🧠 Why does price have memory?

Because pivots form where institutions choose to do business—again and again.

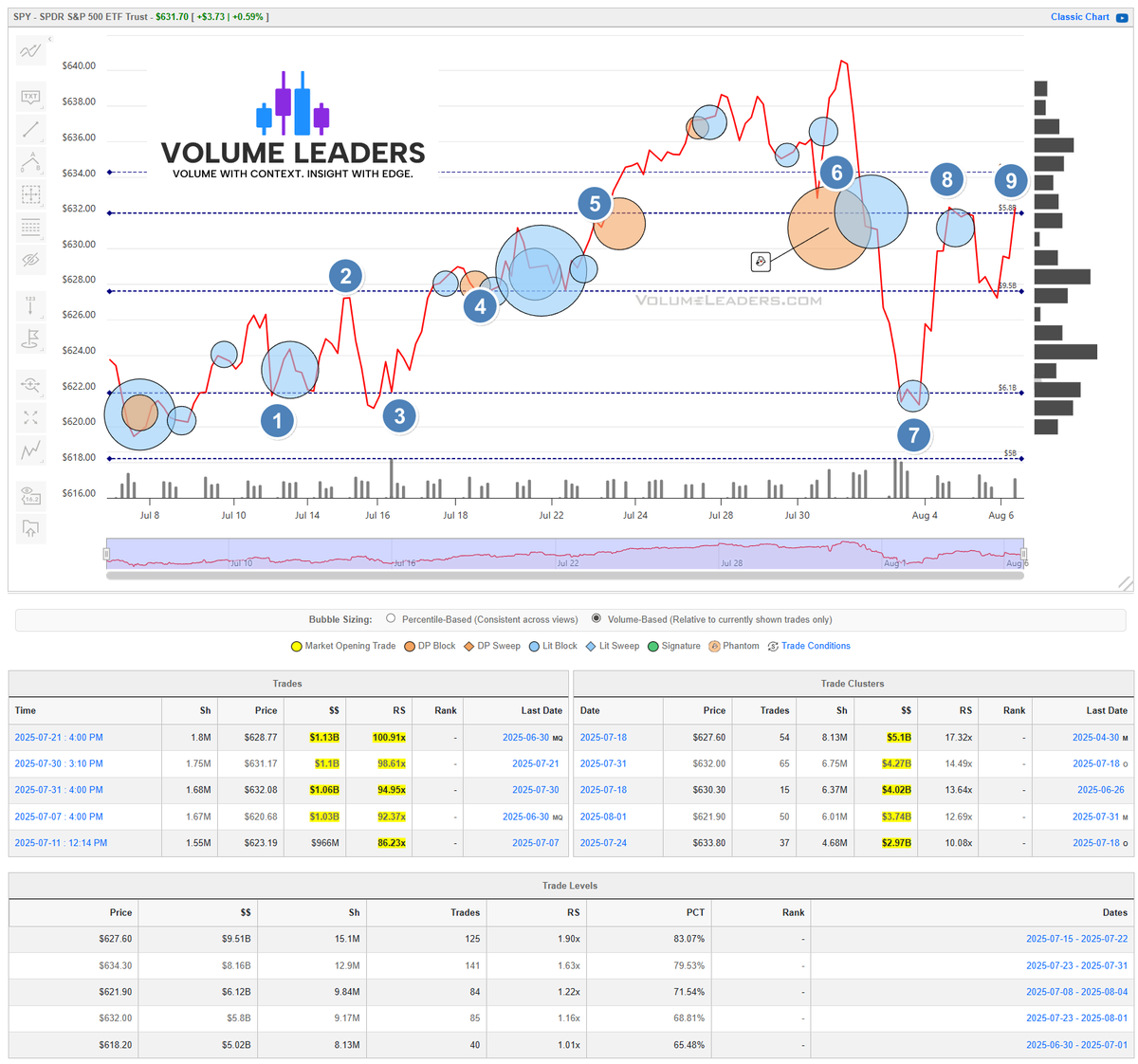

Here’s $SPY over the last 30 days using VolumeLeaders Levels. Notice how each turn aligns with footprints left by institutions.

Let’s walk through them 👇

Because pivots form where institutions choose to do business—again and again.

Here’s $SPY over the last 30 days using VolumeLeaders Levels. Notice how each turn aligns with footprints left by institutions.

Let’s walk through them 👇

Pivot 1: Institutions load size at the bottom.

•Large clustered trades define the first memory zone

•Price reacts with a clean bounce

•Large clustered trades define the first memory zone

•Price reacts with a clean bounce

Pivot 2: Price approaches the next Level.

•Institutions defend

•Structure: support confirmed

This becomes your reference level for future tests.📏

•Institutions defend

•Structure: support confirmed

This becomes your reference level for future tests.📏

Pivot 3: Pullback into institutional zone.

•Price tags Level

•Bounces in line with prior activity

📌 This is price-memory in action.

•Price tags Level

•Bounces in line with prior activity

📌 This is price-memory in action.

Pivot 4: Reload zone. Institutions active again.

Pivot 5: Breakout push forms new upper reference.

•Institutions are campaigning—adding size without chasing price.

Pivot 5: Breakout push forms new upper reference.

•Institutions are campaigning—adding size without chasing price.

Pivot 6: Institutions defend upper Levels again.

•Notice how price pivots exactly where the big trades clustered.

•Notice how price pivots exactly where the big trades clustered.

Pivot 7: Sharp drop into lower Level.

•Institutions show up.

•Bounce aligns with previous pivot zone.

•Price “remembers” because money remembers. 💸

•Institutions show up.

•Bounce aligns with previous pivot zone.

•Price “remembers” because money remembers. 💸

Pivot 8: Another defense at upper Level.

Pivot(?) 9: Guess where we are today? Institutions active again.

•This repeated behavior is why Levels matter—clear structure for trades with defined risk 😍

Pivot(?) 9: Guess where we are today? Institutions active again.

•This repeated behavior is why Levels matter—clear structure for trades with defined risk 😍

Price has memory because institutions leave footprints.

VolumeLeaders Levels show:

•Where big money is active

•Where pivots are likely to form

•How to frame trades with context & risk

🎯 Arm yourself with the data to decisively navigate thousands of tickers for yourself →

#Trading #Orderflow #OptionsFlow $SPYvolumeleaders.com

VolumeLeaders Levels show:

•Where big money is active

•Where pivots are likely to form

•How to frame trades with context & risk

🎯 Arm yourself with the data to decisively navigate thousands of tickers for yourself →

#Trading #Orderflow #OptionsFlow $SPYvolumeleaders.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh