Everyone thinks Trump got rich from real estate.

That's wrong.

His real fortune came from ONE strategy his grandfather invented during the 1890s gold rush.

Here's how this 130-year-old principle built a $8 BILLION empire: 🧵

That's wrong.

His real fortune came from ONE strategy his grandfather invented during the 1890s gold rush.

Here's how this 130-year-old principle built a $8 BILLION empire: 🧵

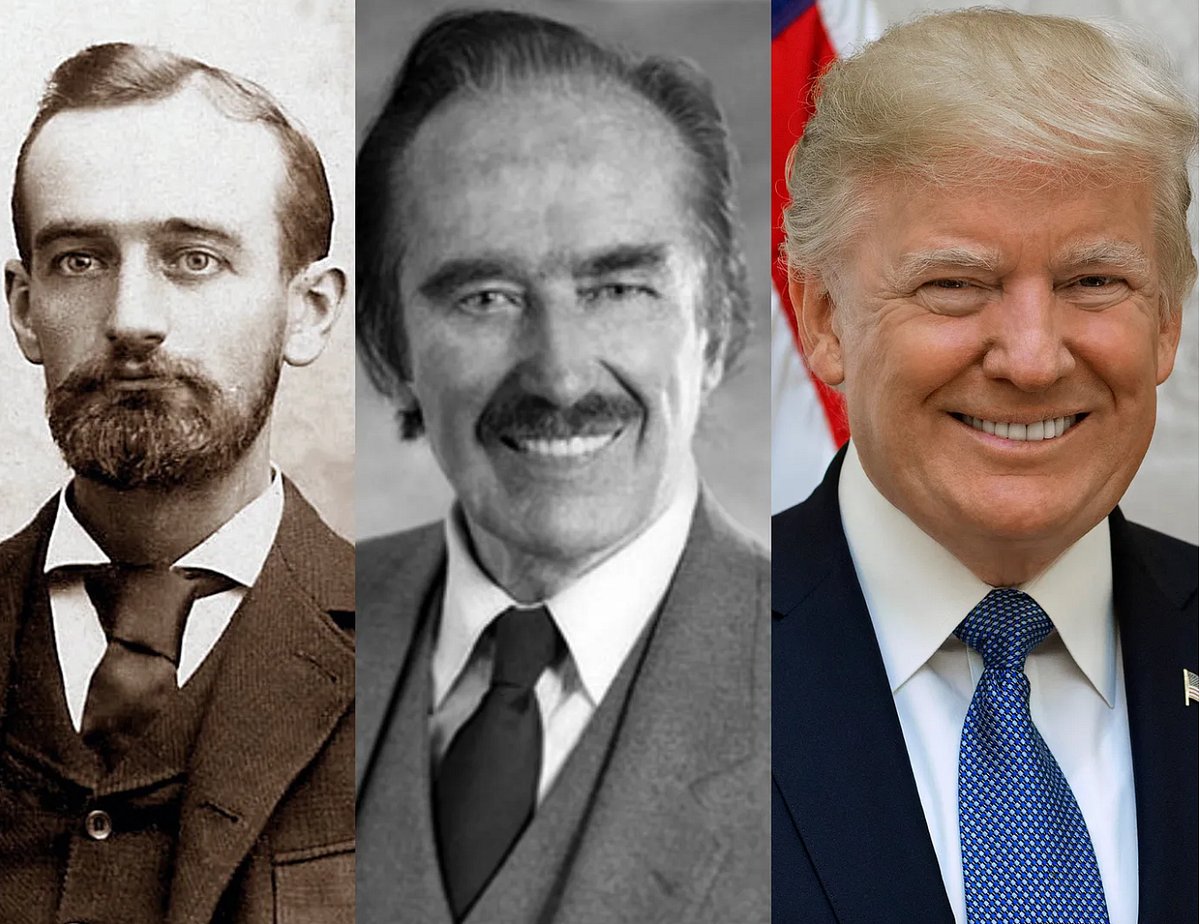

Trump's wealth started with his grandfather Friedrich Trump.

In the 1890s, while others were digging for gold, Friedrich did something smarter:

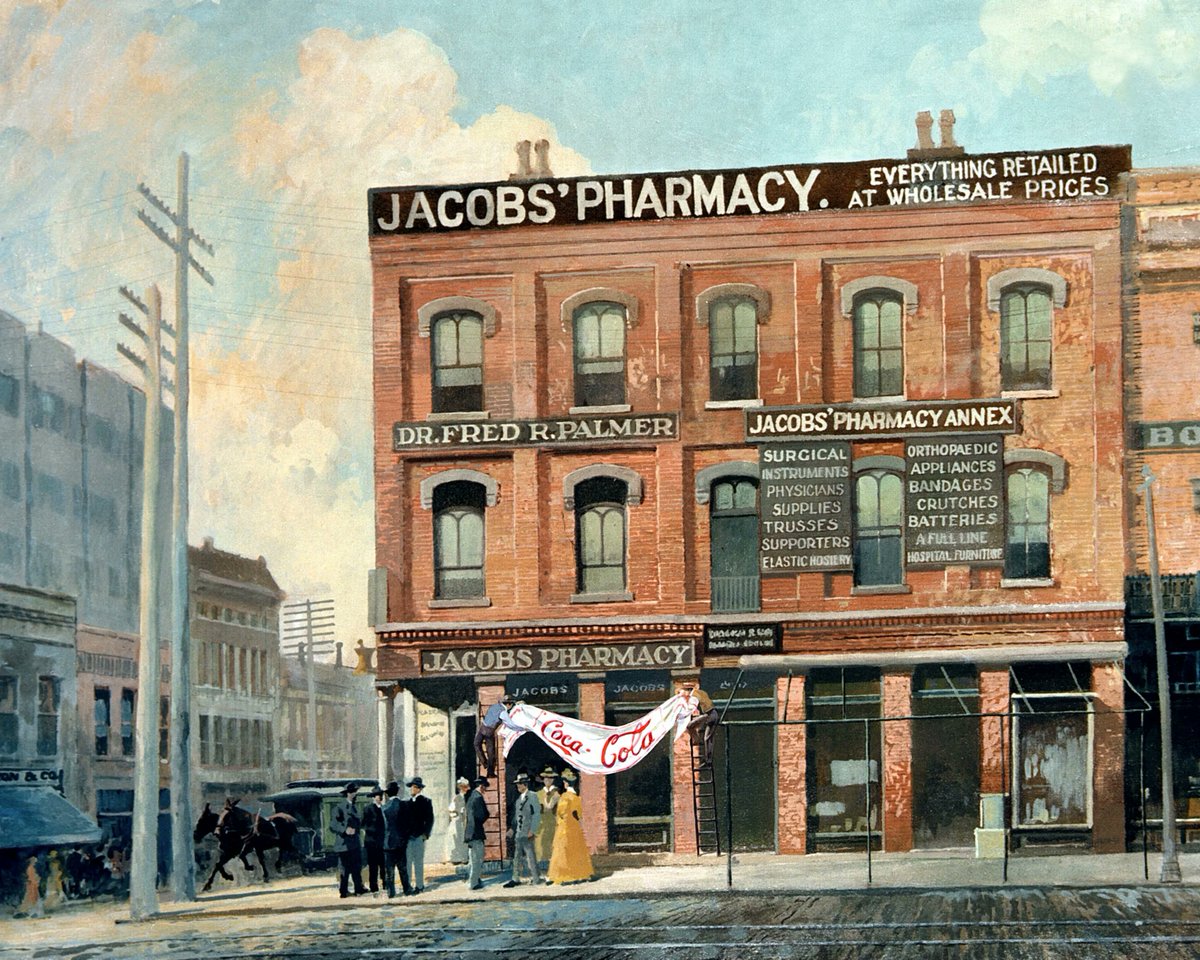

He opened restaurants and hotels for the miners.

Instead of gambling on finding gold, he sold picks and shovels to the gamblers...

In the 1890s, while others were digging for gold, Friedrich did something smarter:

He opened restaurants and hotels for the miners.

Instead of gambling on finding gold, he sold picks and shovels to the gamblers...

Friedrich made a fortune serving miners, not mining.

When he returned to Germany in 1901, he was wealthy enough to marry and live comfortably.

But German authorities kicked him out for dodging military service.

Then it got even worse:

When he returned to Germany in 1901, he was wealthy enough to marry and live comfortably.

But German authorities kicked him out for dodging military service.

Then it got even worse:

Forced back to America, he died young in the 1918 flu pandemic.

After he died in 1918, his widow Elizabeth was left with three young children.

She took Friedrich's savings from the mining ventures and started investing in real estate:

After he died in 1918, his widow Elizabeth was left with three young children.

She took Friedrich's savings from the mining ventures and started investing in real estate:

In 1923, she partnered with her son Fred to found "E. Trump & Son."

Fred was just out of high school but had big vision.

He spotted where the money was flowing: Government housing contracts.

Fred positioned himself as the government's go-to builder.

The result?

Fred was just out of high school but had big vision.

He spotted where the money was flowing: Government housing contracts.

Fred positioned himself as the government's go-to builder.

The result?

Fred became "The Henry Ford of homebuilding."

His strategy was simple but brilliant:

1. Buy cheap land in outer boroughs.

2. Build thousands of middle-class apartments.

3. Use government contracts during WWII for guaranteed income.

By the 1940s, he was making millions.

His strategy was simple but brilliant:

1. Buy cheap land in outer boroughs.

2. Build thousands of middle-class apartments.

3. Use government contracts during WWII for guaranteed income.

By the 1940s, he was making millions.

In 1946, his son Donald was born into this growing real estate empire.

Donald grew up watching his father build thousands of apartments across Brooklyn and Queens.

After college, he joined the family business in 1968.

But Donald had bigger ambitions than his father:

Donald grew up watching his father build thousands of apartments across Brooklyn and Queens.

After college, he joined the family business in 1968.

But Donald had bigger ambitions than his father:

When Donald joined the business in the early 1970s, he made a crucial decision.

He saw where the money was flowing: Manhattan real estate.

While others including Fred avoided the risky urban market, he positioned himself right in the money stream.

Higher risk. Higher reward.

He saw where the money was flowing: Manhattan real estate.

While others including Fred avoided the risky urban market, he positioned himself right in the money stream.

Higher risk. Higher reward.

In the early 1970s, he convinced his father to back his first big Manhattan play:

The Commodore Hotel was a dump near Grand Central Station.

Everyone said Donald was crazy to buy it.

But Donald saw it would drive massive foot traffic:

The Commodore Hotel was a dump near Grand Central Station.

Everyone said Donald was crazy to buy it.

But Donald saw it would drive massive foot traffic:

He positioned himself at the intersection of transportation and tourism money flows.

Then he renovated it into the Grand Hyatt in 1980.

The deal made him a Manhattan player.

Same principle as his grandfather Friedrich.

But there's more:

Then he renovated it into the Grand Hyatt in 1980.

The deal made him a Manhattan player.

Same principle as his grandfather Friedrich.

But there's more:

Trump's real breakthrough came with Trump Tower in 1983.

58 stories of luxury on Fifth Avenue.

But here's the genius move: he lived in the penthouse.

Donald positioned himself where wealthy people wanted to live, work, and be seen.

He became the gateway to Manhattan status:

58 stories of luxury on Fifth Avenue.

But here's the genius move: he lived in the penthouse.

Donald positioned himself where wealthy people wanted to live, work, and be seen.

He became the gateway to Manhattan status:

And then throughout the 1980s, Trump expanded aggressively:

- Casinos in Atlantic City.

- The Plaza Hotel purchase.

- Real estate across New York.

His strategy: use debt to buy assets, then use those assets as collateral for more debt.

This game worked until it didn't:

- Casinos in Atlantic City.

- The Plaza Hotel purchase.

- Real estate across New York.

His strategy: use debt to buy assets, then use those assets as collateral for more debt.

This game worked until it didn't:

In the early 1990s, Trump's debt hit $3.4 billion.

His casinos were bleeding money.

Banks could have destroyed him.

Instead, they restructured his debt.

Why? He owed them so much, his failure was their problem too.

His comeback strategy was brilliant:

His casinos were bleeding money.

Banks could have destroyed him.

Instead, they restructured his debt.

Why? He owed them so much, his failure was their problem too.

His comeback strategy was brilliant:

He licensed his name instead of owning properties.

Lower risk, steady income.

Trump hotels, golf courses, and condos worldwide, many he didn't even own.

He positioned his name where other people's money was flowing.

Every Trump-branded project paid him without the risk.

Lower risk, steady income.

Trump hotels, golf courses, and condos worldwide, many he didn't even own.

He positioned his name where other people's money was flowing.

Every Trump-branded project paid him without the risk.

The lesson from Trump's success:

1. Position yourself in money flows, don't chase them

2. Government contracts provide guaranteed streams

3. Leverage amplifies your position

4. Brand value can outlast physical assets

5. Sometimes owing too much money makes you untouchable

1. Position yourself in money flows, don't chase them

2. Government contracts provide guaranteed streams

3. Leverage amplifies your position

4. Brand value can outlast physical assets

5. Sometimes owing too much money makes you untouchable

Trump's grandfather served miners instead of mining.

His father positioned himself in government money flows.

Donald positioned himself in Manhattan luxury streams.

Three generations. Same principle:

Don't chase the gold. Position yourself where gold miners spend their money.

His father positioned himself in government money flows.

Donald positioned himself in Manhattan luxury streams.

Three generations. Same principle:

Don't chase the gold. Position yourself where gold miners spend their money.

Most investors do the opposite of this strategy.

They chase the gold (hot stocks) instead of positioning themselves where the real money flows.

They buy high when everyone's excited, sell low when everyone's scared.

There's a better way:

They chase the gold (hot stocks) instead of positioning themselves where the real money flows.

They buy high when everyone's excited, sell low when everyone's scared.

There's a better way:

Investors:

Tired of timing the market and second-guessing trades only to buy high and sell low?

Our platforms have already helped over 40,000 investors automate their investments.

We have over $150M in assets under management.

Sign up for FREE here:

app.surmount.ai/signup

Tired of timing the market and second-guessing trades only to buy high and sell low?

Our platforms have already helped over 40,000 investors automate their investments.

We have over $150M in assets under management.

Sign up for FREE here:

app.surmount.ai/signup

That's it. Thanks for reading.

Follow me @LogWeaver, for more stories like this.

Follow me @LogWeaver, for more stories like this.

Video Credits: youtube.com/watch?v=eyFKQE…

youtube.com/shorts/FCERxRF…

youtube.com/watch?v=sc8zcS…

youtube.com/watch?v=b3LKoI…

youtube.com/watch?v=_FLo14…

youtube.com/watch?v=xt2vvF…

youtube.com/shorts/FCERxRF…

youtube.com/watch?v=sc8zcS…

youtube.com/watch?v=b3LKoI…

youtube.com/watch?v=_FLo14…

youtube.com/watch?v=xt2vvF…

• • •

Missing some Tweet in this thread? You can try to

force a refresh