The diamond cartel might be dying. And the president of Botswana just pulled out a shovel.

He called De Beers “broke” and said, “maybe we should sell the diamonds ourselves.”

He called De Beers “broke” and said, “maybe we should sell the diamonds ourselves.”

This is a head of state talking about a company his government literally co-owns.

And not just any company—De Beers, the world’s largest diamond company. The same company that once told the world: “A diamond is forever.”

And not just any company—De Beers, the world’s largest diamond company. The same company that once told the world: “A diamond is forever.”

For over a century, De Beers was the diamond cartel—controlling supply, setting prices, and calling the shots.

So when Botswana’s president announces that De Beers is broke, you pay attention.

But you might be wondering: what’s Botswana got to do with diamonds?

So when Botswana’s president announces that De Beers is broke, you pay attention.

But you might be wondering: what’s Botswana got to do with diamonds?

Well, Botswana is the reason De Beers even exists in its current form.

In the late 1960s, Botswana found diamonds—some of the best in the world, in fact.

When De Beers showed up, Botswana didn’t just hand everything over. They negotiated a 50-50 joint venture called Debswana.

In the late 1960s, Botswana found diamonds—some of the best in the world, in fact.

When De Beers showed up, Botswana didn’t just hand everything over. They negotiated a 50-50 joint venture called Debswana.

That’s extremely rare.

De Beers could’ve easily bullied a newly independent African country into a terrible deal—that’s what usually happened.

But Botswana somehow got 50-50. And that changed everything.

De Beers could’ve easily bullied a newly independent African country into a terrible deal—that’s what usually happened.

But Botswana somehow got 50-50. And that changed everything.

Botswana went from having nothing to becoming one of Africa’s fastest-growing economies.

They actually used the diamond money properly—built schools, roads, hospitals. Meanwhile, De Beers got a stable, long-term supply of high-quality diamonds.

It worked brilliantly for decades. Today, about 70% of De Beers’ diamonds come from Botswana. As do a good chunk of their profits.

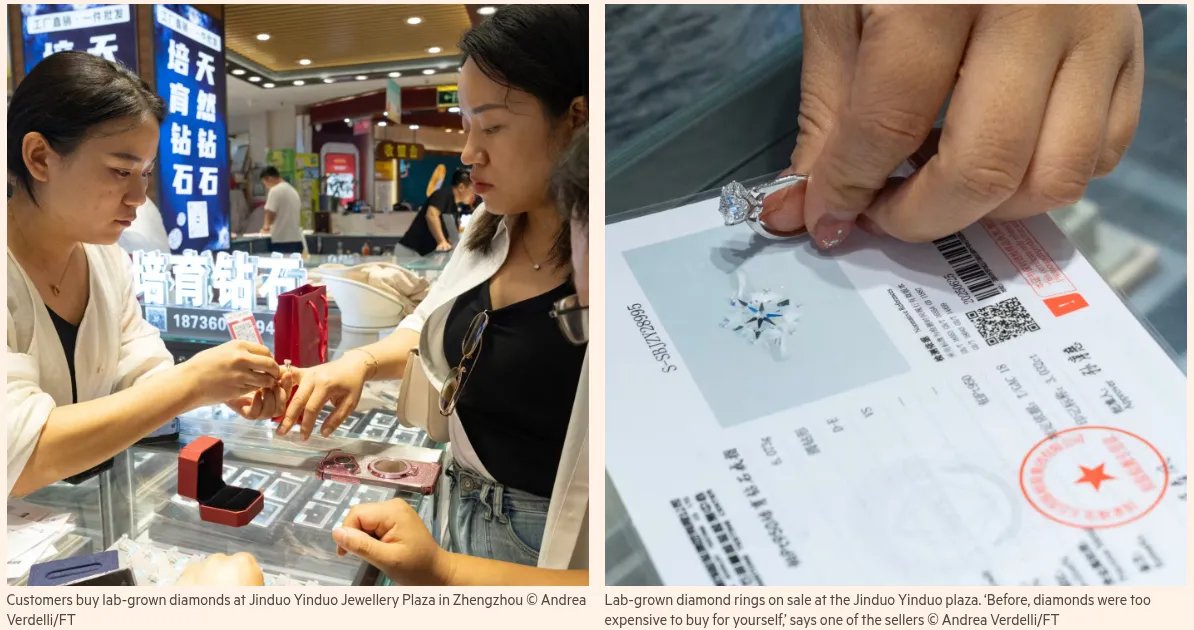

Image source: @FinancialTimes

They actually used the diamond money properly—built schools, roads, hospitals. Meanwhile, De Beers got a stable, long-term supply of high-quality diamonds.

It worked brilliantly for decades. Today, about 70% of De Beers’ diamonds come from Botswana. As do a good chunk of their profits.

Image source: @FinancialTimes

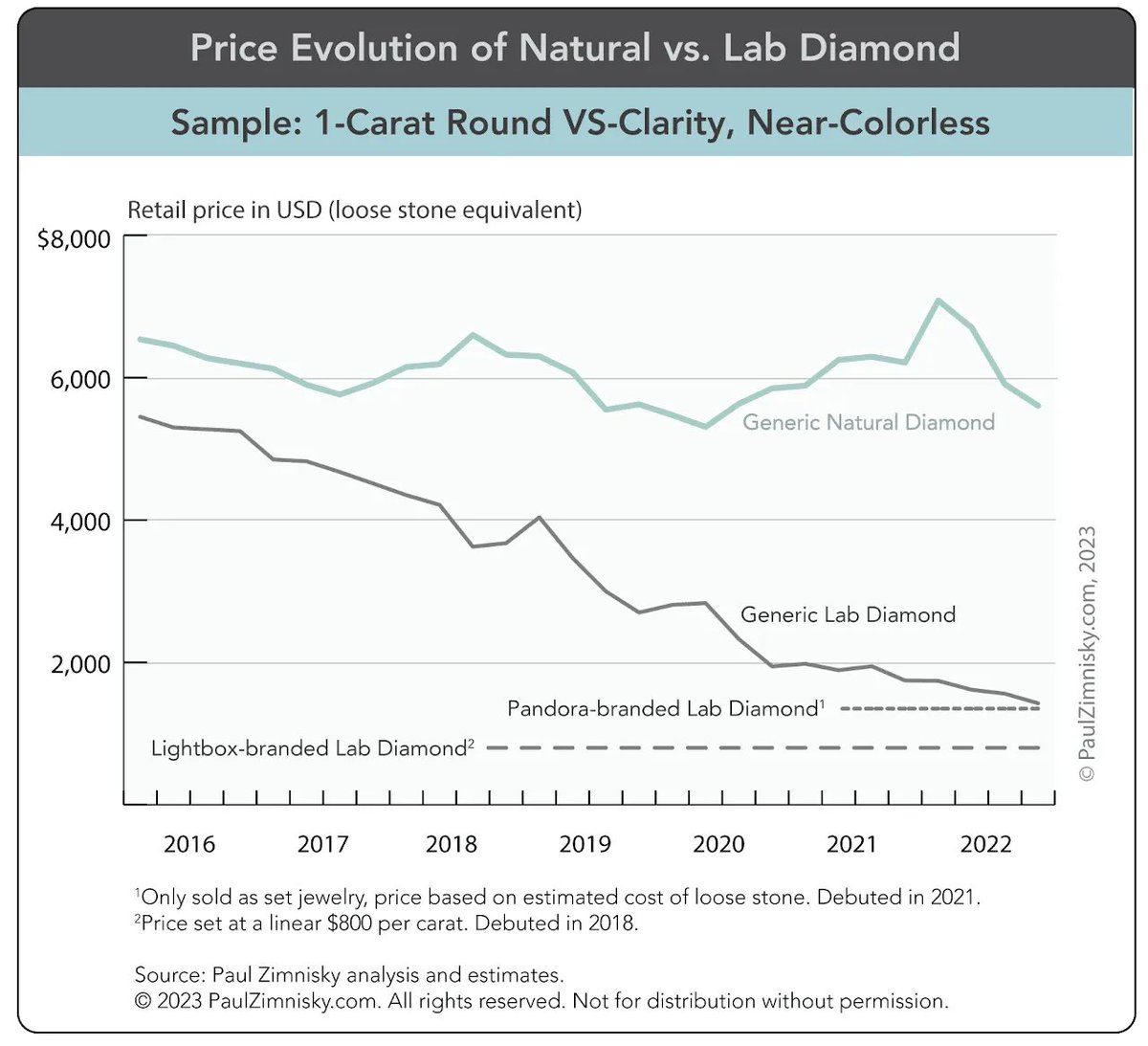

But if you’ve been following the space, this isn’t surprising. The diamond market is in serious trouble. Why? Lab-grown diamonds.

They’re practically identical to natural diamonds. But they cost a fraction and can be produced endlessly in labs.

Image source: @paulzimnis

They’re practically identical to natural diamonds. But they cost a fraction and can be produced endlessly in labs.

Image source: @paulzimnis

Their entry turned diamonds from rare luxury items into commodities. In the US and China—the world’s largest diamond markets—people just aren’t buying natural diamonds like before.

Lab-grown sales have skyrocketed. De Beers tried fighting back by launching its own lab-grown brand: Lightbox.

It backfired. They triggered a price war and eventually shut it down earlier this year. Now they’re sitting on a $2 billion stockpile of natural diamonds—their biggest since 2008.

Image source: @FinancialTimes

Lab-grown sales have skyrocketed. De Beers tried fighting back by launching its own lab-grown brand: Lightbox.

It backfired. They triggered a price war and eventually shut it down earlier this year. Now they’re sitting on a $2 billion stockpile of natural diamonds—their biggest since 2008.

Image source: @FinancialTimes

De Beers even cut prices—a move that was once unthinkable for the cartel. Then came another blow: their parent company, Anglo-American, wanted out.

Facing a hostile takeover attempt by BHP, Anglo decided to offload non-core assets. That includes De Beers. Botswana, it seemed, was giving the company a lifeline.

Facing a hostile takeover attempt by BHP, Anglo decided to offload non-core assets. That includes De Beers. Botswana, it seemed, was giving the company a lifeline.

Just before the current president, Duma Boko, came to power, the previous government signed a new 10-year deal with De Beers.

This deal looked like a big win for Botswana.

Their share of the diamonds from the joint venture would go from:

➡️ 25% to 30% immediately

➡️ 40% in five years

➡️ 50% eventually

On paper, it looked like a major upgrade.

This deal looked like a big win for Botswana.

Their share of the diamonds from the joint venture would go from:

➡️ 25% to 30% immediately

➡️ 40% in five years

➡️ 50% eventually

On paper, it looked like a major upgrade.

But selling diamonds has become really hard. Especially now, considering the biggest seller is in serious trouble.

Image source: @FinancialTimes

Image source: @FinancialTimes

Botswana is basically getting more diamonds… at a time when nobody wants them.

When President Boko first came in, he sounded supportive. He said we need to “safeguard the goose that lays the golden egg”—basically, let’s protect the De Beers partnership.

When President Boko first came in, he sounded supportive. He said we need to “safeguard the goose that lays the golden egg”—basically, let’s protect the De Beers partnership.

Earlier this year, De Beers CEO Al Cook told the FT that Botswana had “expressed an interest to increase its stake” in the company.

Makes sense—diamonds are: 90% of Botswana’s exports and about a third of GDP.

Makes sense—diamonds are: 90% of Botswana’s exports and about a third of GDP.

But over time, the tone changed. That’s when Boko dropped the “they’re broke” comment.

And honestly, it might be strategic. Botswana owns 15% of De Beers. All the diamonds flow through them. So any sale of Anglo’s 85% stake? It basically needs Botswana’s blessing.

So maybe this is leverage.

And honestly, it might be strategic. Botswana owns 15% of De Beers. All the diamonds flow through them. So any sale of Anglo’s 85% stake? It basically needs Botswana’s blessing.

So maybe this is leverage.

Here’s the bottom line:

We’re watching the potential end of an empire. De Beers controlled diamonds for over a century—by controlling the story. Now, lab-grown killed the story. The parent wants out.

And the country that supplies the diamonds is calling De Beers broke.

We’re watching the potential end of an empire. De Beers controlled diamonds for over a century—by controlling the story. Now, lab-grown killed the story. The parent wants out.

And the country that supplies the diamonds is calling De Beers broke.

We cover this and two more interesting stories in today's edition of Who said what? Watch on YouTube or read on Substack. All links here:

thedailybriefing.substack.com/p/why-is-de-be…

thedailybriefing.substack.com/p/why-is-de-be…

• • •

Missing some Tweet in this thread? You can try to

force a refresh