Just announced: the UK's most famous libel firm, Carter-Ruck, is being prosecuted before the Solicitors Disciplinary Tribunal for recklessly enabling a $4bn fraud

It's astonishing how reckless Carter-Ruck was - likely causing $$$ more to be lost to fraudsters

The full story:

It's astonishing how reckless Carter-Ruck was - likely causing $$$ more to be lost to fraudsters

The full story:

The original reporting on all this was from Ed Siddons and Matthew Valencia for The Bureau of Investigative Journalism: thebureauinvestigates.com/stories/2023-1…

We then conducted a detailed investigation and legal analysis of what Carter-Ruck did, and what they should have known at the time. I'll summarise in this thread, but way more detail here: taxpolicy.org.uk/2023/12/18/car…

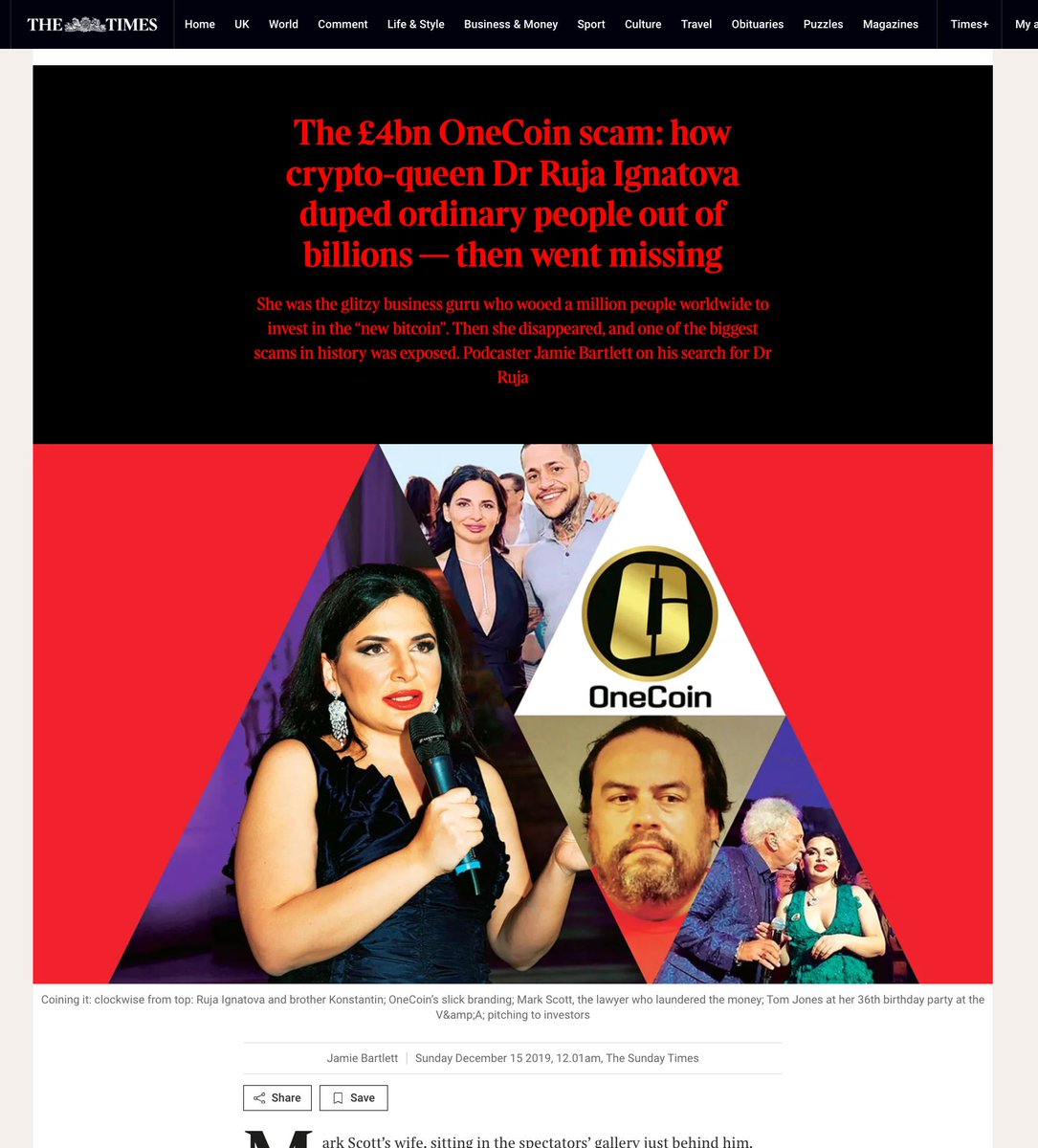

OneCoin was founded in 2014. It presented itself as a cryptocurrency, better than BitCoin, “mined” by computers, held on a blockchain, and traded on an exchange. OneChain was aggressively marketed online and offline.

Everything was a lie – OneCoin was one of the biggest scams in history. There was no “mining”. There was no blockchain. The “exchange” presented fake prices, designed to make investors think the price of OneCoin was rising. thetimes.com/uk/law/article…

OneCoin failed spectacularly in 2017, and its executives are all now either in jail or in hiding. Around $4bn was stolen from millions of investors, across 125 countries. Its founder, Ruja Ignatova, is one of the FBI’s ten most wanted fugitives.

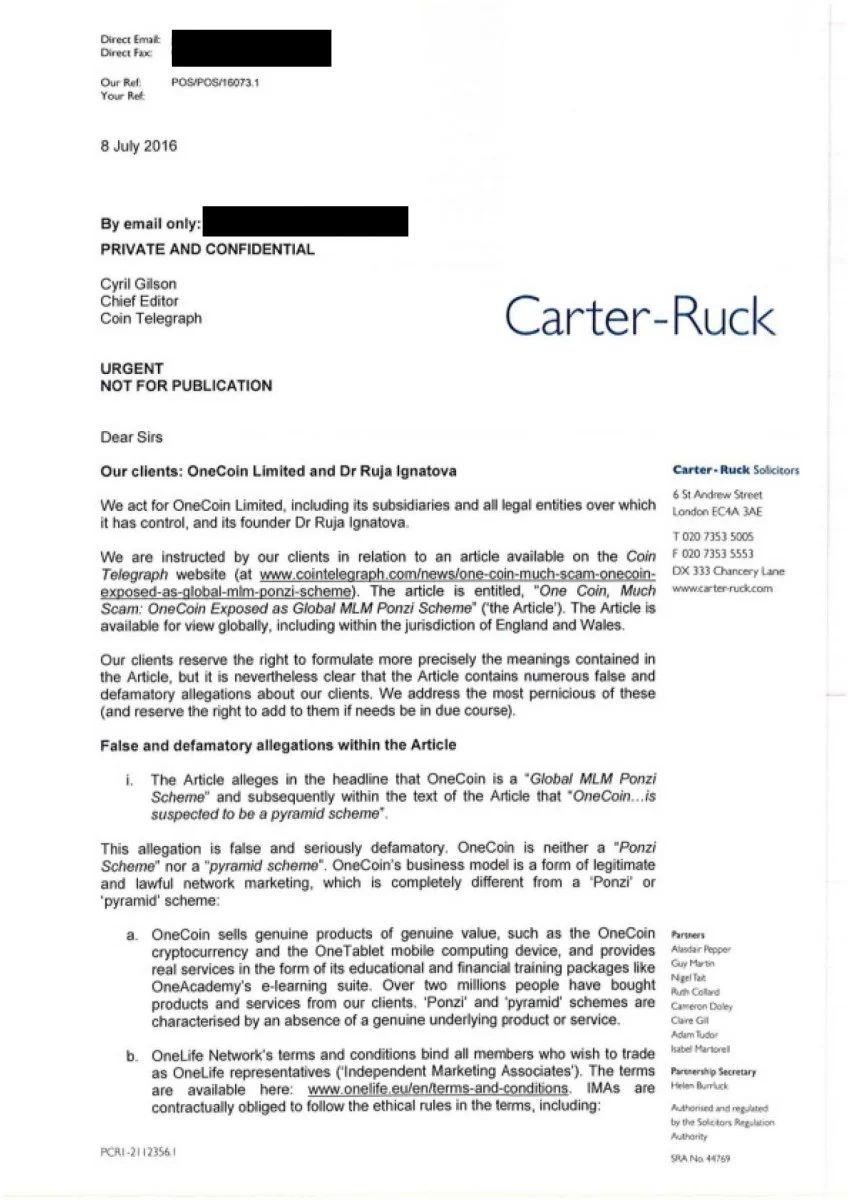

Carter-Ruck started acting for OneCoin in 2016. At that point there was a *pile* of evidence OneCoin was a fraud:

@Cointelegraph is a website publishing news on the cryptocurrency industry. Its Twitter account has 2.8 million followers.

In May 2015 it published an article accusing OneCoin of being a fraud...

In May 2015 it published an article accusing OneCoin of being a fraud...

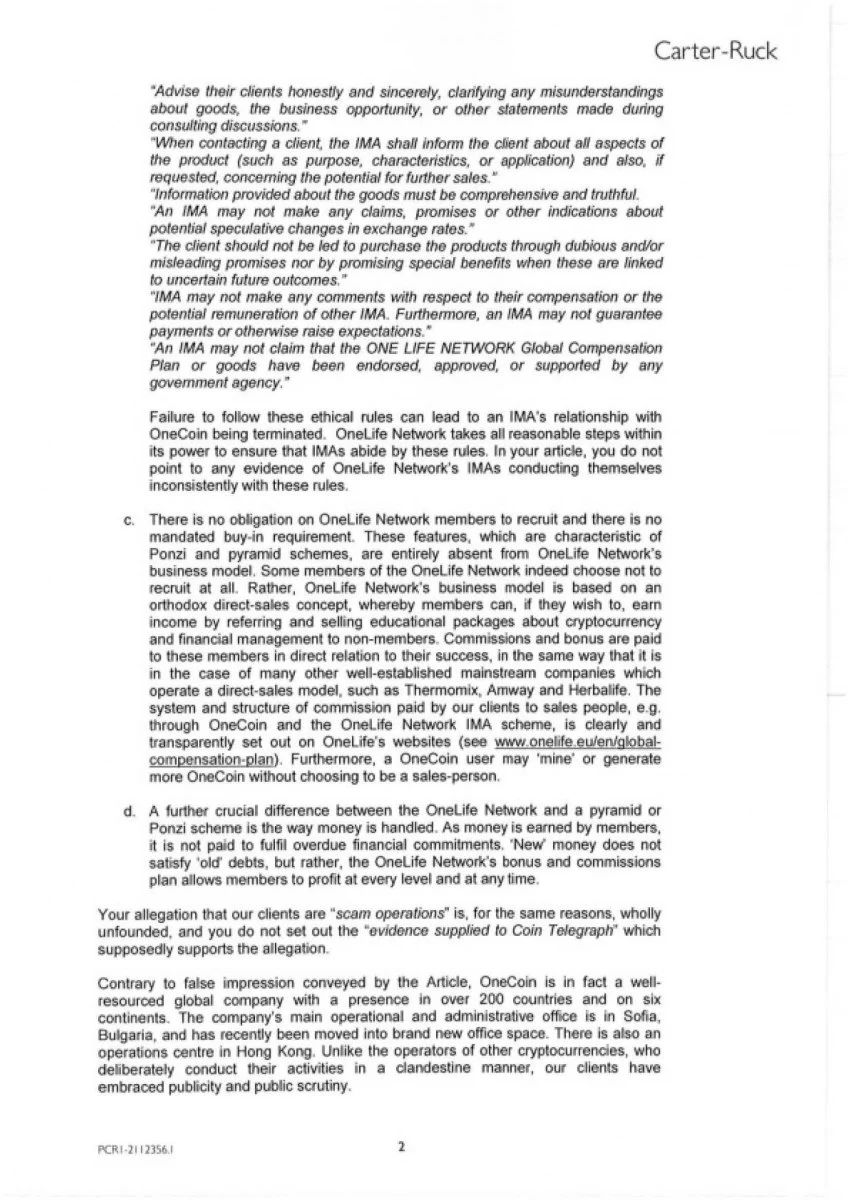

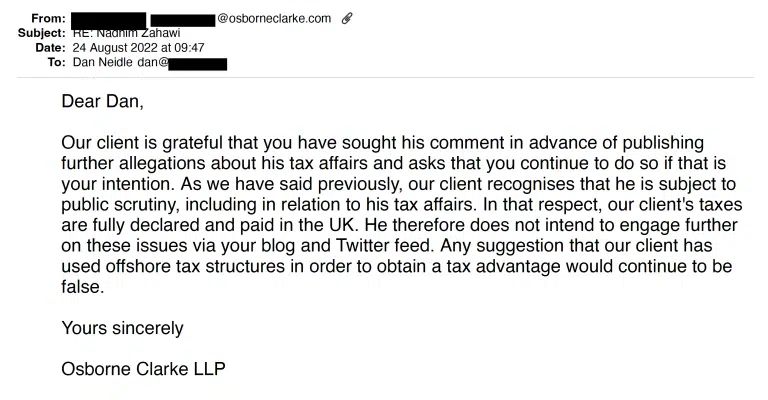

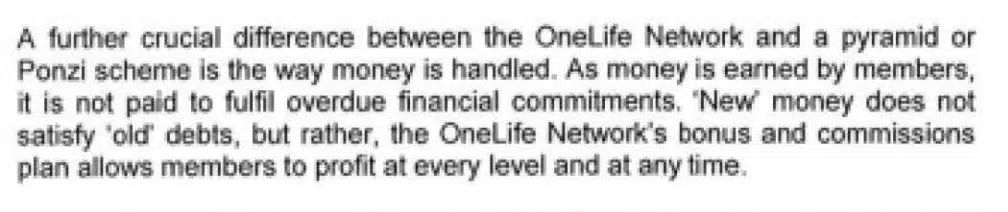

@Cointelegraph The letter is scandalous. Here's their denial that OneCoin is a Ponzi scheme, which anyone with even the slightest understanding would realise amounts to an admission OneCoin *is* a Ponzi scheme:

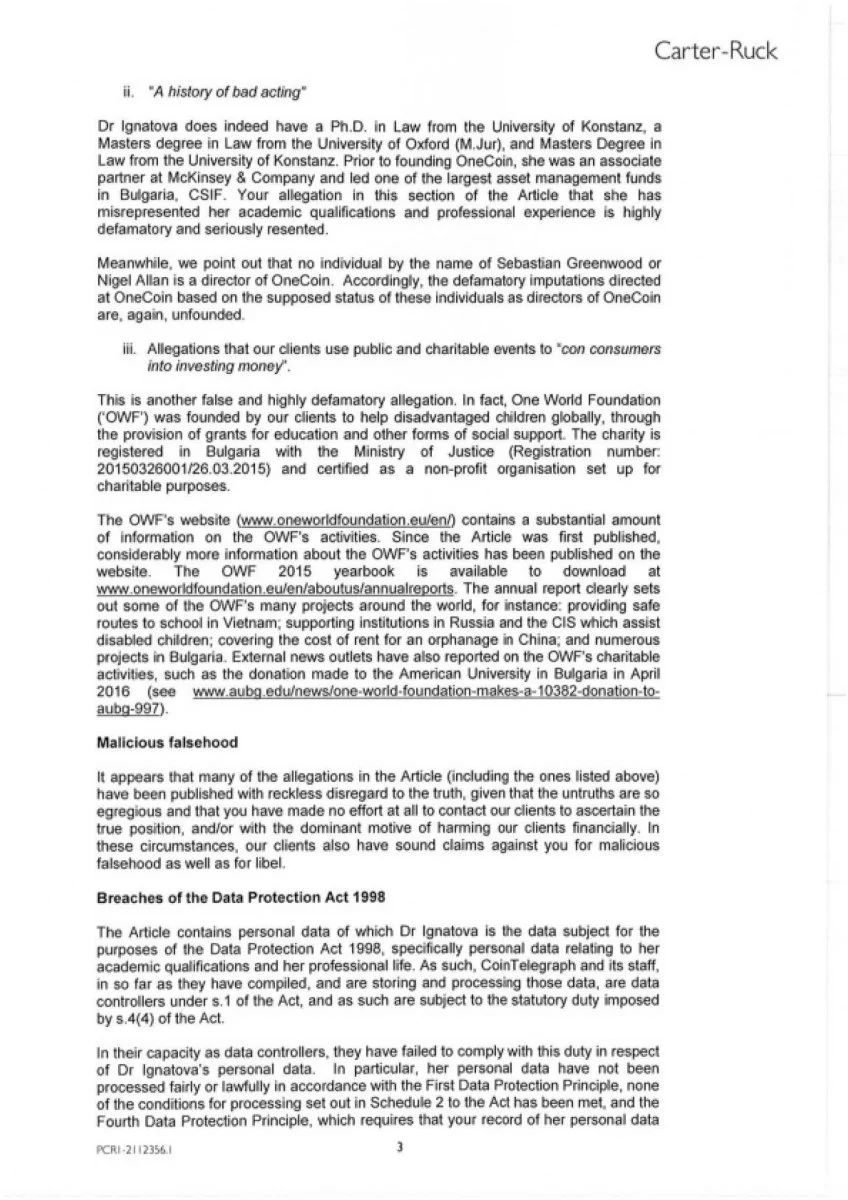

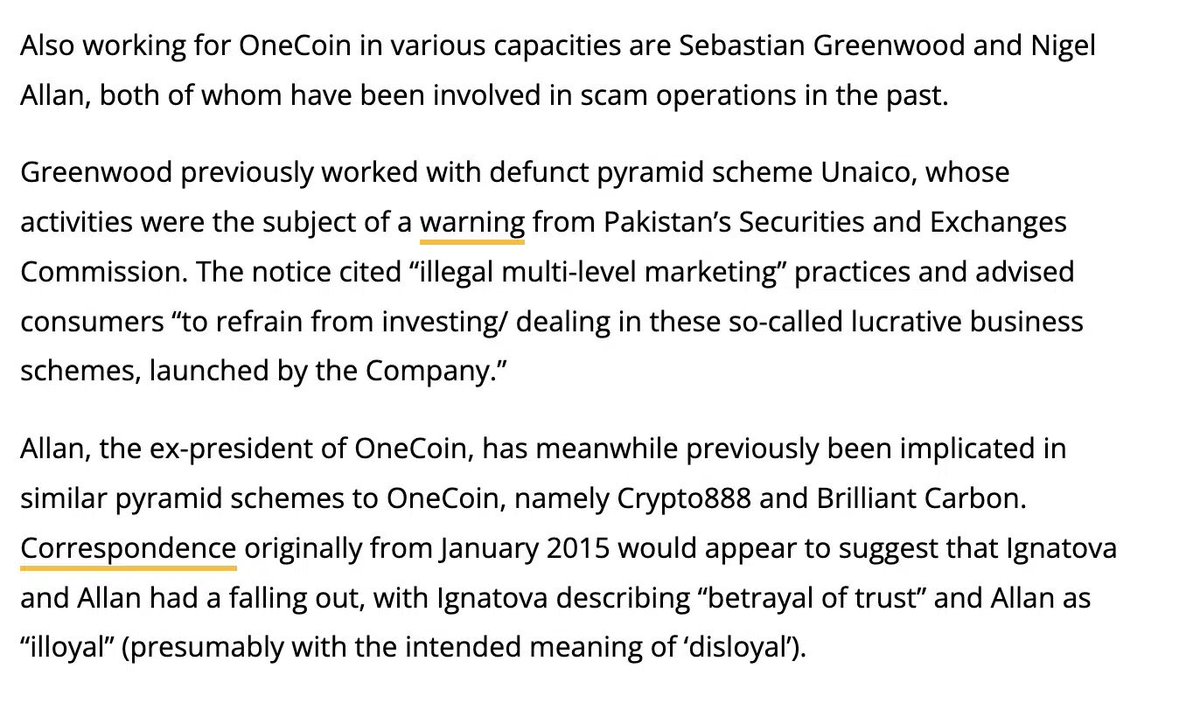

@Cointelegraph Here's Coin Telegraph's claim that Sebastian Greenwood and Nigel Allan had previous involvement in scams. And here's Carter-Ruck's response.

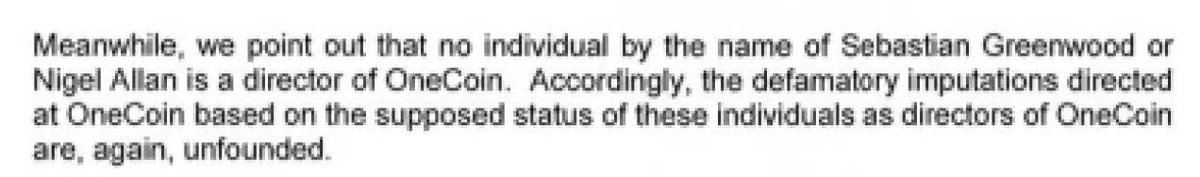

@Cointelegraph This is a very peculiar paragraph. Coin Telegraph didn’t say they were “directors”. It said they were “working in various capacities” and that Allan was the “ex-president” of OneCoin. A Google search in 2016 would have immediately revealed that these statements were true.

@Cointelegraph The paragraph was false and misleading. Beyond reckless for a lawyer to write it.

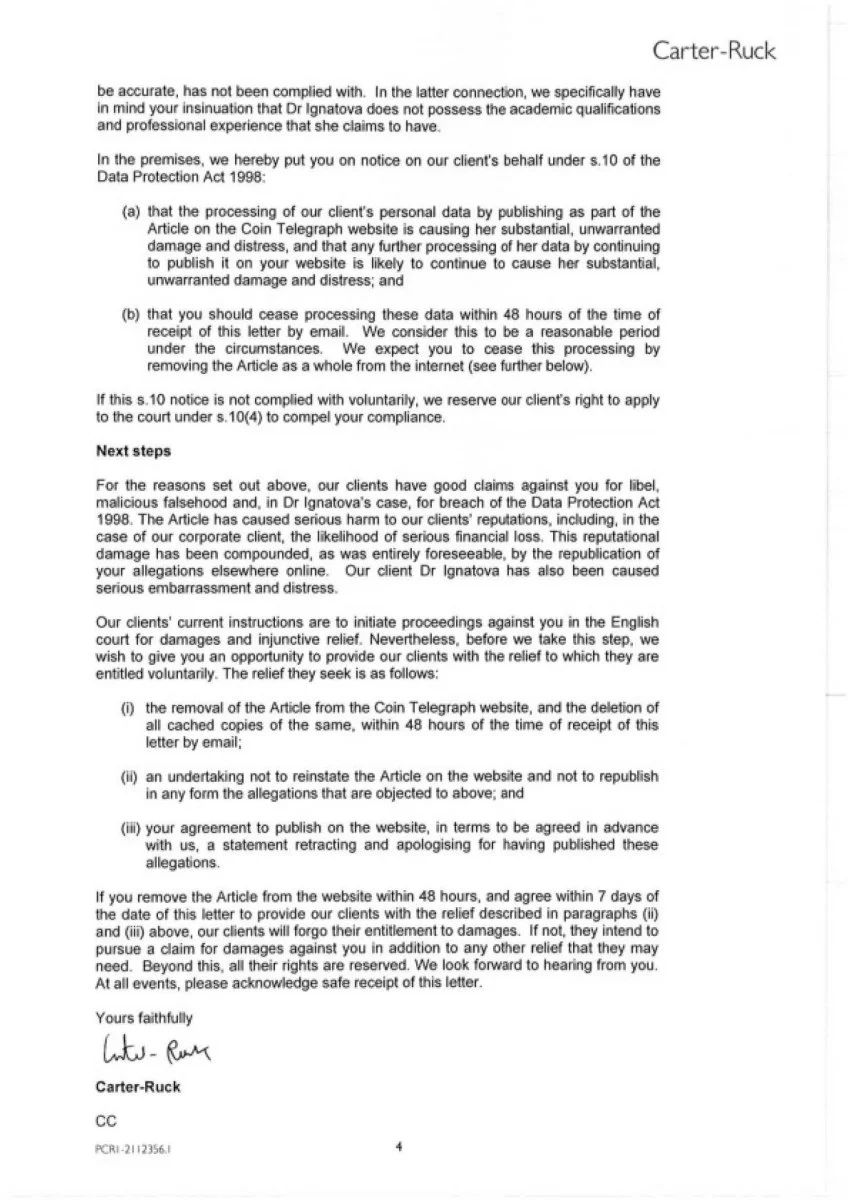

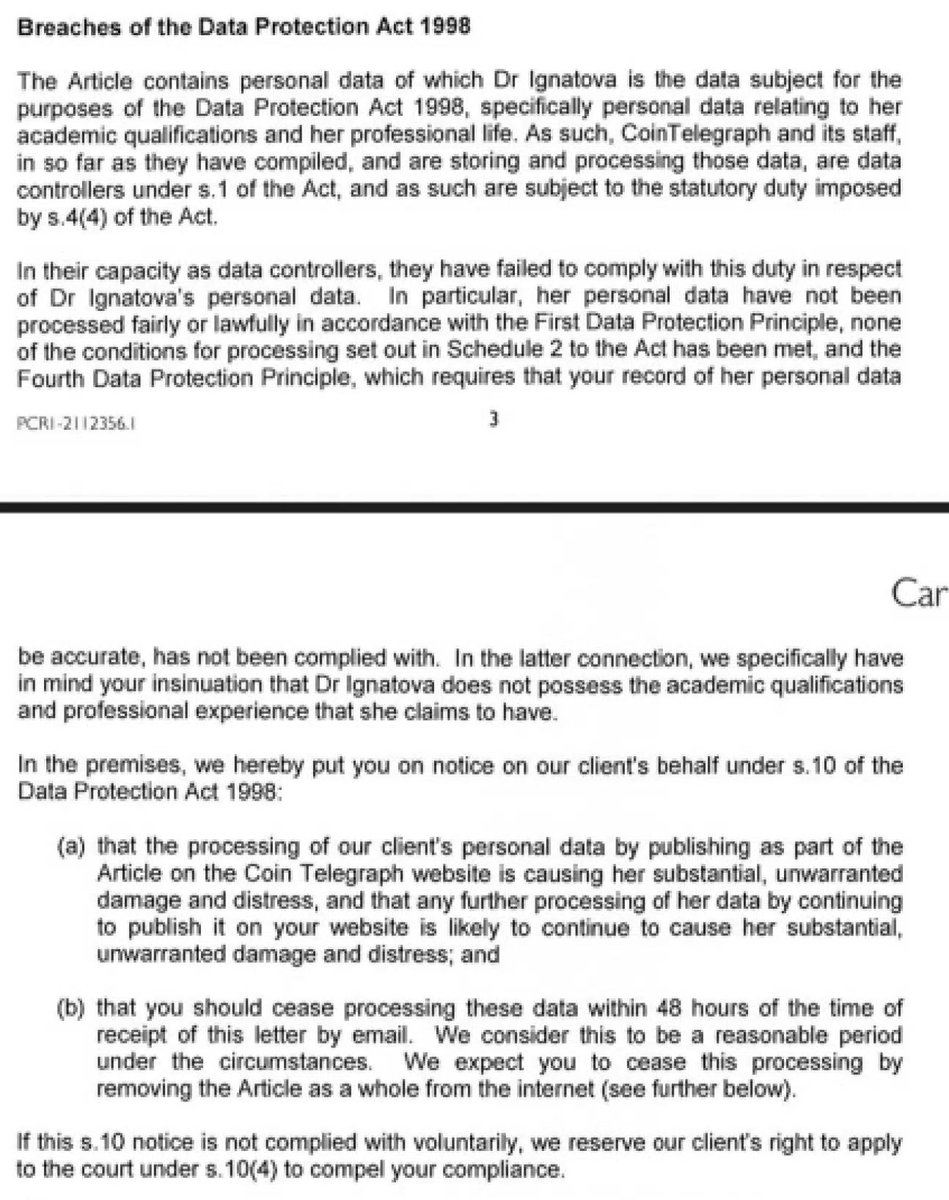

@Cointelegraph And Carter-Ruck then abused GDPR to try to silence Coin Telegraph:

There's a journalism exception from GDPR. This was a meritless threat. A disgrace.

There's a journalism exception from GDPR. This was a meritless threat. A disgrace.

@Cointelegraph It then gets worse. A woman called Jen McAdam had invested in OneCoin but became convinced it was a Ponzi scheme in part based upon accusations made by Bjørn Bjercke, a Norwegian cryptocurrency expert. She discussed them in this webinar:

@Cointelegraph Mr Bjercke had established that OneCoin transactions did not actually appear on what OneCoin claimed was their blockchain. It was a fraud.

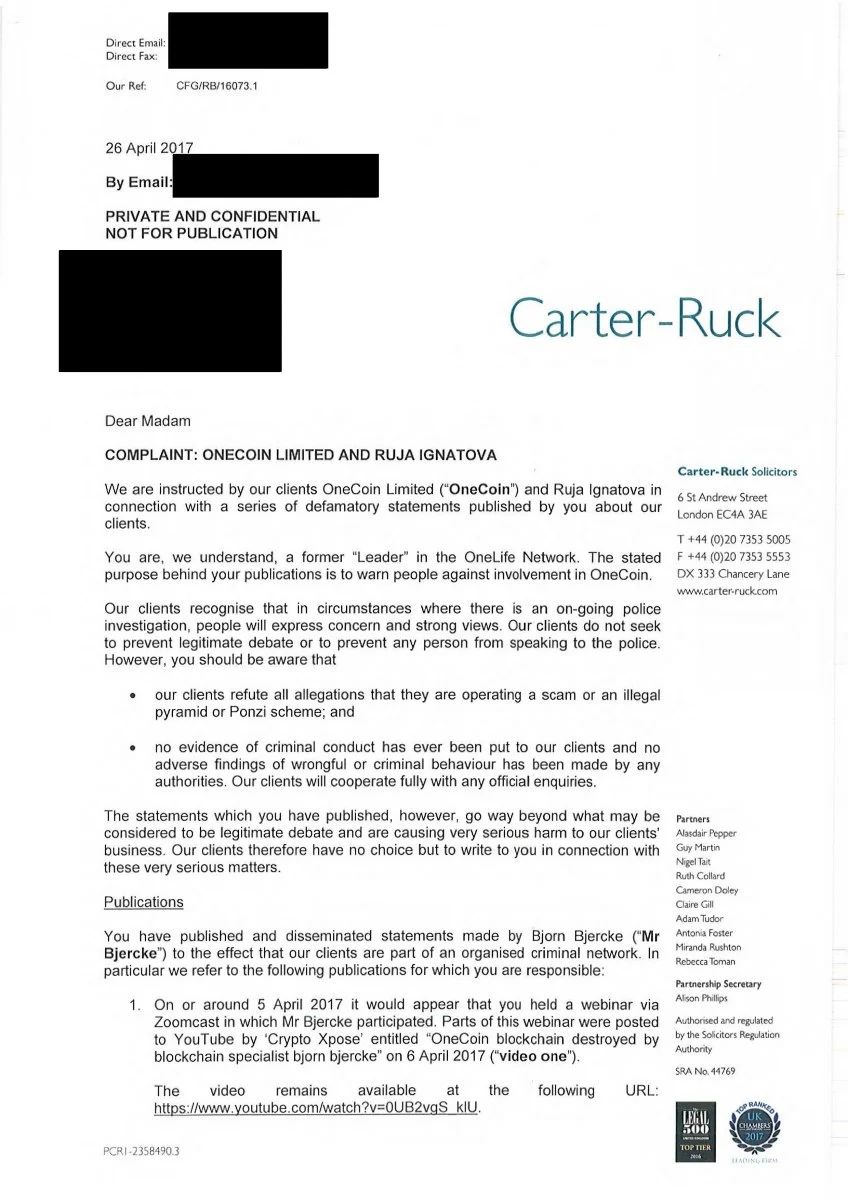

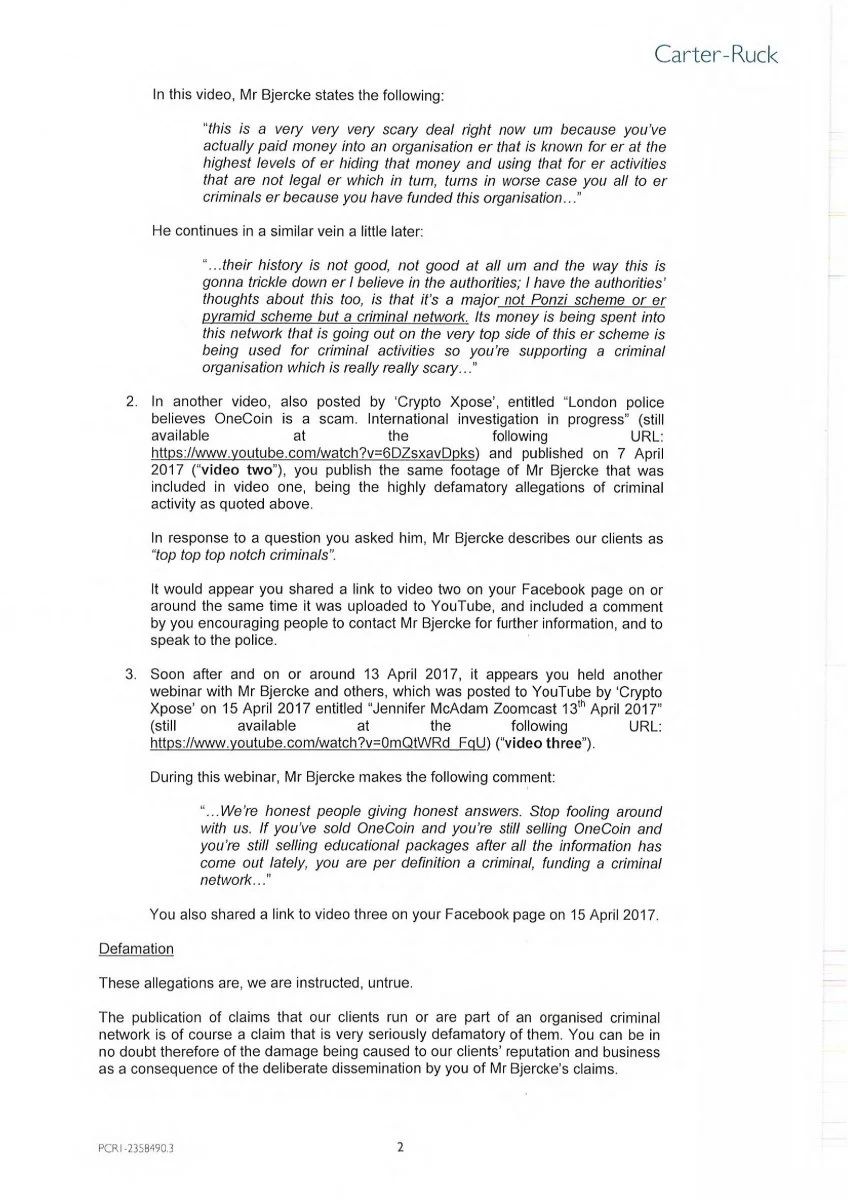

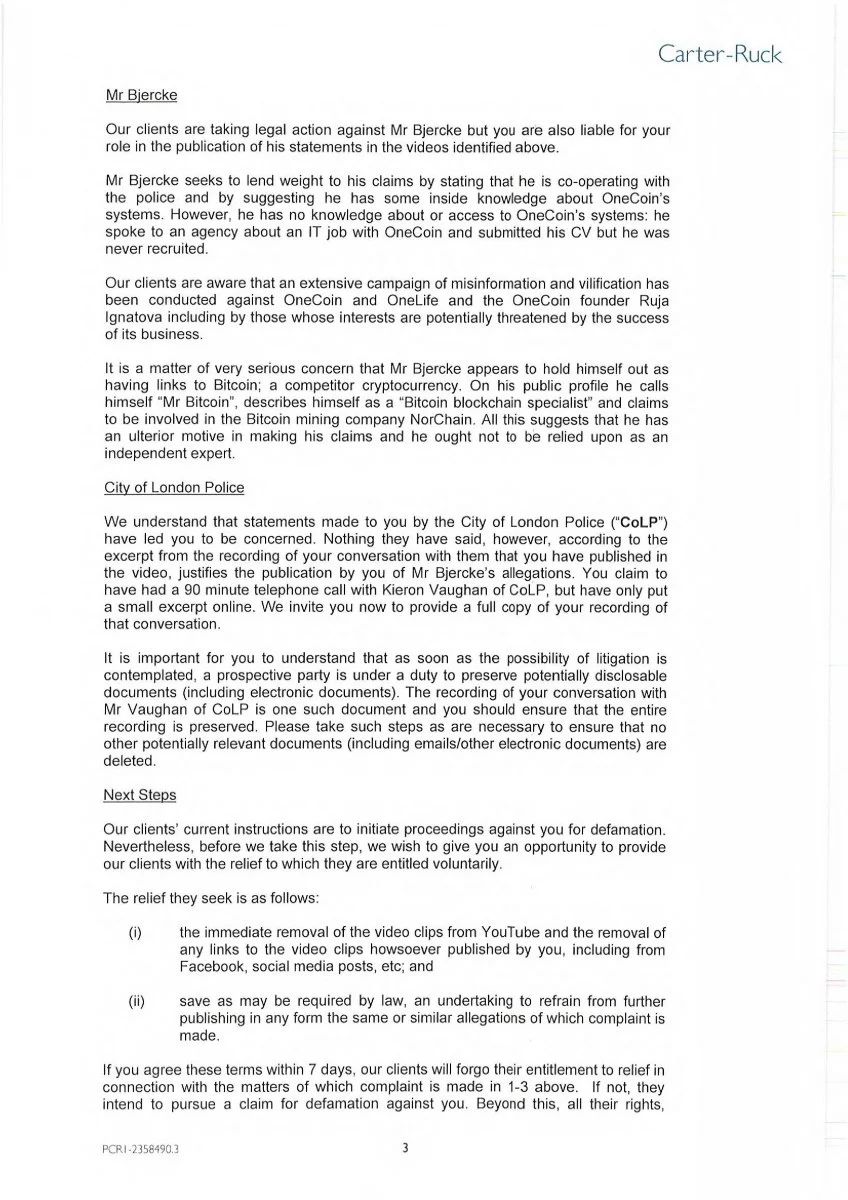

And that claim triggered another threat from Carter-Ruck:

And that claim triggered another threat from Carter-Ruck:

@Cointelegraph The letter fails to engage with, or even mention, Mr Bjercke’s evidence that the OneCoin blockchain was faked. It's just pure intimidation. Again, a disgrace.

(Technically: the letter fails to comply with the pre-action protocol for defamation)

(Technically: the letter fails to comply with the pre-action protocol for defamation)

@Cointelegraph There's more. The attempt in Norway to bring a claim against Mr Bjercke. The intimidation of the FCA, resulting in the FCA withdrawing its warning notice. The mounting evidence of fraud, which Carter-Ruck ignored.

@Cointelegraph Carter-Ruck continued to act until right before OneCoin failed. Their efforts to protect OneCoin's reputation were highly successful. Articles weren't published. The FCA warning notice was removed.

And this likely resulted in millions more being lost to the fraud.

And this likely resulted in millions more being lost to the fraud.

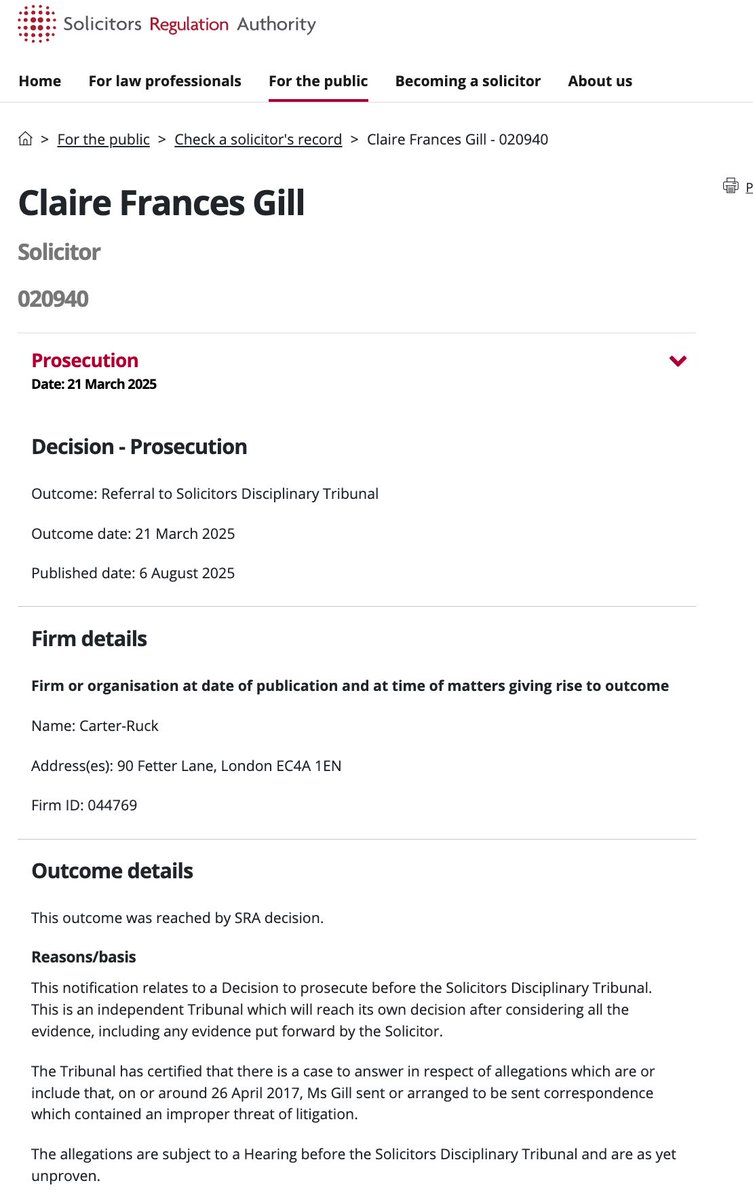

@Cointelegraph The SRA decided last month to prosecute the Carter-Ruck partner responsible, Claire Gill. Carter-Ruck tried to prevent this becoming public, but the SRA - to its credit - persisted. sra.org.uk/consumers/soli…

@Cointelegraph Full details in our report here: taxpolicy.org.uk/2023/12/18/car…

@Cointelegraph For updates on this, you can follow me here, or subscribe for free updates taxpolicy.org.uk/subscribe

@Cointelegraph And thanks to @IainTurner5 for reminding me about this brilliant BBC podcast series about OneCoin bbc.co.uk/sounds/brand/p…

• • •

Missing some Tweet in this thread? You can try to

force a refresh