Slightly surprised to discover I've been referred to the International Criminal Court in the Hague for war crimes.

My actions are apparently comparable with the recruitment of child soldiers.

The full document: taxpolicy.org.uk/wp-content/ass…

The full document: taxpolicy.org.uk/wp-content/ass…

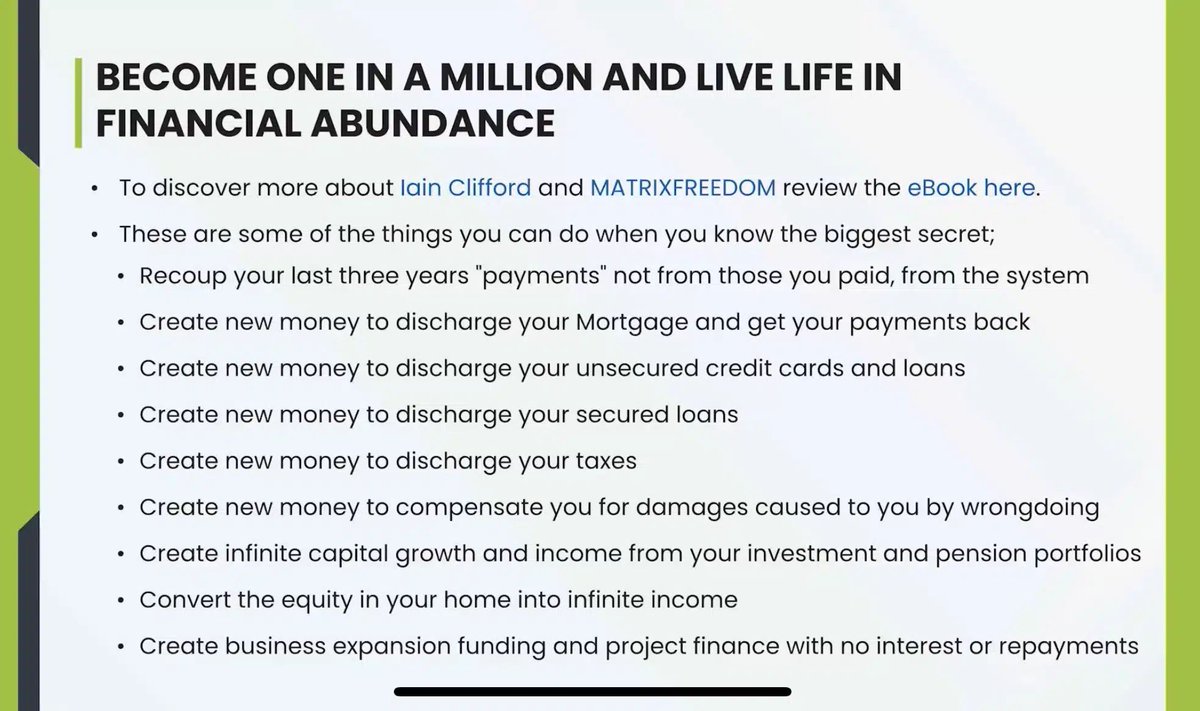

This is, of course, all completely barking. It's from Iain Clifford Stamp, a "sovereign citizen" scammer who was sentenced to twelve months imprisonment last month, for completely ignoring court orders. .judiciary.uk/judgments/comm…

Stamp charges vulnerable people thousands of pounds on the false promise he will make their mortgages disappear and magic money out of nowhere. He makes millions from it.

More background here: taxpolicy.org.uk/2024/06/08/mat…

More background here: taxpolicy.org.uk/2024/06/08/mat…

Stamp says he's fled to Northern Cyprus to escape justice. He's still flogging his weird cult-like-scheme. It's destroyed relationships and broken up families.

Can anyone stop him?

Can anyone stop him?

• • •

Missing some Tweet in this thread? You can try to

force a refresh