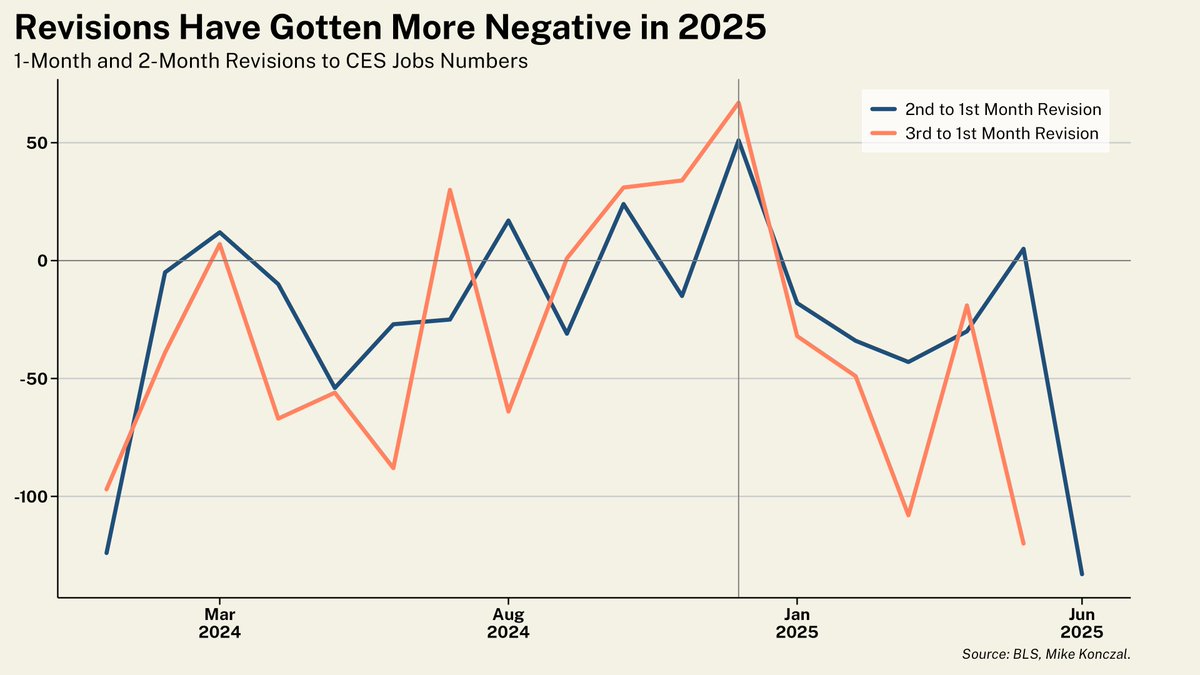

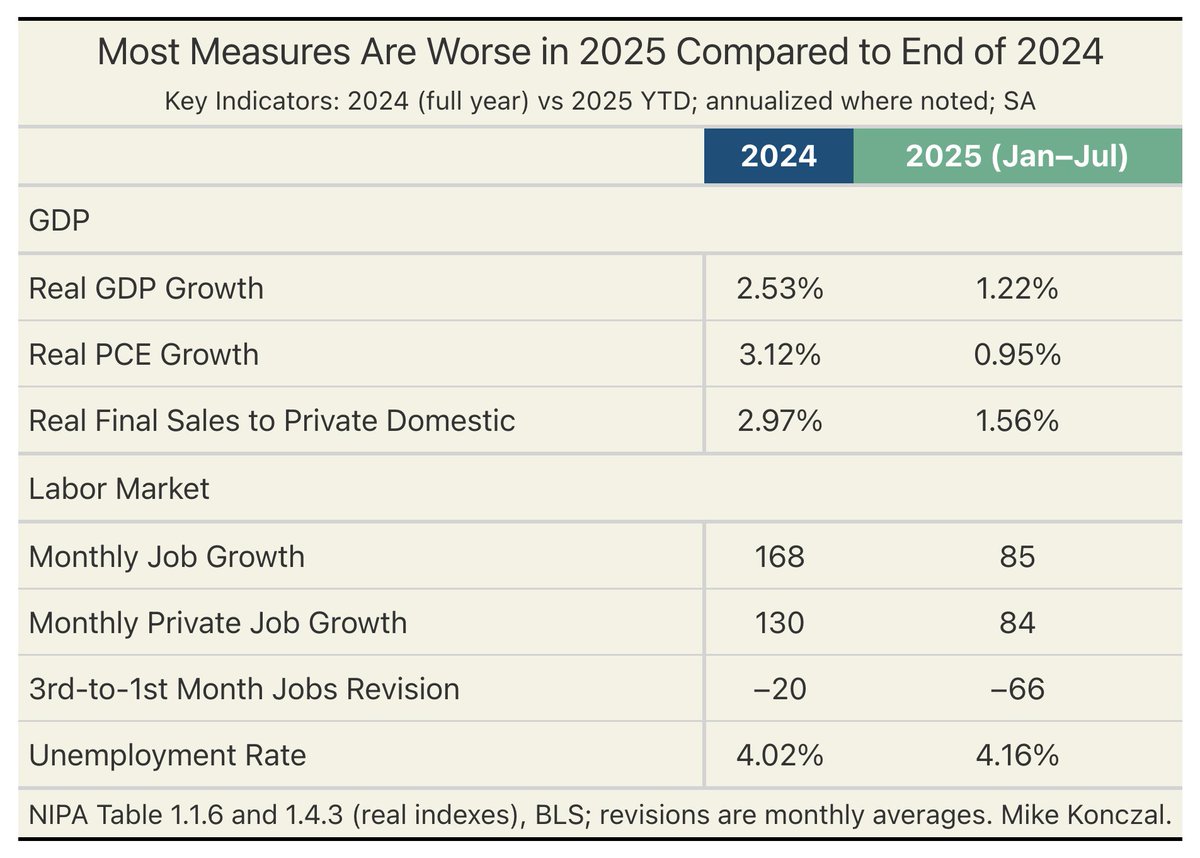

This is a bad jobs report. 73,000 jobs would have been worrisome to begin with, but deeply negative revisions to the previous two-months wiped out much of the recent gains. 2025 looks a lot worse the further we get into it.

There's a lot to cover, let's dig in. /1

There's a lot to cover, let's dig in. /1

First: revisions. Negative revisions naturally occur at the end of recoveries/economic turning points from complexities of estimating business births, deaths, and seasonal adjusts.

While it was negative in early 2024 alongside strong jobs growth, it is collapsing now in 2025. /2

While it was negative in early 2024 alongside strong jobs growth, it is collapsing now in 2025. /2

Middle column here is just May and June incorporating the revision, where private education and health services account for 170% of all private sector job growth.

Manufacturing jobs are being lost at a comparable clip to Federal jobs, -11/-12 in July and -13/-18 previously. /3

Manufacturing jobs are being lost at a comparable clip to Federal jobs, -11/-12 in July and -13/-18 previously. /3

Sorry to be a messy b who loves drama, but let's remember last fall when then Senator Marco attacked the "fake jobs numbers" and implicitly the BLS itself for revisions that were significantly less negative and less scary than we're experiencing now. /4

https://x.com/marcorubio/status/1842246712225603776

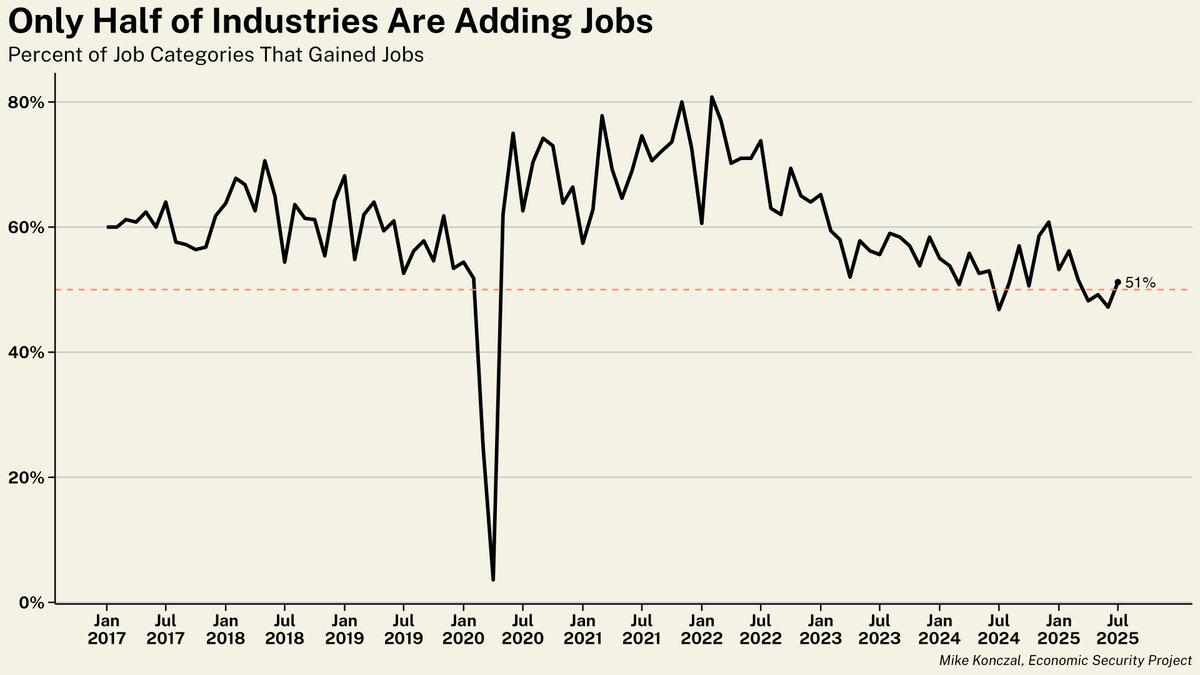

One potential reason for both the low job growth and (speculative) more negative revisions is that job growth has become more concentrated in fewer industries in 2025.

Here's percent of all subindustries adding jobs. It's been around 50%, a worrying number, for a while now. /5

Here's percent of all subindustries adding jobs. It's been around 50%, a worrying number, for a while now. /5

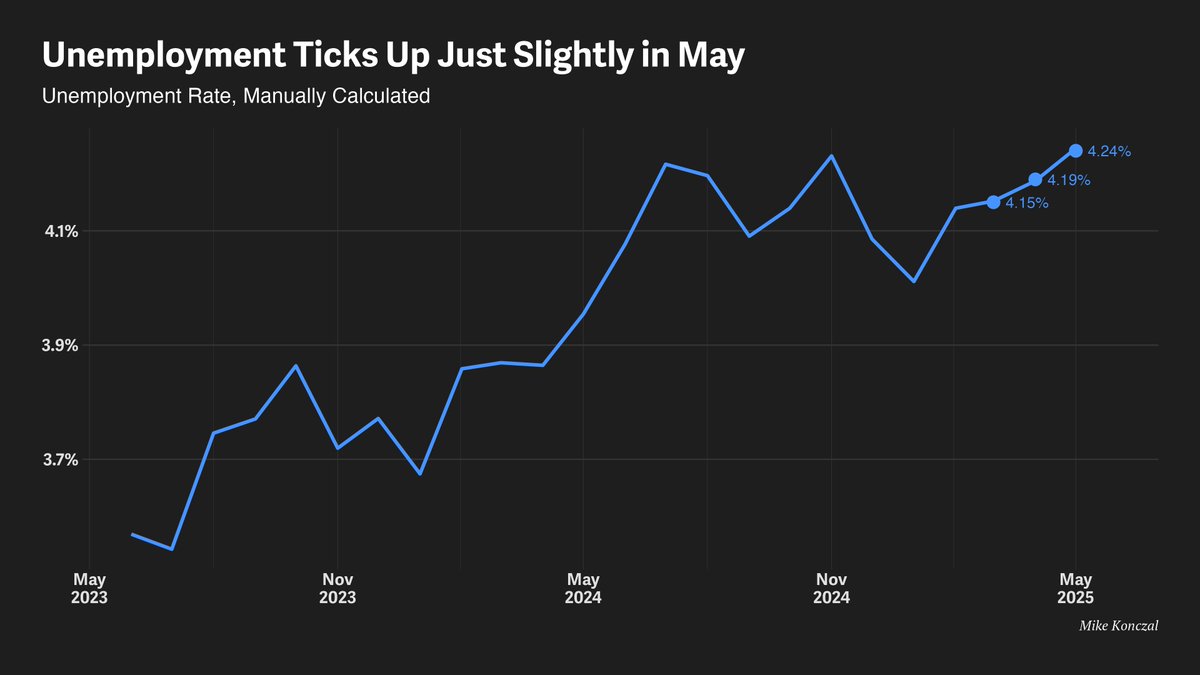

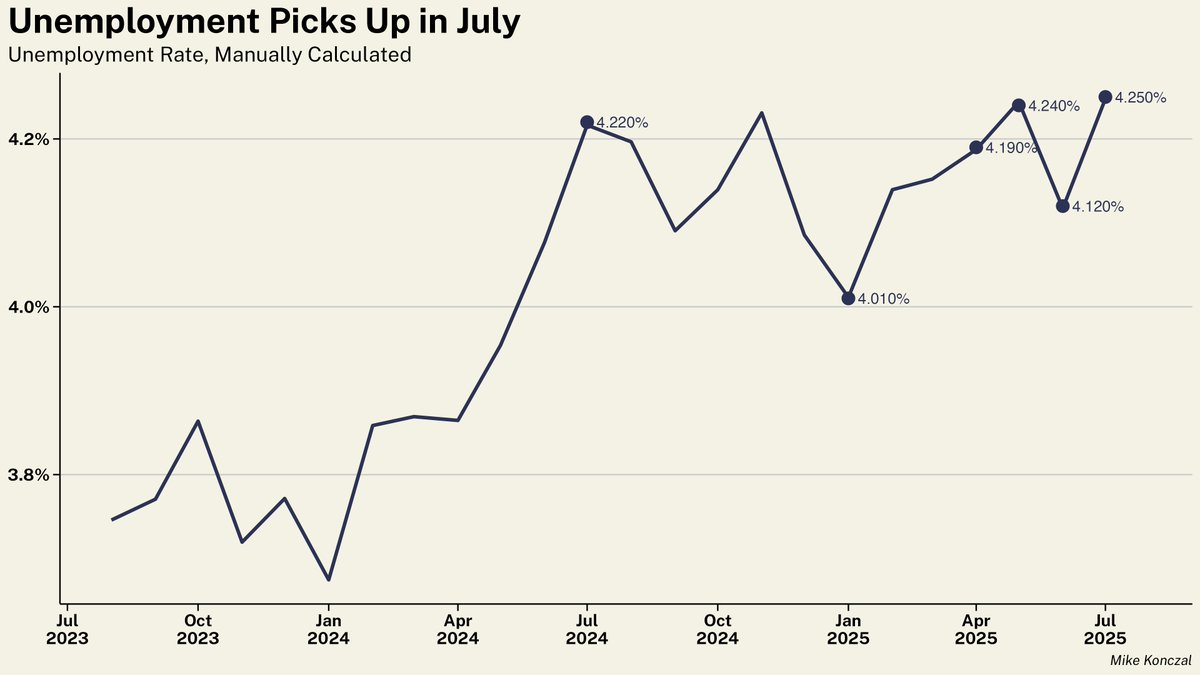

So here's the debate: why isn't the unemployment rate increasing? Though some pickup since January, about 0.25%, it's not that much.

Some will say that, without immigration, the labor force doesn't expand much. And while there's truth there, something else may be up. /6

Some will say that, without immigration, the labor force doesn't expand much. And while there's truth there, something else may be up. /6

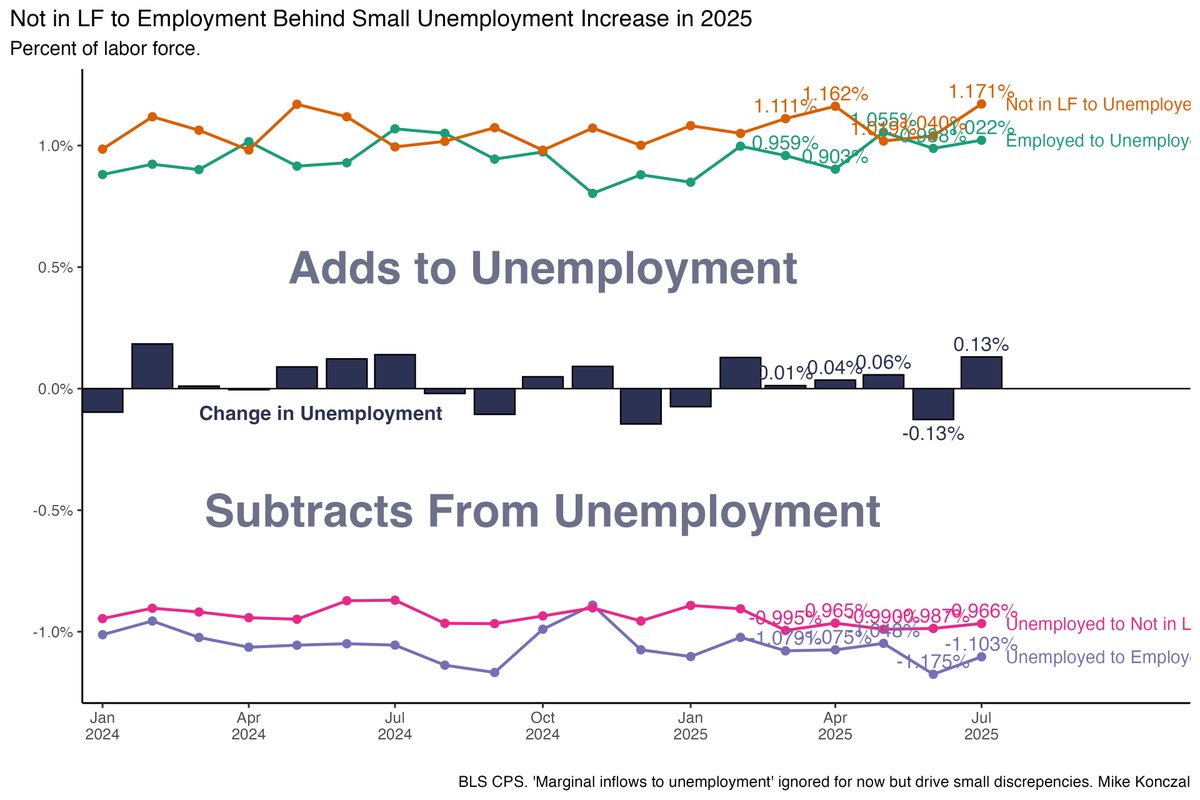

Here's the unemployment rate broken down into its components. Job leavers has been subtracting from unemployment in 2025.

Likely: people are afraid to quit their jobs under Trump due to weak hiring, which mechanically covers up the increasing new entrants who can't find jobs. /7

Likely: people are afraid to quit their jobs under Trump due to weak hiring, which mechanically covers up the increasing new entrants who can't find jobs. /7

If you made it this far, treat yourself to this bad boy, which I'm not going to bother to explain.

NLF -> U flow is the highest percent in a long while; there was some encouragement last month on the flows but this month looks notably worse. /8

NLF -> U flow is the highest percent in a long while; there was some encouragement last month on the flows but this month looks notably worse. /8

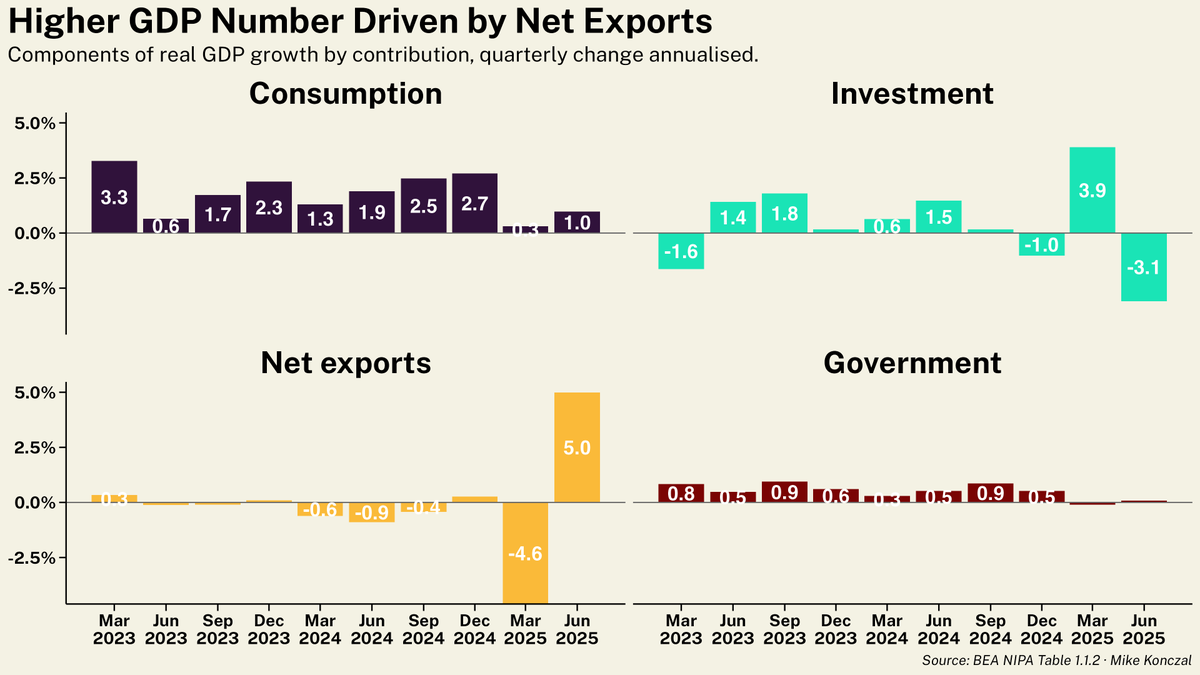

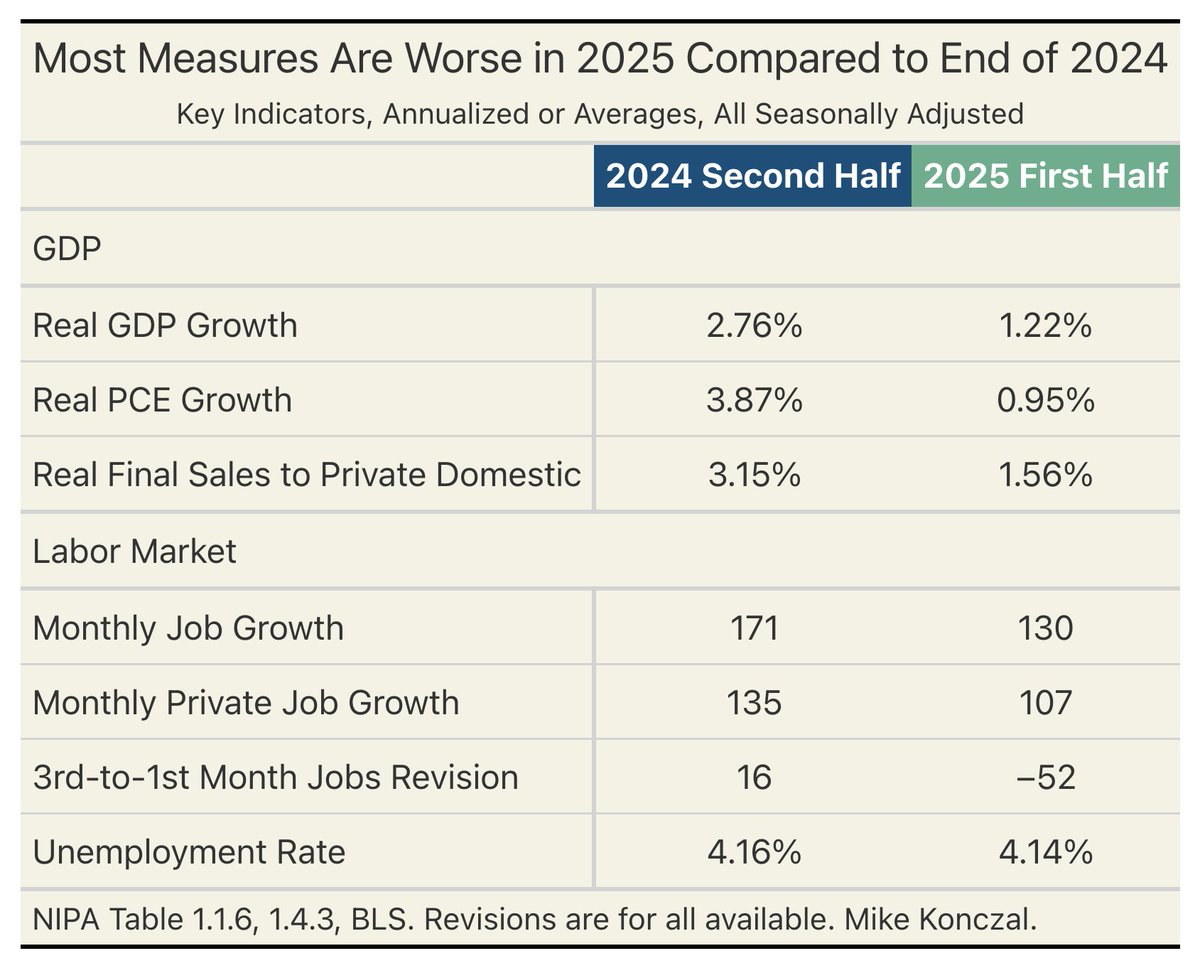

Last, here's GDP measures for the first two quarters alongside jobs. I see weakness across the board, a slowdown since 2024, with little positive.

Now is the time for a major pro-growth course correction from the Trump administration if they hope to turn this around. 9/9

Now is the time for a major pro-growth course correction from the Trump administration if they hope to turn this around. 9/9

• • •

Missing some Tweet in this thread? You can try to

force a refresh