Nayara Energy, India's second-largest oil refinery, is in serious trouble. The Indo-Russian venture is caught in the crossfire of EU sanctions against Russia, and it's creating a cascade of problems that could reshape India's energy landscape.🧵👇

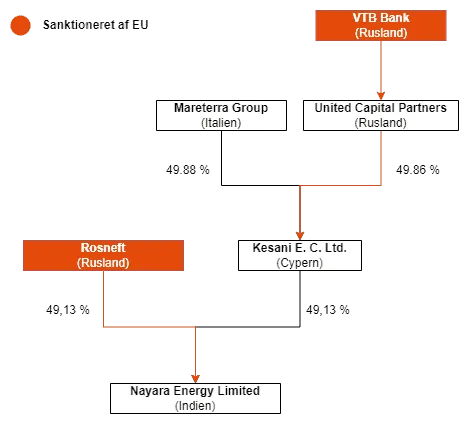

The crisis stems from Nayara's ownership structure. Back in 2017, debt-laden Essar sold its 98% stake in what was then Essar Oil to two entities - each getting 49.13%. One was Russia's Rosneft. The other was Kesani, jointly owned by Italian fund Maraterra and Russian fund UCP.

After the sale, Essar Oil became Nayara Energy. Today it owns a Gujarat refinery processing 20 million tonnes annually - that's 8% of India's refining capacity - plus 6,750 petrol pumps. But the Russian owners wanted out, struggling to repatriate profits due to sanctions.

Rosneft announced in 2024 it wanted to offload its stake for $20 billion. The problem? Sanctions made profit repatriation tricky, and Indian law requires RBI approval for foreign owners to take back profits. Most profits were simply reinvested back in India.

Major players passed on the steep $20 billion asking price. Adani, Saudi Aramco, ONGC, and Indian Oil Corporation all declined. That left Reliance as the main suitor - a deal that could make it India's largest oil refiner, surpassing IOC.

Strategically, the acquisition made perfect sense for Reliance. Nayara's Vadinar refinery sits just 15 km from Reliance's Jamnagar complex. Plus, Nayara has a much stronger distribution network - nearly three times more petrol pumps than Reliance.

But on July 18, the EU hit Russia with far stricter sanctions as the Ukraine conflict worsened, effectively killing the deal. These weren't just tighter price caps - they represented a fundamental shift in how the EU approaches Russian energy.

The sanctions began in 2022 with a novel strategy - a $60 price cap on Russian oil. The goal was delicate: keep Russian oil flowing to maintain stable global prices, but ensure Russia wouldn't profit. Third parties like India were meant to capture the upside.

But the war continued, and sanctions evolved. The EU gradually reduced dependence on Russian energy, aiming to eliminate it wholesale by 2027. Russian oil exports to EU dropped from 155 million tonnes in 2021 to just 24 million tonnes in 2024.

The latest sanctions lowered the price cap to $47.60 and blacklisted 14 individuals and 41 entities accused of boosting Russian military power. Nayara Energy made the blacklist, sending a clear message to Russian-owned entities in friendly countries.

The sanctions hit multiple fronts: Russian-owned entities face frozen assets, crude oil from these entities can't be sold to EU, shipping vessels connected to them are banned from European ports, and software/industrial goods suppliers face sanctions.

The immediate impact on Nayara was severe. Over recent days, three oil vessel owners terminated contracts. Oil-laden vessels were stranded at sea, cut off from European ports. Microsoft briefly cut IT services before restoring them after two days.

Internally, the company is hemorrhaging leadership. A CEO, three directors, and two senior executives all quit in July. The refinery is now operating at 70-80% capacity, down from over 100% just months ago as external support evaporates.

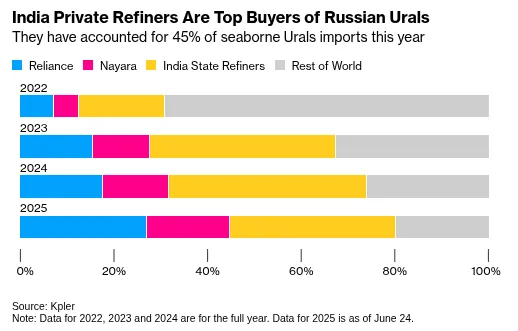

Nayara called the sanctions "unjust," especially since profits never actually went to Russia. But Russian crude makes up 70% of Nayara's imports, making it a key revenue source - a number too high for the EU to ignore.

The company is adapting by diversifying imports - a supertanker of Iraqi crude just arrived this week. It's also demanding advance payments from buyers to prevent contract cancellations. But long-term implications remain unclear.

Structurally, Nayara may weather this storm. In FY23, it hardly exported any oil to Europe. Over 80% goes to Asia, Africa, and the Middle East, with heavy focus on the growing Indian market for future growth.

This crisis reflects India's broader energy dilemma. We import most of our oil, and Russian crude now accounts for 30-35% of imports, up from just 2% in FY2022. The Ukraine mess became India's economic gift - but it's a geopolitical nightmare.

India faces an impossible choice: maintain ties with the EU (our second-largest trading partner and fellow China rival) while preserving Russian energy relations. As conflicts escalate, walking this tightrope while ensuring energy security gets increasingly difficult.

We cover this and one more interesting story in today's edition of The Daily Brief. Watch on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts.

All links here:thedailybrief.zerodha.com/p/nayara-is-un…

All links here:thedailybrief.zerodha.com/p/nayara-is-un…

• • •

Missing some Tweet in this thread? You can try to

force a refresh