Thread 🧵: You Weren’t Trained to Trade, You Were Trained to Be Liquidity

The worst part?

You paid to become the exit liquidity.

Let me explain 👇

(Liquidity Breakdown)

The worst part?

You paid to become the exit liquidity.

Let me explain 👇

(Liquidity Breakdown)

Every retail strategy you learned:

• Breakouts

• Trendlines

• Support/Resistance

• Orderblocks from YouTube videos

All built around visible logic.

Predictable logic.

Logic that institutions exploit.

• Breakouts

• Trendlines

• Support/Resistance

• Orderblocks from YouTube videos

All built around visible logic.

Predictable logic.

Logic that institutions exploit.

Your entry is their exit.

Your stop is their target.

Your risk management is their reward system.

You were taught to enter where it’s comfortable.

But markets don’t pay comfort.

They pay pain.

Your stop is their target.

Your risk management is their reward system.

You were taught to enter where it’s comfortable.

But markets don’t pay comfort.

They pay pain.

Think about it:

Why does price always seem to “grab” your stop…

Then reverse?

It’s not bad luck.

It’s design.

You are participating exactly how you’re expected to.

Why does price always seem to “grab” your stop…

Then reverse?

It’s not bad luck.

It’s design.

You are participating exactly how you’re expected to.

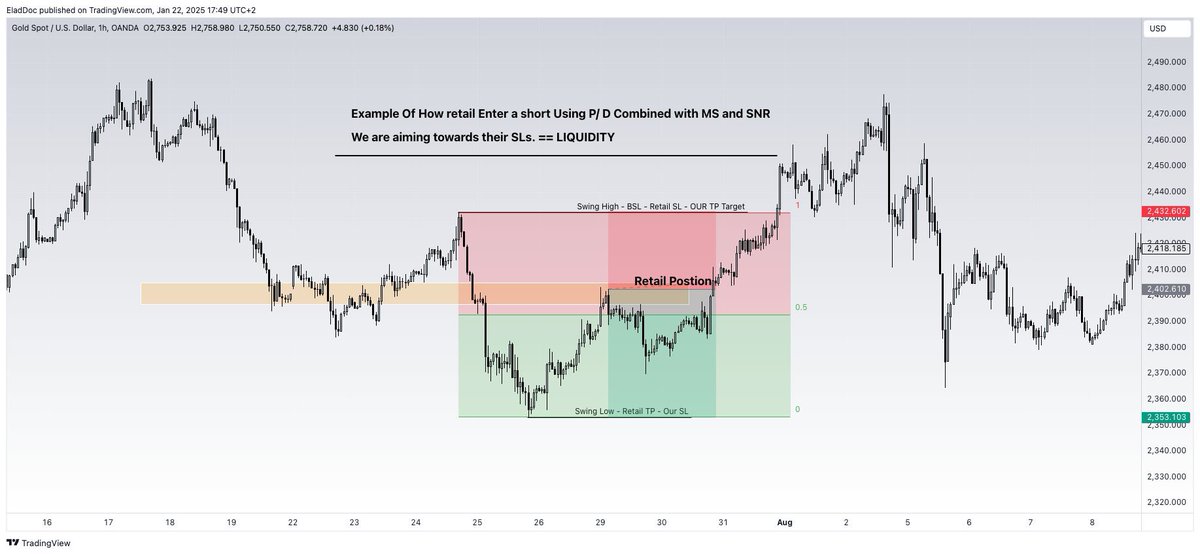

Retail POIs are emotional landmarks:

• Structure = entry

• Support and Resistance = entry

• Swing low = stop

The market offers you these…

So you commit capital into their trap.

• Structure = entry

• Support and Resistance = entry

• Swing low = stop

The market offers you these…

So you commit capital into their trap.

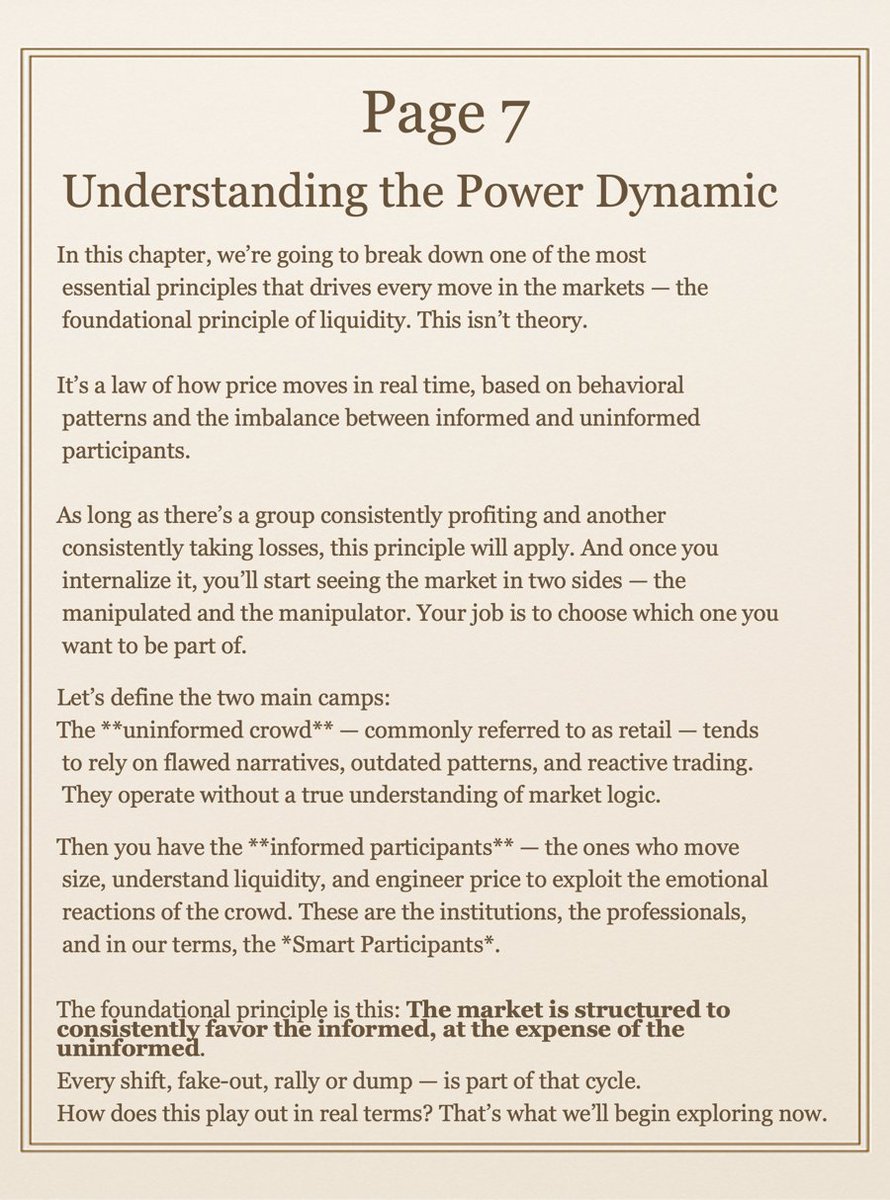

Advanced Liquidity flips the view:

You stop seeing POIs as opportunities.

And start seeing them as manipulation areas.

Where retail gets in?

You wait.

Let them commit.

Then strike.

You stop seeing POIs as opportunities.

And start seeing them as manipulation areas.

Where retail gets in?

You wait.

Let them commit.

Then strike.

It’s not about being early.

It’s about being on the right side of the trap.

You wait for retail to show their hand.

Once liquidity pools taken,

You anticipate the expansion, not the entry.

It’s about being on the right side of the trap.

You wait for retail to show their hand.

Once liquidity pools taken,

You anticipate the expansion, not the entry.

Once you learn this lens,

Every price move looks different.

Every candle becomes intentional.

And you stop being the hunted.

You become the hunter.

Every price move looks different.

Every candle becomes intentional.

And you stop being the hunted.

You become the hunter.

Ask yourself:

Have you been trained to trade like a winner,

or trained to provide the fuel for the winner?

Be honest.

Because that answer will define your future in this game.

Advanced Liquidity Logic.

Follow, Like and RT For more about AL.

Have you been trained to trade like a winner,

or trained to provide the fuel for the winner?

Be honest.

Because that answer will define your future in this game.

Advanced Liquidity Logic.

Follow, Like and RT For more about AL.

• • •

Missing some Tweet in this thread? You can try to

force a refresh