Quality growth investor │ Sharing in-depth reports on compounders │ Teaching our subscribers how to build a portfolio with high returns and low risk │ link👇

How to get URL link on X (Twitter) App

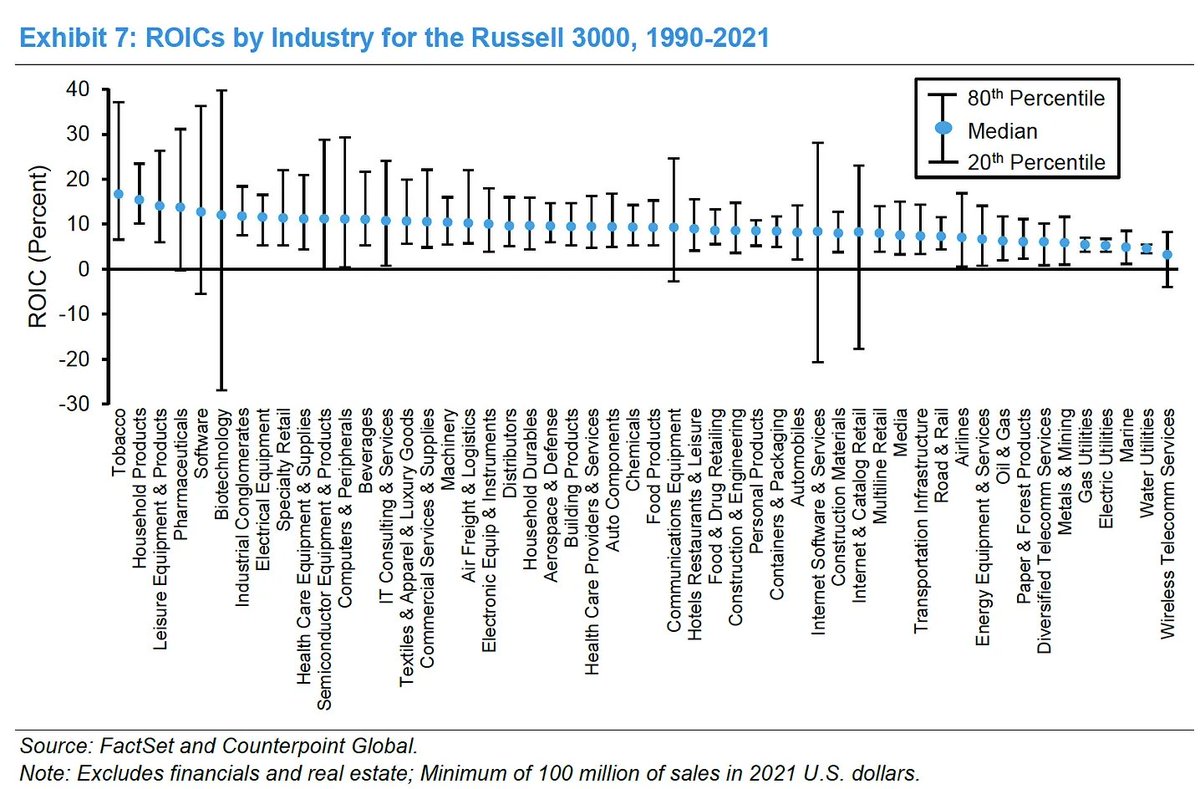

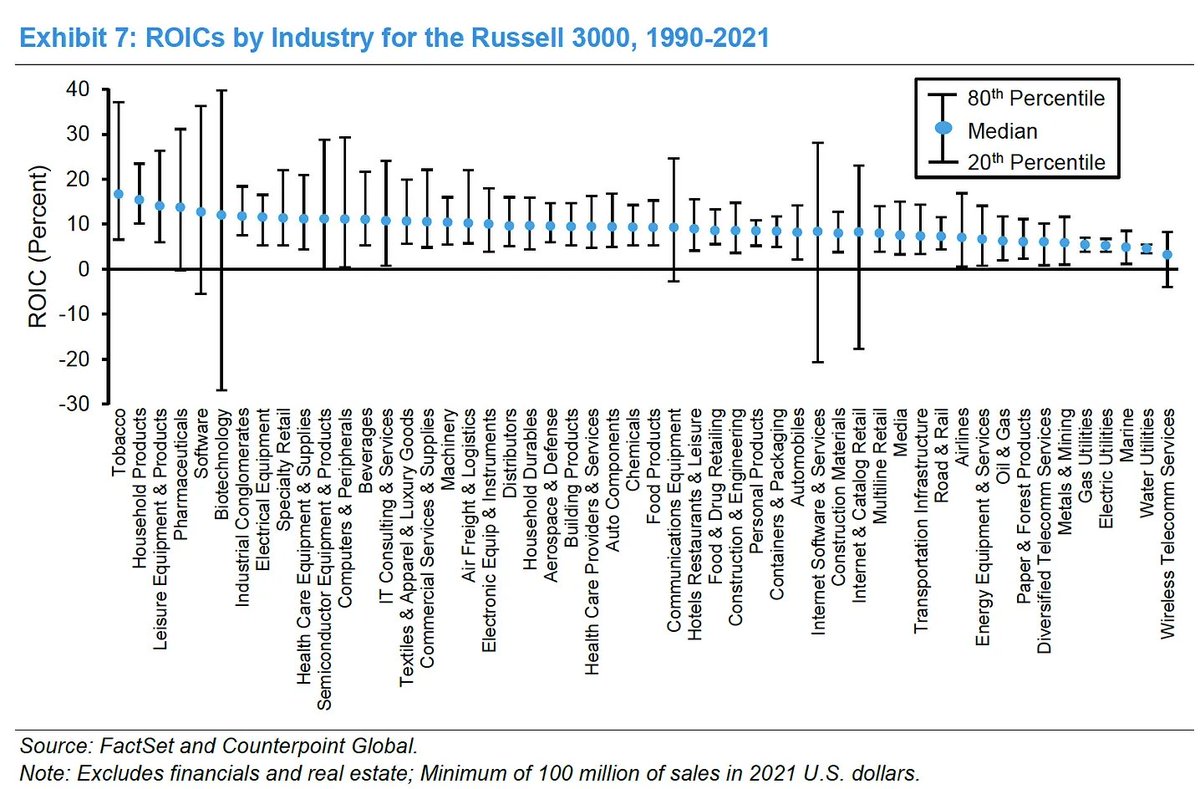

1️⃣ Balancing ROIC and Growth to Create Value (Tim Koller, McKinsey)

1️⃣ Balancing ROIC and Growth to Create Value (Tim Koller, McKinsey)

Exceptional Business Models

Exceptional Business Models

1️⃣ Excess Cash - Now What?

1️⃣ Excess Cash - Now What?

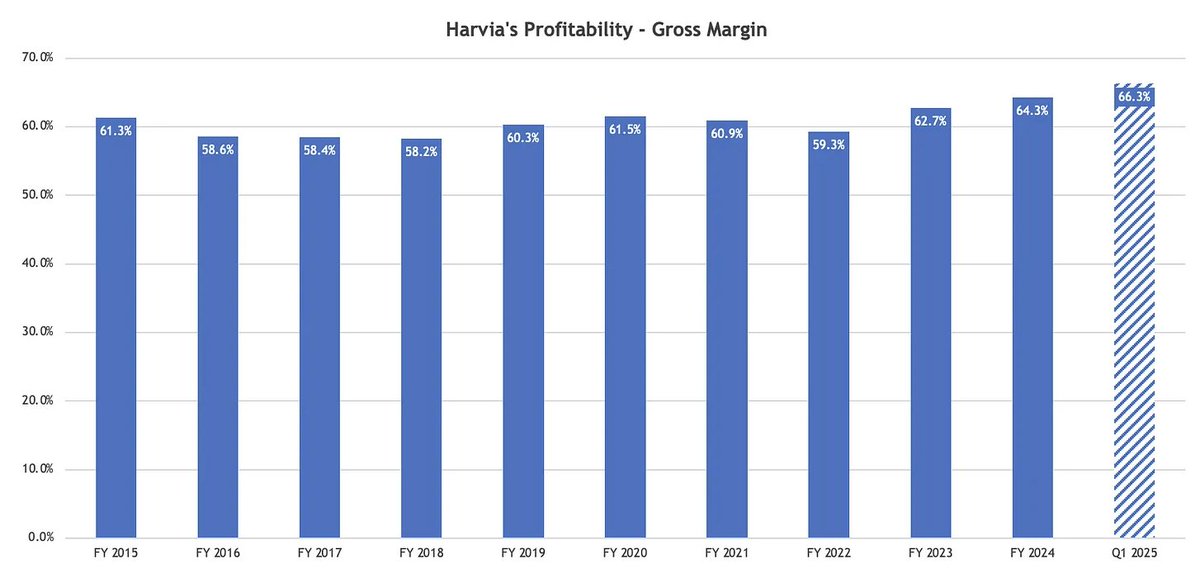

1⃣ Driving Gross Margin to Reinvest in OPEX

1⃣ Driving Gross Margin to Reinvest in OPEX

2/ Regionally, Europe showed modest growth of 2%, while Asia (excluding Japan) declined 11%, primarily due to weakened Chinese demand. The US saw a 3% decline, and Japan was down 1%.

2/ Regionally, Europe showed modest growth of 2%, while Asia (excluding Japan) declined 11%, primarily due to weakened Chinese demand. The US saw a 3% decline, and Japan was down 1%.

1⃣ In the U.S. alone, the sauna market is estimated at 800m USD, growing at 10-15% annually. Following the ThermaSol acquisition, Harvia holds a 14-15% market share in the U.S.

1⃣ In the U.S. alone, the sauna market is estimated at 800m USD, growing at 10-15% annually. Following the ThermaSol acquisition, Harvia holds a 14-15% market share in the U.S.

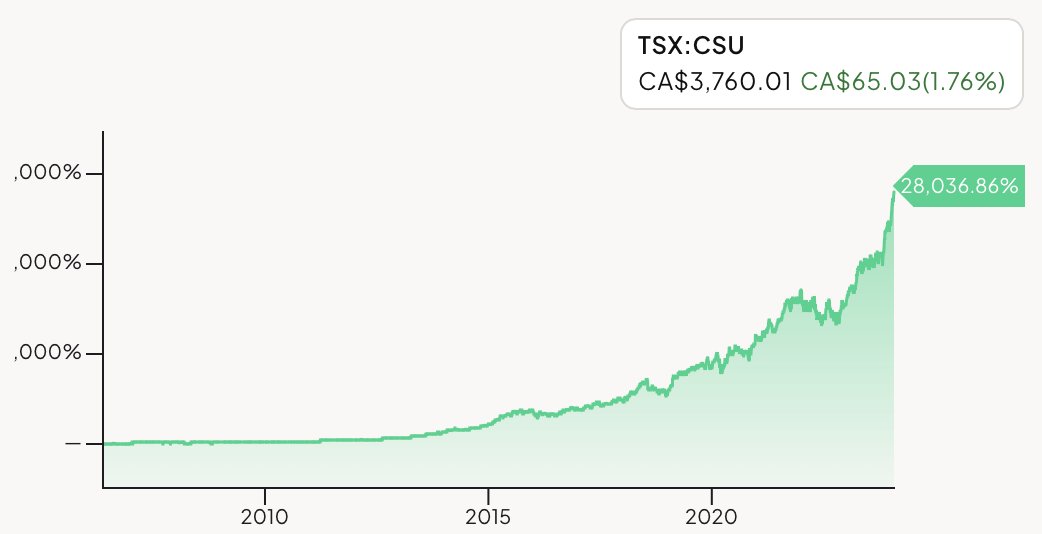

Serial acquirers - Thanks to the higher NPV (Net Present Value) of future cash streams, negative capital employed serial acquirers with good organic growth have the highest return potential amongst all others. Simply stated, high or low organic growth: it won’t matter that much to overall working capital and CAPEX movements. Organic growth expenses show up in their P&L and are being compensated for by revenue growth. Unsurprisingly, we feel comfortable putting most of our allocation to serial acquirers in the CSI family basket.

Serial acquirers - Thanks to the higher NPV (Net Present Value) of future cash streams, negative capital employed serial acquirers with good organic growth have the highest return potential amongst all others. Simply stated, high or low organic growth: it won’t matter that much to overall working capital and CAPEX movements. Organic growth expenses show up in their P&L and are being compensated for by revenue growth. Unsurprisingly, we feel comfortable putting most of our allocation to serial acquirers in the CSI family basket.

1/ Large Pool of Opportunities

1/ Large Pool of Opportunities

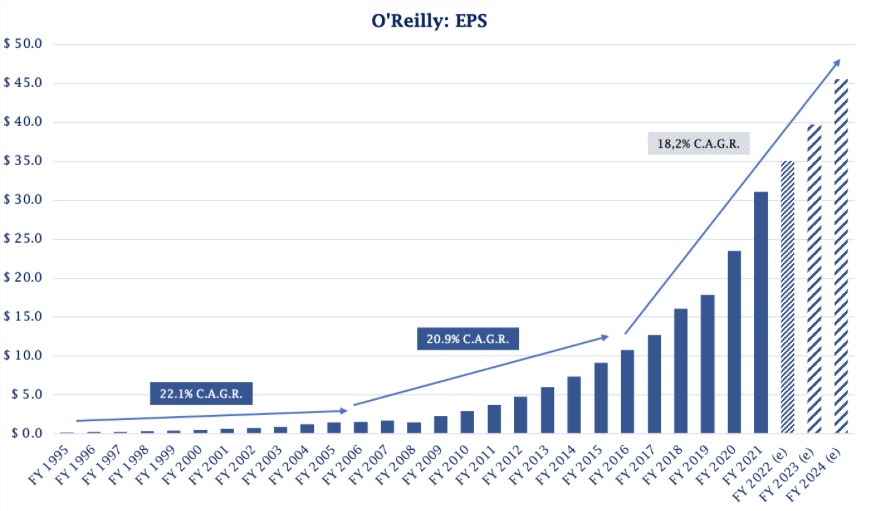

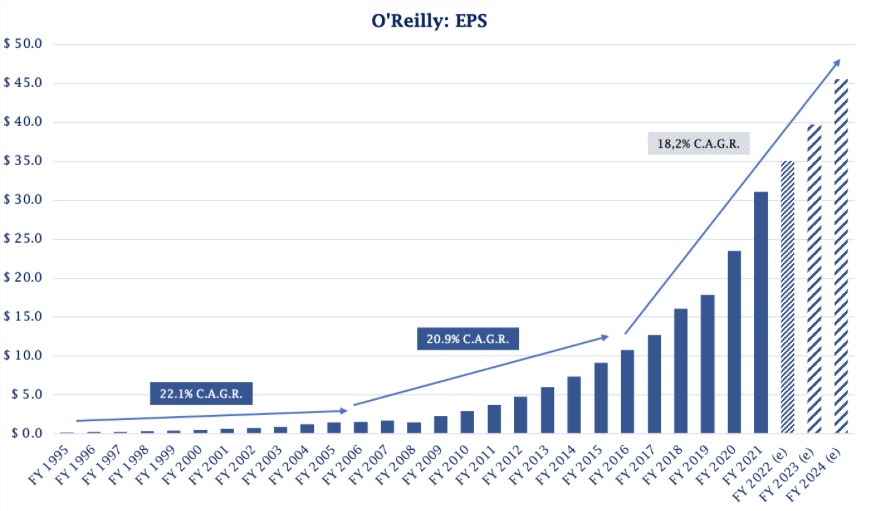

1/ Quality growth companies are in fact long-term value stocks. They've outpaced our expectations, allowing us to earn returns way above our hurdle rate. The trick is to keep compounding your cash flow, NOPAT... through good times and bad.

1/ Quality growth companies are in fact long-term value stocks. They've outpaced our expectations, allowing us to earn returns way above our hurdle rate. The trick is to keep compounding your cash flow, NOPAT... through good times and bad.

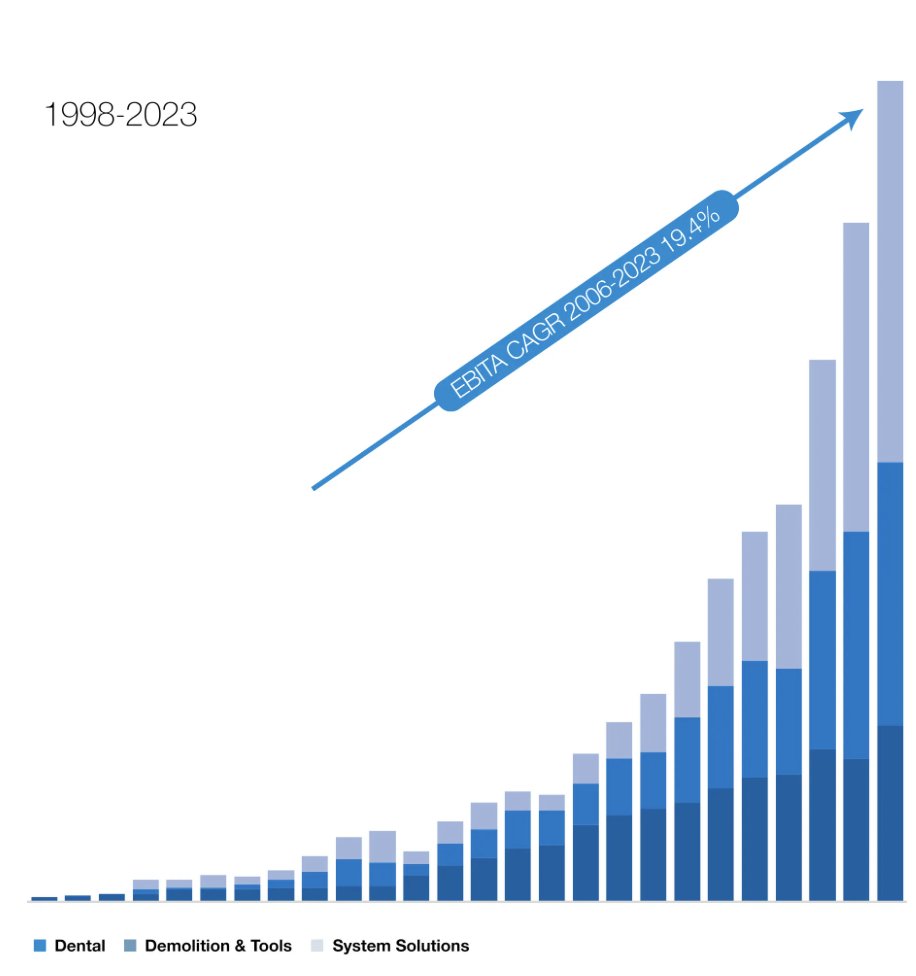

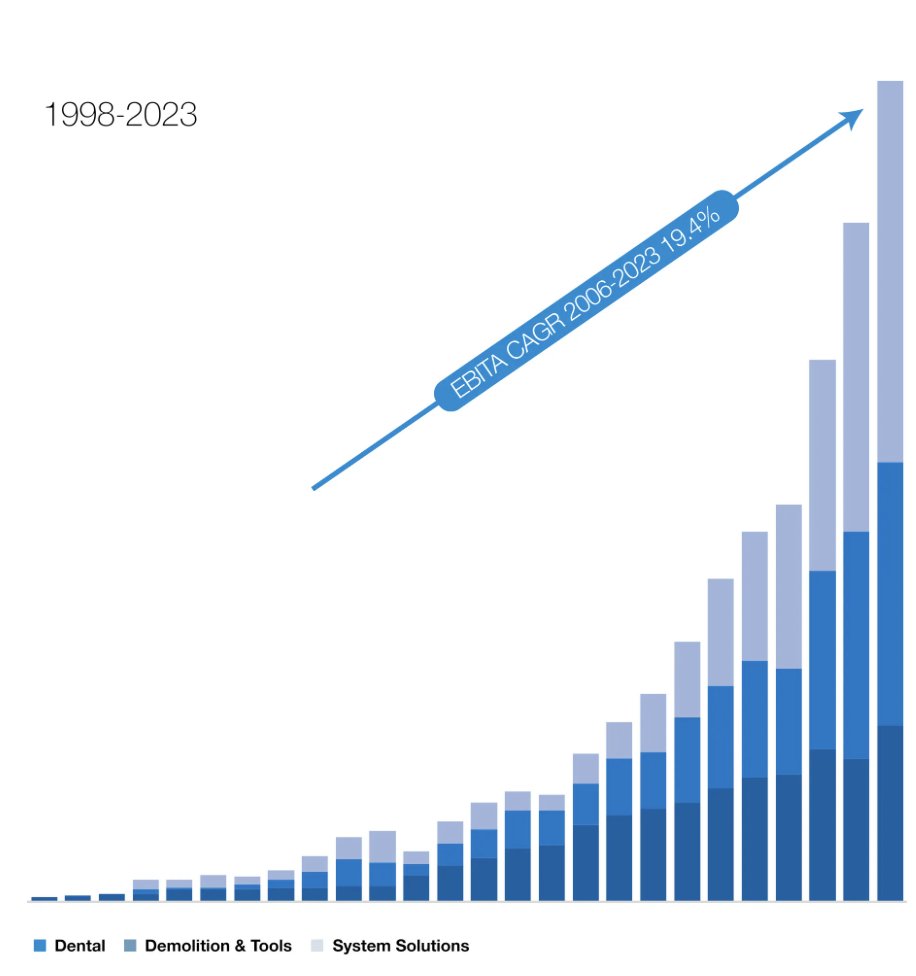

Diverse segments

Diverse segments

We love Harvia's products: it's great to enjoy the warm feeling and aromas of a traditional sauna. And all around the world, the awareness of the sauna and health benefits are strongly on the rise.

We love Harvia's products: it's great to enjoy the warm feeling and aromas of a traditional sauna. And all around the world, the awareness of the sauna and health benefits are strongly on the rise.

One of ORLY's smaller competitors (with about $650M in annual sales) is (PRTS) which positions itself as a disruptor and intrigued many growth investors at the beginning of the pandemic.

One of ORLY's smaller competitors (with about $650M in annual sales) is (PRTS) which positions itself as a disruptor and intrigued many growth investors at the beginning of the pandemic.

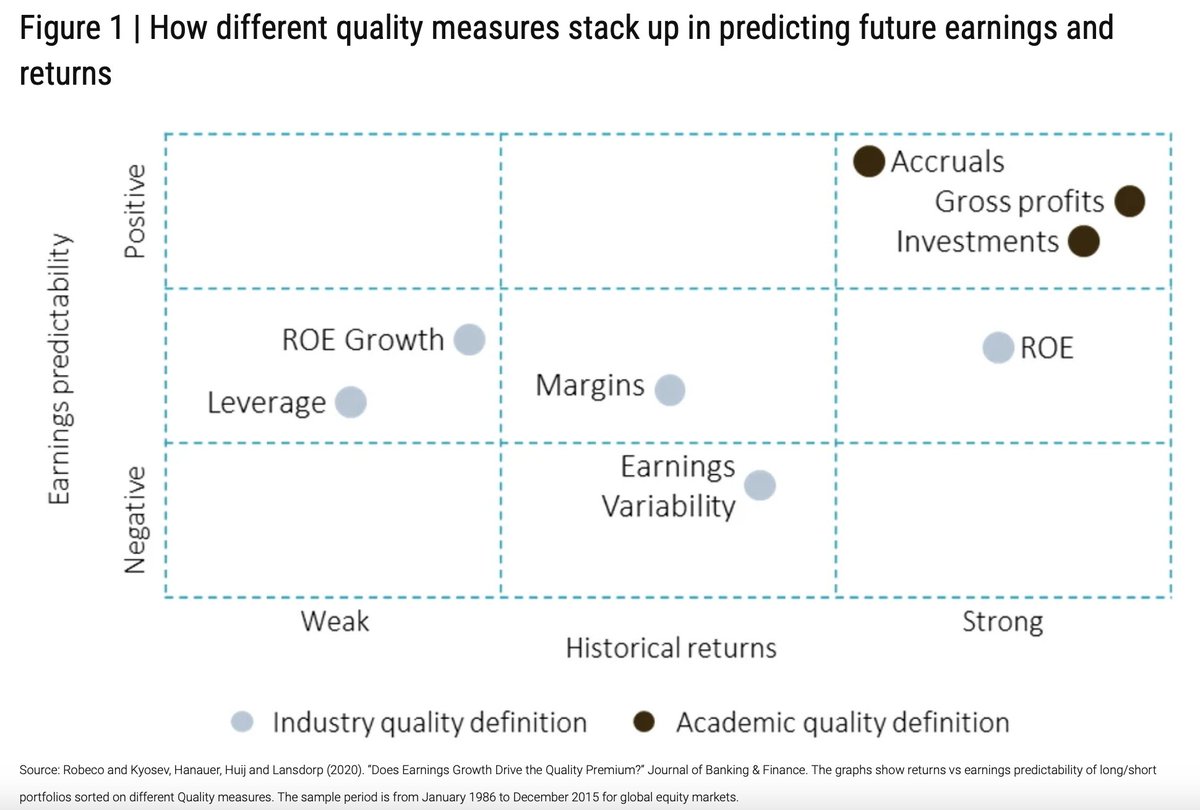

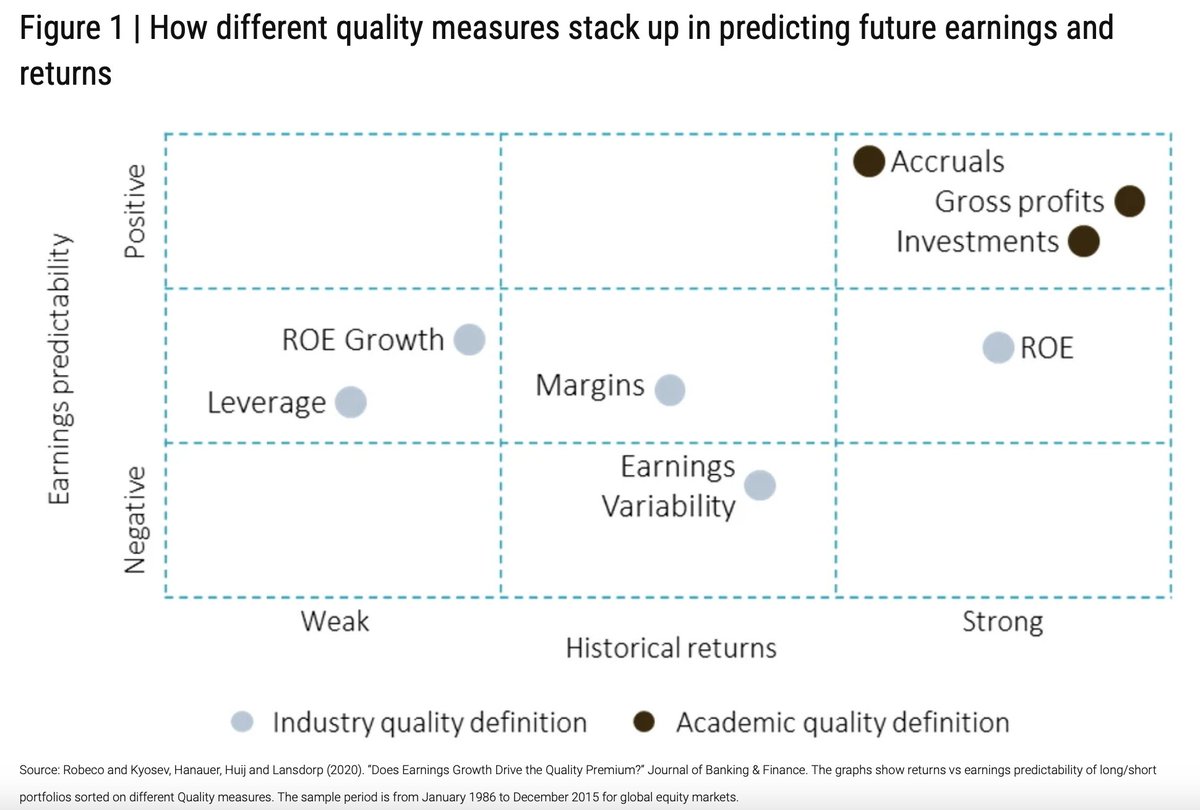

1/ Unfounded pessimisms on the future profitability of high Quality firms drive premium

1/ Unfounded pessimisms on the future profitability of high Quality firms drive premium

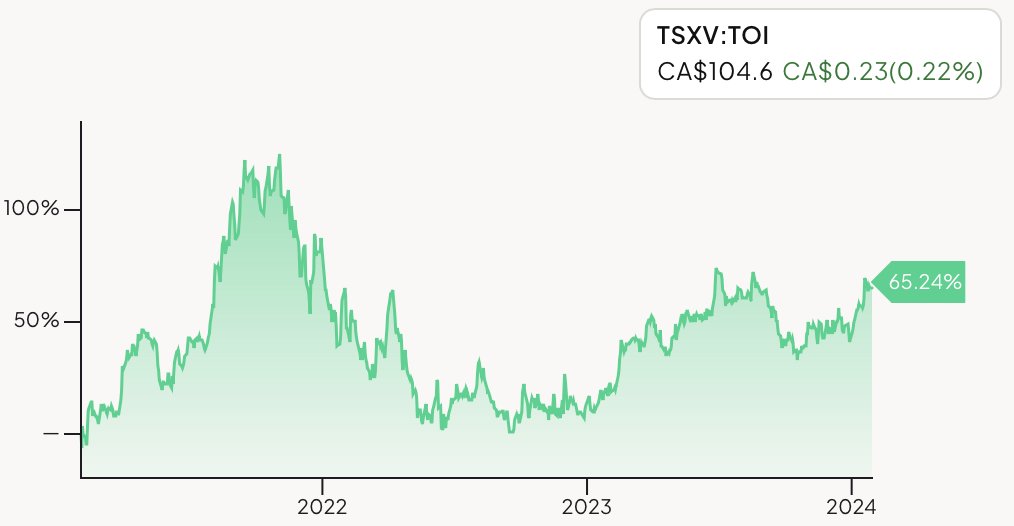

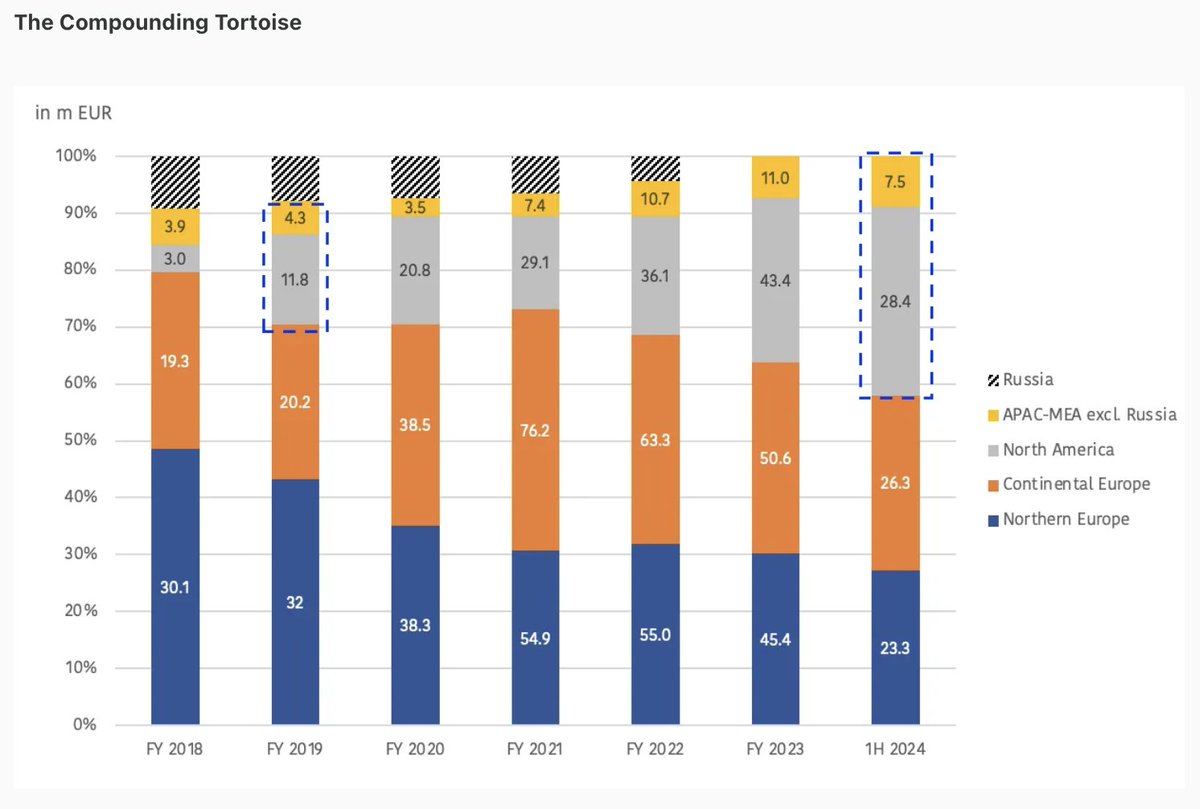

2. Topicus com

2. Topicus com