In 2022, Nadhim Zahawi’s solicitor sent me a libel threat - and said I wasn’t even allowed to say he’d written to me.

The Solicitors Disciplinary Tribunal ruled that was improper.

Now he’s appealing.

A 🧵 on why it matters.

The Solicitors Disciplinary Tribunal ruled that was improper.

Now he’s appealing.

A 🧵 on why it matters.

In July 2022, I wrote that I thought Nadhim Zahawi had lied about his taxes. I was right. Nadhim Zahawi lied repeatedly about his tax affairs...

... and continued to do so until it became public that - at the same time he was saying he'd always paid taxes in full - he was negotiating a £5m settlement with HMRC, including back-taxes plus penalties.

Mr Zahawi was then sacked by the Prime Minister in January 2023

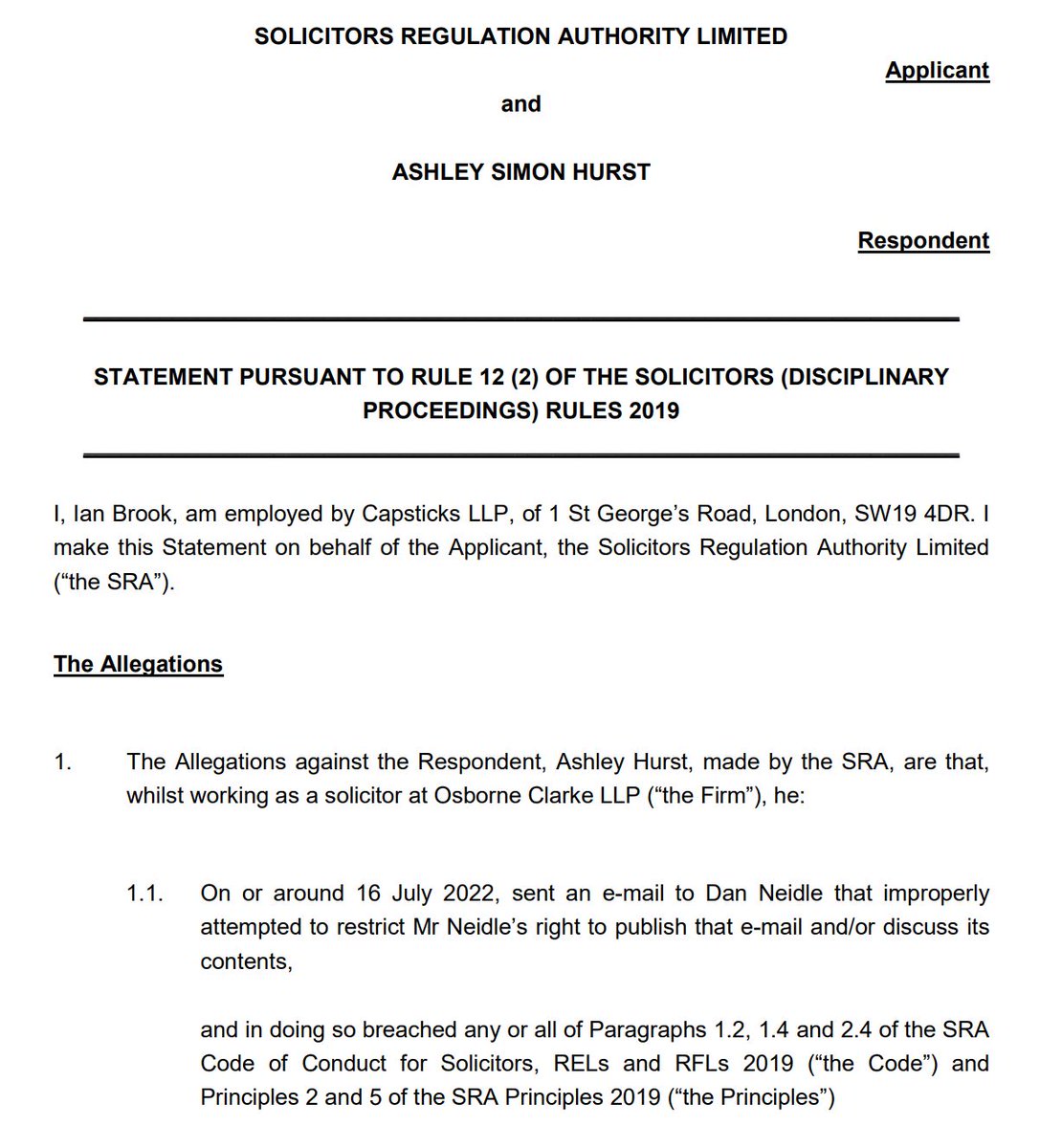

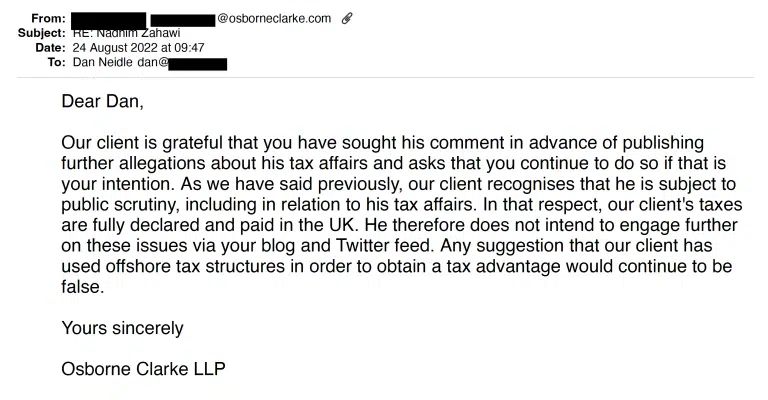

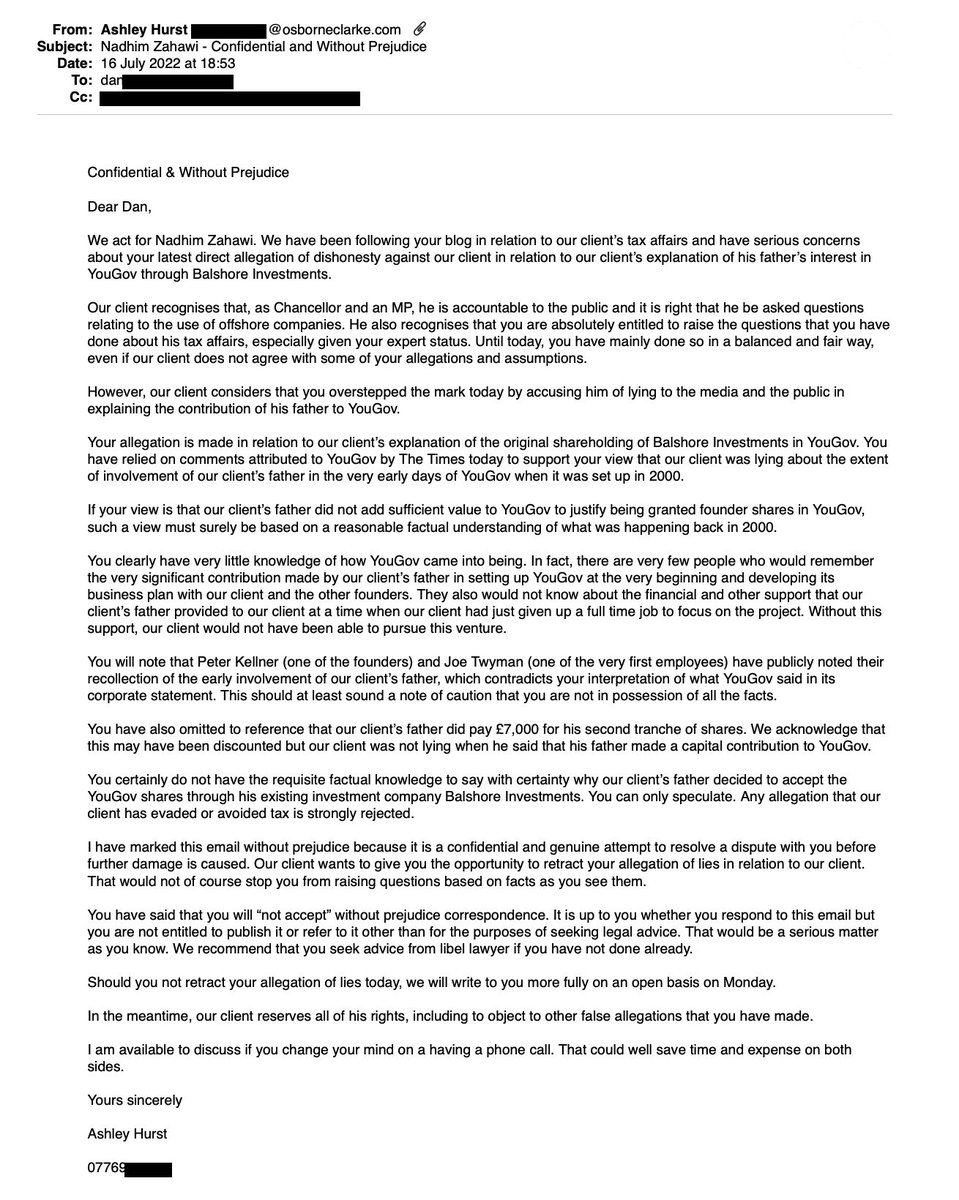

But back in July 2022, Nadhim Zahawi's solicitor, Ashley Hurst, emailed me demanding that I retract my allegation, with the implicit threat of libel action if I did not

Hurst went further: he claimed that the email was "without prejudice" and confidential, and that I was not permitted to publish it or even refer to it. He said it would be a "serious matter" if I did. I took that to be another threat.

I was astonished at the idea that a solicitor could send someone a libel threat, and prevent them from publishing it, or even mentioning it. The Solicitors Regulation Authority agreed, publishing guidance making clear such conduct was prohibited...

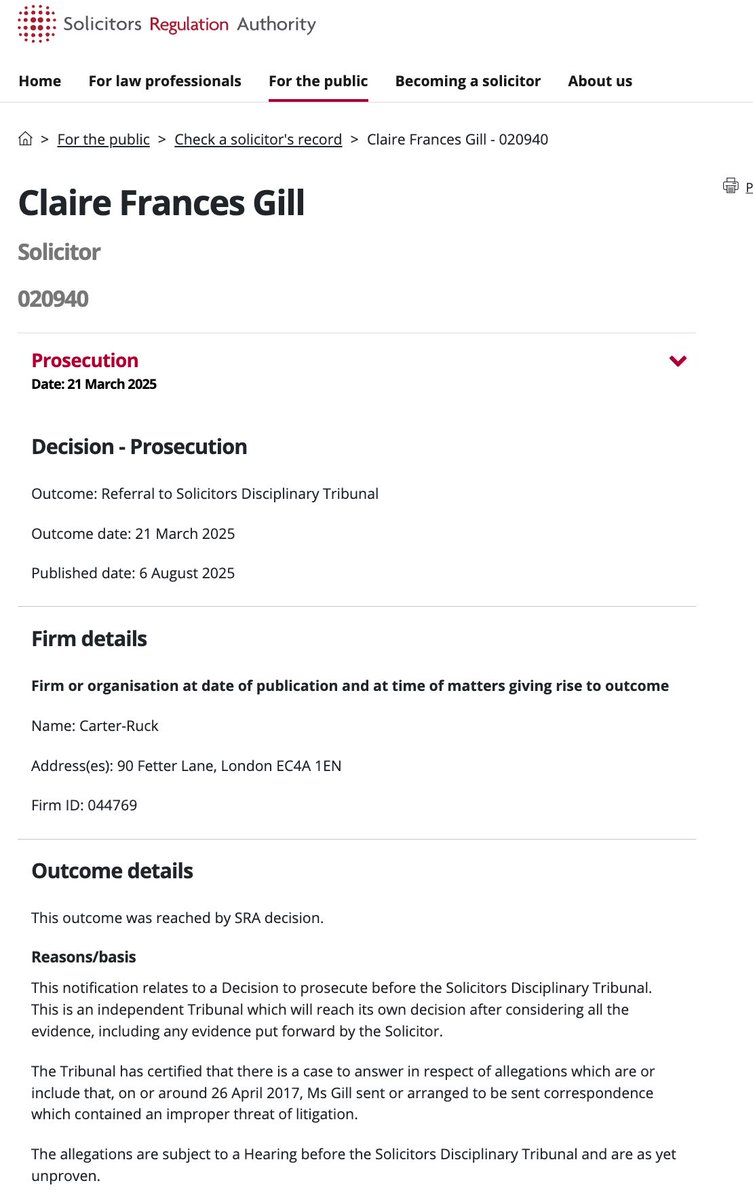

In December 2024, the Solicitors Disciplinary Tribunal found that the email was improper, and agreed that it contained an implicit threat of action against me if I disclosed the existence of the email. solicitorstribunal.org.uk/wp-content/upl…

Mr Hurst was fined £50,000 and had to pay the SRA's costs of £298,391, as well as his own costs of £908,172.

(Although I expect Osborne Clarke are paying these - the firm has backed Mr Hurst throughout. )

(Although I expect Osborne Clarke are paying these - the firm has backed Mr Hurst throughout. )

Mr Hurst is now appealing to the Administrative Court.

If he wins this appeal, then solicitors will have a green light to claim their libel threats cannot be published, or even referred to. The "secret SLAPP" will have become blessed by the courts.

If he wins this appeal, then solicitors will have a green light to claim their libel threats cannot be published, or even referred to. The "secret SLAPP" will have become blessed by the courts.

That would be a terrible result for everybody who cares about free speech.

I'm publishing Mr Hurst's grounds of appeal, and the SRA's response, here: taxpolicy.org.uk/2025/08/05/zah…

• • •

Missing some Tweet in this thread? You can try to

force a refresh