My biggest winners weren’t luck.

They followed the same patterns — over and over again.

Here are 10 lessons from my biggest trades 👇

They followed the same patterns — over and over again.

Here are 10 lessons from my biggest trades 👇

1) Clear Pattern Before Breakout:

Every one formed a clean base — flat base, flag, or VCP. No sloppy ranges. Tight price action = power building.

Every one formed a clean base — flat base, flag, or VCP. No sloppy ranges. Tight price action = power building.

2) Strong Uptrend Before the Base:

They were already leaders. Most were up 50-100%+ before forming the base. Strength attracts more strength.

They were already leaders. Most were up 50-100%+ before forming the base. Strength attracts more strength.

3) Explosive Volume on Breakout:

The best breakouts came on 30%+ average volume. Funds were buying. Weak-volume breakouts? They usually failed.

The best breakouts came on 30%+ average volume. Funds were buying. Weak-volume breakouts? They usually failed.

4) Hot Sector or Theme:

AI infrastructure, battery tech, drones, rare earths … big money flows into big stories. Narrative matters.

AI infrastructure, battery tech, drones, rare earths … big money flows into big stories. Narrative matters.

5) Fundamental Power:

Most had EPS growth of 50%+ YoY and / or sales growth of 20%+. Institutions chase growth.

Most had EPS growth of 50%+ YoY and / or sales growth of 20%+. Institutions chase growth.

6) Liquidity to Handle Size:

$10M-20M+ average daily turnover made it possible to scale in and out without moving the stock.

$10M-20M+ average daily turnover made it possible to scale in and out without moving the stock.

7) Patience After Entry:

Many ran for weeks. I didn’t sell at +10% — I held above EMA8 or EMA21 until the trend broke.

Many ran for weeks. I didn’t sell at +10% — I held above EMA8 or EMA21 until the trend broke.

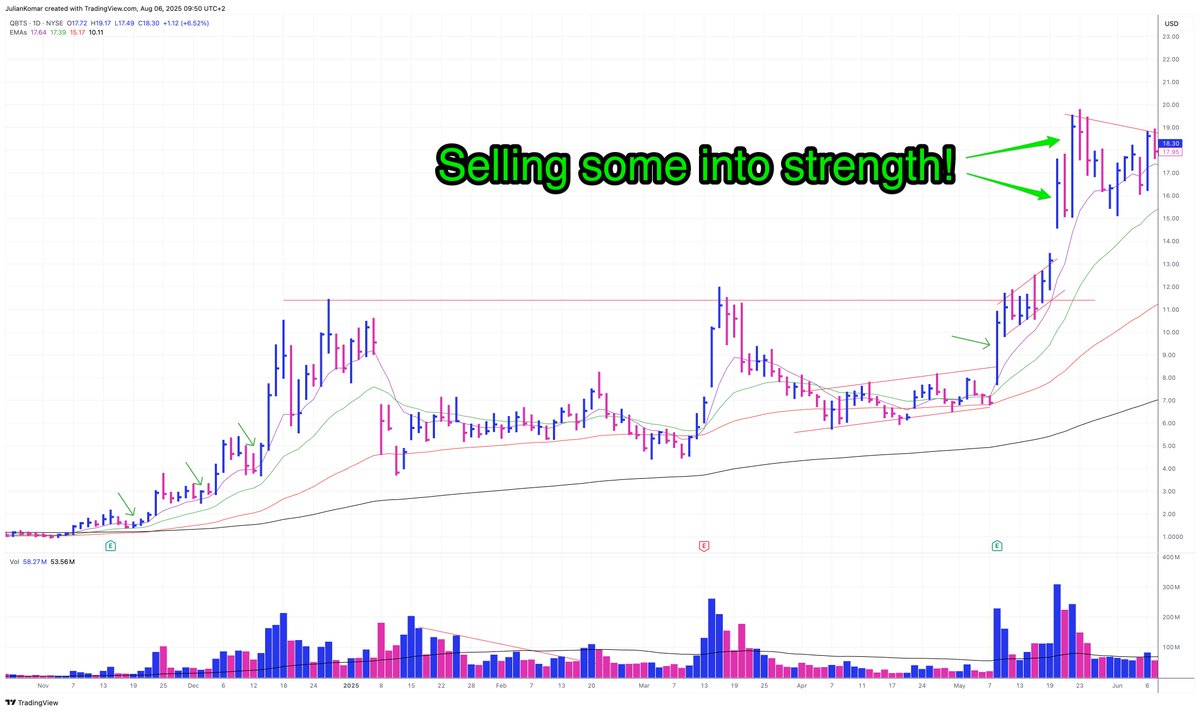

8) Scaling Out Into Strength:

Taking 10–20% off on big up days locked in gains and reduced stress — without killing the trade.

Taking 10–20% off on big up days locked in gains and reduced stress — without killing the trade.

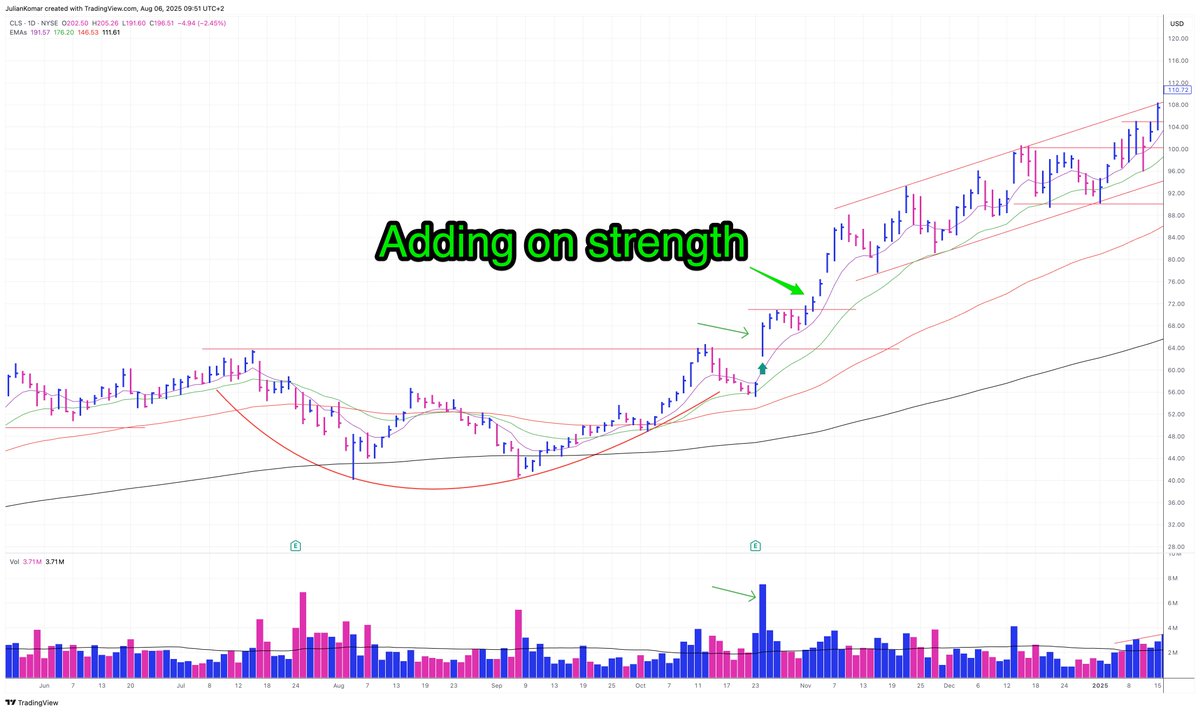

9) No Additions in Weakness:

I only added on strength — reclaiming highs with volume. Adding in pullbacks often destroyed the trade.

I only added on strength — reclaiming highs with volume. Adding in pullbacks often destroyed the trade.

10) Conviction From Preparation:

I knew the story, the chart, and the risk before I entered. That’s why I could hold through noise.

These patterns repeat.

I’ve taught them to thousands of traders.

I think everybody can learn them.

I knew the story, the chart, and the risk before I entered. That’s why I could hold through noise.

These patterns repeat.

I’ve taught them to thousands of traders.

I think everybody can learn them.

PS: Want to trade high-potential stocks? 🚀 Get 14 days FREE access to my premium trading service!

✅ Daily trade setups (incl. entries & stops)

✅ Live chat with me

✅ In-depth video reports

👉 julian-komar.com/market-update-…

✅ Daily trade setups (incl. entries & stops)

✅ Live chat with me

✅ In-depth video reports

👉 julian-komar.com/market-update-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh