1) beHYPE on @0xHyperBeat

This will actually be one of the key sources for yield for a lot of the plays.

It's basically a pre-deposit campaign that will get 20% of the total airdrop.

Smart money assumes a 30% FDV airdrop around $75M-$200M FDV according to points pricing.

This will actually be one of the key sources for yield for a lot of the plays.

It's basically a pre-deposit campaign that will get 20% of the total airdrop.

Smart money assumes a 30% FDV airdrop around $75M-$200M FDV according to points pricing.

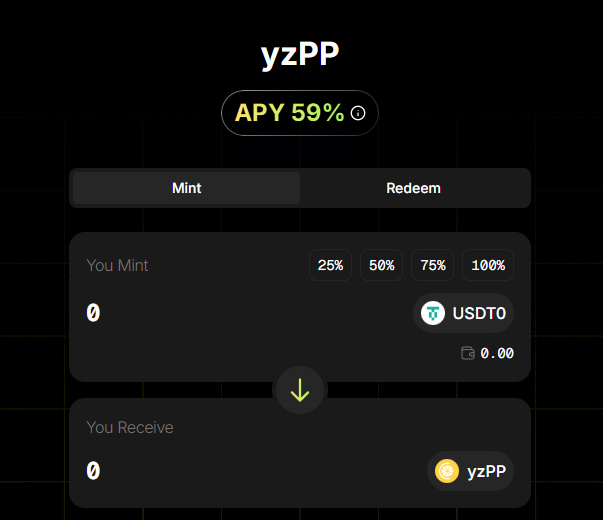

2) beHYPE on @spectra_finance

29% fixes APR until Aug 30th really can't be beat.

That's a 1.6% ROI in the next 26 days FIXED with no leverage.

Granted, liquidity isn't super deep. But even the LP at 26ish% is great and you'd still get points.

29% fixes APR until Aug 30th really can't be beat.

That's a 1.6% ROI in the next 26 days FIXED with no leverage.

Granted, liquidity isn't super deep. But even the LP at 26ish% is great and you'd still get points.

3) But also, you can sell your points on @RumpelLabs

I've actually been buying the points under 30M implied FDV...but that's a story for another post.

They also have hbHYPE and @MEVCapital's HYPE which I've used before.

Every Wed/Thur you can mint the points as tradable tokens and sell them -- this allows you to sell your points before the airdrop.

I've actually been buying the points under 30M implied FDV...but that's a story for another post.

They also have hbHYPE and @MEVCapital's HYPE which I've used before.

Every Wed/Thur you can mint the points as tradable tokens and sell them -- this allows you to sell your points before the airdrop.

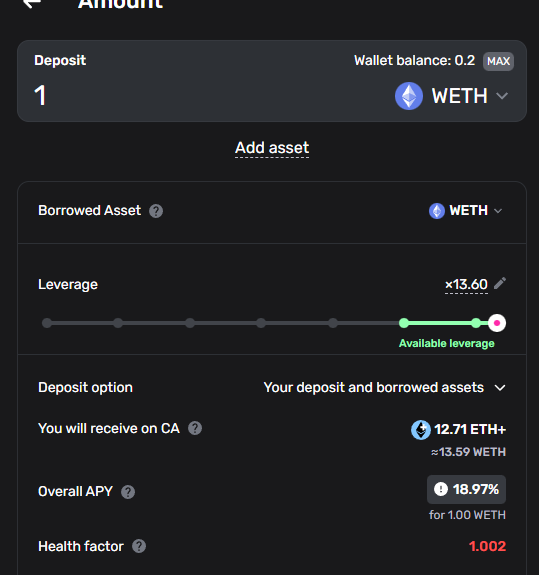

4) In the same vein, leveraged wstHYPE on @sentimentxyz

There were some sweet Sentiment private liquidity deals floating around, but even just farming the airdrop is enticing.

I have no idea how to value the airdrop, but Rumpel values the points at $0.054, giving a looped APR of 82.54% net

There were some sweet Sentiment private liquidity deals floating around, but even just farming the airdrop is enticing.

I have no idea how to value the airdrop, but Rumpel values the points at $0.054, giving a looped APR of 82.54% net

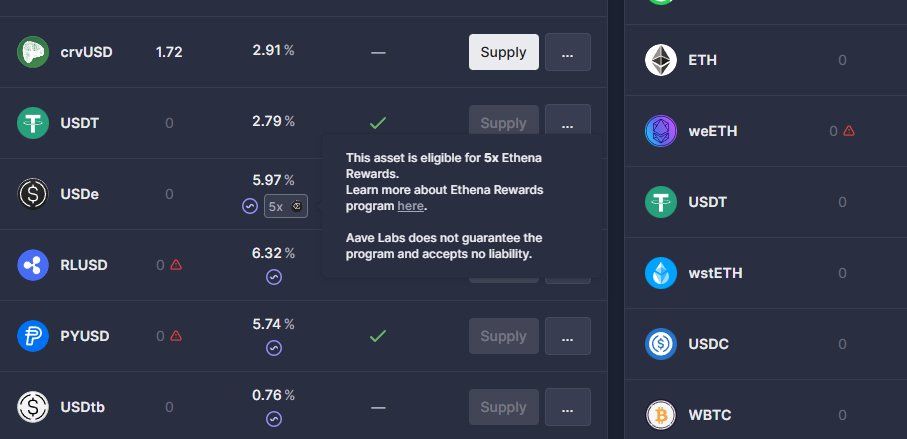

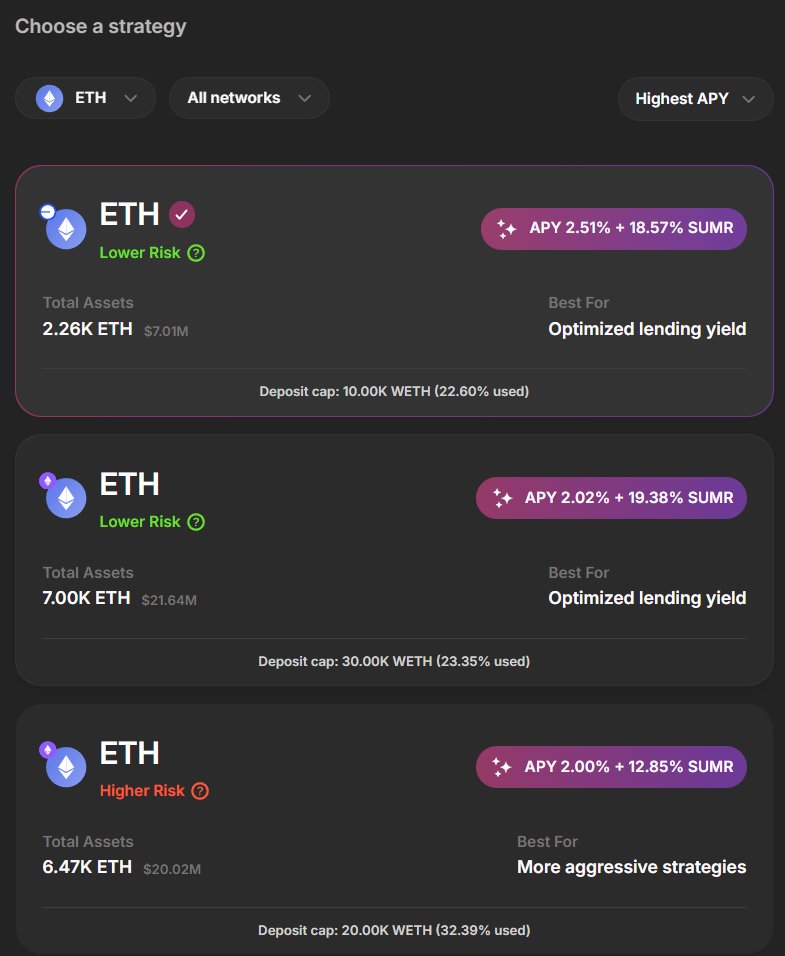

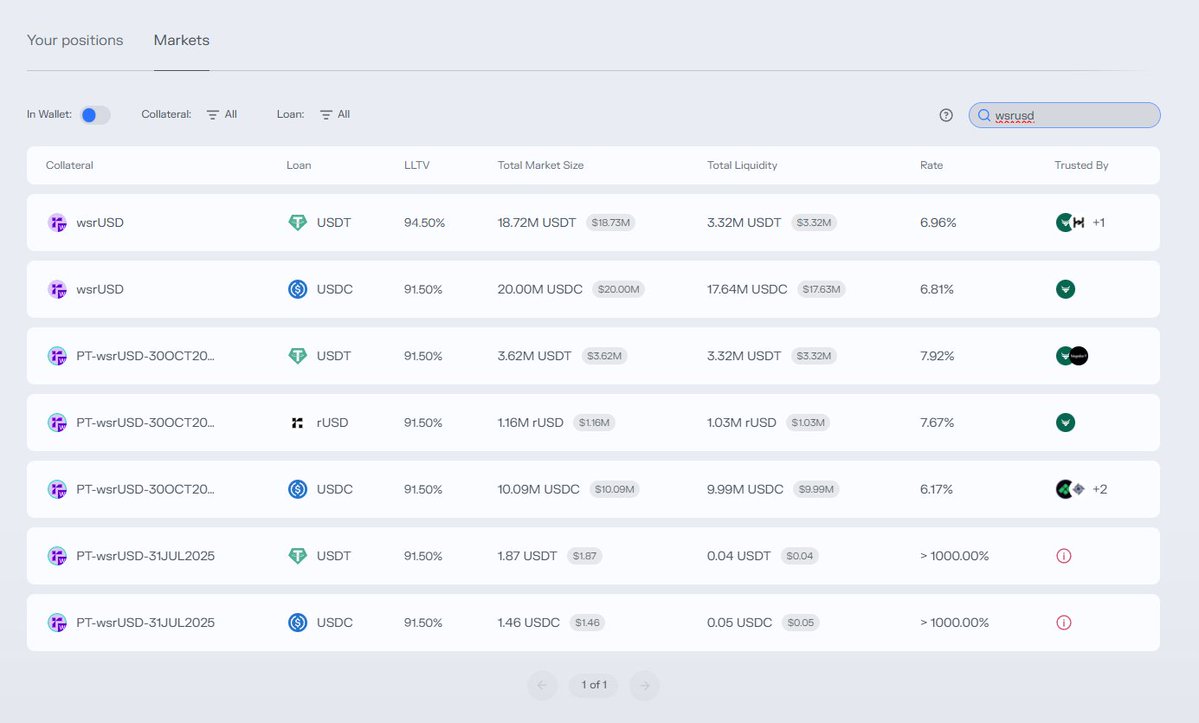

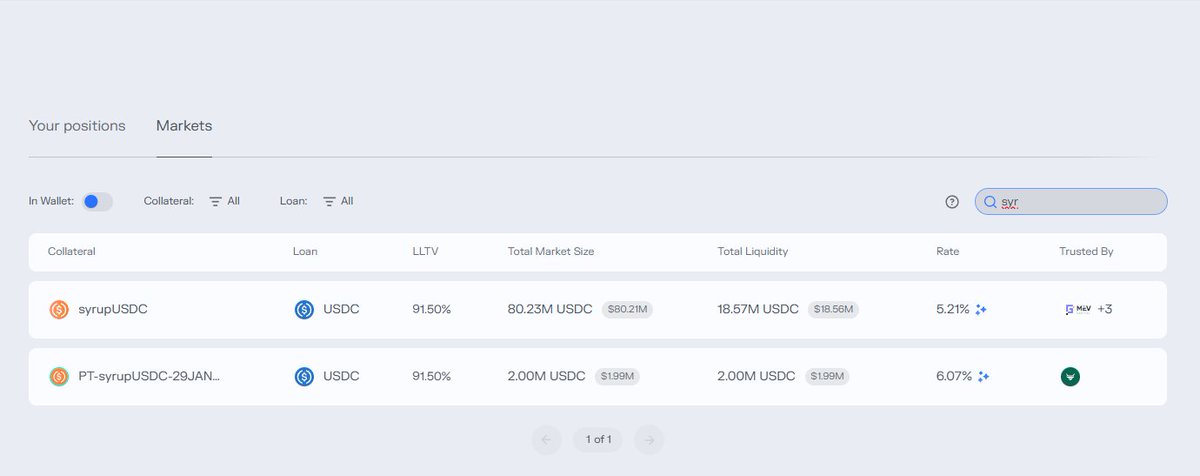

5) Just use @pendle_fi

Pendle made headlines when it launched onto HyperEVM, and still offers the best LONGTERM yields you can get on $HYPE.

I.E., you can lock in a 3.11% ROI for the next 85 days via beHYPE.

If beHYPE normalizes at 2% after the airdrop, this is the best way to get a long-term exposure to an outsized yield imo.

ALSO, if IY collapses after the campaign ends, you'll be able to exit early with a faster ROI / higher actualized APR.

(PTs are inherently short IY)

Pendle made headlines when it launched onto HyperEVM, and still offers the best LONGTERM yields you can get on $HYPE.

I.E., you can lock in a 3.11% ROI for the next 85 days via beHYPE.

If beHYPE normalizes at 2% after the airdrop, this is the best way to get a long-term exposure to an outsized yield imo.

ALSO, if IY collapses after the campaign ends, you'll be able to exit early with a faster ROI / higher actualized APR.

(PTs are inherently short IY)

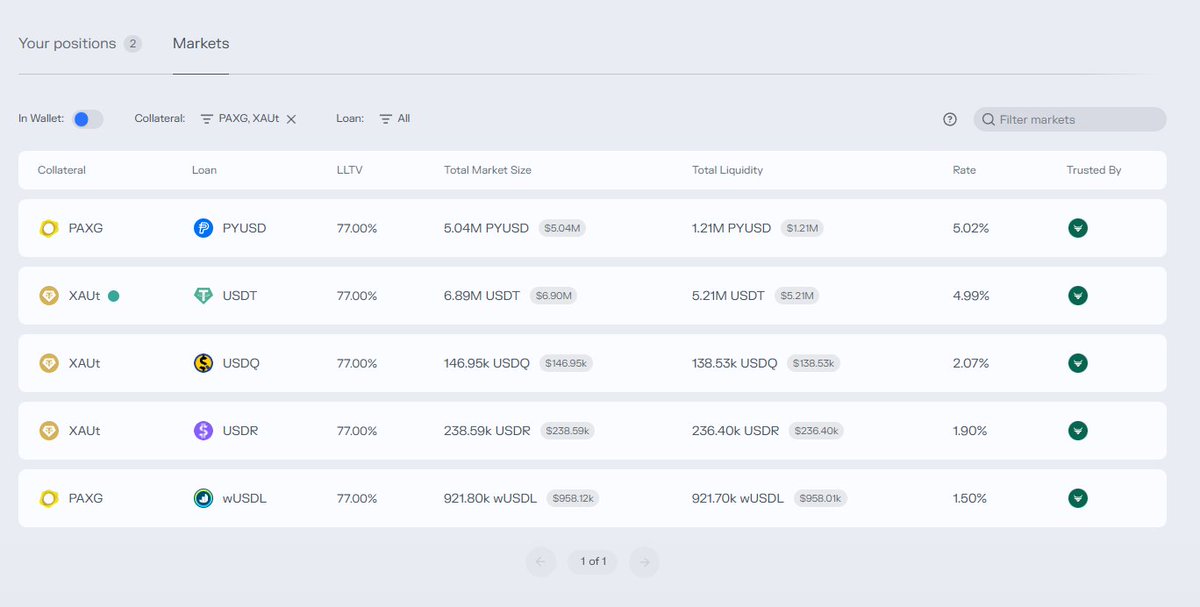

6) Buy liquidated HYPE with @felixprotocol

Get paid 16% organic APR on feUSD while potentially picking up severely discounted HYPE during liquidation events.

IMO, this is the best possible way to buy HYPE if there's another dip.

I already know a handful of people who got 5-10% discounted HYPE from this stability pool.

And 16% on stables is nothing to scoff at while you wait...

Get paid 16% organic APR on feUSD while potentially picking up severely discounted HYPE during liquidation events.

IMO, this is the best possible way to buy HYPE if there's another dip.

I already know a handful of people who got 5-10% discounted HYPE from this stability pool.

And 16% on stables is nothing to scoff at while you wait...

7) Never forget you can delta neutral...

If you get a fixed rate 30% APR on Spectra, you can neutralize at 2x short on HyperLiquid and get a net 26% for the next 26 days.

OR, you can lock in the 13% on Pendle and get a 15% net for the next few months.

AND farm points the entire time. You could also just farm the HyperBeat points or Kinetiq points etc and be paid to short.

The world is your oyster.

If you get a fixed rate 30% APR on Spectra, you can neutralize at 2x short on HyperLiquid and get a net 26% for the next 26 days.

OR, you can lock in the 13% on Pendle and get a 15% net for the next few months.

AND farm points the entire time. You could also just farm the HyperBeat points or Kinetiq points etc and be paid to short.

The world is your oyster.

I'll admit, I'm somewhat new to the HyperEVM ecosystem. Whatever I missed, please let me know!

The only related ambassadorships mentioned here are Pendle and maybe Liquity since I mentioned Felix?

This post was more just for fun / education than anything.

Thanks for reading!

The only related ambassadorships mentioned here are Pendle and maybe Liquity since I mentioned Felix?

This post was more just for fun / education than anything.

Thanks for reading!

• • •

Missing some Tweet in this thread? You can try to

force a refresh