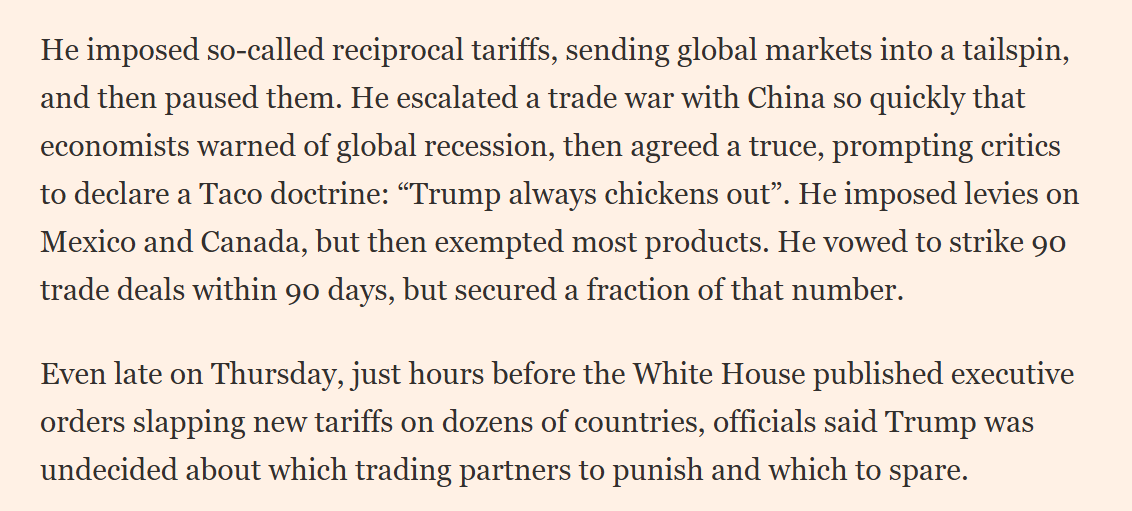

Good summary of the state of Trump's term two tariff offensive, from the FT's Aime Williams and @dimi

1/

1/

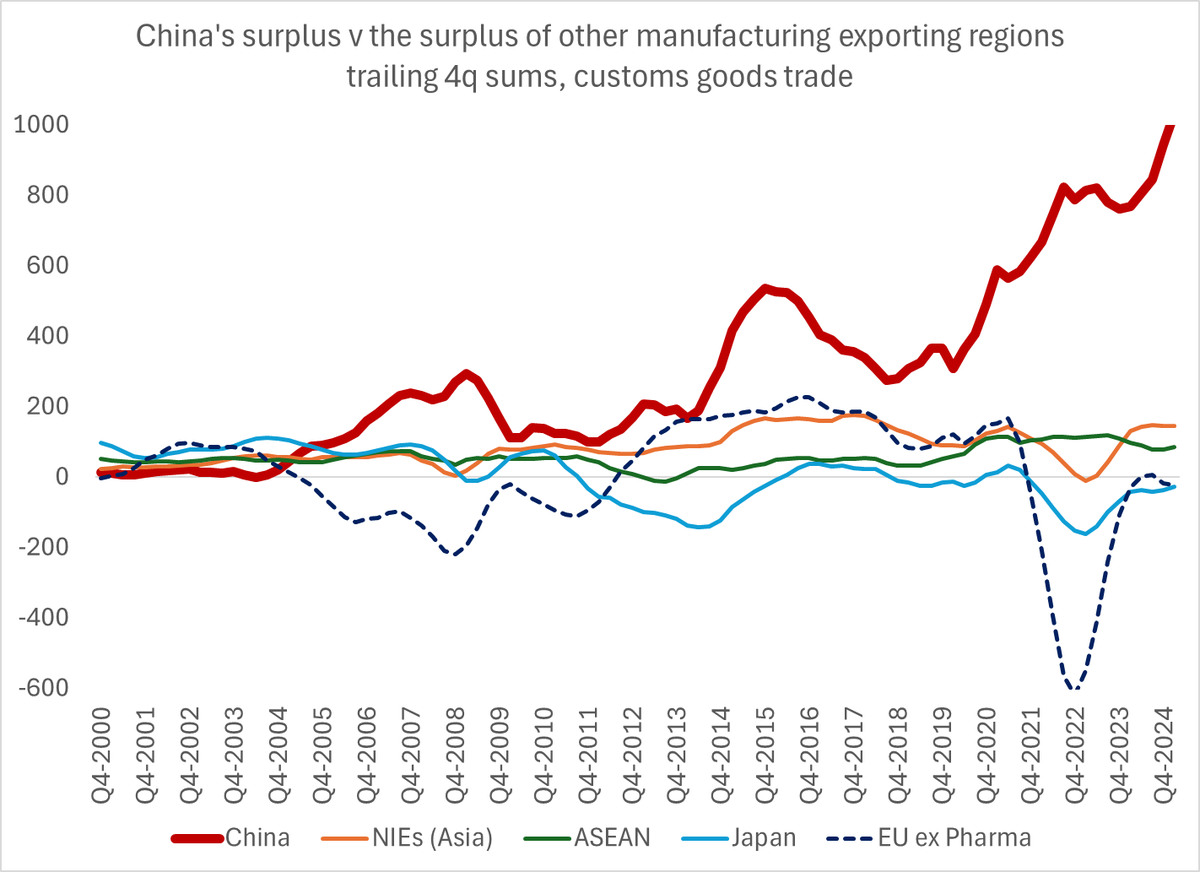

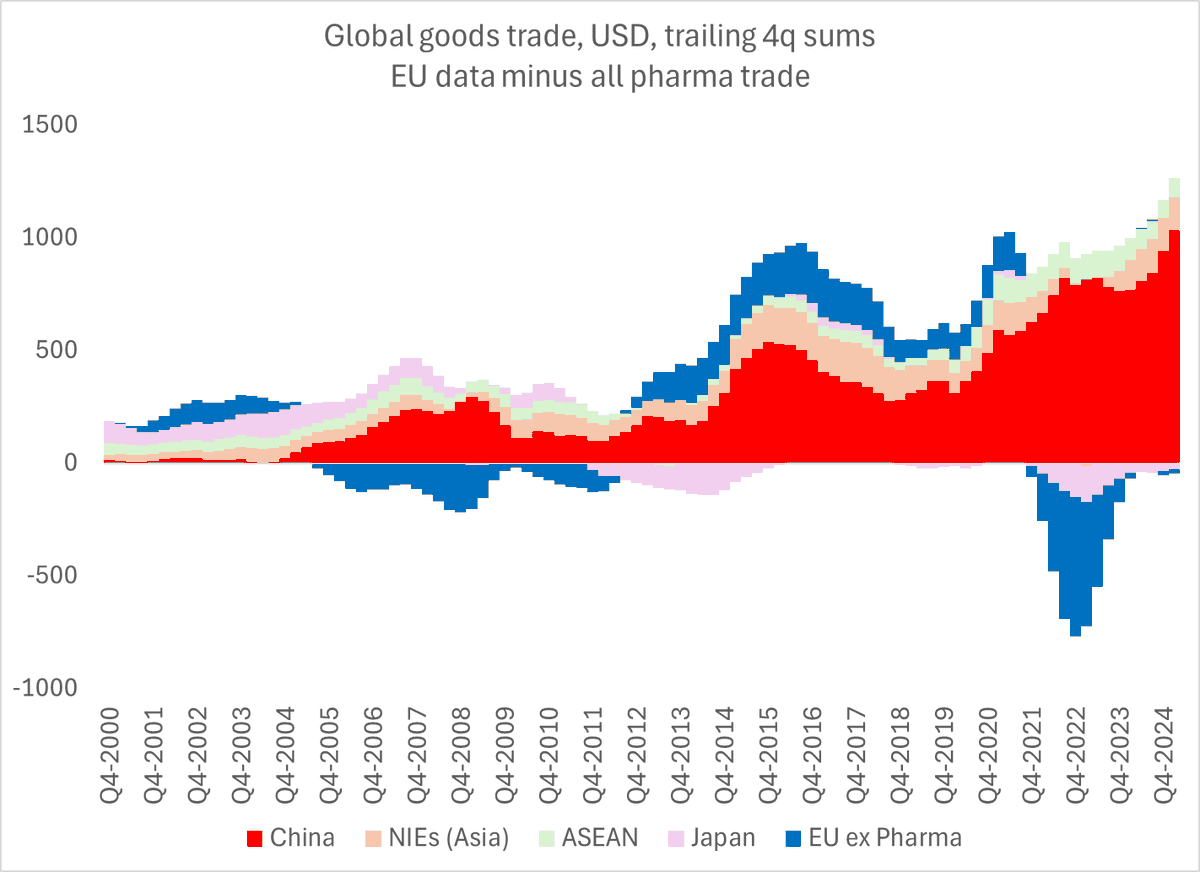

The "deals" struck by the deal maker in chief haven't been entirely, well, coherent -- raising tariffs on SE Asia to ~ 20 and some tariffs on Mexico to 25% helped China out, as it reduced the edge of alternative suppliers

2/ ft.com/content/05e524…

2/ ft.com/content/05e524…

And the 15% tariff "deals" with Japan, Korea and the EU have put US auto manufacturers at a significant disadvantage, as they face 25% tariffs on parts from Mexico and Canada + enormously inflated steel and aluminum prices from the 50% tariffs

3/

wsj.com/business/autos…

3/

wsj.com/business/autos…

Given that Michigan is an important part of the Trump coalition, a "Japan first" trade policy that punishes Detroit and the UAW doesn't seem sustainable -- but with Trump, who knows ...

4/

ft.com/content/6071e8…

4/

ft.com/content/6071e8…

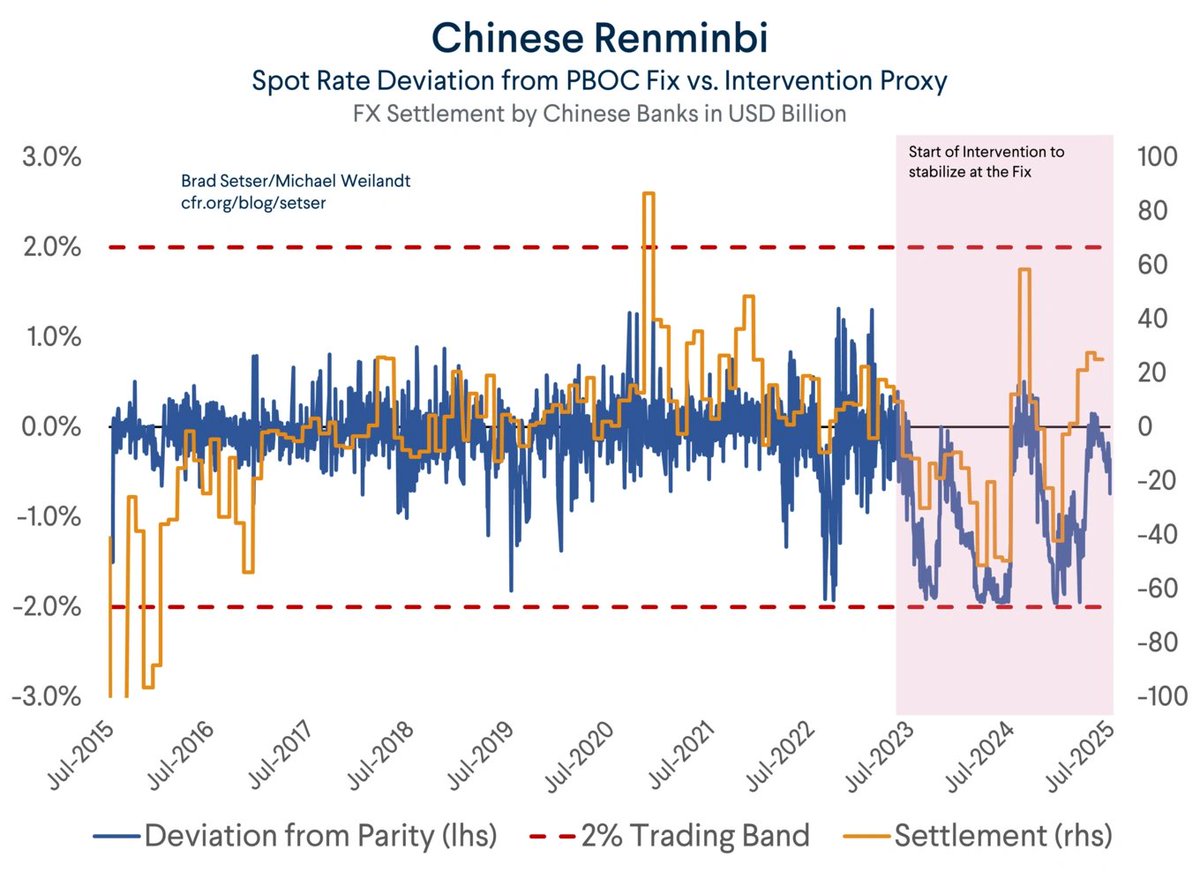

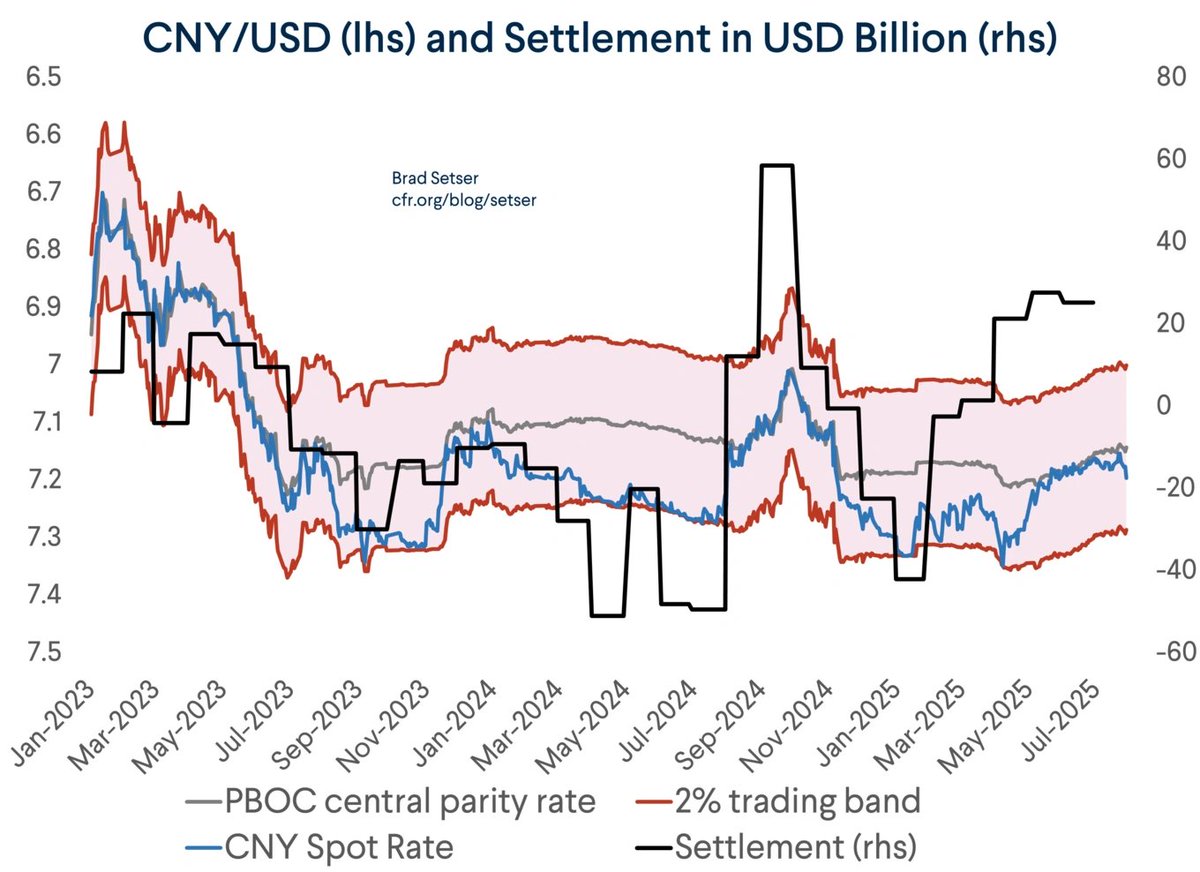

Still a bit surprised that Bessent, a currency guy, didn't make the yen more of a focal point in the negotiations with Japan: the yen is down 25% in nominal terms & more in real terms relative to Trump's first term.

Incentive to keep producing in Japan = clear

5/

Incentive to keep producing in Japan = clear

5/

• • •

Missing some Tweet in this thread? You can try to

force a refresh