Growth & Momentum Stocks Trader | I’ll teach you how to trade high-potential stocks | Get my free eBook below ↓

5 subscribers

How to get URL link on X (Twitter) App

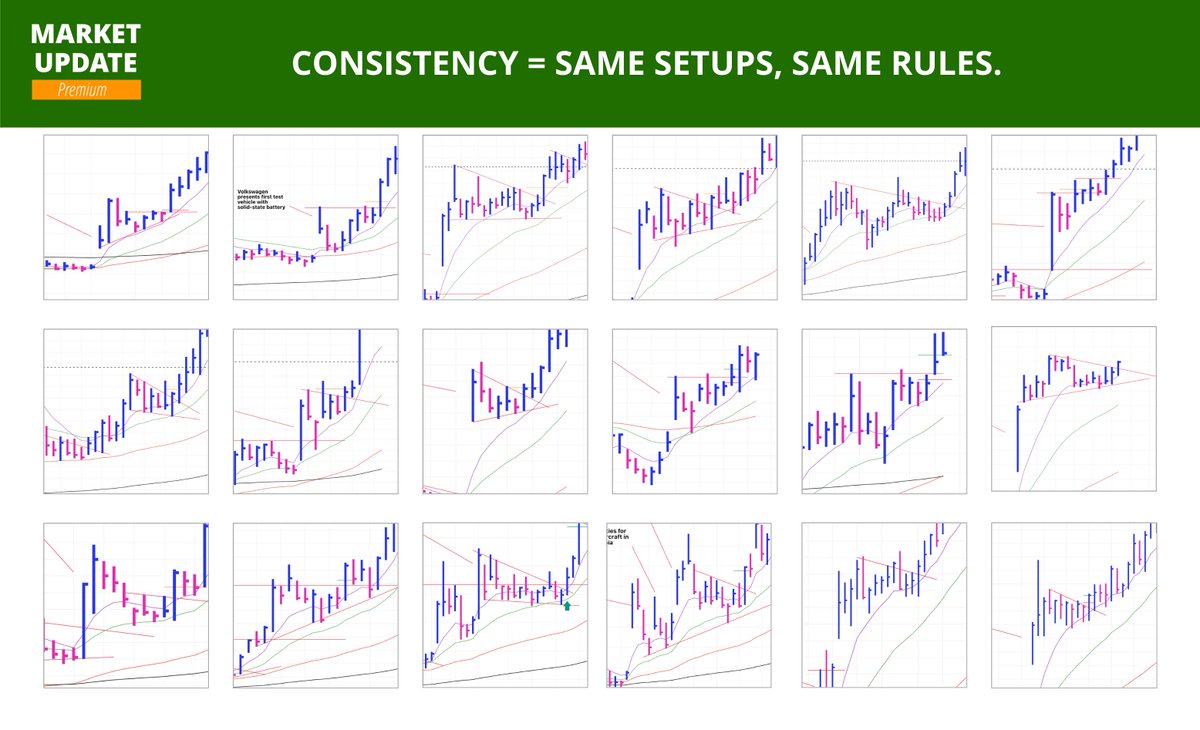

1. Pick One Setup

1. Pick One Setup

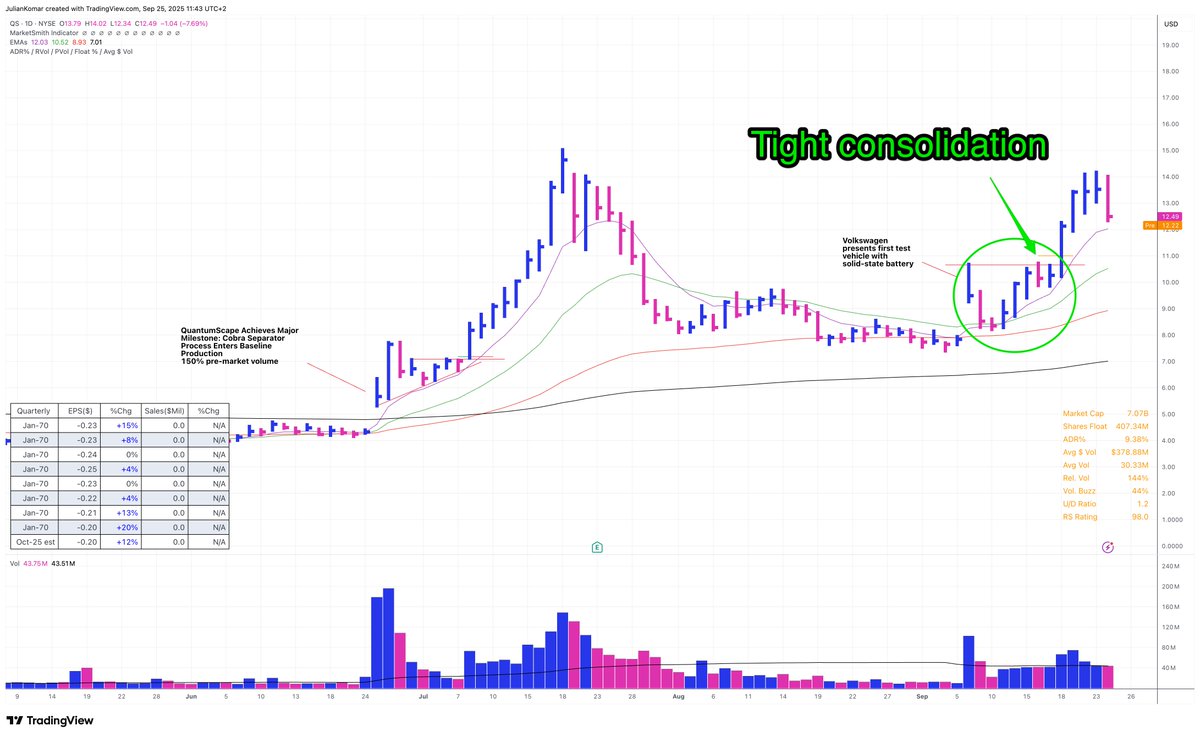

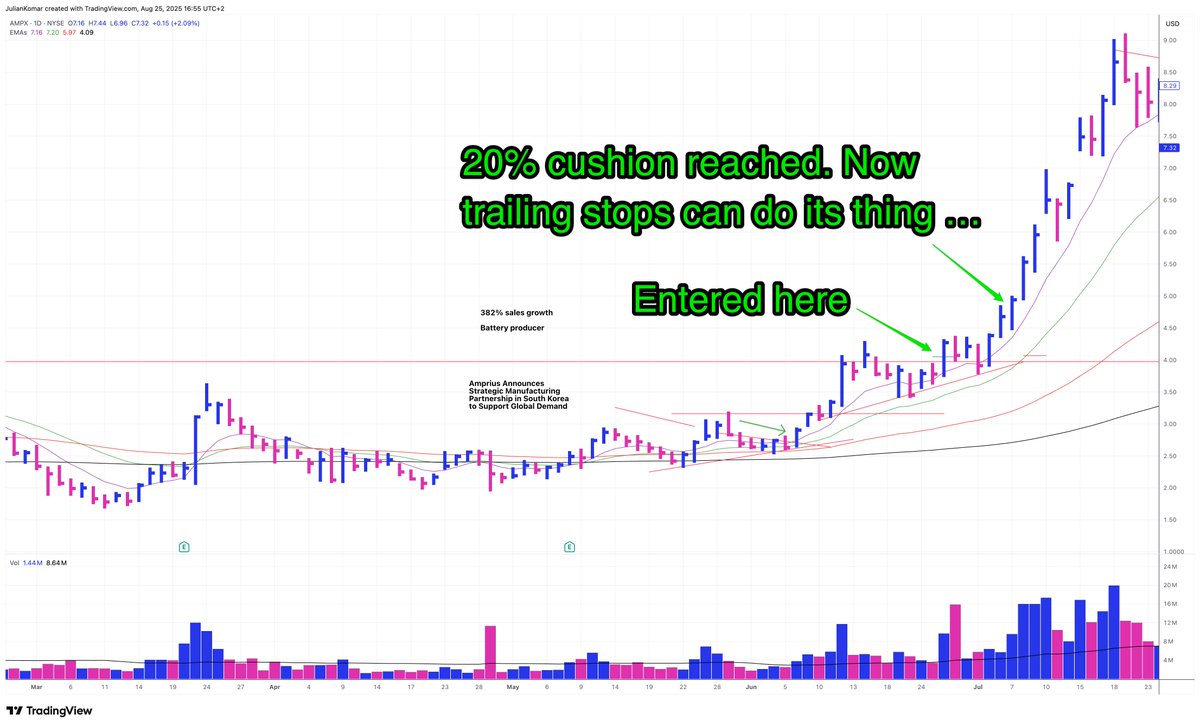

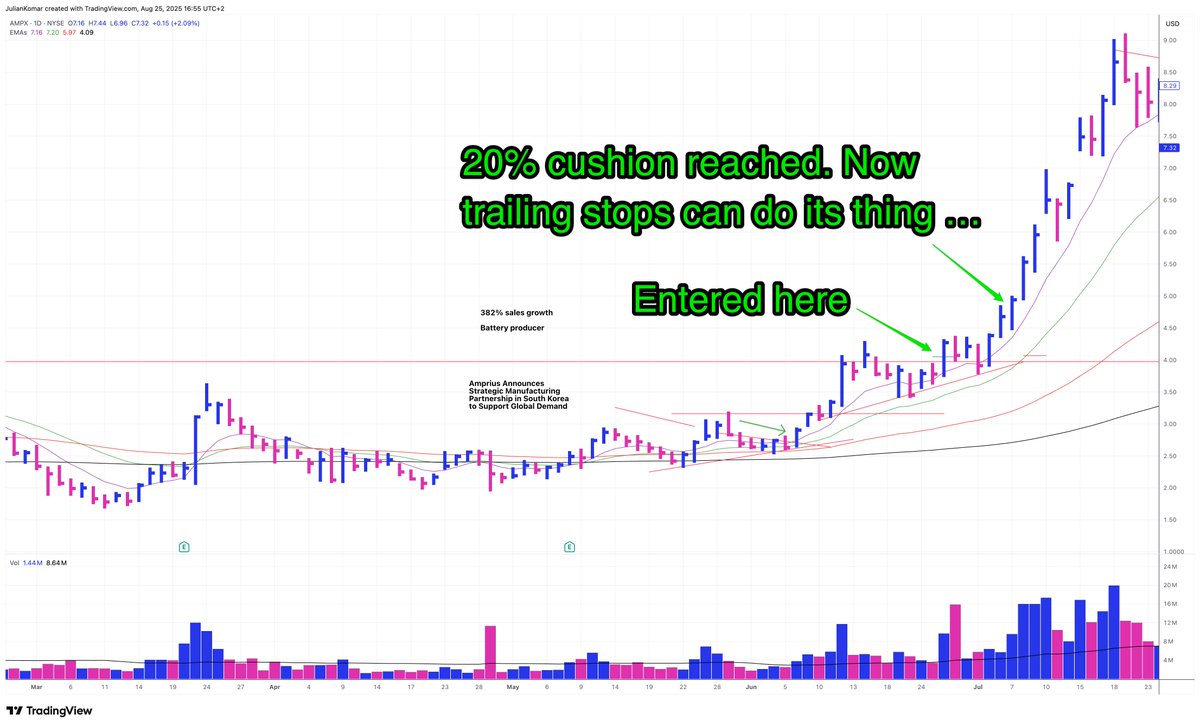

1️⃣ What is Cushion?

1️⃣ What is Cushion?

1️⃣ Why EMAs Work

1️⃣ Why EMAs Work

1. Max 1% Risk:

1. Max 1% Risk:

1) Start with momentum screener

1) Start with momentum screener

1) Know the Flow

1) Know the Flow

1. I stopped trading junk setups.

1. I stopped trading junk setups.

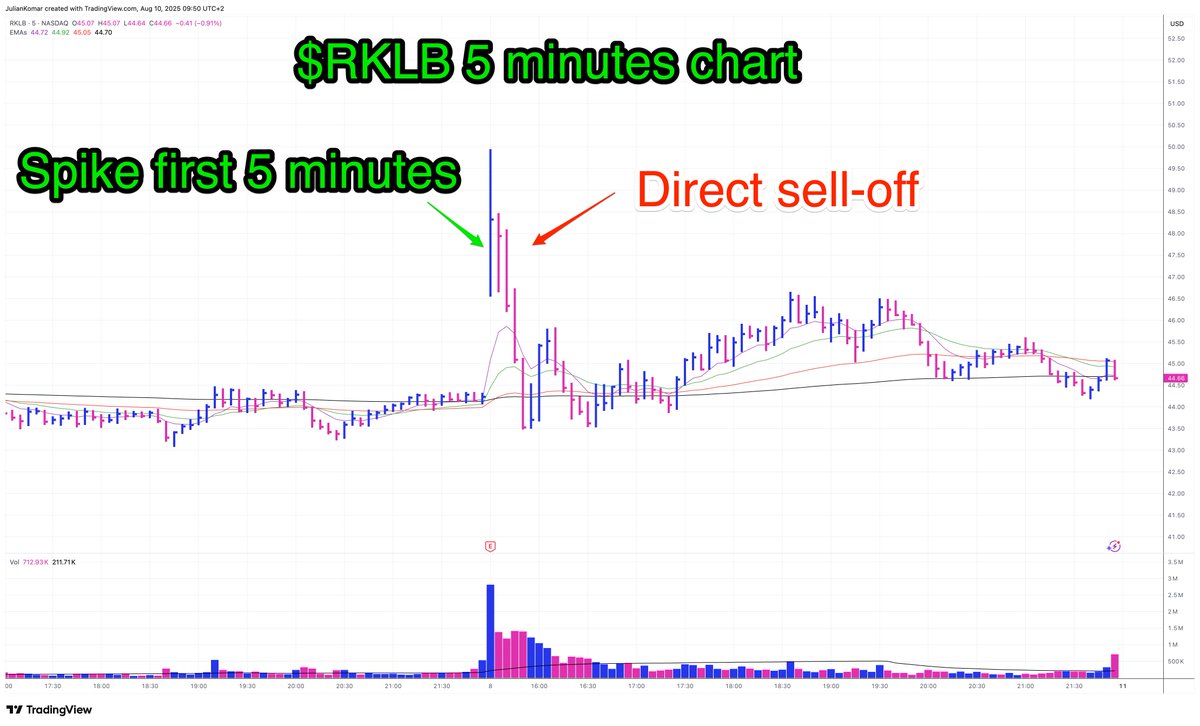

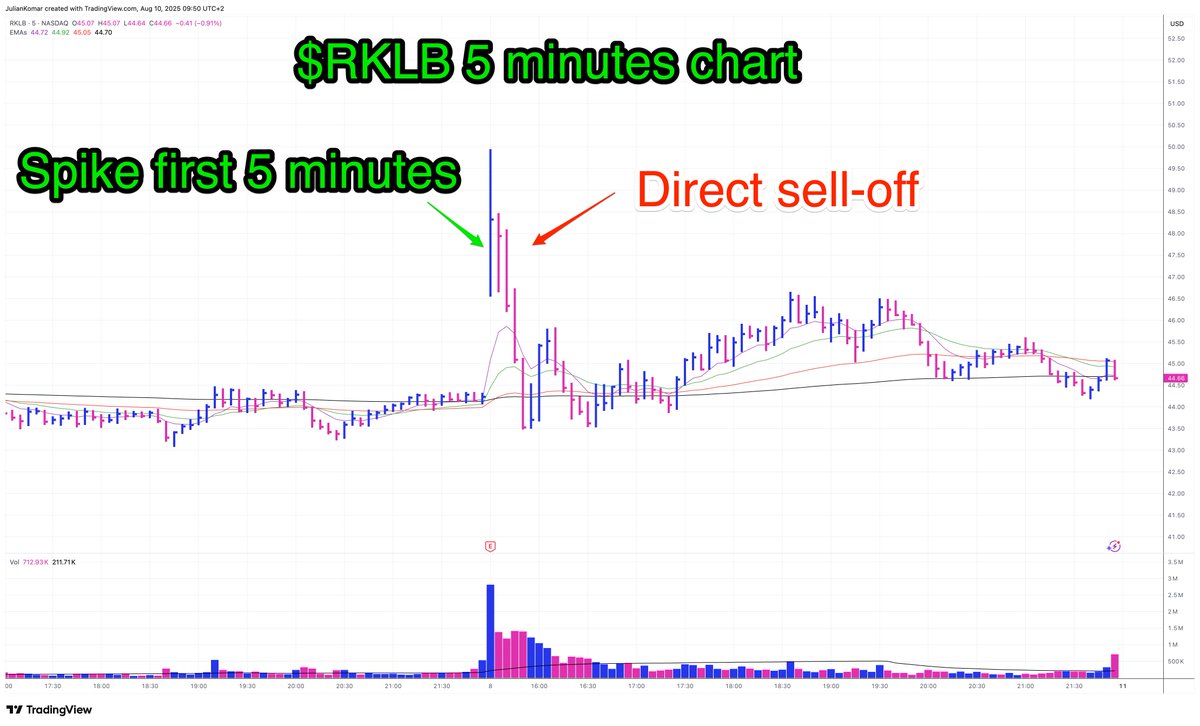

#1 Short term IPO patters

#1 Short term IPO patters

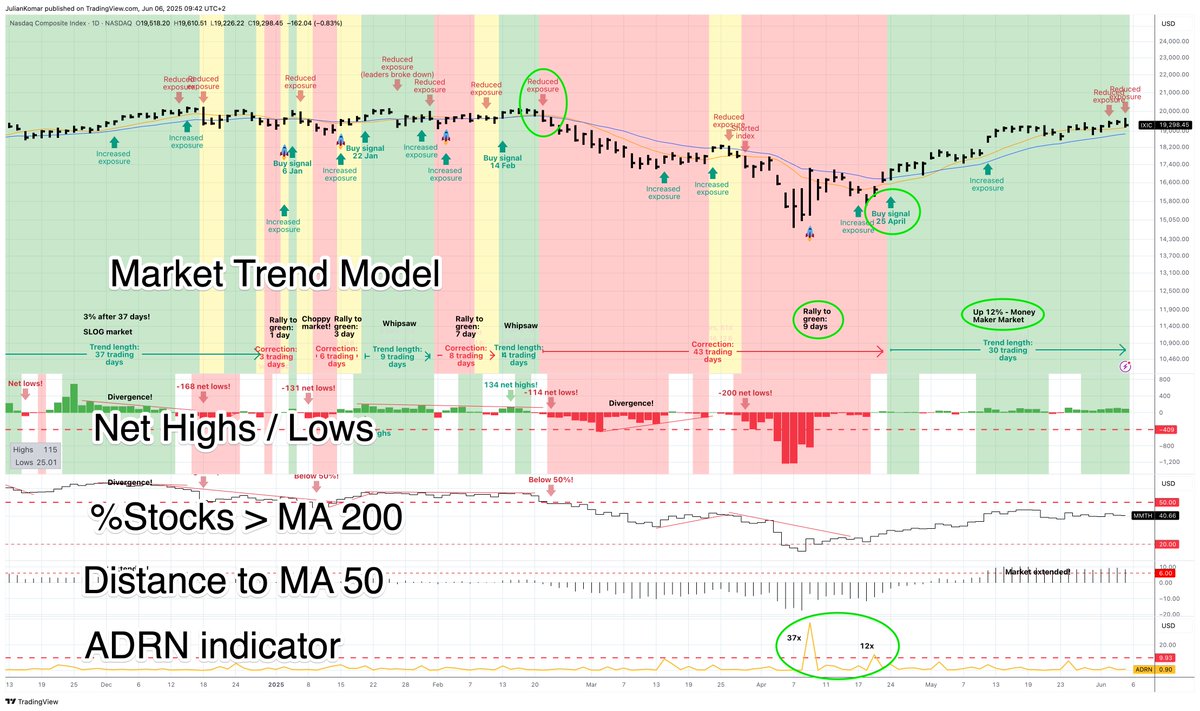

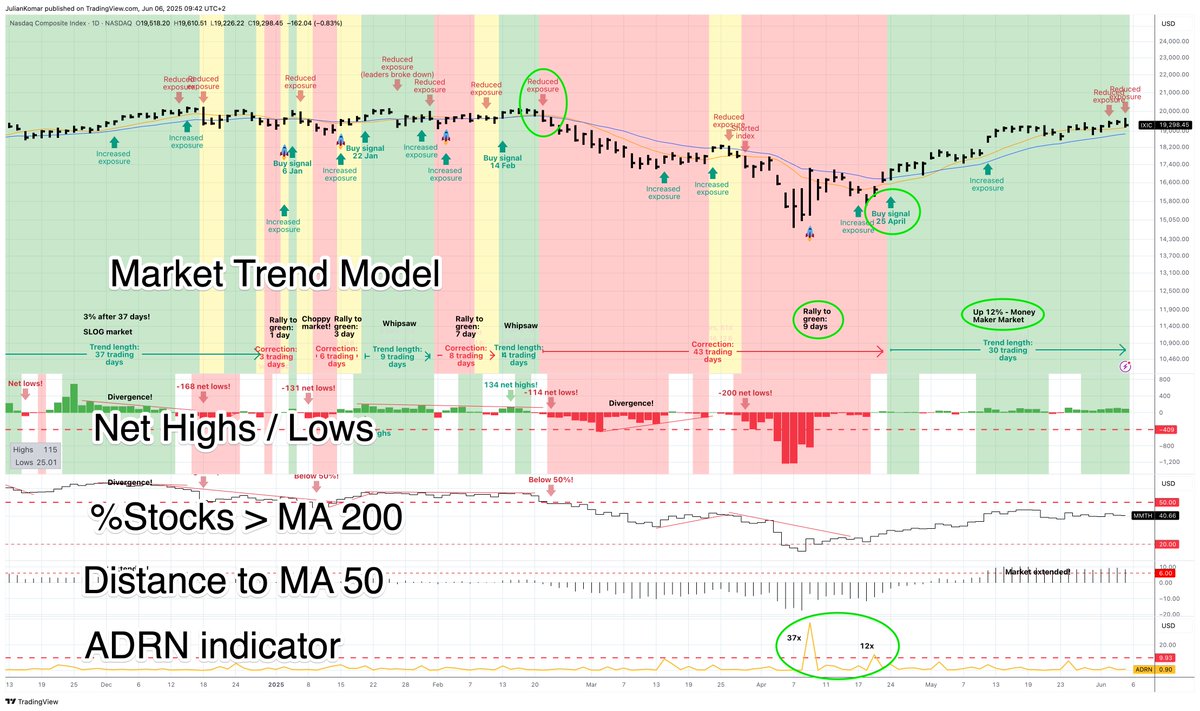

#1 The simplest market trend model (not in the screenshot!)

#1 The simplest market trend model (not in the screenshot!)