92% of millennials believe they will never be able to retire.

The solution?

Stop saving in dollars. Start saving in Bitcoin.

The math tells you the truth: 🧵👇

The solution?

Stop saving in dollars. Start saving in Bitcoin.

The math tells you the truth: 🧵👇

I recently played poker for 2 hours.

I profited $1,909.

I’m choosing to save my winnings in Bitcoin.

I profited $1,909.

I’m choosing to save my winnings in Bitcoin.

Let’s be conservative and say that in 10 years, Bitcoin will have surpassed gold's market cap, which would be a 15x on Bitcoin's current price.

That turns my $1,909 into $28,635.

But that’s not the point.

That turns my $1,909 into $28,635.

But that’s not the point.

Money isn’t our most valuable asset.

Time is.

Time is.

My hourly win rate for my poker session was $954.50.

Two hours = $1,909.

In 10 years, due to Bitcoin's appreciation (15x), my poker winnings are worth $28,635.

That's like sitting at the table for 30 hours.

But I didn't.

I sat for two.

Two hours = $1,909.

In 10 years, due to Bitcoin's appreciation (15x), my poker winnings are worth $28,635.

That's like sitting at the table for 30 hours.

But I didn't.

I sat for two.

By saving my winnings in Bitcoin, I've granted myself an extra 28 hours that I *don't have to work* to make money.

Do you understand how significant that is?

Do you understand how significant that is?

By saving my money in Bitcoin, I have given myself more time.

Time that I don’t have to spend slaving away to make money, time that I can choose to spend with my family, my friends, pursuing my true curiosities… the list goes on.

Time that I don’t have to spend slaving away to make money, time that I can choose to spend with my family, my friends, pursuing my true curiosities… the list goes on.

That's the superpower of Bitcoin.

You gain purchasing power *without* trading time for it. You let your savings work while you live your life.

With fiat (the current system), it’s the opposite. Your value drains over time. So does your life.

You gain purchasing power *without* trading time for it. You let your savings work while you live your life.

With fiat (the current system), it’s the opposite. Your value drains over time. So does your life.

Let’s look at fiat:

If I saved that same $1,909 in dollars…

At an average annual inflation rate of 7% (which is the rate since 1971), I lose half of that value in 10 years.

Now it’s worth ~$954.50. As if I only played 1 hour, not 2.

An entire hour, stolen. But wait...

If I saved that same $1,909 in dollars…

At an average annual inflation rate of 7% (which is the rate since 1971), I lose half of that value in 10 years.

Now it’s worth ~$954.50. As if I only played 1 hour, not 2.

An entire hour, stolen. But wait...

Let's scale it:

Say you work 2,000 hours this year and earn $40,000.

You save it in dollars. 10 years later, it’s worth ~$20,000.

You just lost 1,000 hours of labor.

That’s 42 full days of your life… gone.

And that's just one year of your work.

Say you work 2,000 hours this year and earn $40,000.

You save it in dollars. 10 years later, it’s worth ~$20,000.

You just lost 1,000 hours of labor.

That’s 42 full days of your life… gone.

And that's just one year of your work.

Imagine doing this every year for a decade.

That’s 420 days of work—over a year of your life—wasted by inflation.

That's as if you worked every day for a year and didn't get paid a dime.

And you wonder why the world feels broken, and why the average person feels helpless.

That’s 420 days of work—over a year of your life—wasted by inflation.

That's as if you worked every day for a year and didn't get paid a dime.

And you wonder why the world feels broken, and why the average person feels helpless.

Flip the script:

The person who saved in Bitcoin 10 years ago?

Their $40,000 became $11,640,000.

If $40,000 represents one year of time, they've saved 291 years of time.

Now, they don't have to worry as much about working to make money. Bitcoin has done the work for them.

The person who saved in Bitcoin 10 years ago?

Their $40,000 became $11,640,000.

If $40,000 represents one year of time, they've saved 291 years of time.

Now, they don't have to worry as much about working to make money. Bitcoin has done the work for them.

This is what money is supposed to do.

As global productivity increases, money should rise in value to reflect it.

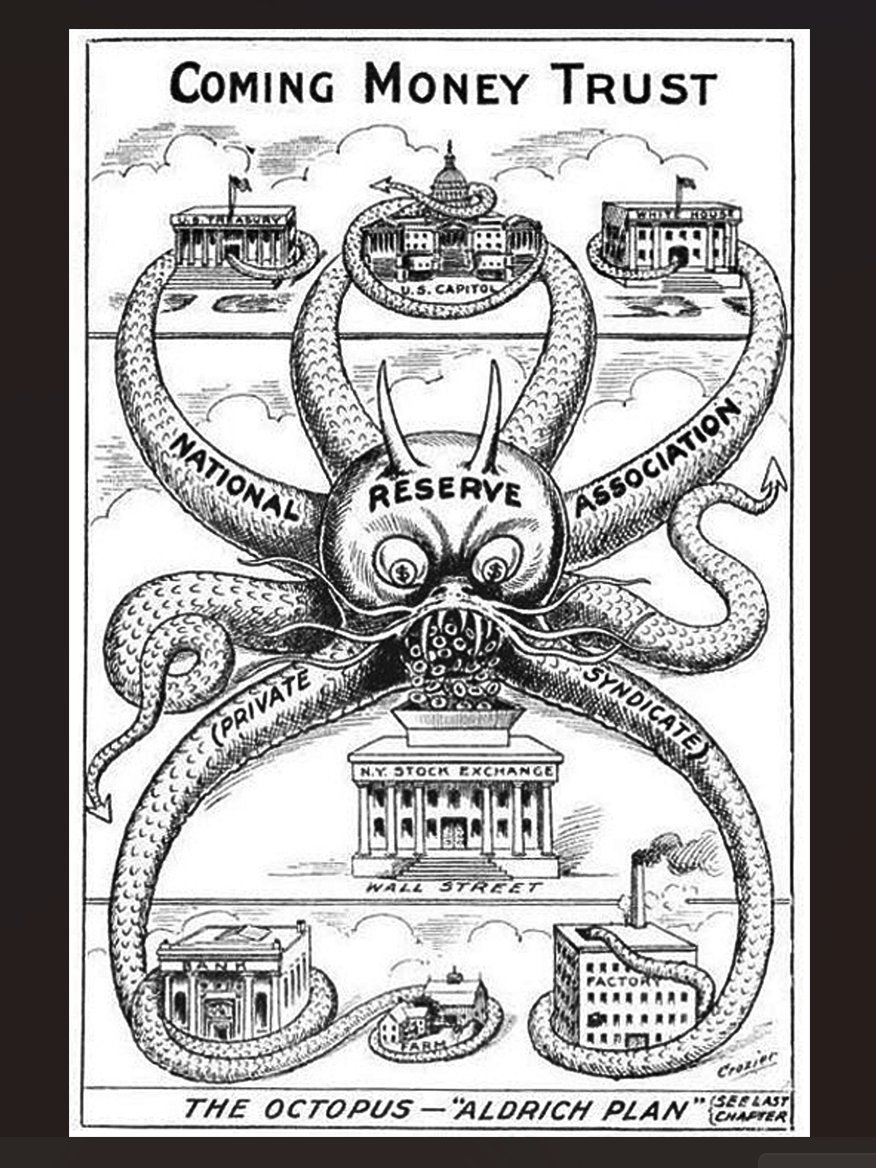

But fiat currencies are political, inflated, and manipulated.

That’s why you work harder, longer, and still fall behind.

Bitcoin fixes this.

As global productivity increases, money should rise in value to reflect it.

But fiat currencies are political, inflated, and manipulated.

That’s why you work harder, longer, and still fall behind.

Bitcoin fixes this.

Bitcoin is the index of global productivity.

It’s pure money.

It reflects the value we create, without manipulation.

21 million BTC. Zero inflation.

That’s why it’s the best savings technology in history.

It’s pure money.

It reflects the value we create, without manipulation.

21 million BTC. Zero inflation.

That’s why it’s the best savings technology in history.

Don’t take it from me.

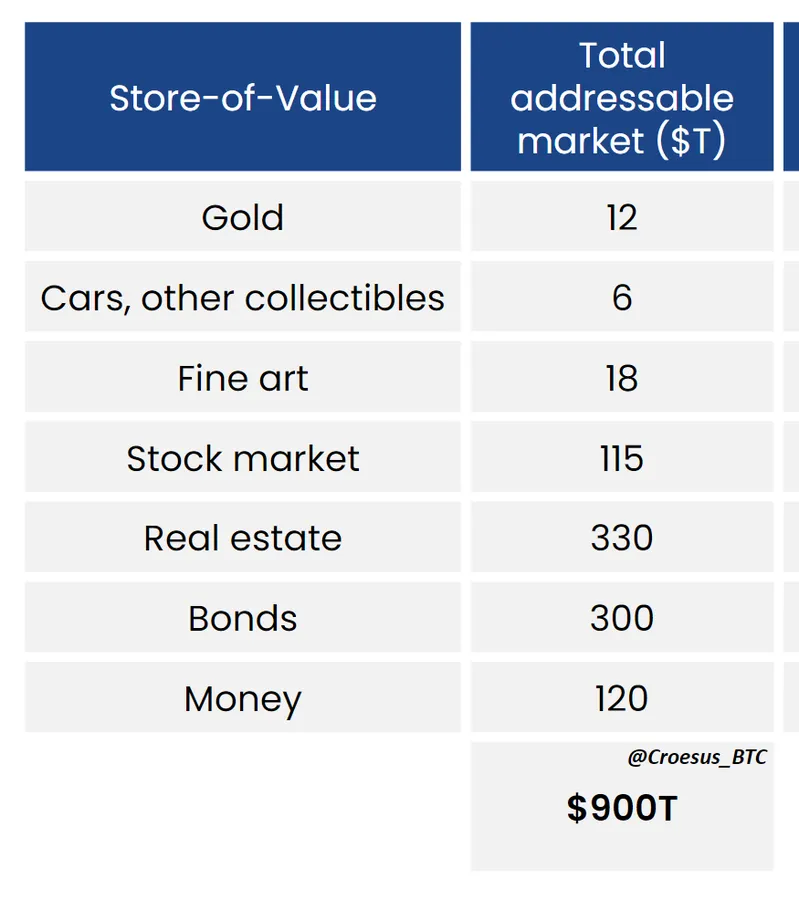

Just look at the market.

Has anything outperformed Bitcoin over the last decade?

Has any group been able to retire earlier than Bitcoiners?

Just look at the market.

Has anything outperformed Bitcoin over the last decade?

Has any group been able to retire earlier than Bitcoiners?

There's you in 2035 wishing you had saved your money in Bitcoin in 2025.

Yet here you are, in 2025, with the opportunity directly in front of you.

Yet here you are, in 2025, with the opportunity directly in front of you.

It's not about retirement. It's not about money.

It's about freedom.

It's about having the time to do what you please, without stress, worry, or concern over your finances.

It's about freedom.

It's about having the time to do what you please, without stress, worry, or concern over your finances.

The moment you start saving in Bitcoin is the moment you start freeing your time.

The longer you wait, the more time you lose.

The quicker you understand that (and act on it), the quicker your time will be freed.

The longer you wait, the more time you lose.

The quicker you understand that (and act on it), the quicker your time will be freed.

Yes, Bitcoin gives you more purchasing power.

But more importantly, it gives you freedom.

The freedom to choose how to spend your life.

Bitcoin is time.

Use it wisely. 🔮🪄

But more importantly, it gives you freedom.

The freedom to choose how to spend your life.

Bitcoin is time.

Use it wisely. 🔮🪄

If you enjoyed the thread, give it a like/retweet⬇️

Follow @Cole_Walmsley for more.

Follow @Cole_Walmsley for more.

https://x.com/Cole_Walmsley/status/1951356729200906698

• • •

Missing some Tweet in this thread? You can try to

force a refresh