Insurance companies have a playbook to avoid paying your claims.

I spent years defending them in court.

Now I expose their 4 favorite tactics that cost property owners millions.

Here's what they don't want you to know:

I spent years defending them in court.

Now I expose their 4 favorite tactics that cost property owners millions.

Here's what they don't want you to know:

First, the uncomfortable truth insurers hide.

They're profit machines disguised as protectors.

Every denied claim boosts their bottom line.

Every delayed payment earns them interest.

Your disaster becomes their opportunity...

They're profit machines disguised as protectors.

Every denied claim boosts their bottom line.

Every delayed payment earns them interest.

Your disaster becomes their opportunity...

The game is rigged from the start.

You buy protection. They sell loopholes.

Most property owners never realize what hit them.

Here are the 4 tactics destroying your recoveries:

You buy protection. They sell loopholes.

Most property owners never realize what hit them.

Here are the 4 tactics destroying your recoveries:

Tactic #1: The Percentage Deductible Trap

Your deductible used to be a flat $10,000.

Now it's 2-5% of your property value.

On a $10M building, that's $200,000 minimum.

But the real damage comes next:

Your deductible used to be a flat $10,000.

Now it's 2-5% of your property value.

On a $10M building, that's $200,000 minimum.

But the real damage comes next:

During hard markets, these percentages can reach 10%.

Your $200K deductible becomes $1M overnight.

Property owners must cover massive amounts before insurance pays anything.

The shift from flat to percentage deductibles changed everything.

Your $200K deductible becomes $1M overnight.

Property owners must cover massive amounts before insurance pays anything.

The shift from flat to percentage deductibles changed everything.

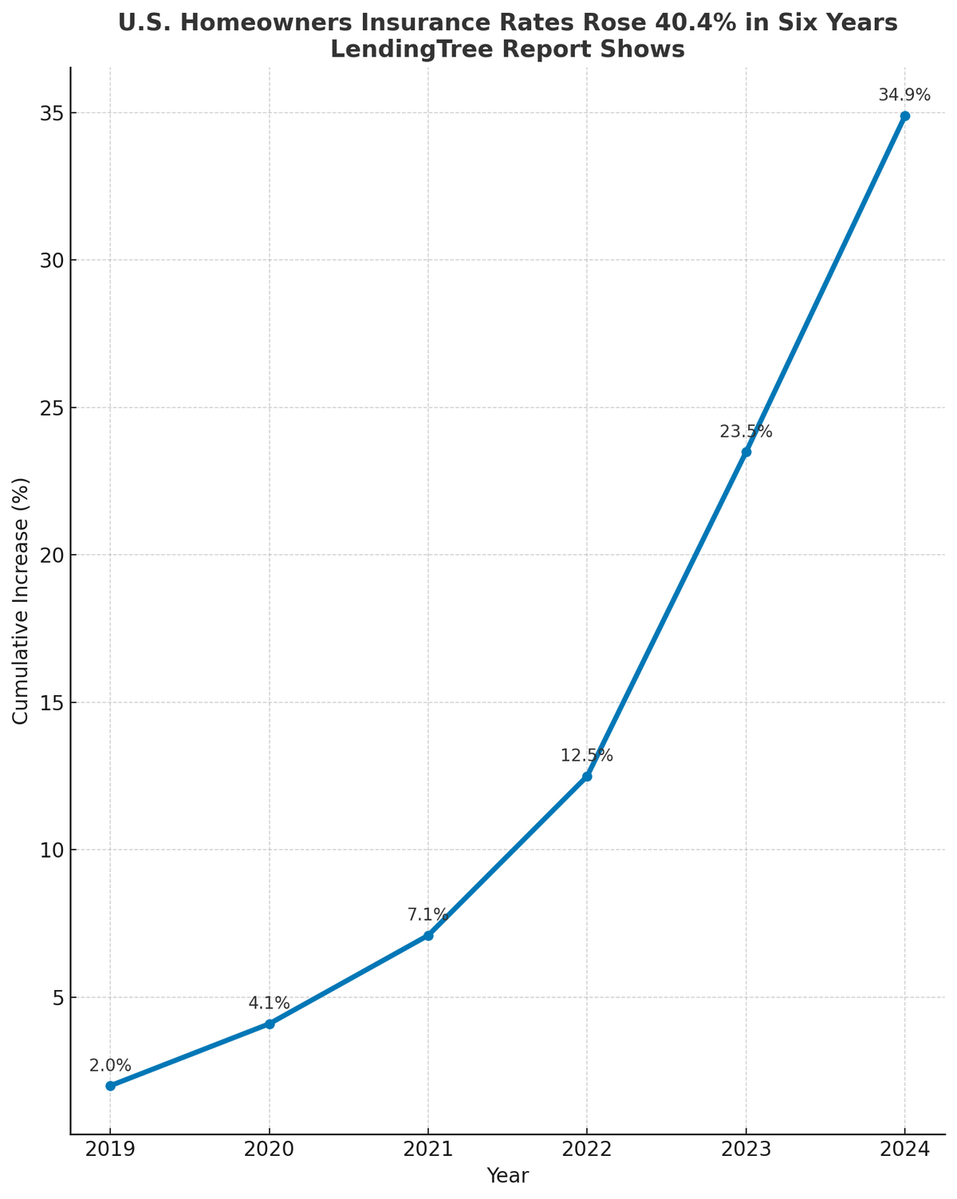

Tactic #2: Premium Increases That Never Stop

Year one brings competitive rates.

Then premiums climb based on "market conditions."

Each renewal brings new reasons for increases.

The pattern repeats until you're trapped:

Year one brings competitive rates.

Then premiums climb based on "market conditions."

Each renewal brings new reasons for increases.

The pattern repeats until you're trapped:

Switching means new inspections and coverage gaps.

So you accept each increase rather than risk exposure.

This gives insurers power to raise rates knowing you'll stay.

Premium costs compound year after year.

So you accept each increase rather than risk exposure.

This gives insurers power to raise rates knowing you'll stay.

Premium costs compound year after year.

Tactic #3: Notice Requirements Built to Fail

Your policy demands immediate claim notification.

Miss the deadline and lose your coverage.

These requirements hide in policy fine print.

Most discover them too late:

Your policy demands immediate claim notification.

Miss the deadline and lose your coverage.

These requirements hide in policy fine print.

Most discover them too late:

Disasters don't follow business hours.

But notification deadlines don't pause for weekends.

One day's delay can void your entire claim.

The clock starts ticking immediately.

But notification deadlines don't pause for weekends.

One day's delay can void your entire claim.

The clock starts ticking immediately.

Tactic #4: The Completion Holdback

Insurance approves your claim but holds back payment.

They release funds only after repairs are "verified complete."

This creates an impossible situation:

Insurance approves your claim but holds back payment.

They release funds only after repairs are "verified complete."

This creates an impossible situation:

Contractors need payment to start work.

But insurance won't pay until work is done.

Property owners get stuck in the middle.

Many never receive that final payment.

But insurance won't pay until work is done.

Property owners get stuck in the middle.

Many never receive that final payment.

These tactics compound each other's damage.

High deductibles reduce your starting point.

Strict deadlines threaten your coverage.

Holdbacks limit your cash flow.

Rising premiums drain your reserves.

High deductibles reduce your starting point.

Strict deadlines threaten your coverage.

Holdbacks limit your cash flow.

Rising premiums drain your reserves.

The combined effect destroys recovery potential.

What starts as full coverage becomes partial payment.

Each tactic takes another bite.

Property owners end up with pennies on the dollar.

What starts as full coverage becomes partial payment.

Each tactic takes another bite.

Property owners end up with pennies on the dollar.

But these aren't unchangeable laws.

They're contract terms that can be challenged.

Knowing how insurers operate changes everything.

Understanding their playbook becomes your defense:

They're contract terms that can be challenged.

Knowing how insurers operate changes everything.

Understanding their playbook becomes your defense:

After years defending insurance companies, I switched sides.

Now I help property owners fight back.

We know every tactic because we used to deploy them.

That inside knowledge makes all the difference.

Now I help property owners fight back.

We know every tactic because we used to deploy them.

That inside knowledge makes all the difference.

We counter each of their moves:

Against their delays, we file immediate demands.

Against lowball offers, we demonstrate disparities.

Against technical denials, we cite chapter and verse.

Full recovery becomes possible with the right approach.

Against their delays, we file immediate demands.

Against lowball offers, we demonstrate disparities.

Against technical denials, we cite chapter and verse.

Full recovery becomes possible with the right approach.

If you're a Texas property owner facing insurance challenges, we can help.

We work on contingency - no recovery, no fee.

Visit to learn how we level the playing field.gravely.law

We work on contingency - no recovery, no fee.

Visit to learn how we level the playing field.gravely.law

I'm Marc Gravely

• Texas Business Champion

• Founder of Gravely PC, specializing in construction defects/insurance recovery

• Former insurance defense attorney who saw the light

Follow @MarcGravely for insights on the daily influence of insurance

Repost to help others grow

• Texas Business Champion

• Founder of Gravely PC, specializing in construction defects/insurance recovery

• Former insurance defense attorney who saw the light

Follow @MarcGravely for insights on the daily influence of insurance

Repost to help others grow

https://twitter.com/1594141225975775232/status/1951281928424014125

Video/Image Credits:

- The Tax Deduction Trap - Dave Ramsey

youtube.com/shorts/qeBg9qG…

- How insurance premiums and deductibles work

youtube.com/watch?v=hcMDaM…

- This Is Why Universal Life Insurance Is CRAP!

youtube.com/watch?v=entJ28…

- The Tax Deduction Trap - Dave Ramsey

youtube.com/shorts/qeBg9qG…

- How insurance premiums and deductibles work

youtube.com/watch?v=hcMDaM…

- This Is Why Universal Life Insurance Is CRAP!

youtube.com/watch?v=entJ28…

• • •

Missing some Tweet in this thread? You can try to

force a refresh