🚨Health Insurance Policy Analyser-ICICI Lombard Elevate

Imagine,

A 10L policy adds 10L bonus each year without any upper cap!🤯

In the 5th year, it becomes 50L

In the 10th year, it becomes 1cr and so on

The power of unlimited bonus in "Elevate"

A thread🧵on the features of ICICI Lombard Elevate?👇

Imagine,

A 10L policy adds 10L bonus each year without any upper cap!🤯

In the 5th year, it becomes 50L

In the 10th year, it becomes 1cr and so on

The power of unlimited bonus in "Elevate"

A thread🧵on the features of ICICI Lombard Elevate?👇

Room Rent limit:-

The policy has a single private AC room limit.

But this can be modified to have no room rent limit

The policy has a single private AC room limit.

But this can be modified to have no room rent limit

Co-pay

This policy does not have any co-pay.

This means the insurer will pay the entire claim

This policy does not have any co-pay.

This means the insurer will pay the entire claim

Infinite Care:-

Covers the medical expenses incurred for the hospitalization of the insured person or any one claim during the lifetime of the policy, without any limits on the annual sum insured. (T&C Apply)

One unlimited claim during the lifetime of the policy!

Covers the medical expenses incurred for the hospitalization of the insured person or any one claim during the lifetime of the policy, without any limits on the annual sum insured. (T&C Apply)

One unlimited claim during the lifetime of the policy!

No Claim Bonus:-

The no-claim bonus is 20% each year upto 100%.

However, this can be modified by a power booster:-

Power Booster

At the end of each Policy Year, the company will provide a Cumulative Bonus of 100% of the expiring or renewed Annual Sum Insured (whichever is lower)

This has no upper cap

The no-claim bonus is 20% each year upto 100%.

However, this can be modified by a power booster:-

Power Booster

At the end of each Policy Year, the company will provide a Cumulative Bonus of 100% of the expiring or renewed Annual Sum Insured (whichever is lower)

This has no upper cap

This means if u buy a 10L policy

For the First 5 years,

2L will be added each year maximum upto 10L

On top of this,

10L will be added each year without any cap for unlimited no of years

For the First 5 years,

2L will be added each year maximum upto 10L

On top of this,

10L will be added each year without any cap for unlimited no of years

Waiting period:-

The waiting period is 3 years for pre existing diseases

Hower with a rider the waiting period can be reduced.

When the rider is applied, there will be no additional loading other than the cost for this additional cover. This covers asthma, diabetes, hypertension, hyperlipidemia, obesity.

The waiting period is 3 years for pre existing diseases

Hower with a rider the waiting period can be reduced.

When the rider is applied, there will be no additional loading other than the cost for this additional cover. This covers asthma, diabetes, hypertension, hyperlipidemia, obesity.

Maternity:-

The maximum limit for maternity is 10% of the Sum insured or Rs 1lakh

The waiting period for maternity is 2 years

However, with additional cover, it can be reduced to 1 year if chosen.

However maternity premium increase is too high top consider it

The maximum limit for maternity is 10% of the Sum insured or Rs 1lakh

The waiting period for maternity is 2 years

However, with additional cover, it can be reduced to 1 year if chosen.

However maternity premium increase is too high top consider it

Reduction in premium increase for Jump Start

Jump start gives instant cover to pre existing diseases

🩺Asthama

🩺Blood pressure

🩺Diabeties

🩺cholestrol

ICICI applied a flat loading of 30% on these illnesses.

Now the loading can be as low as 10%

This is really a huge reduction in loading the company is offering

Jump start gives instant cover to pre existing diseases

🩺Asthama

🩺Blood pressure

🩺Diabeties

🩺cholestrol

ICICI applied a flat loading of 30% on these illnesses.

Now the loading can be as low as 10%

This is really a huge reduction in loading the company is offering

Worldwide cover:-

This feature gives u a claim anywhere in the world.

A waiting period of 2 years applies for any claim under this cover, except for accidental emergencies, and this is the same for new members added to the policy.

With additional cover, this can be reduced to 1 year.

This feature gives u a claim anywhere in the world.

A waiting period of 2 years applies for any claim under this cover, except for accidental emergencies, and this is the same for new members added to the policy.

With additional cover, this can be reduced to 1 year.

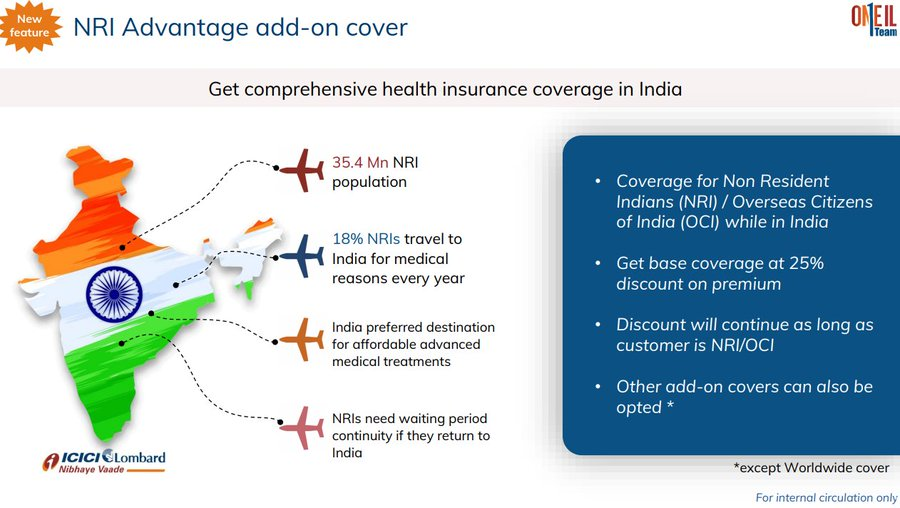

NRI Discount:-

ICICI will now offer 25% discount to NRIs

This is a great move to encourage NRIs to buy health insurance in India and get continuity benefits when they return

ICICI will now offer 25% discount to NRIs

This is a great move to encourage NRIs to buy health insurance in India and get continuity benefits when they return

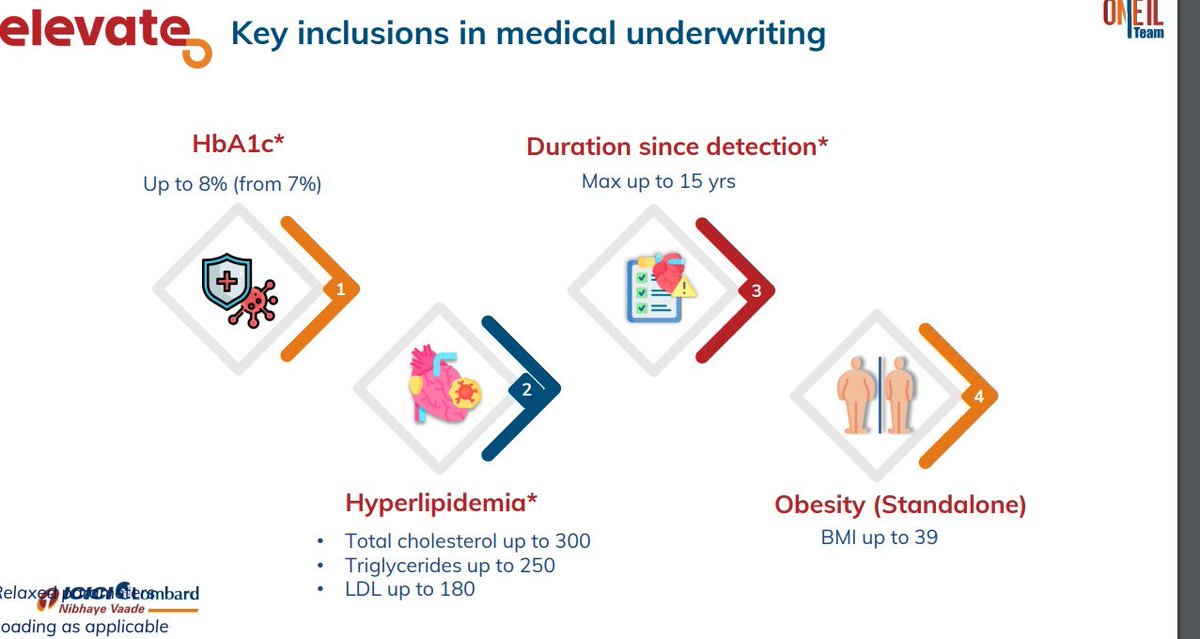

Relaxation in underwriting guidelines

ICICI has made major changes to underwriting guidelines

The guidelines are further relaxed now

ICICI has made major changes to underwriting guidelines

The guidelines are further relaxed now

Consumable cover:-

Consumables can be covered thru a rider called claim protector,

This gives 100% cover to the customer for non payable items

Consumables can be covered thru a rider called claim protector,

This gives 100% cover to the customer for non payable items

Restoration benefit:-

ICICI Lombard Elevate offer unlimited restoration benefit in its policy,

This is applicable to same person same illness as well as the same person, different illness

ICICI Lombard Elevate offer unlimited restoration benefit in its policy,

This is applicable to same person same illness as well as the same person, different illness

Here is our view on the game changer features of elevate

https://x.com/NIKHILLJHA/status/1847109393881694270

Premium:-

The premium for a 30 year Old for a 10L sum Insured is Rs 11,000.

The premium is in line with other comprehensive policy of similar nature.

The premium for a 30 year Old for a 10L sum Insured is Rs 11,000.

The premium is in line with other comprehensive policy of similar nature.

Conclusion:-

ICICI Elevate is a game-changer product,

It gives an unlimited sum insured once during the lifetime of the policy.

It has some very good features.

All other insurers will have to get products to match Elevate now

ICICI Elevate is a game-changer product,

It gives an unlimited sum insured once during the lifetime of the policy.

It has some very good features.

All other insurers will have to get products to match Elevate now

• • •

Missing some Tweet in this thread? You can try to

force a refresh