How to get URL link on X (Twitter) App

1/X

1/X

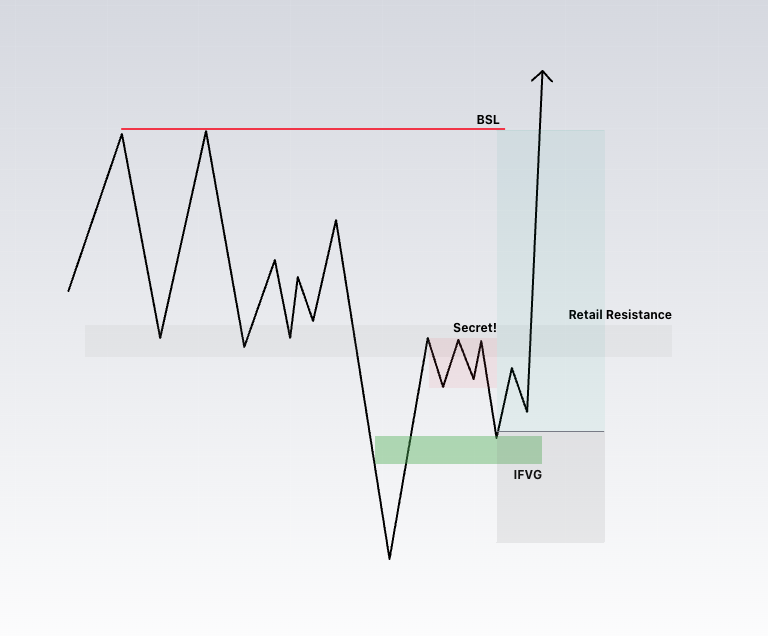

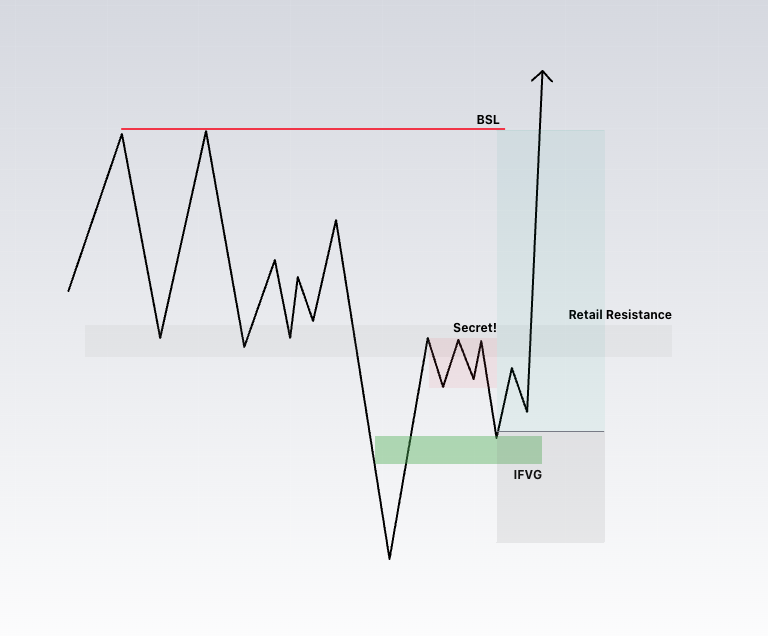

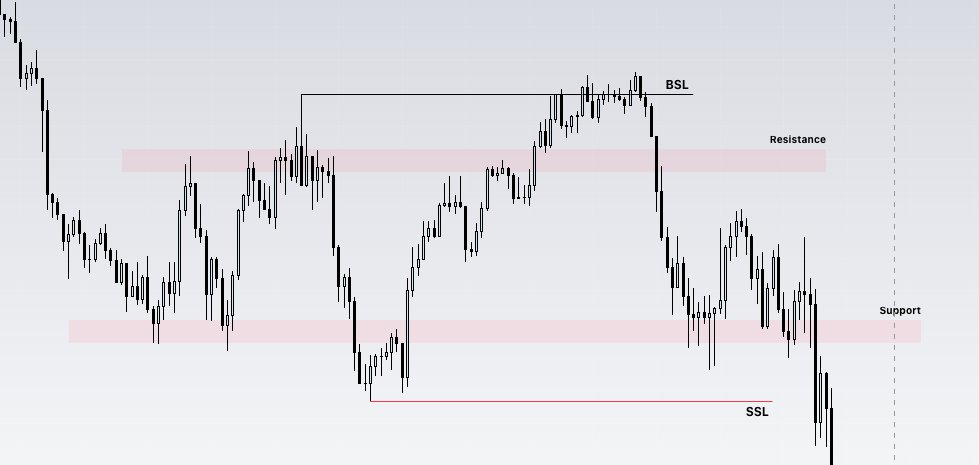

1/X First of all, what differentiates between a good IFVG and a bad IFVG is only, and will always be, liquidity.

1/X First of all, what differentiates between a good IFVG and a bad IFVG is only, and will always be, liquidity.

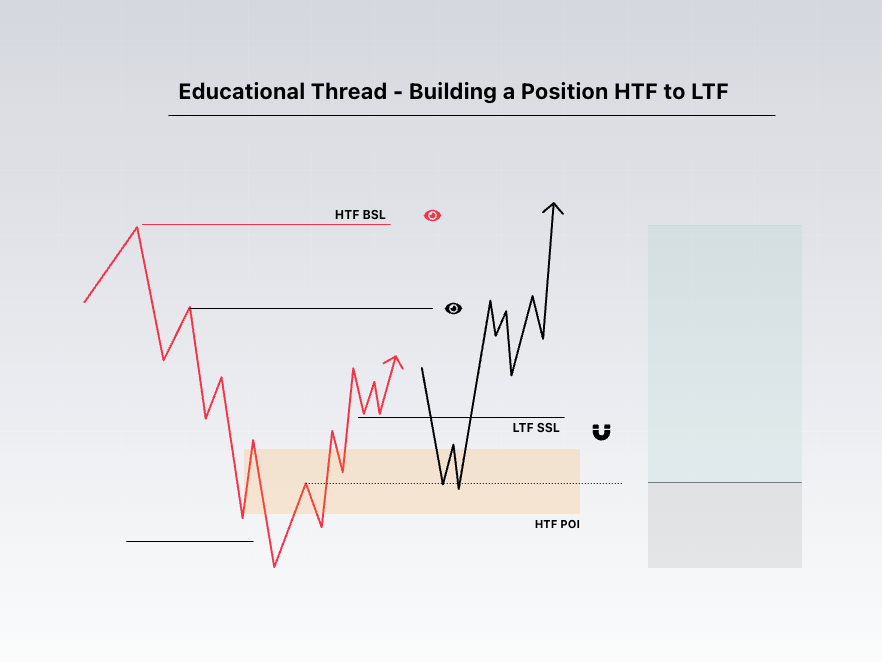

Step 1. Higher Time Frames.

Step 1. Higher Time Frames.

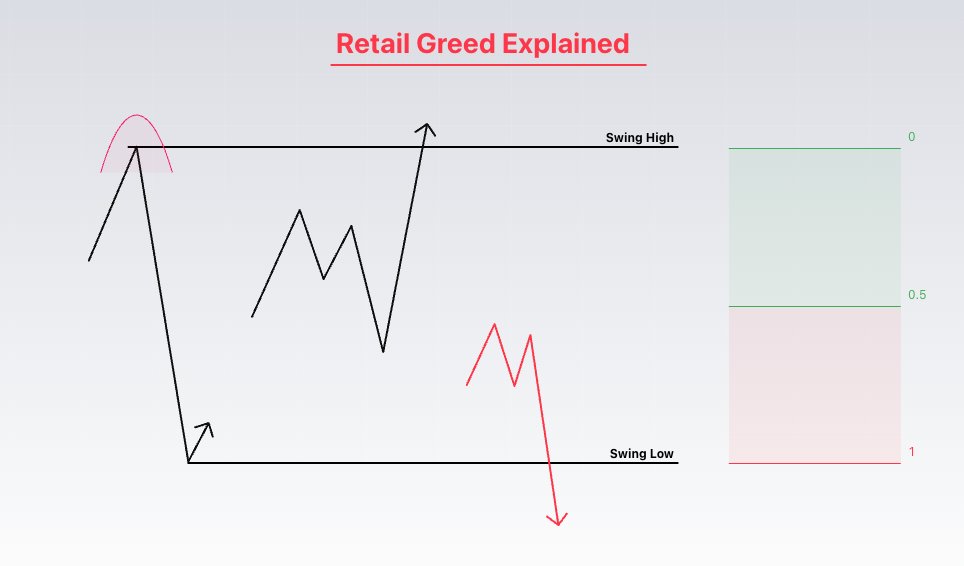

In order to understand what greed is and how to measure it, we first need to take a range and mark a Fibonacci from the swing low to the swing high, or the opposite.

In order to understand what greed is and how to measure it, we first need to take a range and mark a Fibonacci from the swing low to the swing high, or the opposite.

https://twitter.com/mendatrades/status/1978042045848518916

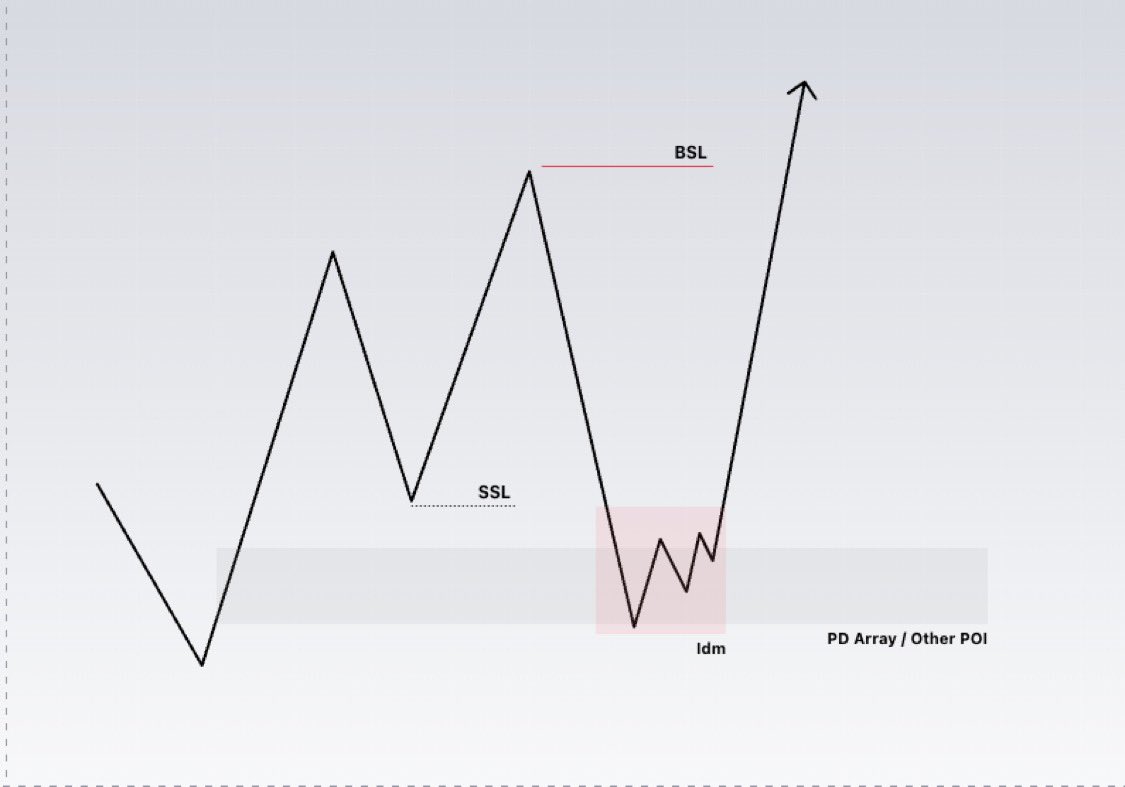

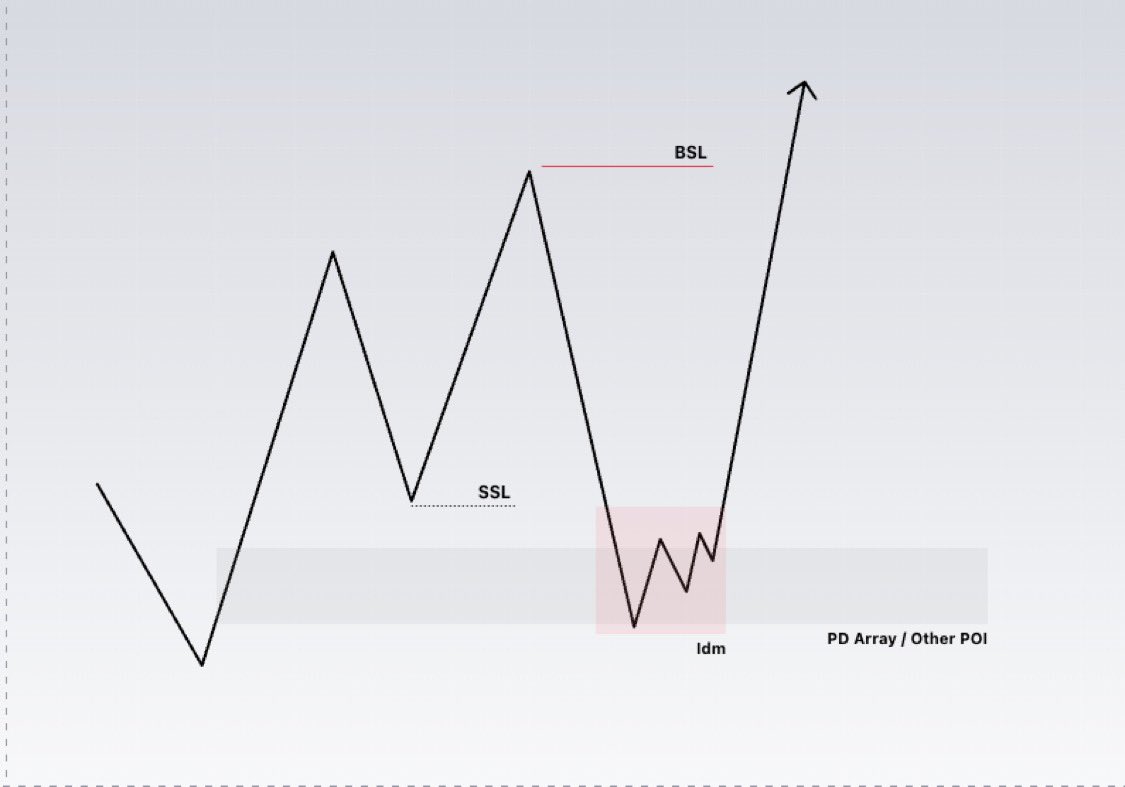

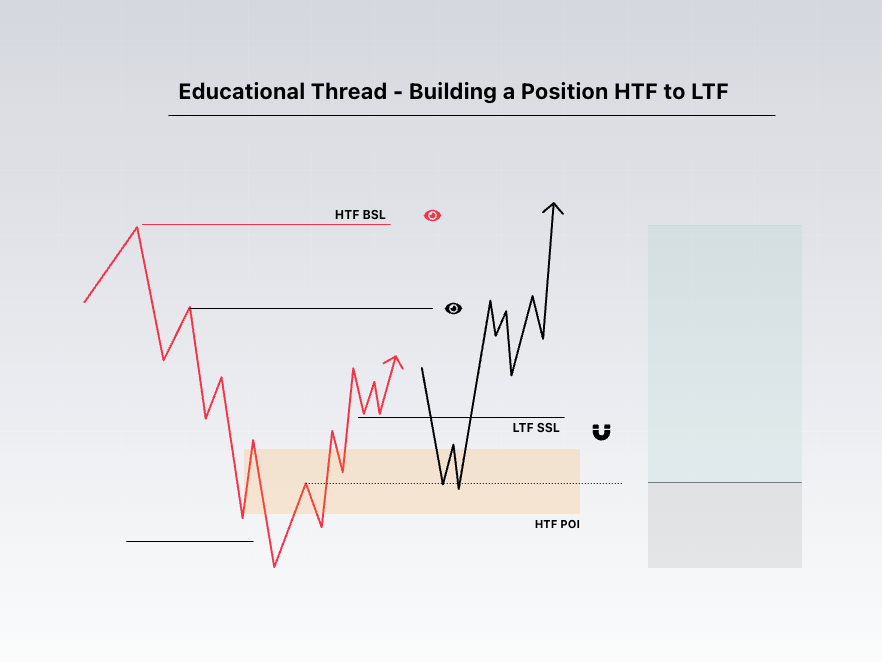

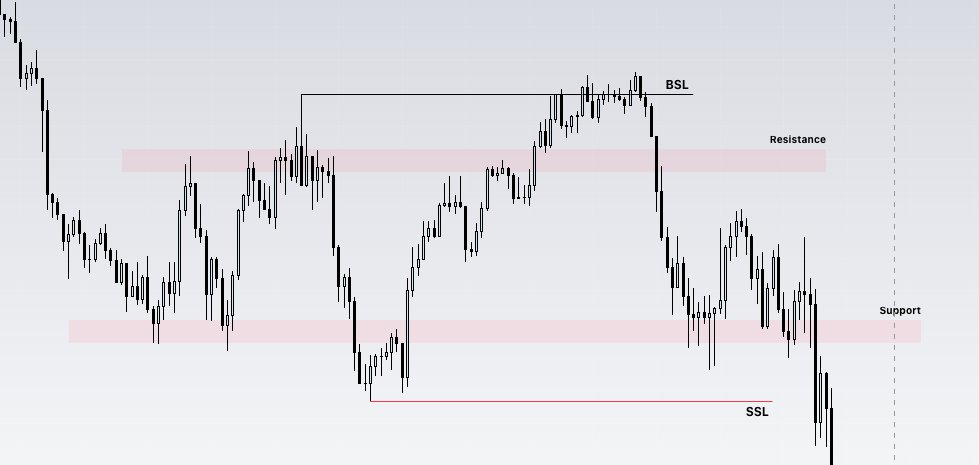

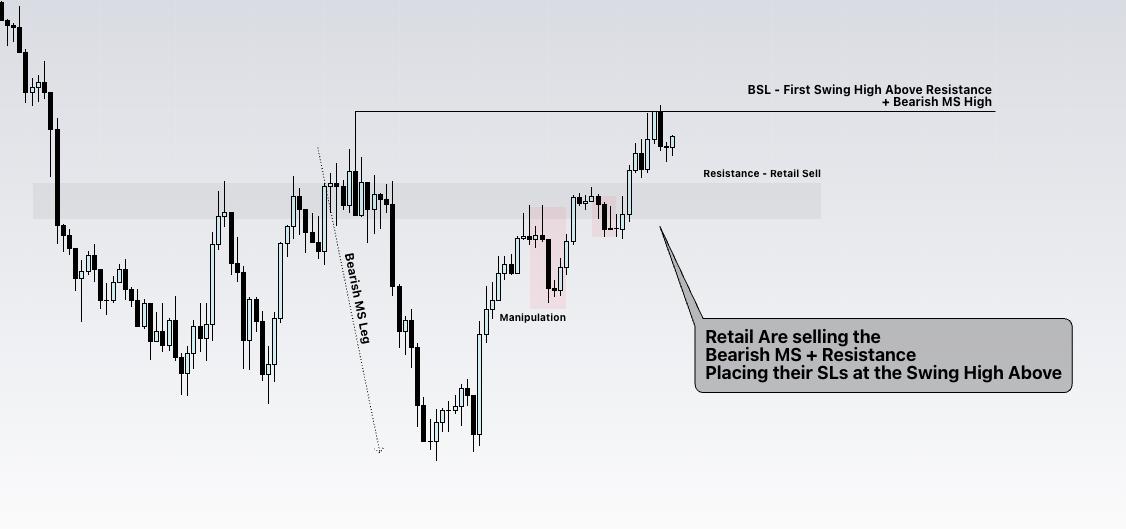

First move, expansion toward the BSL.

First move, expansion toward the BSL.

First Rule:

First Rule:

The market is a zero-sum game.

The market is a zero-sum game.

1. Liquidity Presence Comes First

1. Liquidity Presence Comes First

Accumulation isn’t just sideways price.

Accumulation isn’t just sideways price.