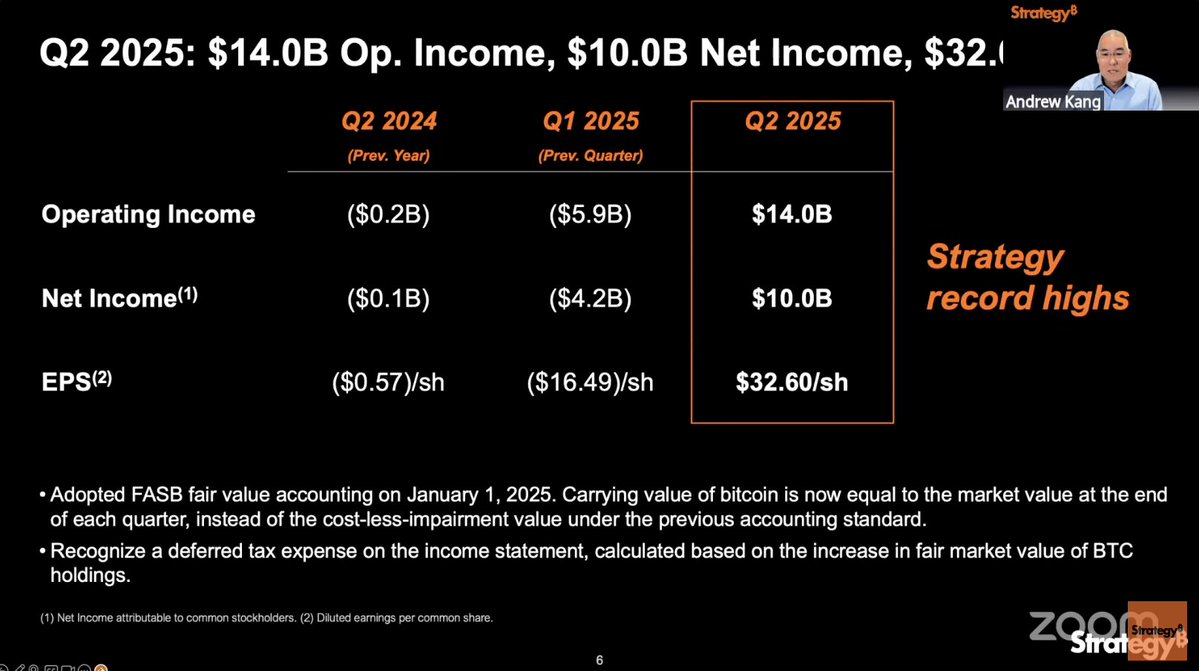

Strategy(MSTR) just posted:

• $14B operating income

• $10B net income

• $32.60 EPS

And yet… it trades at a P/E of 4.7x.

That’s lower than 495 companies in the S&P 500.

Here’s what Wall Street still doesn’t get about MSTR 🧵👇

• $14B operating income

• $10B net income

• $32.60 EPS

And yet… it trades at a P/E of 4.7x.

That’s lower than 495 companies in the S&P 500.

Here’s what Wall Street still doesn’t get about MSTR 🧵👇

This isn’t just a high-performing company.

Strategy is on pace to generate $80 EPS this year.

That’s on just 112M outstanding shares, with most of the value tied directly to BTC.

But the market still doesn’t price it like a Bitcoin proxy—or a tech firm.

Strategy is on pace to generate $80 EPS this year.

That’s on just 112M outstanding shares, with most of the value tied directly to BTC.

But the market still doesn’t price it like a Bitcoin proxy—or a tech firm.

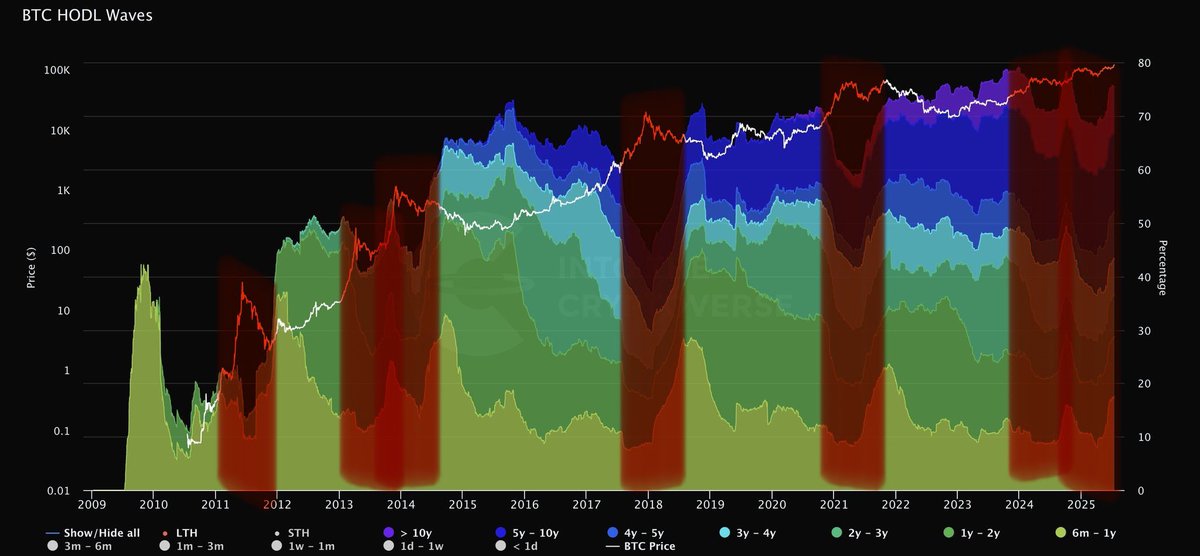

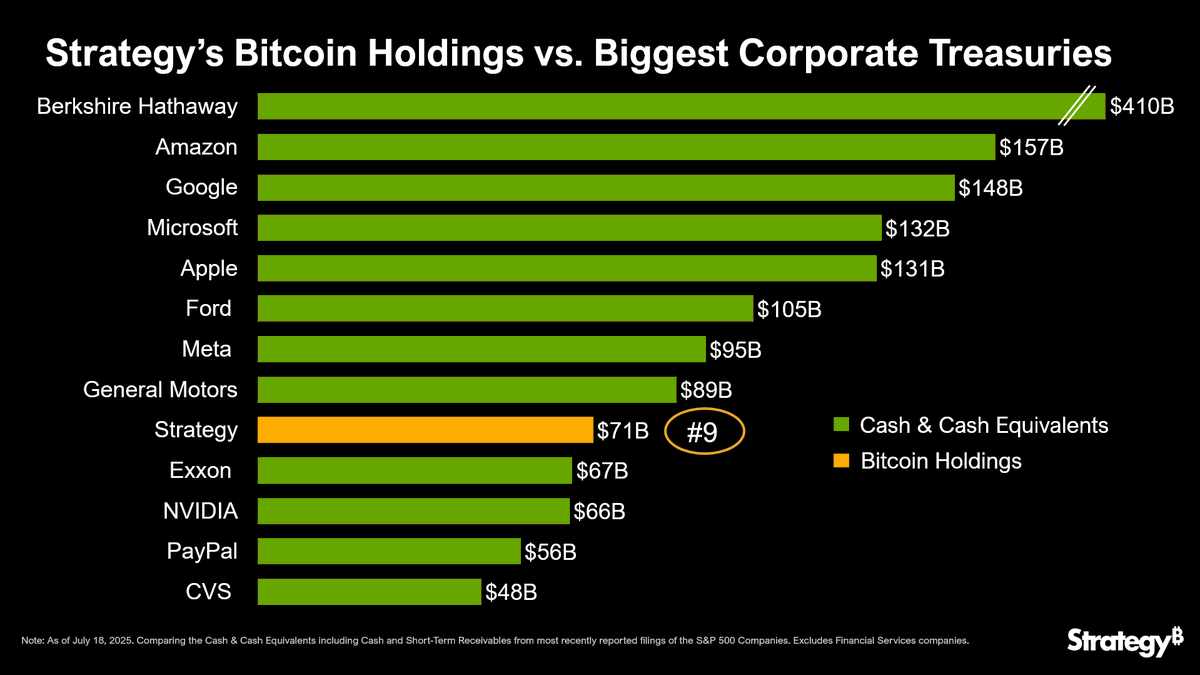

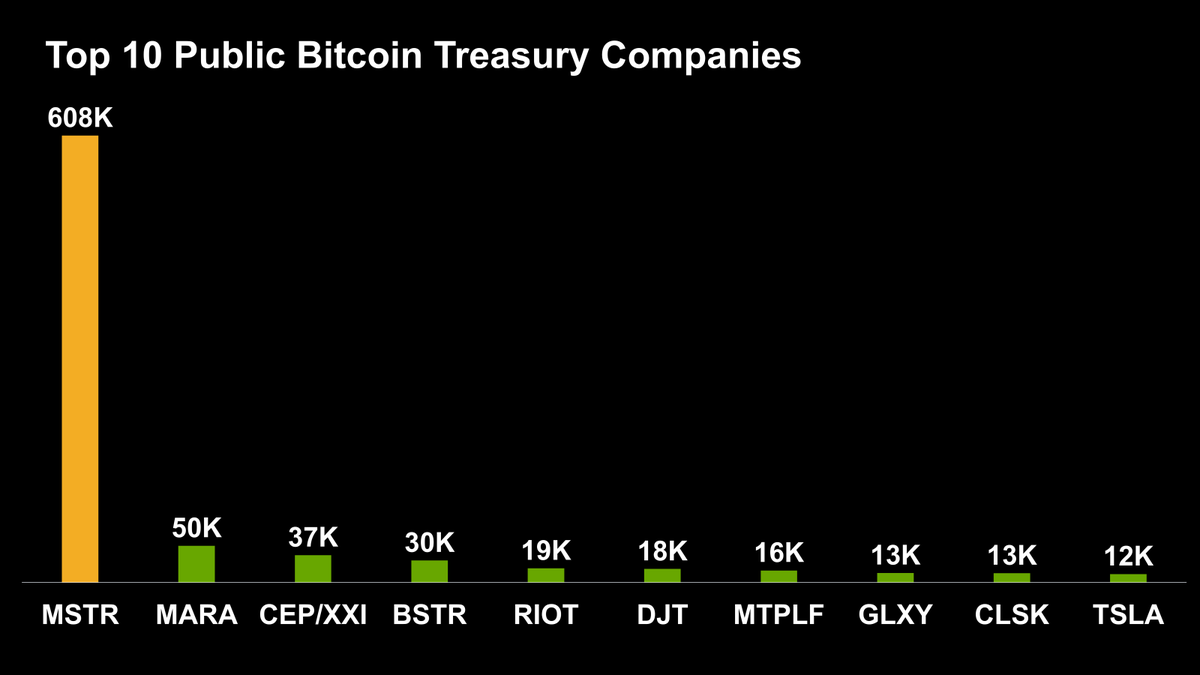

Strategy now holds 628,791 bitcoin. At current prices, it’s worth over $74B.

How much is that, really?

More than every other public company combined.

More than any single nation-state has ever disclosed.

Roughly 3% of total supply—in one ticker.

And they’re still buying.

How much is that, really?

More than every other public company combined.

More than any single nation-state has ever disclosed.

Roughly 3% of total supply—in one ticker.

And they’re still buying.

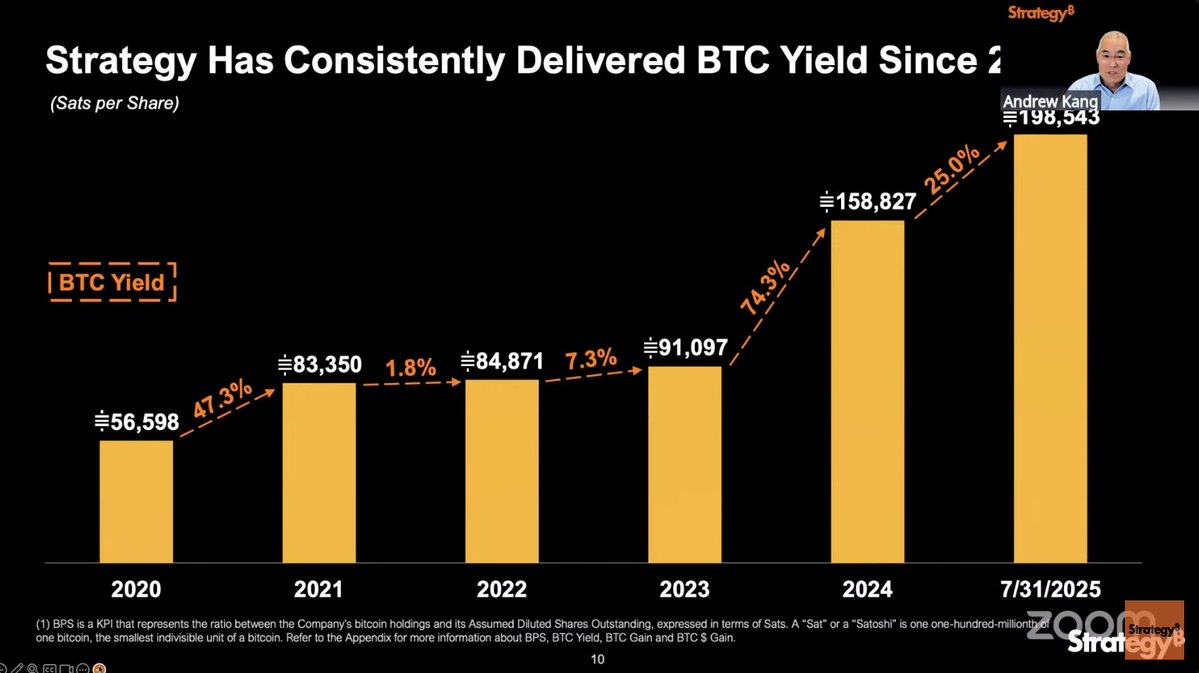

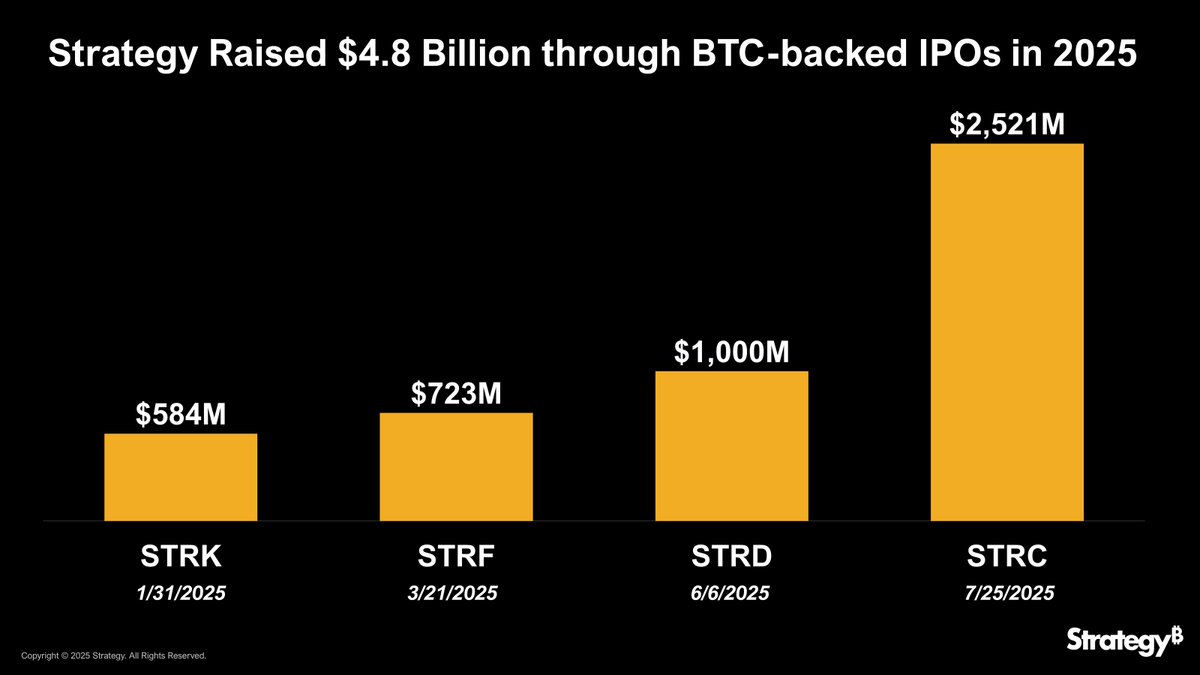

But they didn’t stop at buying Bitcoin.

They built an entire capital structure around it.

Issuing preferreds. Trading convertibles. Raising billions. Paying yield.

And now they’re building a BTC credit market—from short duration to 20-year stretch paper.

They built an entire capital structure around it.

Issuing preferreds. Trading convertibles. Raising billions. Paying yield.

And now they’re building a BTC credit market—from short duration to 20-year stretch paper.

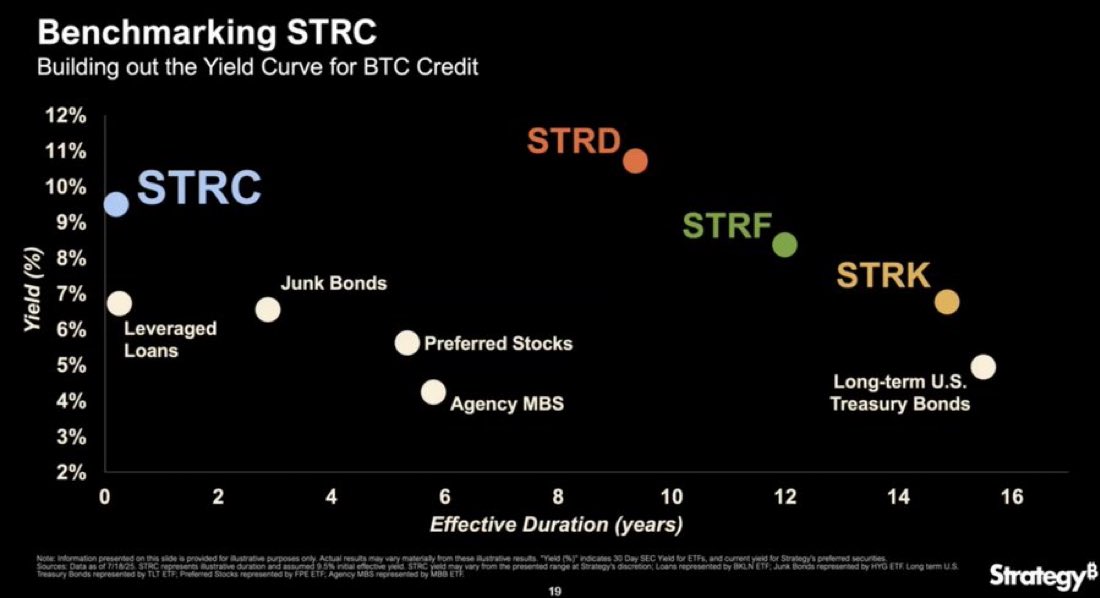

Saylor calls it:

“Digital capital, built on digital collateral, designed by digital intelligence.”

They’re building out an entire Bitcoin yield curve—modeled by AI, issued at scale, and trading publicly.

Bitcoin isn’t just treasury. It’s infrastructure.

“Digital capital, built on digital collateral, designed by digital intelligence.”

They’re building out an entire Bitcoin yield curve—modeled by AI, issued at scale, and trading publicly.

Bitcoin isn’t just treasury. It’s infrastructure.

Wall Street still tries to value MSTR like a tech firm with weird treasury management.

But this isn’t a tech stock.

It’s an emerging BTC-native asset manager, financial architect, and reserve aggregator—all in one ticker.

But this isn’t a tech stock.

It’s an emerging BTC-native asset manager, financial architect, and reserve aggregator—all in one ticker.

So why the 4.7x earnings multiple?

Because Wall Street still sees MSTR as a software firm with an unusual treasury policy.

Not as the first BTC-native asset manager, architecting a financial system on top of digital scarcity.

Because Wall Street still sees MSTR as a software firm with an unusual treasury policy.

Not as the first BTC-native asset manager, architecting a financial system on top of digital scarcity.

While most corporations hoard cash and follow the Fed…

Strategy is building on a new monetary foundation—one that can’t be printed, paused, or politicized.

Bitcoin isn’t just their balance sheet. It’s their base layer.

Strategy is building on a new monetary foundation—one that can’t be printed, paused, or politicized.

Bitcoin isn’t just their balance sheet. It’s their base layer.

This isn’t about chasing MSTR.

It’s about what their balance sheet reveals.

The world is being repriced in Bitcoin.

Some are still watching.

Others are already positioned.

It’s about what their balance sheet reveals.

The world is being repriced in Bitcoin.

Some are still watching.

Others are already positioned.

Swan Private works with investors, institutions, and family offices navigating this shift.

From cold storage to corporate strategy—we help you accumulate, secure, and activate your Bitcoin.

Start the conversation:

swanbitcoin.com/private?utm_ca…

From cold storage to corporate strategy—we help you accumulate, secure, and activate your Bitcoin.

Start the conversation:

swanbitcoin.com/private?utm_ca…

• • •

Missing some Tweet in this thread? You can try to

force a refresh