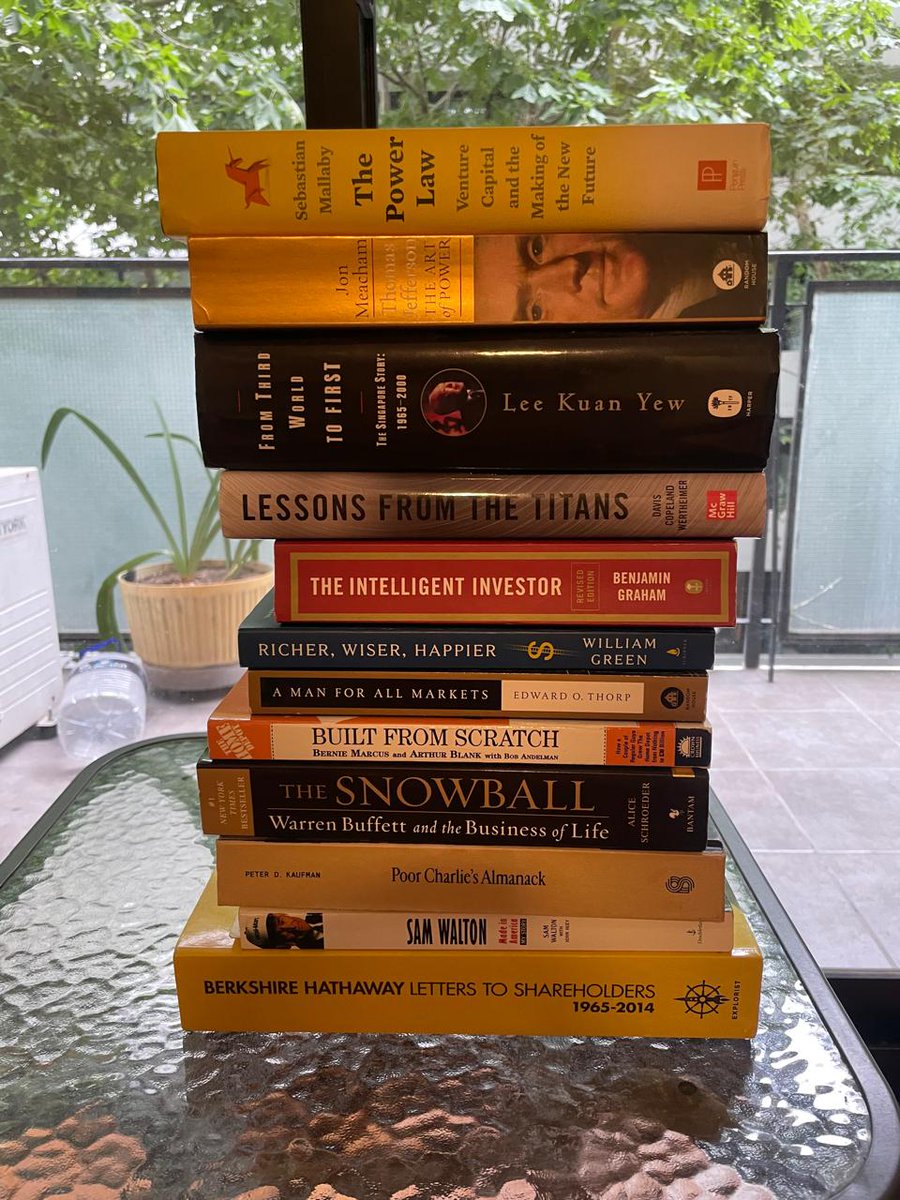

Lee Kuan Yew is the most exceptional leader I've read about.

Long thread with how LKY took Singapore from third world to first:

Long thread with how LKY took Singapore from third world to first:

Lee Kuan Yew's genius was in systematically picking the correct system to fix huge societal issues.

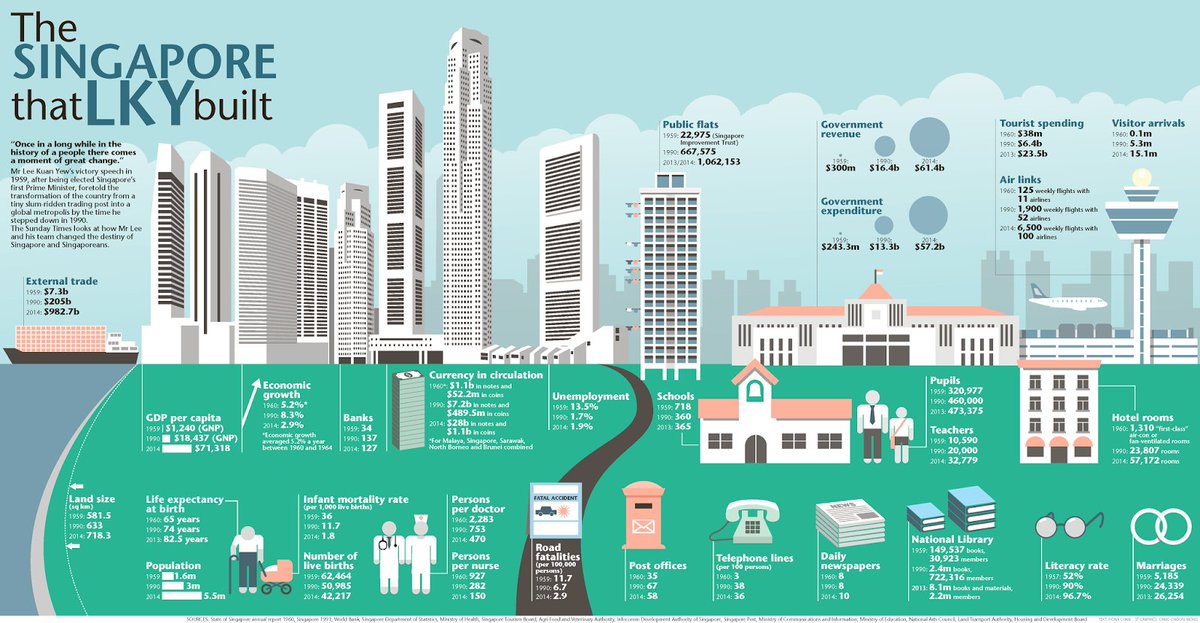

Singapore's GDP per capita increased from $500 in 1965 to $83,000 in 2023.

We'll go over how he laid the foundations for such a crazy outcome.

Singapore's GDP per capita increased from $500 in 1965 to $83,000 in 2023.

We'll go over how he laid the foundations for such a crazy outcome.

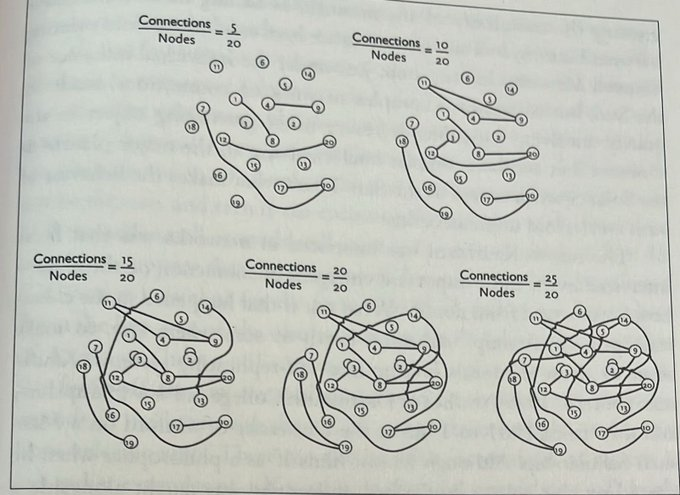

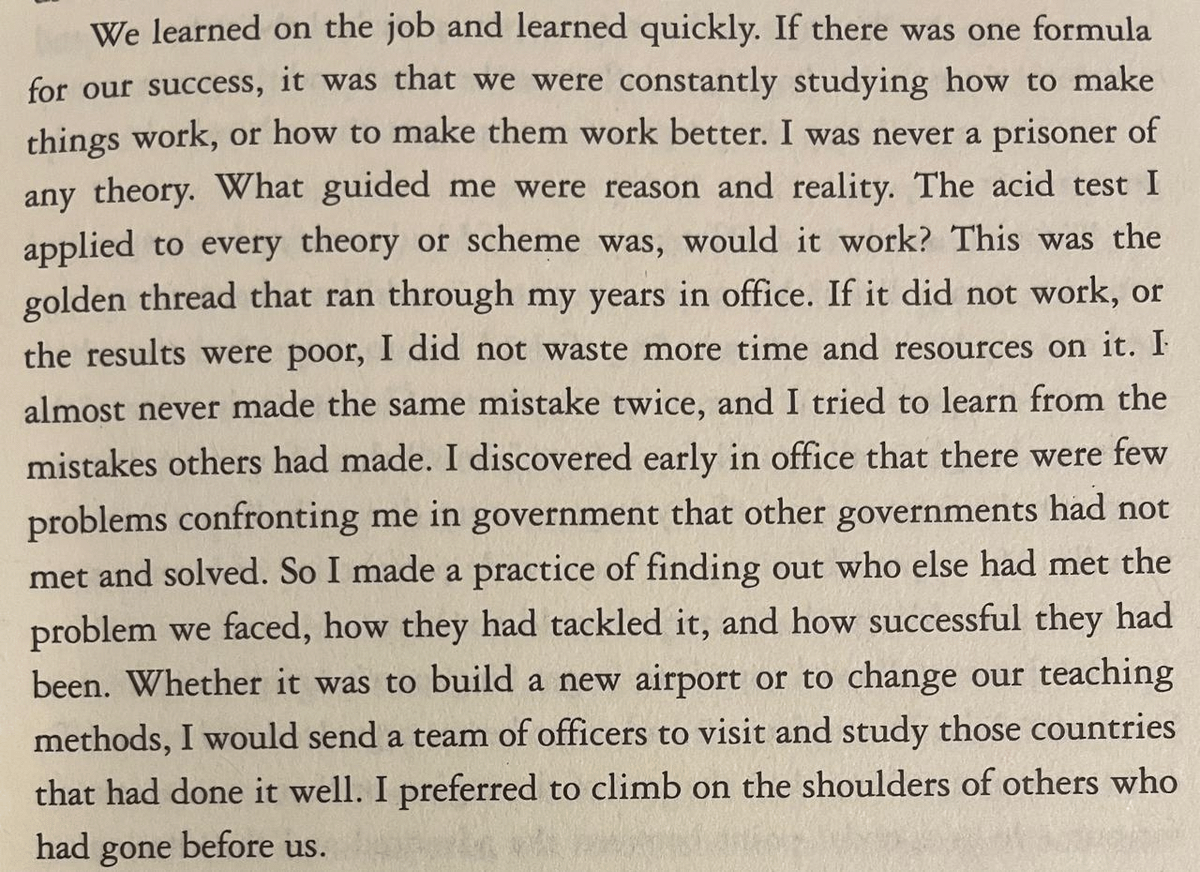

The whole ethos of Lee Kuan Yew's government was very simple:

-Figure out what works and do it.

-Don't be a prisoner of an ideology.

-Avoid what didn't work for others.

-Give a sense of fair play to society.

-Align interests towards Singapore's success.

-Learn from mistakes.

-Figure out what works and do it.

-Don't be a prisoner of an ideology.

-Avoid what didn't work for others.

-Give a sense of fair play to society.

-Align interests towards Singapore's success.

-Learn from mistakes.

Singapore was a British colony from 1820-1959.

In 1963, they merged with Malaya, North Borneo, and Sarawak to form Malaysia.

After disagreeing on how things should be managed, Singapore became independent in 1965.

In 1963, they merged with Malaya, North Borneo, and Sarawak to form Malaysia.

After disagreeing on how things should be managed, Singapore became independent in 1965.

In the mid-60s, issues with Malaysia produced huge tension.

Singapore had no army.

LKY asked the whole world to help them build one.

Only Israel stepped up, and he had to call them 'Mexicans' so as not to provoke antipathy.

After 5 years, Singapore had a sizeable army.

Singapore had no army.

LKY asked the whole world to help them build one.

Only Israel stepped up, and he had to call them 'Mexicans' so as not to provoke antipathy.

After 5 years, Singapore had a sizeable army.

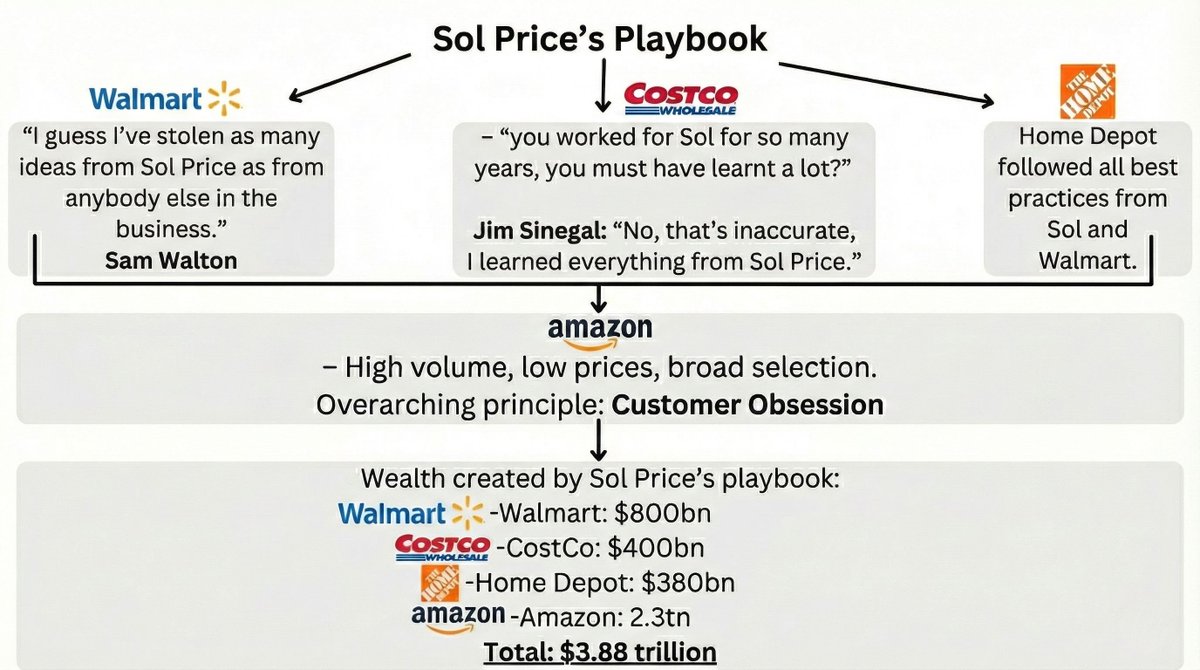

Hong Kong people had brought low technology and labor-intensive businesses in the 60s, but they didn't create many jobs.

After years of trial and error, LKY realized American MNCs would bring high technology, large-scale, operations.

So he went on to recruit American business.

After years of trial and error, LKY realized American MNCs would bring high technology, large-scale, operations.

So he went on to recruit American business.

In 1968, Lee Kuan Yew took a short sabbatical at Harvard.

He delivered speeches to hundreds of people and met dozens of executives.

20 years later, Singapore led in high-value-added electronics, petrochemicals, and precision engineering.

He delivered speeches to hundreds of people and met dozens of executives.

20 years later, Singapore led in high-value-added electronics, petrochemicals, and precision engineering.

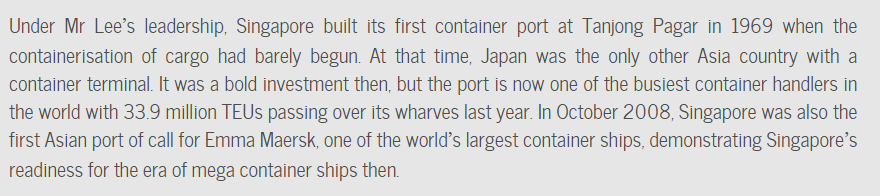

Singapore's infrastructure was a disaster. It was practically nonexistent.

No adequate water or electricity supply, infertile and unprepared land, roads full of holes.

LKY's government built roads, an airport, seaport, upgraded utilities, and urban transport.

No adequate water or electricity supply, infertile and unprepared land, roads full of holes.

LKY's government built roads, an airport, seaport, upgraded utilities, and urban transport.

The government took on many RE developments, but one stands out for its scale.

Jurong was a crocodile-infested swamp and LKY turned it into a breathtaking economic hub.

It got to cover 9,000 completely urbanized acres, home to hundreds of thousands of people.

Jurong was a crocodile-infested swamp and LKY turned it into a breathtaking economic hub.

It got to cover 9,000 completely urbanized acres, home to hundreds of thousands of people.

The next project LKY undertook was training people for high-skill trades.

Multinational corporations would not come to Singapore unless they could find fit workers.

He did this with a combination of scholarships and by encouraging MNCs to train Singaporeans.

Multinational corporations would not come to Singapore unless they could find fit workers.

He did this with a combination of scholarships and by encouraging MNCs to train Singaporeans.

LKY knew foreign companies would need fiscal incentives to invest billions in Singapore.

By 1970, they had issued almost 400 certificates, giving investors tax-free status for 5-10 years.

Some of this is still maintained.

By 1970, they had issued almost 400 certificates, giving investors tax-free status for 5-10 years.

Some of this is still maintained.

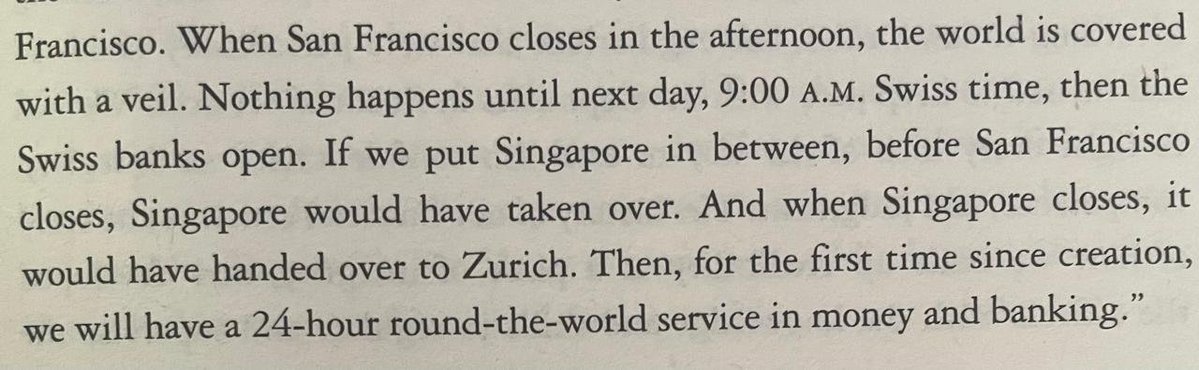

Singapore needed a solid financial system to attract investors, which triggered a marvelous insight.

There was a hole in the traffic of money due to time zones.

Zurich opened, then handed over to Frankfurt and London, then NY, SF, but then nothing happened till 9am.

There was a hole in the traffic of money due to time zones.

Zurich opened, then handed over to Frankfurt and London, then NY, SF, but then nothing happened till 9am.

They started with a modest offshore Asian dollar market.

By 1997, this market handled over $500bn.

Singapore was a key node in the system and its FX market became the 4th largest in the world.

This led to a strong Singapore Dollar.

Lee Kuan Yew attributes it to 3 things:

By 1997, this market handled over $500bn.

Singapore was a key node in the system and its FX market became the 4th largest in the world.

This led to a strong Singapore Dollar.

Lee Kuan Yew attributes it to 3 things:

Singapore had restricted foreign banks from accessing the local market.

This partly insulated them from huge crises, but local banks were dangerously inward-looking.

In 1997, restrictions were lifted and foreign banks were allowed to increase their stake in local banks.

This partly insulated them from huge crises, but local banks were dangerously inward-looking.

In 1997, restrictions were lifted and foreign banks were allowed to increase their stake in local banks.

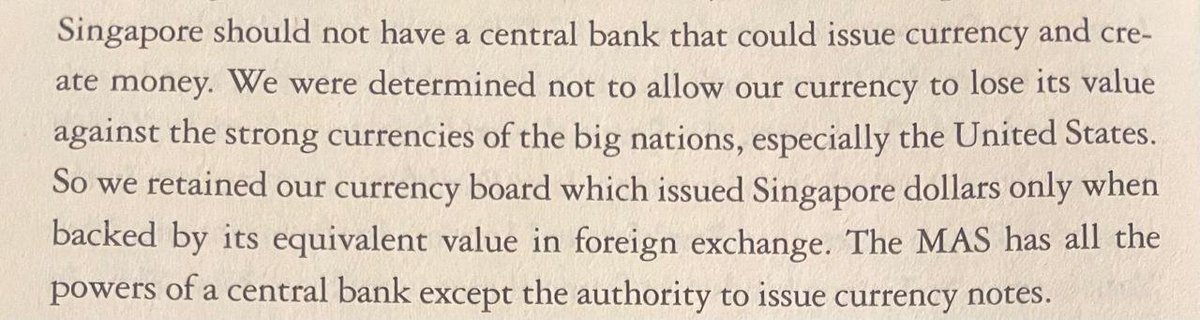

On monetary policy, they proceeded with two entities:

1. Monetary Authority of Singapore.

2. Currency board.

They intended to follow a strictly disciplined path to protect their currency's value.

1. Monetary Authority of Singapore.

2. Currency board.

They intended to follow a strictly disciplined path to protect their currency's value.

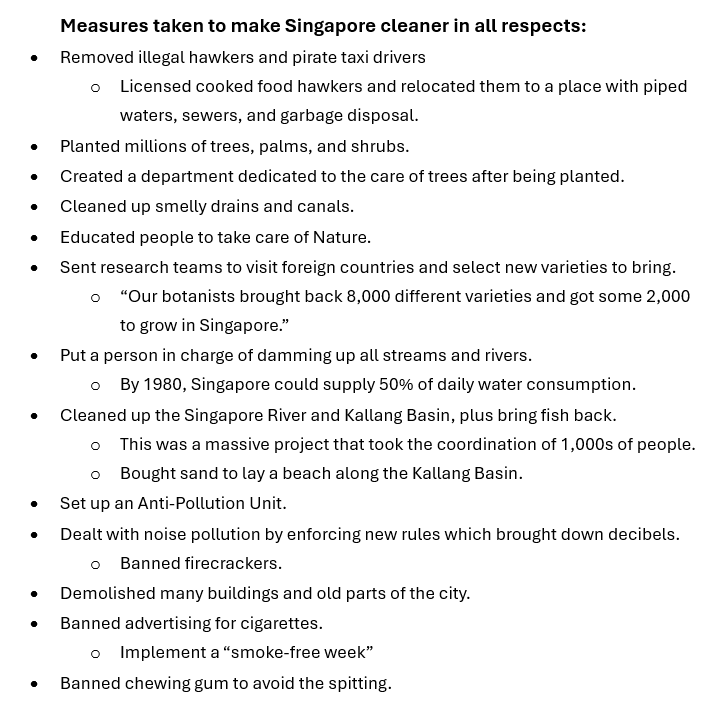

Lee Kuan Yew realized that Singapore had to become a much cleaner city. They needed to:

1. Increase green spaces and actual cleanliness.

2. Change people's habits.

The result was a greatly civilized and neat society.

How they did this:

1. Increase green spaces and actual cleanliness.

2. Change people's habits.

The result was a greatly civilized and neat society.

How they did this:

Singapore still holds a high position in environmental rankings.

As a byproduct of their greening efforts, tourism skyrocketed and is now a great boost to their economy.

In 2023, with a population of 6 million people, Singapore had over 13 million tourists.

As a byproduct of their greening efforts, tourism skyrocketed and is now a great boost to their economy.

In 2023, with a population of 6 million people, Singapore had over 13 million tourists.

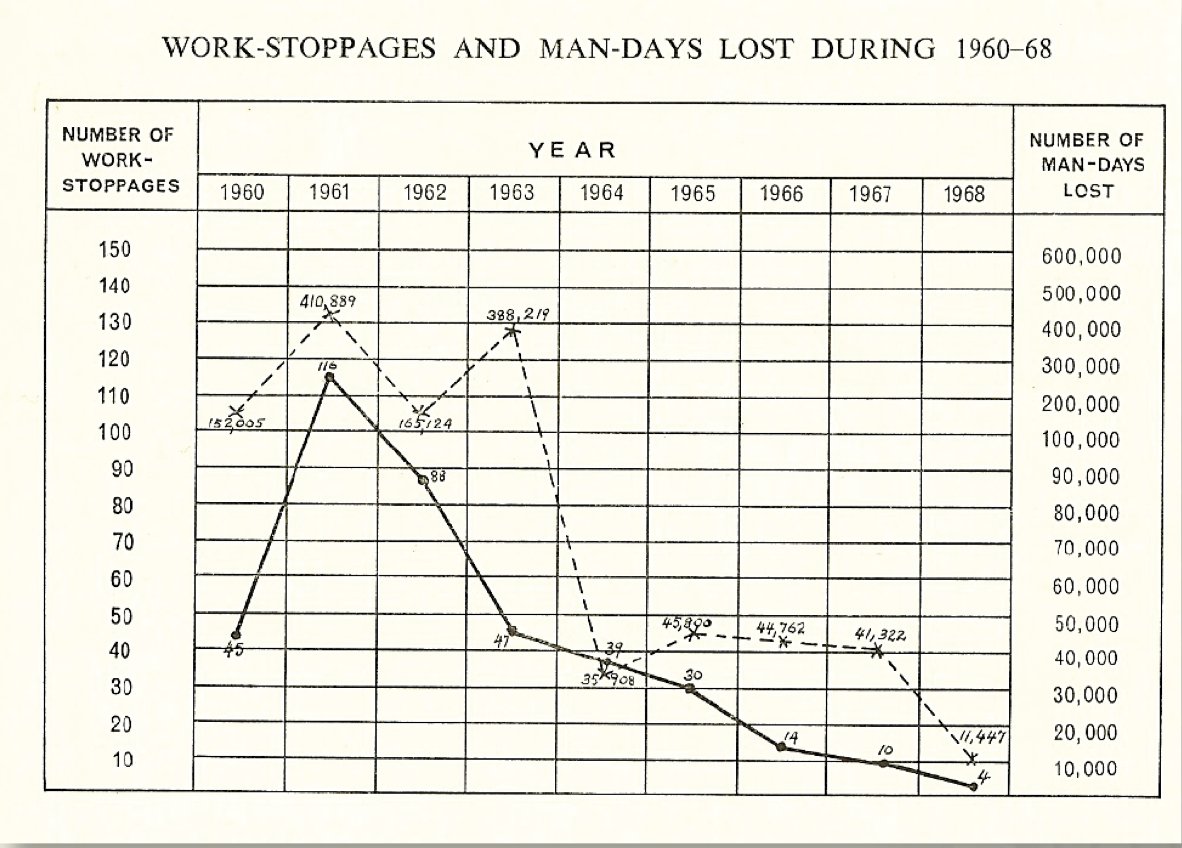

Another big problem LKY dealt with was unions.

Between Jul 1961 and Sep 62, there were 153 strikes.

By 1969, they had none.

With a strong character, he made sure the law was enforced.

Speeches and negotiations turned the game into a reasonable give-and-take.

Between Jul 1961 and Sep 62, there were 153 strikes.

By 1969, they had none.

With a strong character, he made sure the law was enforced.

Speeches and negotiations turned the game into a reasonable give-and-take.

People work better when they have assets to protect.

To align everyone's incentives, LKY set up the Home Development Board to increase home ownership.

By 1965, 50k flats were constructed, providing roofs to 20% of Singaporeans.

By 2000, 88% of people lived in public housing.

To align everyone's incentives, LKY set up the Home Development Board to increase home ownership.

By 1965, 50k flats were constructed, providing roofs to 20% of Singaporeans.

By 2000, 88% of people lived in public housing.

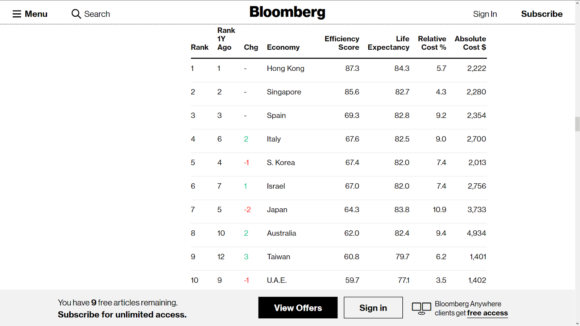

The CPF was a simple savings scheme that LKY turned into gold.

Workers could use up to 20% of their savings for the house down payment.

In healthcare, savings would be used to pay for people's medical bills.

Singapore's healthcare system is now the best and cheapest.

Workers could use up to 20% of their savings for the house down payment.

In healthcare, savings would be used to pay for people's medical bills.

Singapore's healthcare system is now the best and cheapest.

CPF benefits extended beyond these to include insurance and a retirement pension.

After Singaporeans saw how efficient the system was, everyone wanted in.

The CPF grew from 420k members in 1965 to over 2.8 million in 1998, worth S$85 billion.

After Singaporeans saw how efficient the system was, everyone wanted in.

The CPF grew from 420k members in 1965 to over 2.8 million in 1998, worth S$85 billion.

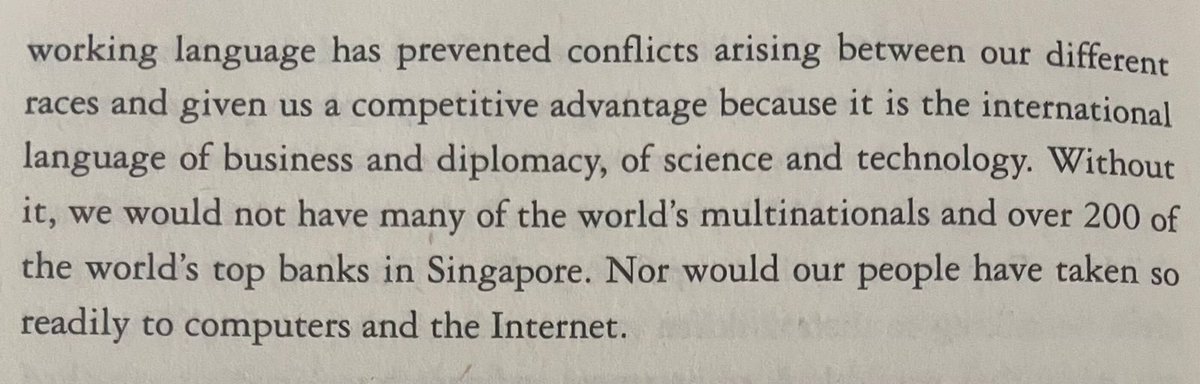

In the 60s, Singapore was a society made of Chinese, Malayans, and Indians, all of whom spoke different languages.

One of LKY's key decisions was favoring the study of English in all schools and universities.

Truly everyone opposed, but he was right.

One of LKY's key decisions was favoring the study of English in all schools and universities.

Truly everyone opposed, but he was right.

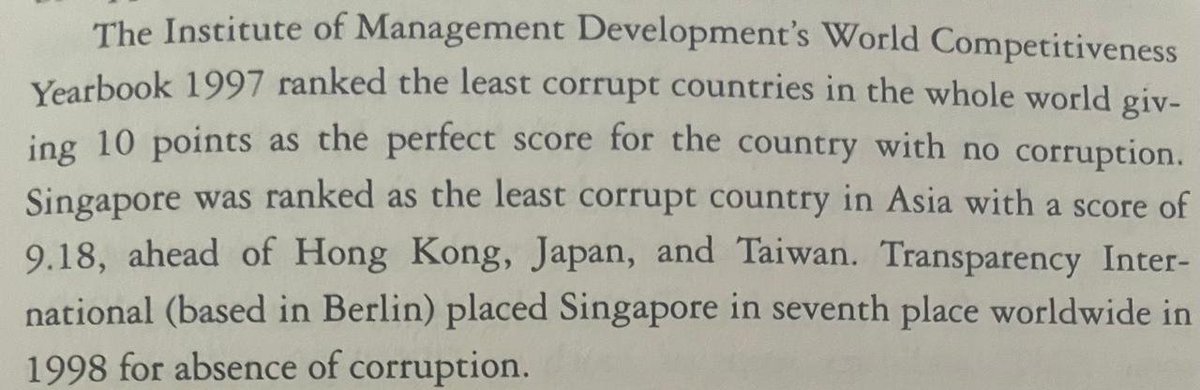

As soon as the PAP got into office in 1959, they made a huge effort to become a clean government.

By taking measures like increasing the fine for corruption and paying ministers a salary comparable to what they could earn in the private sector, he solved corruption.

By taking measures like increasing the fine for corruption and paying ministers a salary comparable to what they could earn in the private sector, he solved corruption.

In 1990, Singapore was an incipient powerhouse.

Lee Kuan Yew still held absolute power and people's confidence, but he decided to step down.

He knew that other countries ended badly because they ignored succession plans. So he moved to an advisory role.

Lee Kuan Yew still held absolute power and people's confidence, but he decided to step down.

He knew that other countries ended badly because they ignored succession plans. So he moved to an advisory role.

Hope you found this thread interesting and feel free to share if you have!

You can follow me at @Giuliano_Mana and I'll help you read more.

You can follow me at @Giuliano_Mana and I'll help you read more.

https://twitter.com/1516427781135114253/status/1951664277015892319

• • •

Missing some Tweet in this thread? You can try to

force a refresh