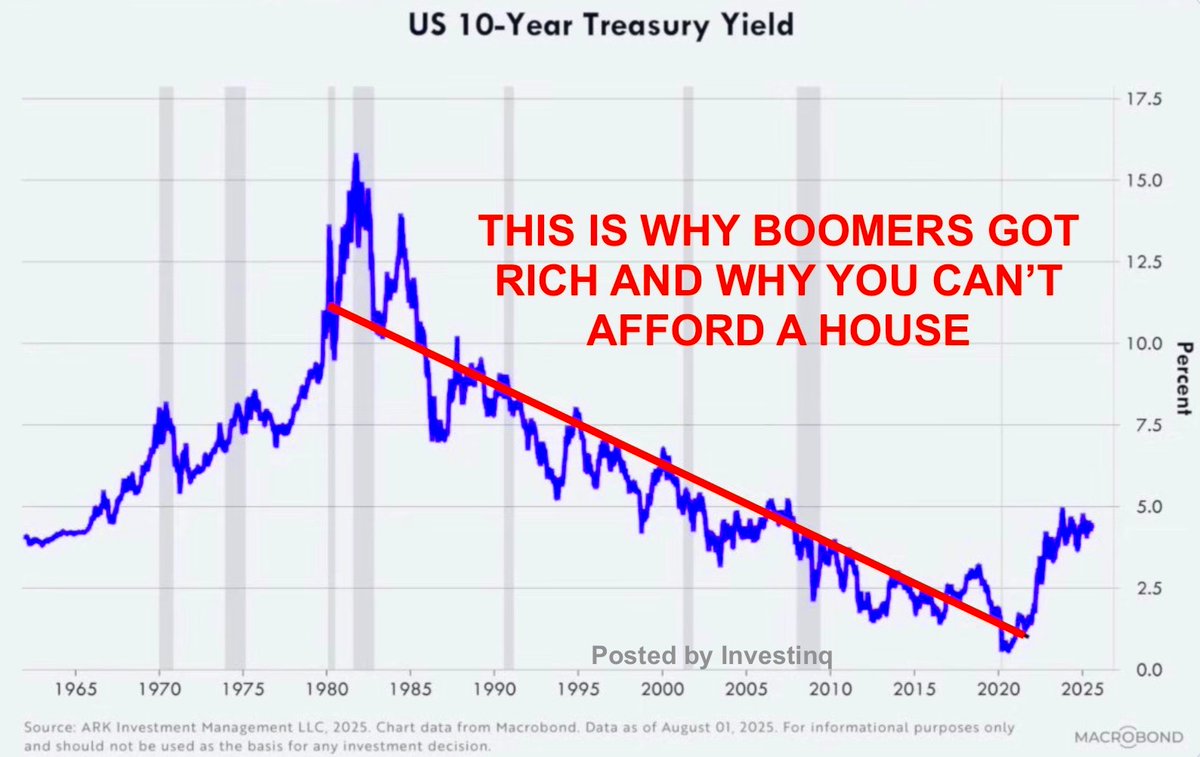

🚨 This is the real reason Boomers are rich and you’re not.

They caught a once-in-a-lifetime financial tailwind.

And it all starts with a boring-sounding number: the 10-Year Treasury Yield.

(a thread)

They caught a once-in-a-lifetime financial tailwind.

And it all starts with a boring-sounding number: the 10-Year Treasury Yield.

(a thread)

Let’s start with the basics: The 10-Year Treasury Note is a loan you make to the U.S. government.

You give them money → they pay you interest every 6 months → and return the full amount after 10 years.

It's the gold standard for safe investments.

You give them money → they pay you interest every 6 months → and return the full amount after 10 years.

It's the gold standard for safe investments.

The yield is your return if you hold it until maturity. Buy a $1,000 bond at a 4% yield? You get $40/year.

But here's the key: Treasury bonds are traded daily.

So their price goes up and down based on what investors think about inflation, the economy, and the Fed.

But here's the key: Treasury bonds are traded daily.

So their price goes up and down based on what investors think about inflation, the economy, and the Fed.

If the price of a bond rises, the yield falls. If the price falls, the yield rises.

Why? Because the coupon payment stays the same so if you pay more for the bond, your return drops.

Bond prices and yields always move in opposite directions.

Why? Because the coupon payment stays the same so if you pay more for the bond, your return drops.

Bond prices and yields always move in opposite directions.

Why do people trade Treasuries? Because they’re the safest, most liquid asset in the world.

Over $1 trillion in Treasuries change hands daily.

And the 10-Year Note is the most watched of all, it’s the global benchmark for long-term interest rates.

Over $1 trillion in Treasuries change hands daily.

And the 10-Year Note is the most watched of all, it’s the global benchmark for long-term interest rates.

The 10-Year Treasury Yield isn’t set by the Fed or the White House. It’s set by buyers and sellers in bond markets based on what they think about the future:

→ Inflation

→ Economic growth

→ Federal Reserve policy

→ Global demand for safe assets

→ Inflation

→ Economic growth

→ Federal Reserve policy

→ Global demand for safe assets

So why does this obscure number matter? Because the 10-year yield sets the tone for the entire financial system. It affects:

→ Mortgage rates

→ Corporate debt

→ Student loans

→ Stock prices

→ Even what the government pays to borrow

→ Mortgage rates

→ Corporate debt

→ Student loans

→ Stock prices

→ Even what the government pays to borrow

Now here's the big picture: In 1981, the 10-year yield peaked at around 15%.

By 2020? It fell to 0.5%. This 40-year drop in interest rates was the strongest financial tailwind in modern history.

Boomers got to ride the entire wave.

By 2020? It fell to 0.5%. This 40-year drop in interest rates was the strongest financial tailwind in modern history.

Boomers got to ride the entire wave.

Why do falling yields matter so much?

Because lower interest rates = cheaper borrowing = higher asset prices.

If you owned a home, stocks, or bonds while rates were falling… your net worth likely soared.

Because lower interest rates = cheaper borrowing = higher asset prices.

If you owned a home, stocks, or bonds while rates were falling… your net worth likely soared.

Let’s start with mortgages.

30-year mortgage rates are closely linked to the 10-year yield.

In 1981, they were ~16%. By 2020? Just ~3%.

30-year mortgage rates are closely linked to the 10-year yield.

In 1981, they were ~16%. By 2020? Just ~3%.

Here’s what that means: At 10% rates, a $1,000/mo mortgage only gets you a ~$114,000 loan.

At 3%? You can borrow ~$237,000.

Same payment. More than 2x the home.

At 3%? You can borrow ~$237,000.

Same payment. More than 2x the home.

So when the 10-year yield fell, homebuyers could borrow more.

That pushed prices up.

And Boomers? They bought homes early when prices were low and watched them soar.

That pushed prices up.

And Boomers? They bought homes early when prices were low and watched them soar.

And they didn’t just watch.

They refinanced over and over each time rates dropped.

Lowering their payments, cashing out equity, or both.

They refinanced over and over each time rates dropped.

Lowering their payments, cashing out equity, or both.

Meanwhile, Millennials are buying homes at:

→ All-time high prices

→ 7% mortgage rates

→ And no opportunity to refinance

The door Boomers walked through is now mostly shut.

→ All-time high prices

→ 7% mortgage rates

→ And no opportunity to refinance

The door Boomers walked through is now mostly shut.

Now let’s talk bonds. Remember: when yields fall, bond prices go up.

If you bought a 10-year bond at 6%, and yields later fall to 3%, your bond is now more valuable.

You can sell it for a profit.

If you bought a 10-year bond at 6%, and yields later fall to 3%, your bond is now more valuable.

You can sell it for a profit.

From 1981–2020, this happened again and again.

Boomers in pensions, 401(k)s, and retirement funds saw bonds deliver huge returns even safer than stocks at times.

They earned interest and capital gains.

Boomers in pensions, 401(k)s, and retirement funds saw bonds deliver huge returns even safer than stocks at times.

They earned interest and capital gains.

Now stocks. Stocks are valued based on future profits.

But those profits are discounted based on interest rates.

When the risk-free rate (10-year yield) is low, future cash flows are worth more today.

But those profits are discounted based on interest rates.

When the risk-free rate (10-year yield) is low, future cash flows are worth more today.

So as the 10-year yield fell, stocks looked more attractive.

Tech stocks especially because they earn most of their profits far in the future.

This helped fuel the 40-year bull market from the 80s through the 2010s.

Tech stocks especially because they earn most of their profits far in the future.

This helped fuel the 40-year bull market from the 80s through the 2010s.

Boomers, who were investing in the 80s, 90s, and 2000s, got:

→ Soaring home values

→ Massive stock market returns

→ Strong bond returns

→ Cheap refinancing

→ And a tax code that rewarded homeownership and retirement savings

→ Soaring home values

→ Massive stock market returns

→ Strong bond returns

→ Cheap refinancing

→ And a tax code that rewarded homeownership and retirement savings

Meanwhile, Millennials and Gen Z are buying homes at:

→ All-time high prices

→ With 7% mortgage rates

→ And little ability to refinance

→ In a market where stocks are already expensive and bonds are just recovering

→ All-time high prices

→ With 7% mortgage rates

→ And little ability to refinance

→ In a market where stocks are already expensive and bonds are just recovering

And here’s the kicker: Falling rates created the home price explosion Millennials now face.

A Boomer could buy a house at 3x income.

Today, that’s 6–10x in major cities and borrowing costs are double what they were just 3 years ago.

A Boomer could buy a house at 3x income.

Today, that’s 6–10x in major cities and borrowing costs are double what they were just 3 years ago.

So let’s recap how falling 10-year yields helped Boomers build wealth:

→ Cheaper mortgages = more affordable homes = rising prices

→ Lower yields = higher bond values

→ Lower yields = higher stock prices

→ Lower rates = easier to borrow and invest

→ Repeat refinances = free up cash

→ Cheaper mortgages = more affordable homes = rising prices

→ Lower yields = higher bond values

→ Lower yields = higher stock prices

→ Lower rates = easier to borrow and invest

→ Repeat refinances = free up cash

And it wasn’t just luck. It was structural.

When interest rates fall, asset values rise.

If you owned assets during a 40-year yield collapse, you got rich. If you didn't, you watched the train leave the station.

When interest rates fall, asset values rise.

If you owned assets during a 40-year yield collapse, you got rich. If you didn't, you watched the train leave the station.

Boomers owned homes, stocks, and bonds when everything was cheap.

Then yields fell for 4 decades and lifted those prices sky-high.

It’s not “Boomers are smarter.” It’s “Boomers bought early and the macro backdrop did the rest.”

Then yields fell for 4 decades and lifted those prices sky-high.

It’s not “Boomers are smarter.” It’s “Boomers bought early and the macro backdrop did the rest.”

Today, Boomers hold over $80 trillion in wealth more than 50% of all U.S. household wealth.

Millennials? Closer to $15 trillion.

Even though they’re the largest working generation.

Millennials? Closer to $15 trillion.

Even though they’re the largest working generation.

That’s not just a gap.

That’s a structural wealth divide created by 40 years of falling interest rates.

And unless rates fall a lot again, It’s unlikely to repeat.

That’s a structural wealth divide created by 40 years of falling interest rates.

And unless rates fall a lot again, It’s unlikely to repeat.

To match what Boomers had, Millennials would need:

→ A massive drop in the 10-year yield (say from 7% to 2%)

→ Stocks and housing to reset and then boom again

→ And multiple opportunities to refinance and extract equity

→ A massive drop in the 10-year yield (say from 7% to 2%)

→ Stocks and housing to reset and then boom again

→ And multiple opportunities to refinance and extract equity

Is it possible? Maybe. But it’s unlikely to happen on the same scale. Boomers got the triple-win:

→ Low entry prices

→ High yields

→ And a generational tailwind from the bond market

→ Low entry prices

→ High yields

→ And a generational tailwind from the bond market

Millennials are getting:

→ High entry prices

→ High yields

→ And lower expected returns across the board

And that’s the core difference.

→ High entry prices

→ High yields

→ And lower expected returns across the board

And that’s the core difference.

Bottom line: Boomers didn’t “get rich by accident" but they did have help.

A 40-year collapse in interest rates made debt cheaper and assets more valuable.

They were positioned perfectly to benefit.

A 40-year collapse in interest rates made debt cheaper and assets more valuable.

They were positioned perfectly to benefit.

And if you want to understand where markets are headed next?

You still need to watch the 10-year yield.

It’s the most important number in finance that nobody talks about at dinner.

You still need to watch the 10-year yield.

It’s the most important number in finance that nobody talks about at dinner.

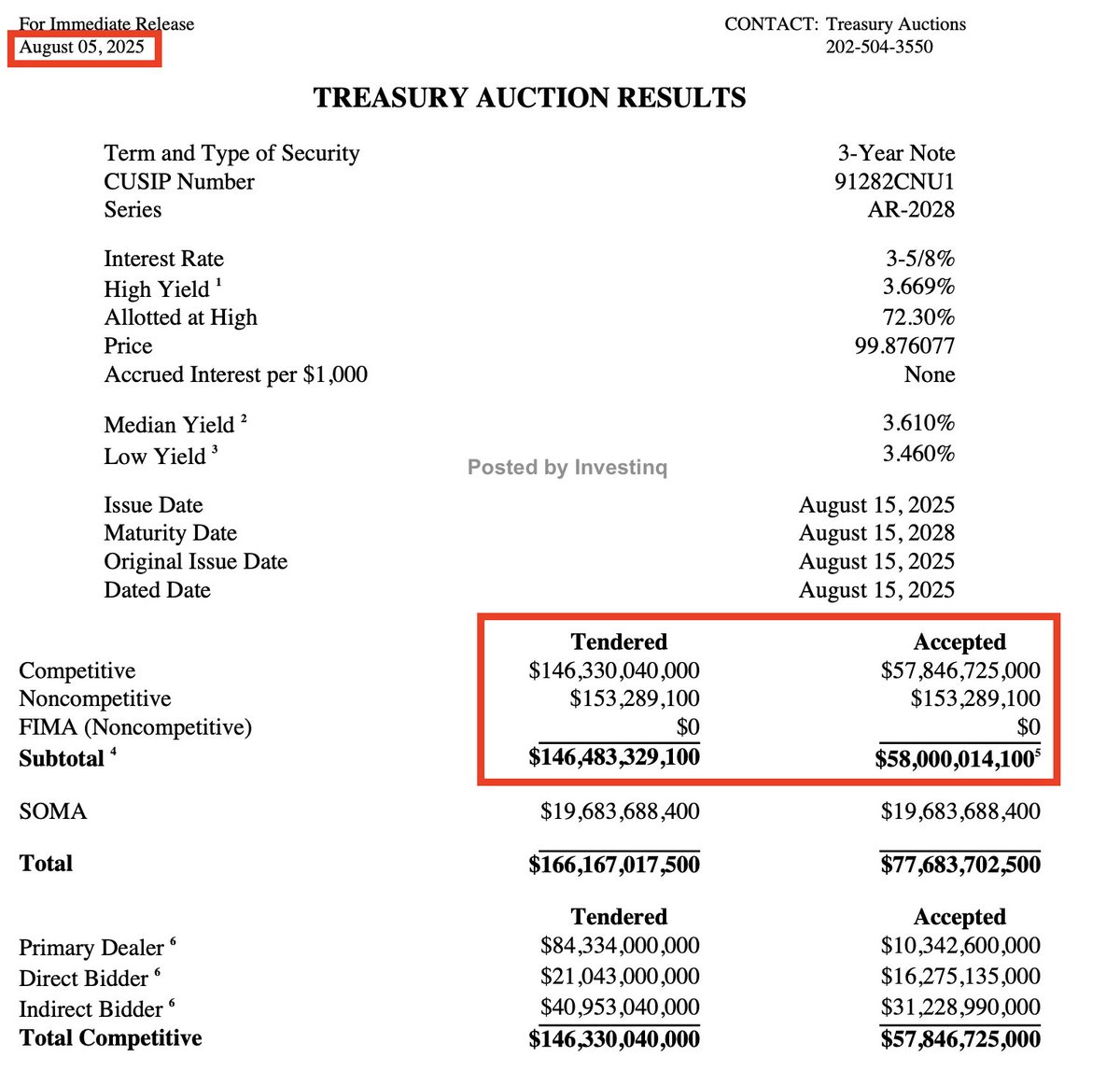

Oh and one more thing: There’s a 10-Year Treasury auction this week.

That means the U.S. government is issuing new 10-year bonds. How strong (or weak) demand is could send signals across the market.

Keep an eye on it. Yields affect everything.

That means the U.S. government is issuing new 10-year bonds. How strong (or weak) demand is could send signals across the market.

Keep an eye on it. Yields affect everything.

If you found these insights valuable: Sign up for my FREE newsletter! thestockmarket.news

I hope you've found this thread helpful.

Follow me @_Investinq for more.

Like/Repost the quote below if you can:

Follow me @_Investinq for more.

Like/Repost the quote below if you can:

https://x.com/_investinq/status/1952442513102364713?s=46

Where are my boomers at? Can you guys check in and confirm the validity of this thread? lol

• • •

Missing some Tweet in this thread? You can try to

force a refresh