5 Must-Read Papers for Quality Investors

It's crucial to concentrate on the foundational drivers and filter out superficial market noise

A 🧵

It's crucial to concentrate on the foundational drivers and filter out superficial market noise

A 🧵

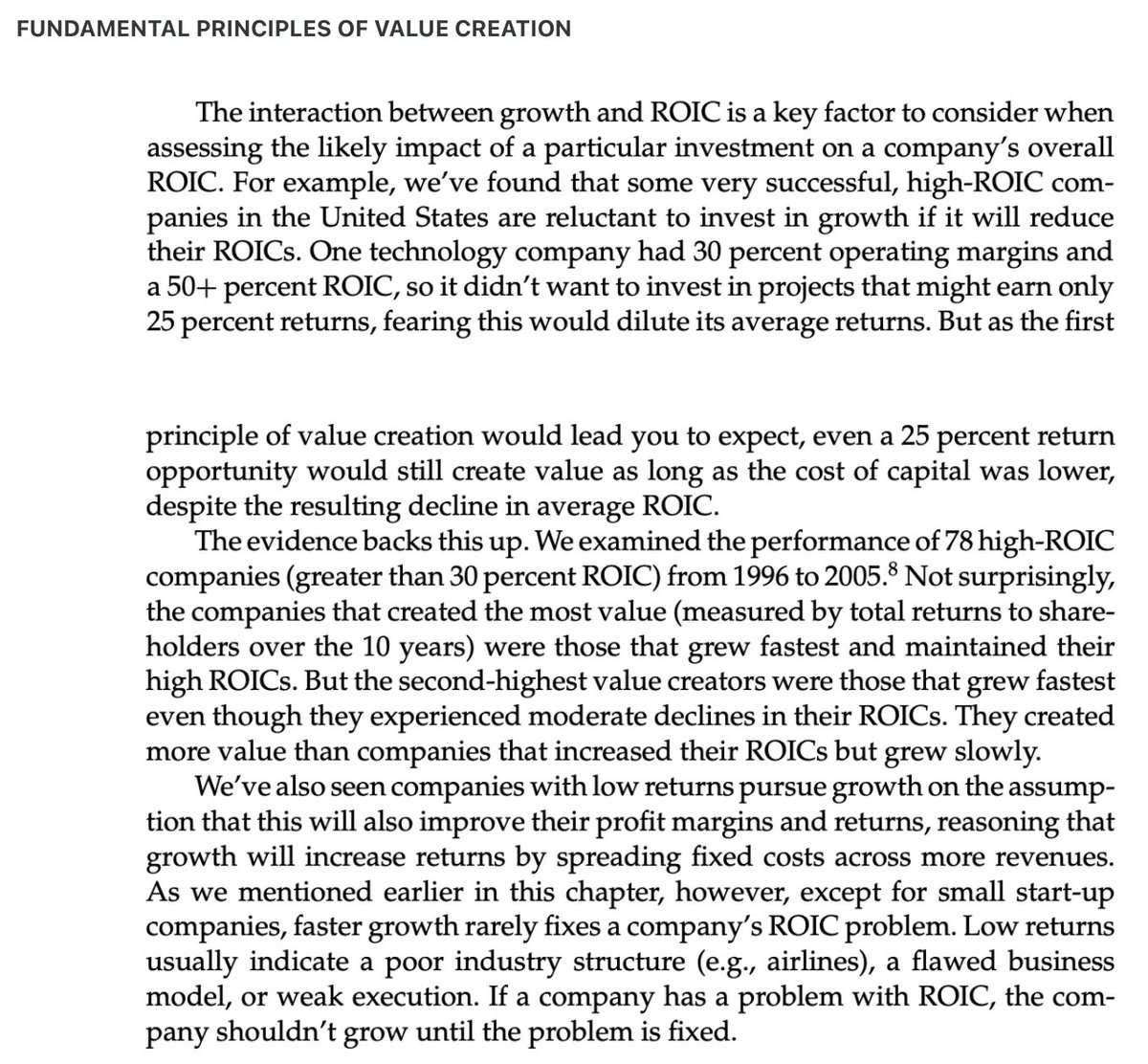

1️⃣ Balancing ROIC and Growth to Create Value (Tim Koller, McKinsey)

Through an examination of long-term patterns of growth and ROIC in large publicly listed US companies from 1965 to 1995, the study concludes that ROIC tends to remain stable over time, whereas growth is often fleeting and declines.

Through an examination of long-term patterns of growth and ROIC in large publicly listed US companies from 1965 to 1995, the study concludes that ROIC tends to remain stable over time, whereas growth is often fleeting and declines.

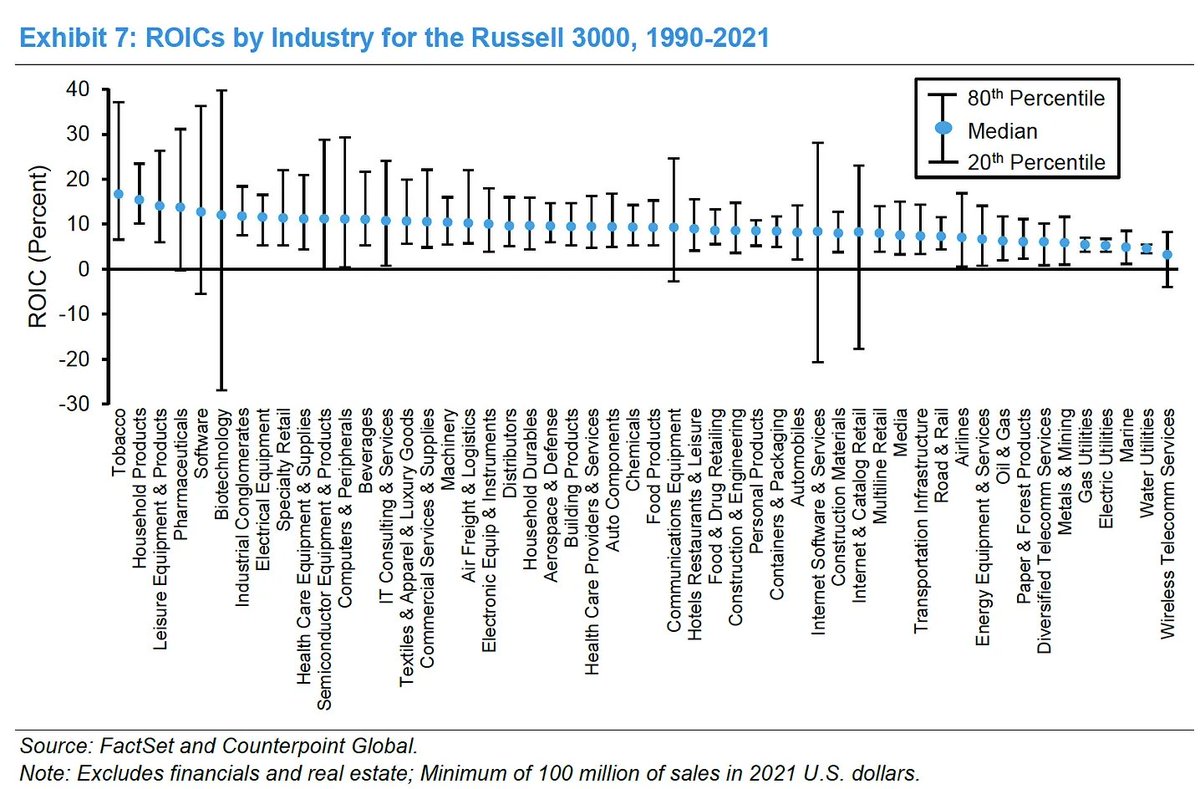

2️⃣ Return on Invested Capital - How to Calculate ROIC and Handle Common Issues (Michael Mauboussin) @mjmauboussin

This paper from Morgan Stanley Investment Management provides a comprehensive guide to understanding, calculating, and effectively utilizing Return on Invested Capital as a financial metric for assessing value creation in companies.

This paper from Morgan Stanley Investment Management provides a comprehensive guide to understanding, calculating, and effectively utilizing Return on Invested Capital as a financial metric for assessing value creation in companies.

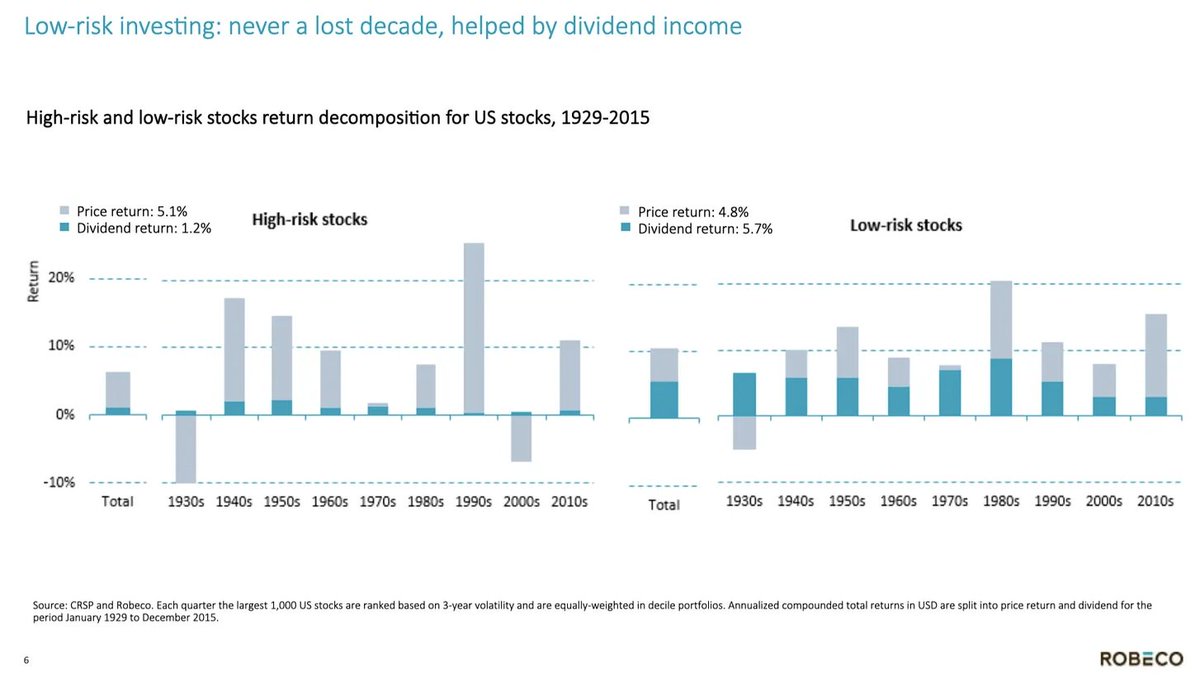

3️⃣ The Volatility Effect (Pim van Vliet and David Blitz)

Robeco’s Pim van Vliet has long challenged the efficient market hypothesis by demonstrating that a simple investment strategy based on historical return volatility can generate superior risk-adjusted returns.

Robeco’s Pim van Vliet has long challenged the efficient market hypothesis by demonstrating that a simple investment strategy based on historical return volatility can generate superior risk-adjusted returns.

4️⃣ Measuring the Moat (Michael Mauboussin)

Another great report from Mauboussin on how to reflect on competitive advantages, assessing a company’s strategic priorities depending on where it currently is in the corporate lifecycle.

The paper integrates various analytical tools, starting with industry-level analysis, including mapping the industry, understanding profit pools, assessing market share instability and concentration, and classifying industry structures.

Another great report from Mauboussin on how to reflect on competitive advantages, assessing a company’s strategic priorities depending on where it currently is in the corporate lifecycle.

The paper integrates various analytical tools, starting with industry-level analysis, including mapping the industry, understanding profit pools, assessing market share instability and concentration, and classifying industry structures.

5️⃣ The Quality Dimension of Value Investing (Robert Novy-Marx)

This paper, published in 2013, argues for a more nuanced approach to value investing that incorporates a firm's quality alongside traditional price-based valuation metrics. Novy-Marx asserts that value investing, as originally conceived by Benjamin Graham, was as much about buying high-quality firms as it was about buying cheap ones.

This paper, published in 2013, argues for a more nuanced approach to value investing that incorporates a firm's quality alongside traditional price-based valuation metrics. Novy-Marx asserts that value investing, as originally conceived by Benjamin Graham, was as much about buying high-quality firms as it was about buying cheap ones.

Liked this thread? Then share it with others

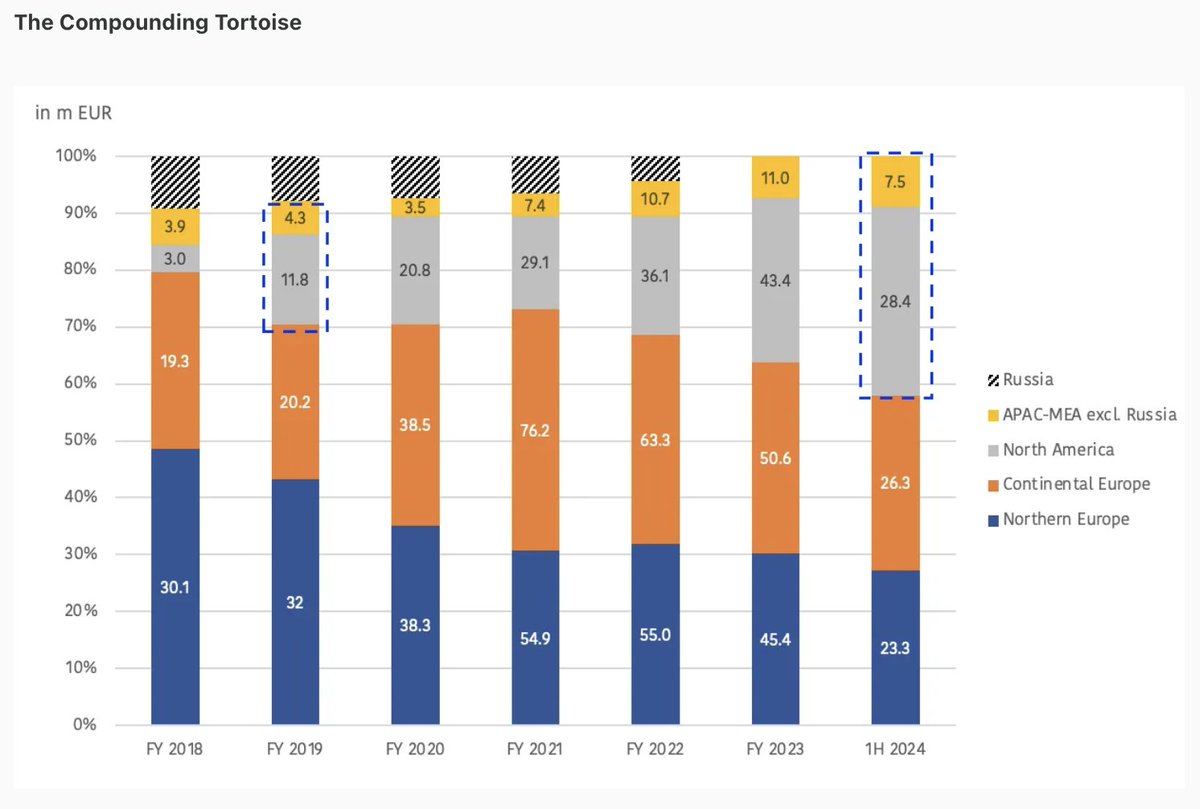

https://x.com/CompTortoise/status/1952428030204203445

• • •

Missing some Tweet in this thread? You can try to

force a refresh