One failure I wouldn’t trade for a success:

Losing $50,000 buying my first business.

Here are 10 lessons on deal-making that I learned the hard way (so you don’t have to):

Losing $50,000 buying my first business.

Here are 10 lessons on deal-making that I learned the hard way (so you don’t have to):

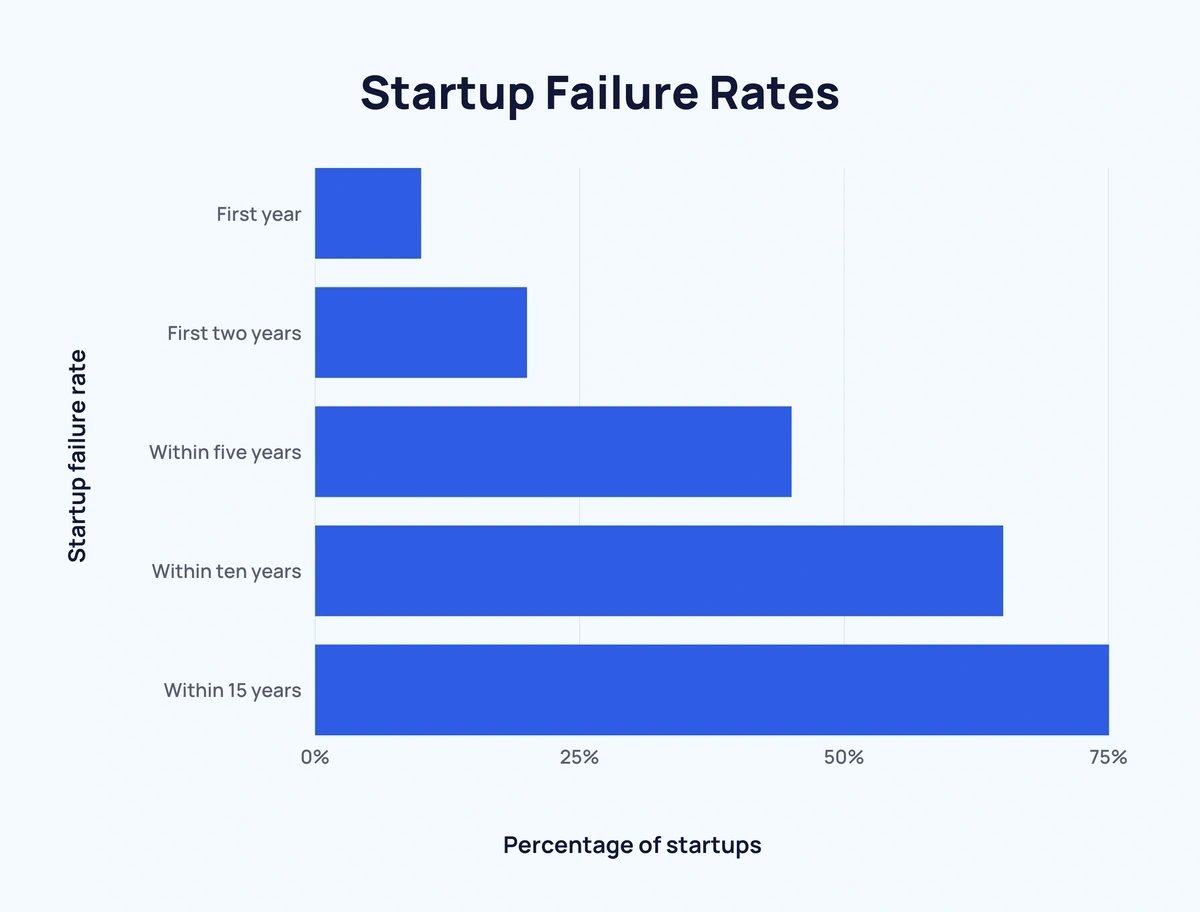

Don't Buy An Unprofitable Business

It's tempting, but just don't.

Buying a turnaround means you're buying someone else's problems - cash burn, broken systems, demoralized teams.

Even if you fix it, you'll spend 3x more time and money than if you bought something that already works.

It's tempting, but just don't.

Buying a turnaround means you're buying someone else's problems - cash burn, broken systems, demoralized teams.

Even if you fix it, you'll spend 3x more time and money than if you bought something that already works.

Beware Of Personal Guarantee Loans (Especially On Your First Deal)

PG = your personal assets are on the line if you can't pay back the business's loan.

Only do it if you're very rich or have investors who can cover you.

No heavier weight than debt you can't pay.

PG = your personal assets are on the line if you can't pay back the business's loan.

Only do it if you're very rich or have investors who can cover you.

No heavier weight than debt you can't pay.

De-risking = Diversifying

You don't need to fund an entire deal yourself.

There are tons of options: seller financing, investors, an SBA loan, etc.

I always want 12 months of cash set aside in case anything goes sideways.

Use different funding so you don’t use all your $$ just to close the deal.

You don't need to fund an entire deal yourself.

There are tons of options: seller financing, investors, an SBA loan, etc.

I always want 12 months of cash set aside in case anything goes sideways.

Use different funding so you don’t use all your $$ just to close the deal.

Avoid Owner-Centric Businesses

“We don't do any marketing, just referrals and word-of-mouth. If you add marketing, you'll get SOO much more business!”

Run.

Your business should never be overly dependent on any one individual (even you).

“We don't do any marketing, just referrals and word-of-mouth. If you add marketing, you'll get SOO much more business!”

Run.

Your business should never be overly dependent on any one individual (even you).

Don't Get Emotionally Attached to A Deal

Acquisitions go wrong when people search for why they SHOULD do a deal.

You should search for why NOT to. Fall in love with the game, not 1 deal.

Set your max price before you start negotiating. When you hit it, walk away.

Acquisitions go wrong when people search for why they SHOULD do a deal.

You should search for why NOT to. Fall in love with the game, not 1 deal.

Set your max price before you start negotiating. When you hit it, walk away.

100% Ownership Isn't The Only Path to Success

• Do sweat equity

• Be a partial owner

• Invest in someone else's deal

100% control isn’t the only win-win scenario.

• Do sweat equity

• Be a partial owner

• Invest in someone else's deal

100% control isn’t the only win-win scenario.

Don't Project for "Ideal" Numbers

Hope is not a strategy.

Run scenarios where revenue drops 30%, key customers leave, and costs go through the roof.

Do worst-case scenario planning.

If your deal still looks good, you've found a winner.

Hope is not a strategy.

Run scenarios where revenue drops 30%, key customers leave, and costs go through the roof.

Do worst-case scenario planning.

If your deal still looks good, you've found a winner.

Do. Not. Run. Out. Of. Cash.

The only real business advice you need:

• Don't run out of cash

• Look at your bank account weekly

• Treat customers like you won't get another

Revenue is vanity, profit is sanity, but cash is king.

Prioritize those metrics in that ascending order and you should be fine.

The only real business advice you need:

• Don't run out of cash

• Look at your bank account weekly

• Treat customers like you won't get another

Revenue is vanity, profit is sanity, but cash is king.

Prioritize those metrics in that ascending order and you should be fine.

There's No "Perfect Business"

Only a perfect business for YOU.

A $10M manufacturing company might be perfect for someone with industrial experience but a nightmare for a first-time buyer.

Match the deal size to your skills, capital, and lifestyle goals.

Only a perfect business for YOU.

A $10M manufacturing company might be perfect for someone with industrial experience but a nightmare for a first-time buyer.

Match the deal size to your skills, capital, and lifestyle goals.

Don't Keep Your Deal Private

It sucks to work hard on a deal only to have people call your baby ugly.

What sucks more? Owning a terrible business.

Find a network to pressure test each deal you look at.

Especially if you are a first-time buyer, experienced owners will spot red flags you're blind to.

It sucks to work hard on a deal only to have people call your baby ugly.

What sucks more? Owning a terrible business.

Find a network to pressure test each deal you look at.

Especially if you are a first-time buyer, experienced owners will spot red flags you're blind to.

Next question I always get:

"How am I supposed to see all this stuff in a deal?"

Turns out, spreadsheets tell stories. You just need to know how to interpret them.

Have you ever wanted to watch a pro dissect a real live deal?

"How am I supposed to see all this stuff in a deal?"

Turns out, spreadsheets tell stories. You just need to know how to interpret them.

Have you ever wanted to watch a pro dissect a real live deal?

I and one of the smartest business buyers I've met are doing it live next week.

It'll be completely free. Online. About 90 minutes long.

We did our first one like this in February, and people loved it so much…we’re doing it again!

Don’t miss it: info.contrarianthinking.co/mc-deal-review…

It'll be completely free. Online. About 90 minutes long.

We did our first one like this in February, and people loved it so much…we’re doing it again!

Don’t miss it: info.contrarianthinking.co/mc-deal-review…

• • •

Missing some Tweet in this thread? You can try to

force a refresh