Dallas housing supply is through the roof.

Active listings measured almost 32,000 in July 2025.

The average for July going back to 2017 is only 20,000.

60% more inventory than normal.

Active listings measured almost 32,000 in July 2025.

The average for July going back to 2017 is only 20,000.

60% more inventory than normal.

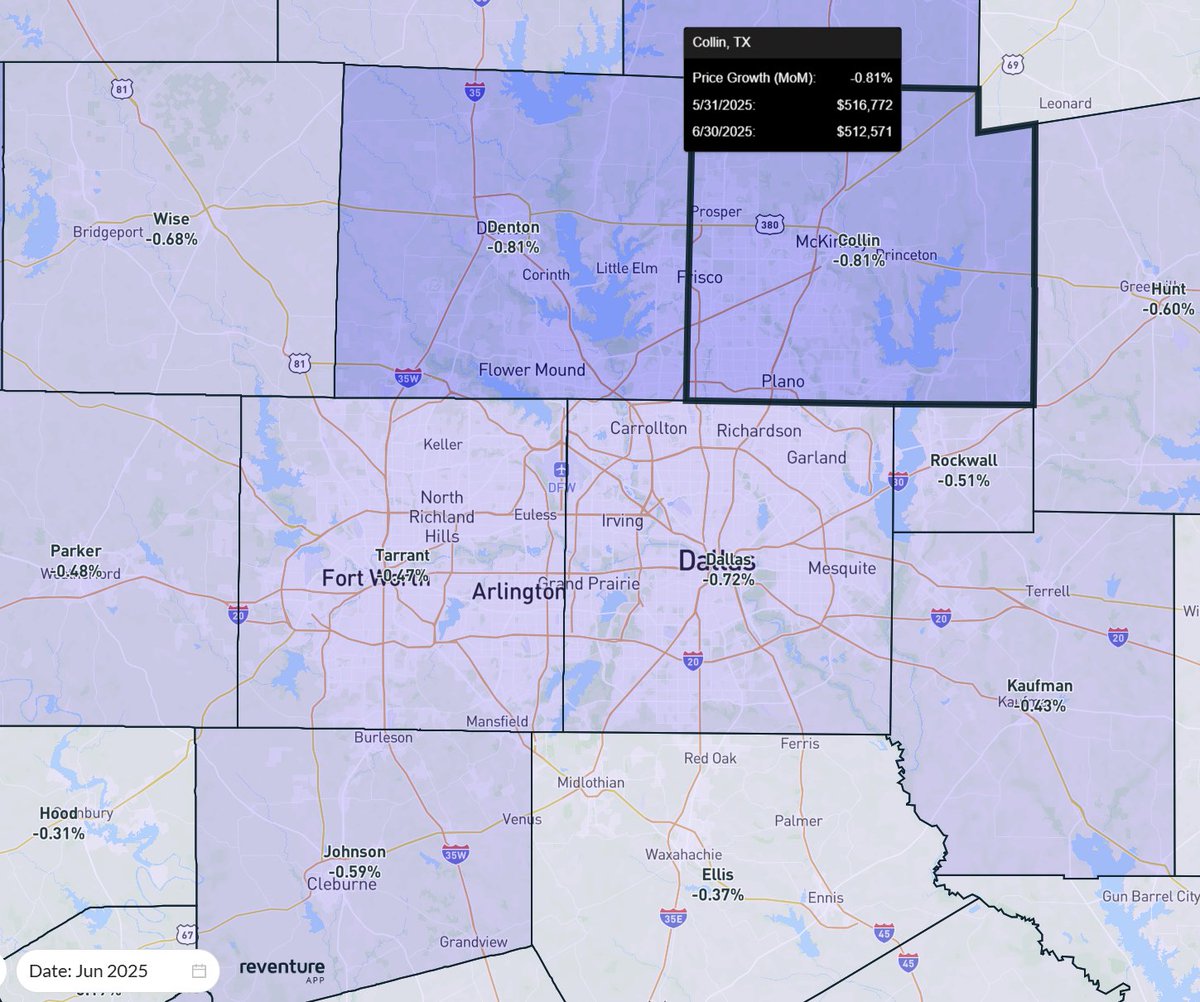

1) The inventory spike is happening pretty much everywhere in DFW.

All major counties are now above a 50% inventory surplus.

All major counties are now above a 50% inventory surplus.

2) Great news for DFW homebuyers.

There's the most selection the market has had since the tail end of the last downturn in 2011-12.

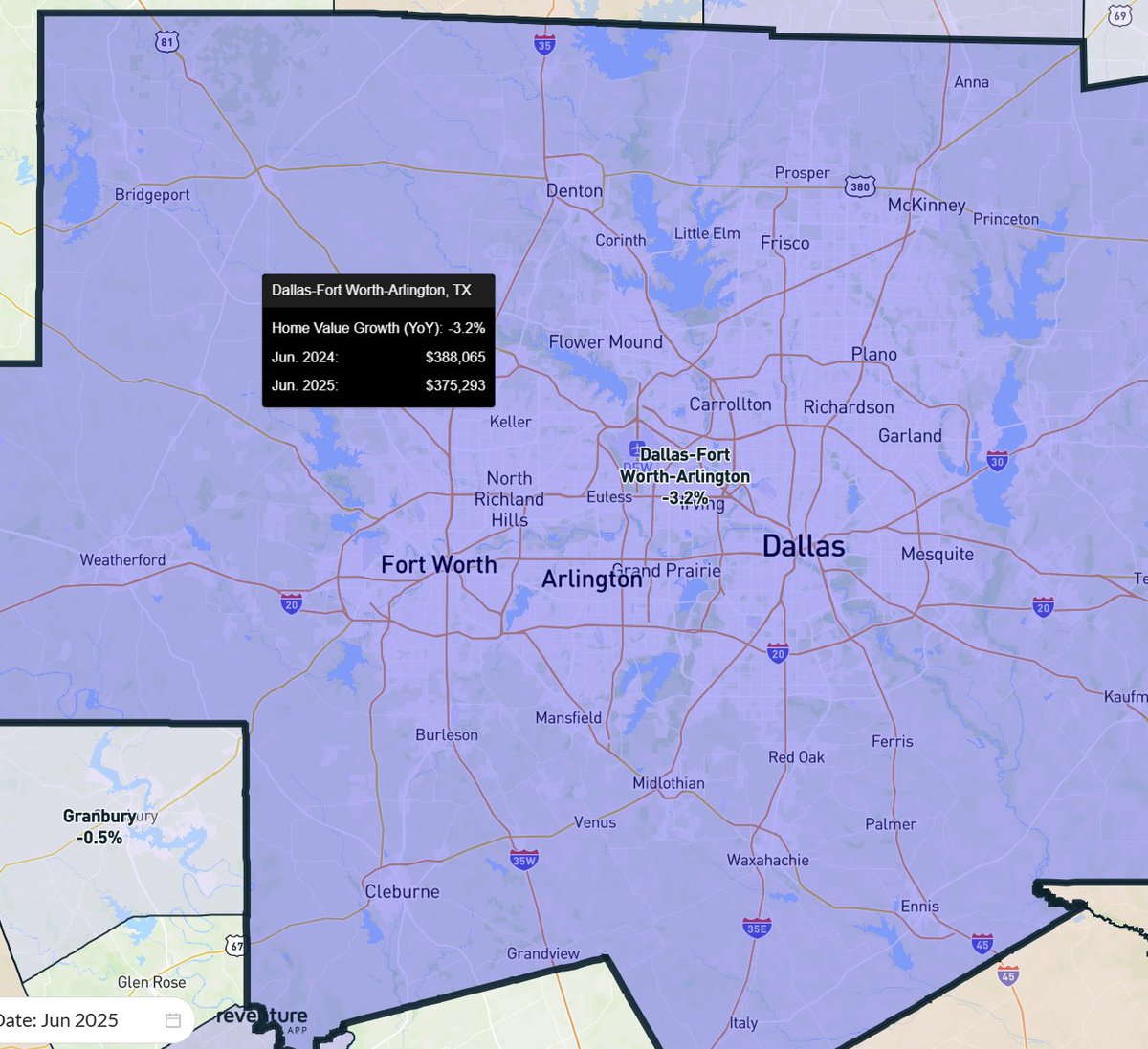

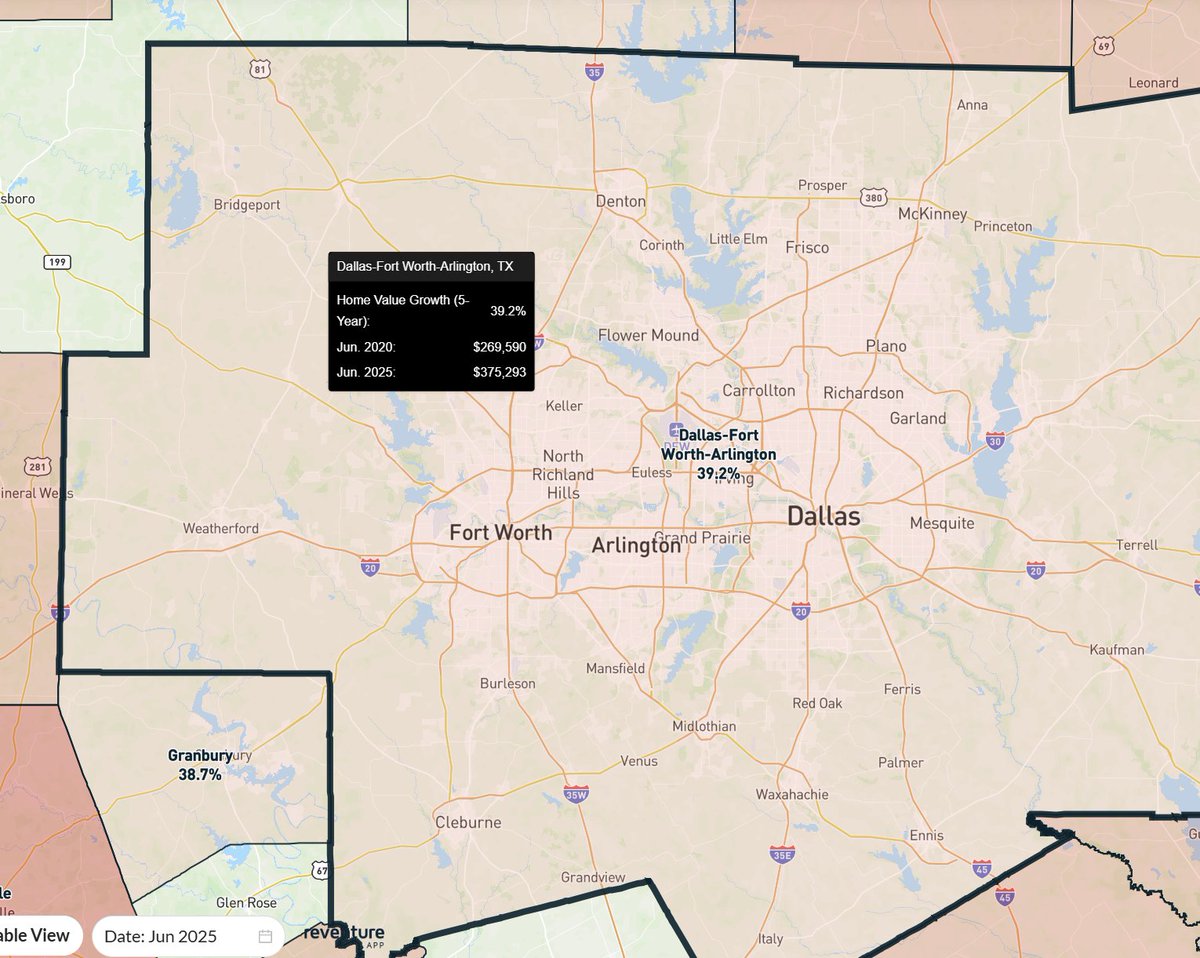

Meanwhile, values are now going down on a year-over-year basis.

There's the most selection the market has had since the tail end of the last downturn in 2011-12.

Meanwhile, values are now going down on a year-over-year basis.

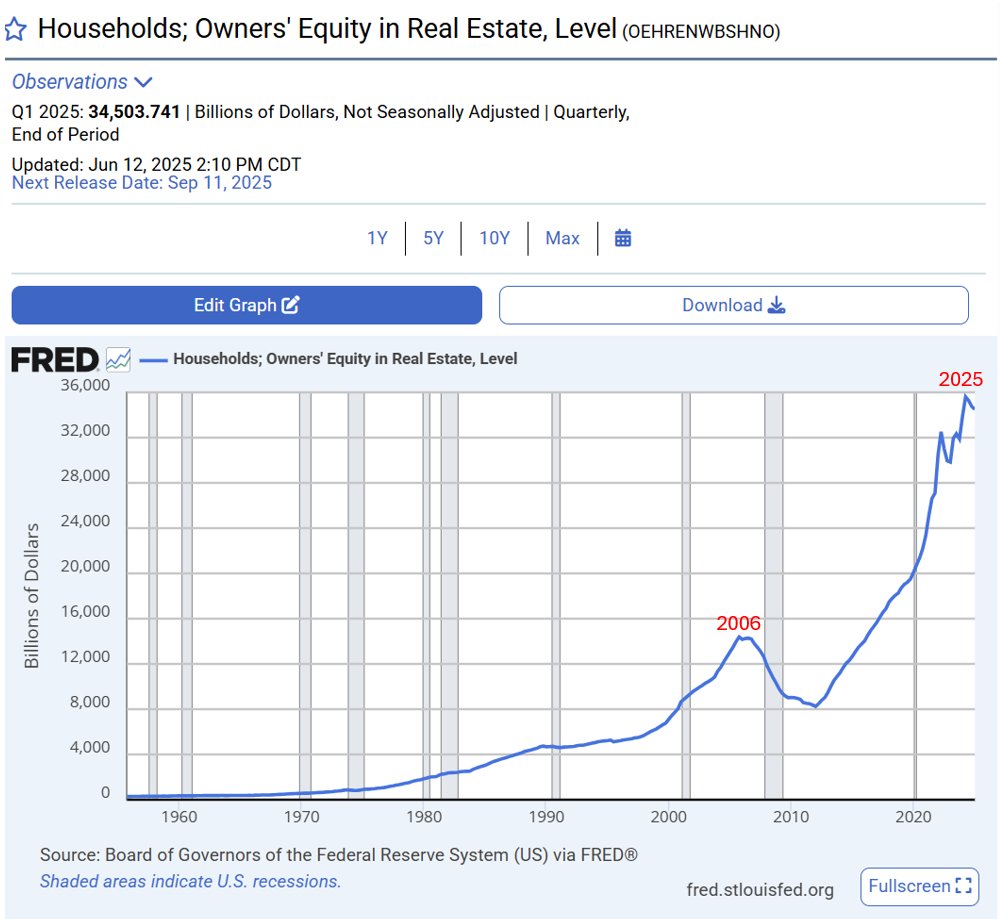

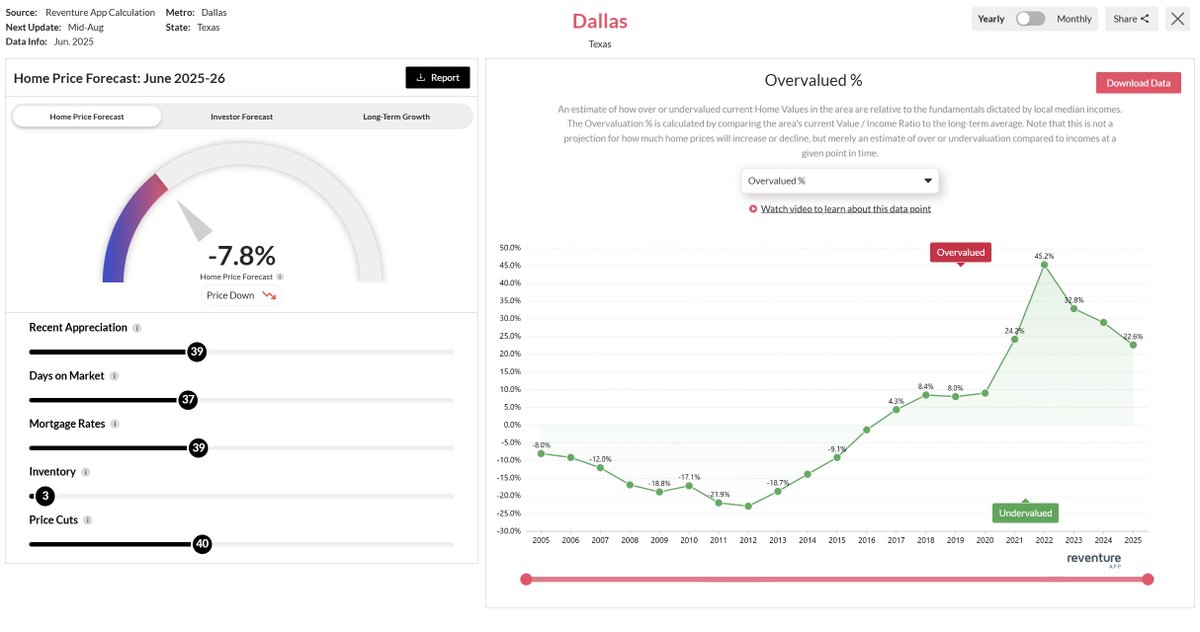

6) We're forecasting a -7.8% drop in DFW over the next 12 months.

Market is still pretty overvalued at 22%. But improving.

Wouldn't be surprised if we see prices drop for a couple years before market bottoms out.

Market is still pretty overvalued at 22%. But improving.

Wouldn't be surprised if we see prices drop for a couple years before market bottoms out.

7) Access the ZIP code-specific forecasts at under a premium plan.

Currently the premium plan costs $39/month.

On August 18th, it will increase to $49/month.

Lock in your subscription now to get the lower pricing.reventure.app

Currently the premium plan costs $39/month.

On August 18th, it will increase to $49/month.

Lock in your subscription now to get the lower pricing.reventure.app

• • •

Missing some Tweet in this thread? You can try to

force a refresh