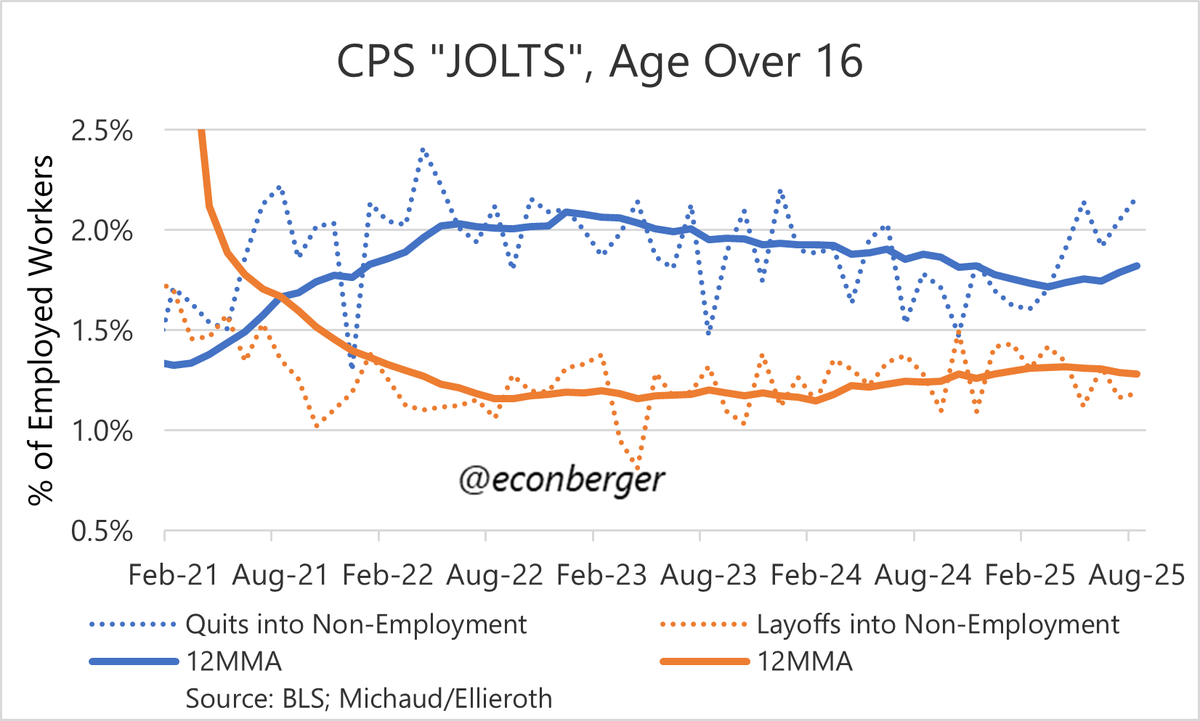

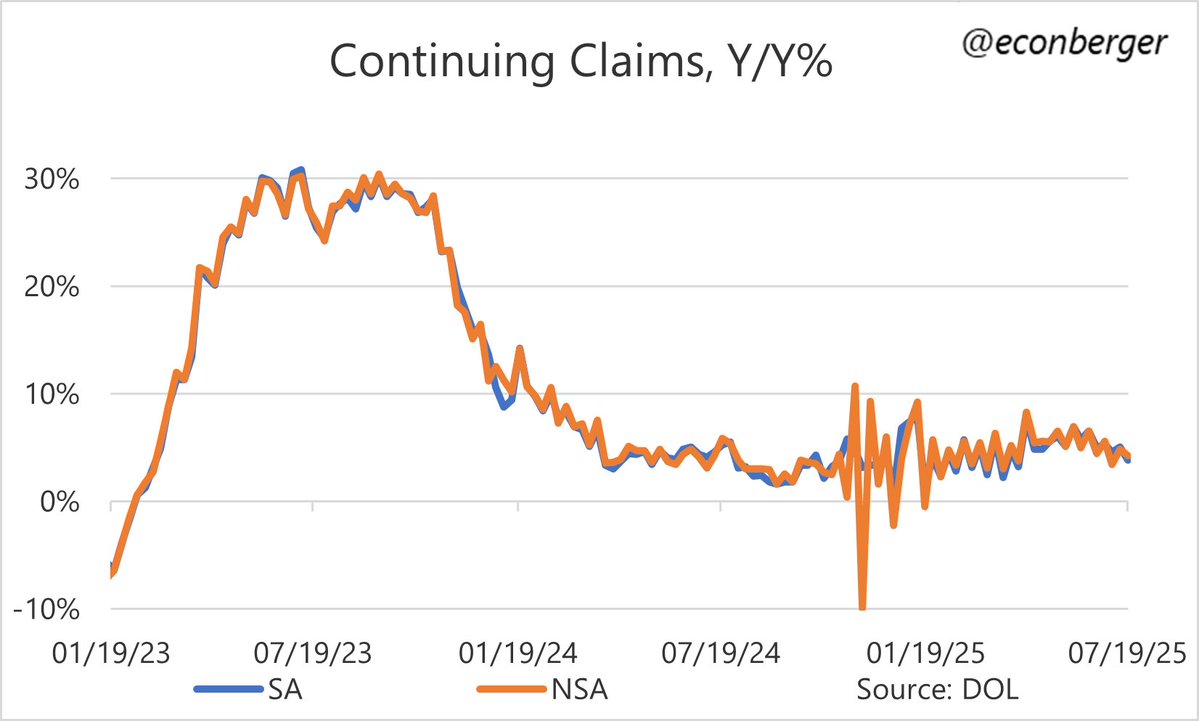

3/ Initial claims continue to run not only below my benchmark, but below the last two years.

Layoffs appear to be coming down; we'll see if other data sources confirm this development in a few weeks.

Layoffs appear to be coming down; we'll see if other data sources confirm this development in a few weeks.

• • •

Missing some Tweet in this thread? You can try to

force a refresh