Modernizing investment management. Founder @surmountinvest, Owner @quantbase_, @forbes Business Council, @WBJonline 25 Under 25

7 subscribers

How to get URL link on X (Twitter) App

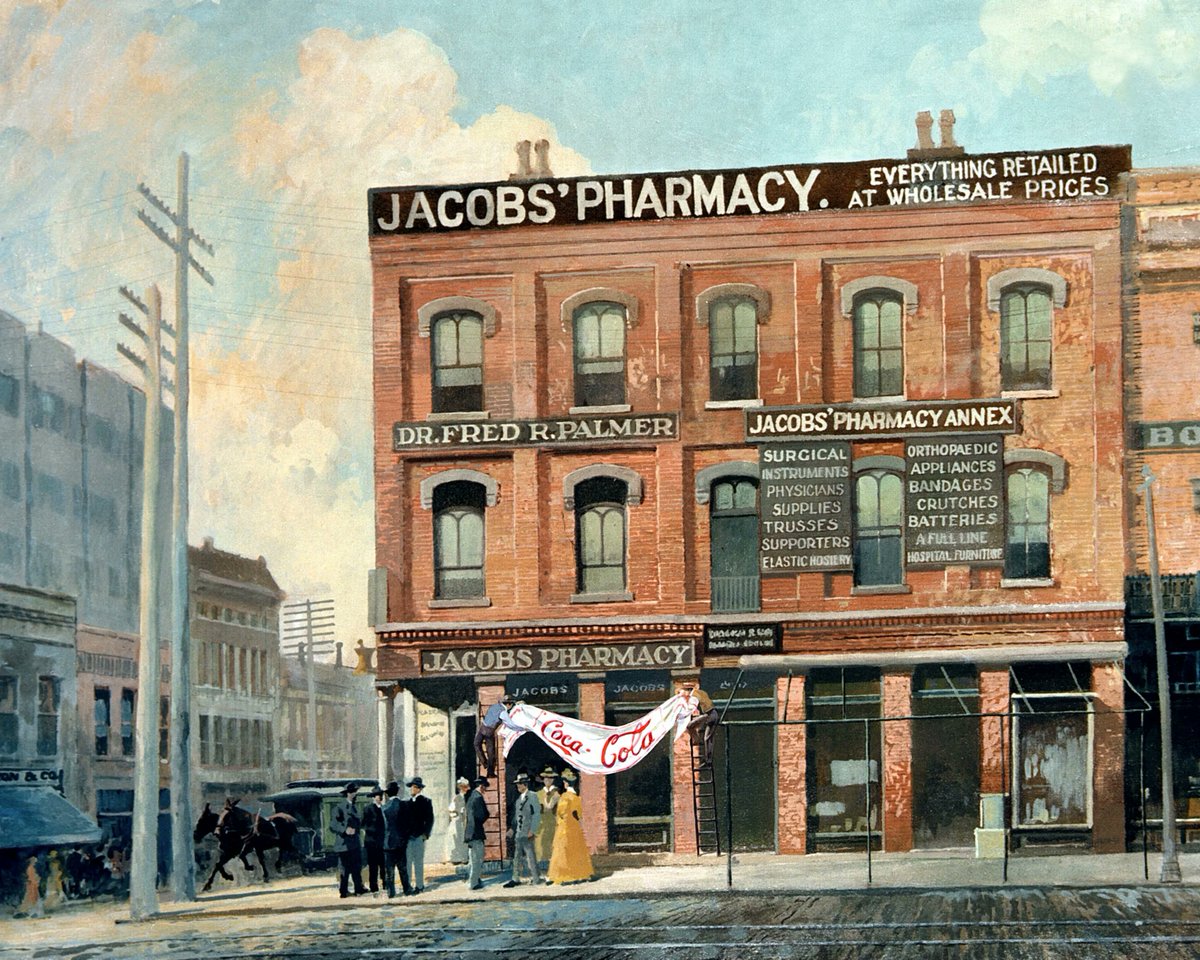

1886: John Pemberton creates Coca-Cola as "medicine."

1886: John Pemberton creates Coca-Cola as "medicine."

1914: Archduke Franz Ferdinand gets assassinated.

1914: Archduke Franz Ferdinand gets assassinated.

Meet Nikolai Kondratiev.

Meet Nikolai Kondratiev.

Meet Clément Juglar.

Meet Clément Juglar.

Meet Jakob Fugger "the Rich."

Meet Jakob Fugger "the Rich."

Welcome to 1700s Japan.

Welcome to 1700s Japan.

Meet Pierre Samuel DuPont.

Meet Pierre Samuel DuPont.

Meet John Law.

Meet John Law.

The biggest myth about China? That Xi Jinping controls everything.

The biggest myth about China? That Xi Jinping controls everything.

The Medallion Fund isn't your typical hedge fund.

The Medallion Fund isn't your typical hedge fund.

It started with Mussolini's guilt money.

It started with Mussolini's guilt money.

The Federal Reserve has a structure unlike any other institution.

The Federal Reserve has a structure unlike any other institution.

Meet the Cargill-MacMillan family.

Meet the Cargill-MacMillan family.

It started with Cornelius "Commodore" Vanderbilt.

It started with Cornelius "Commodore" Vanderbilt.

Trump's wealth started with his grandfather Friedrich Trump.

Trump's wealth started with his grandfather Friedrich Trump.

Meet Michael Sheen.

Meet Michael Sheen.

Back in the day, billionaires had a mission.

Back in the day, billionaires had a mission.

This story starts with a broke prince in 1860.

This story starts with a broke prince in 1860.

Meet Masayoshi Son.

Meet Masayoshi Son.

10/The Rothschilds

10/The Rothschilds

Let's go back to 2003...

Let's go back to 2003...