Context, analytics, and visuals pertaining to institutional trades.

https://t.co/i5V7d5Evfk

https://t.co/rxD1PNHxvo

*Opinions Only*

How to get URL link on X (Twitter) App

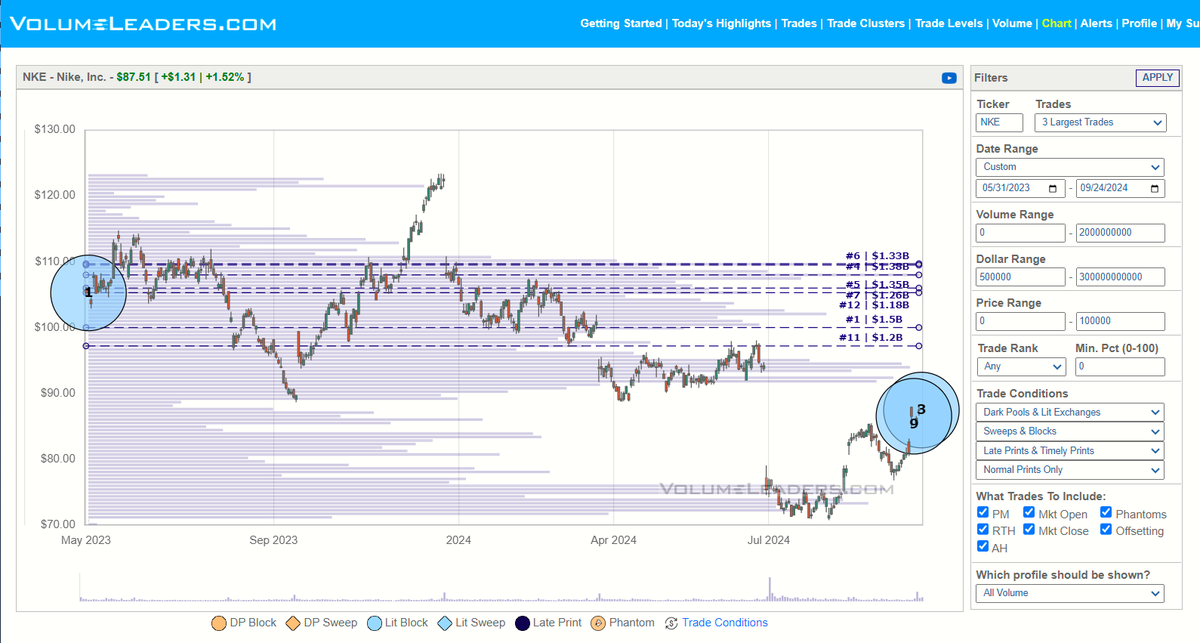

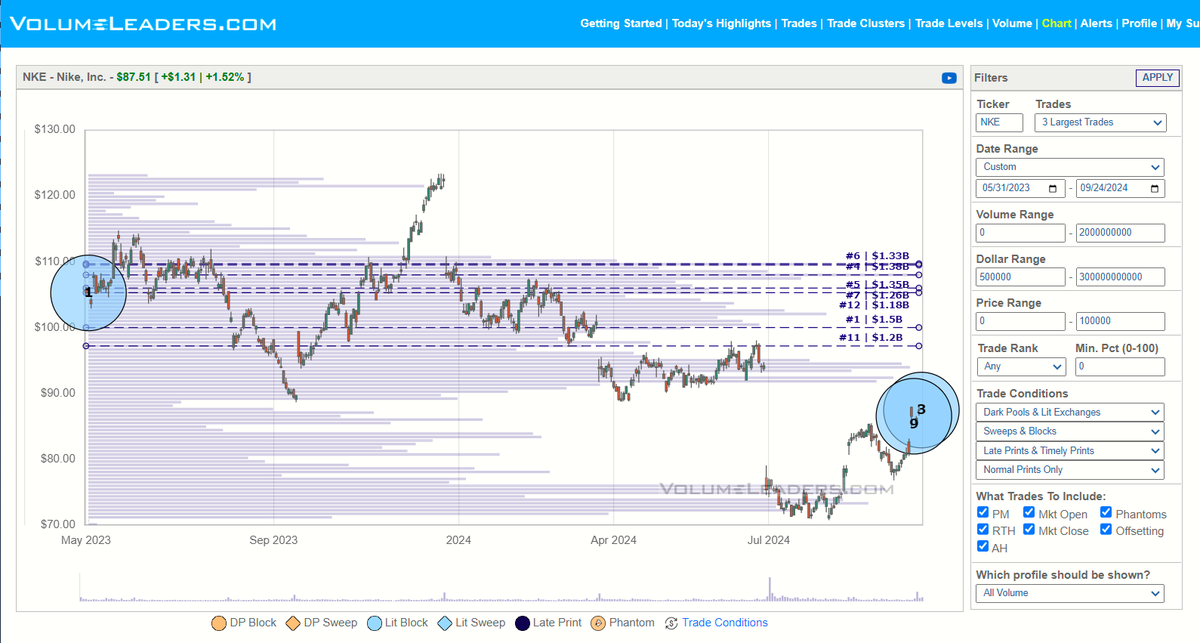

Pivot 1: Institutions load size at the bottom.

Pivot 1: Institutions load size at the bottom.

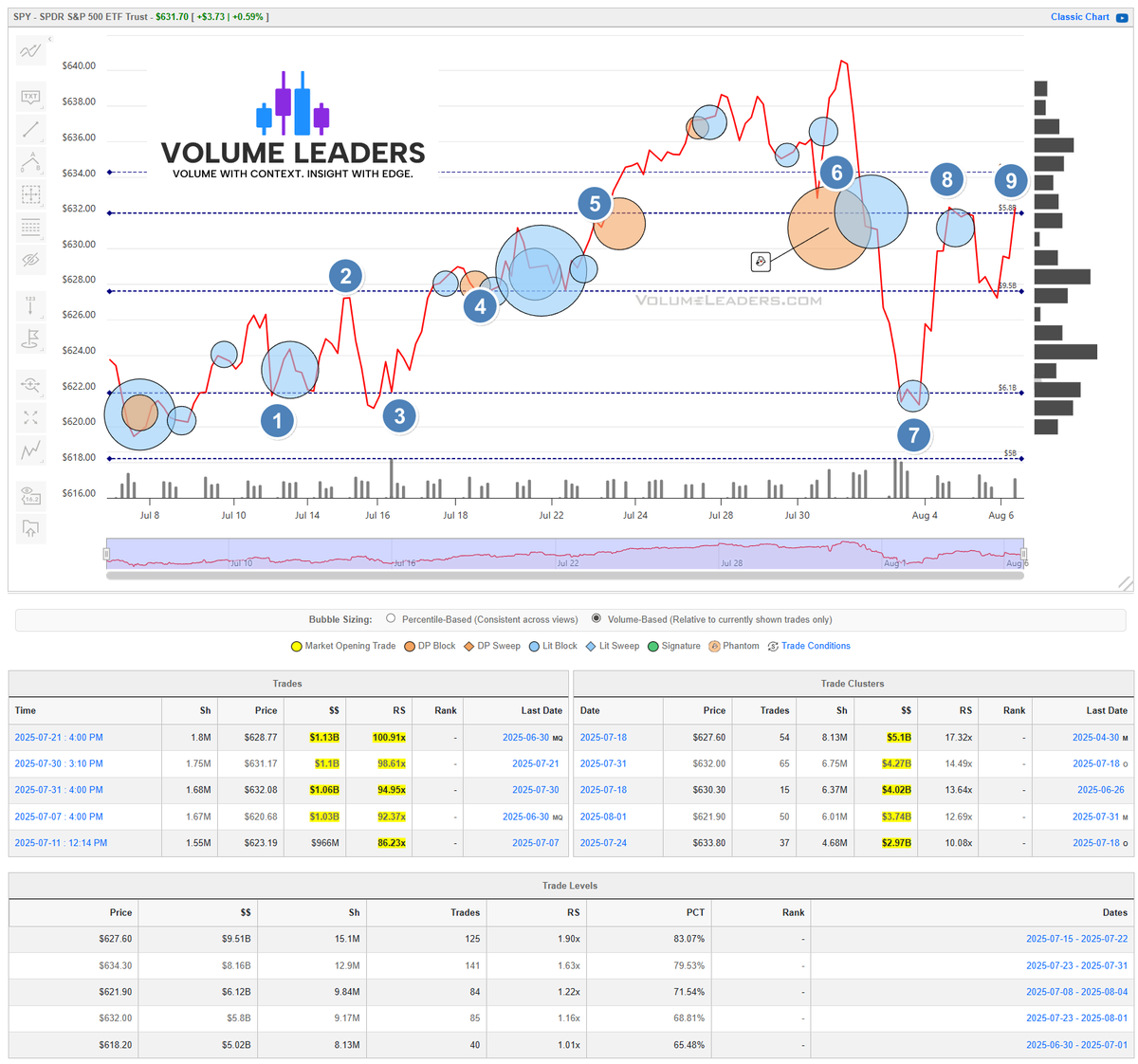

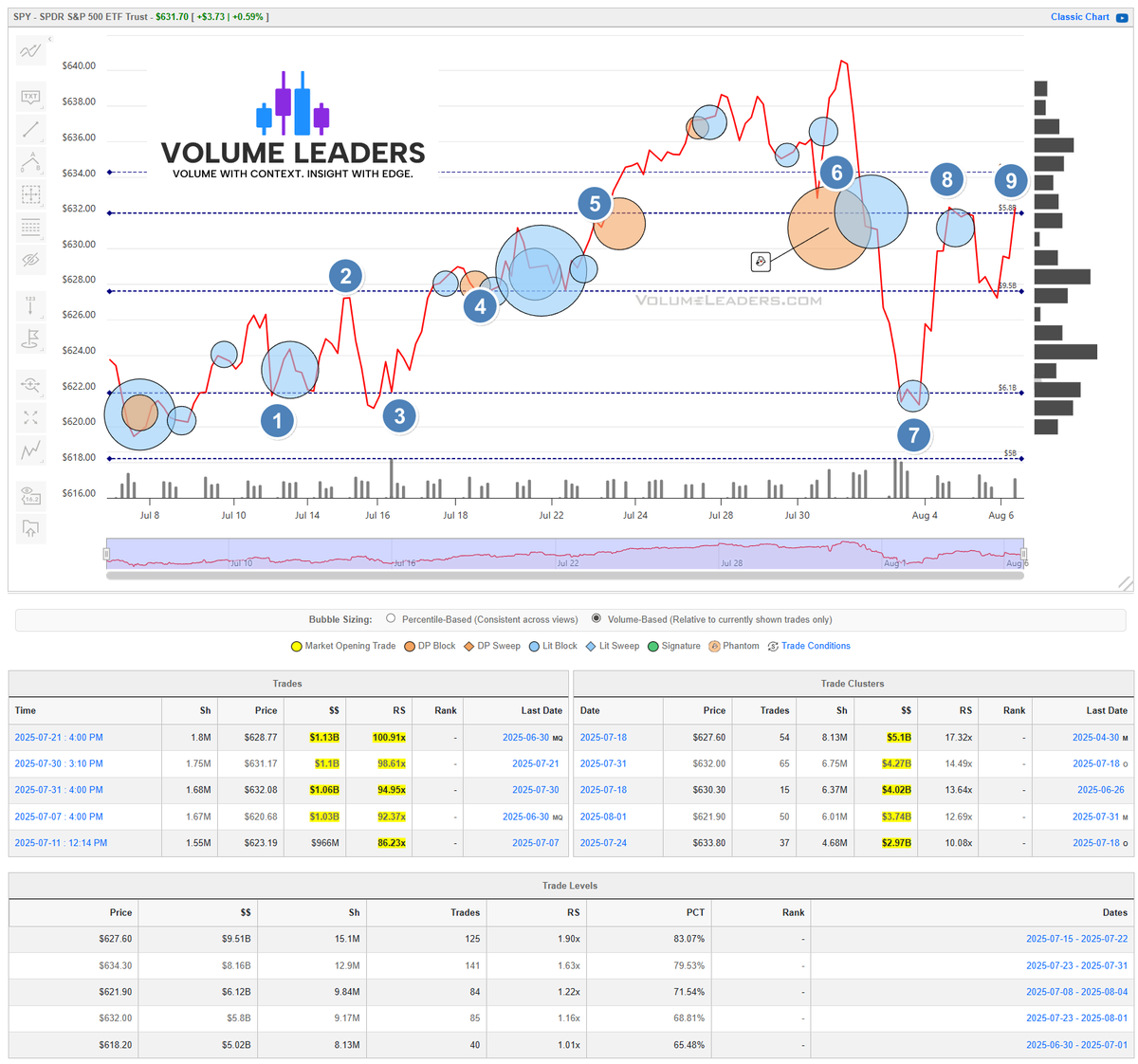

Here’s what VolumeLeaders subs see👀

Here’s what VolumeLeaders subs see👀

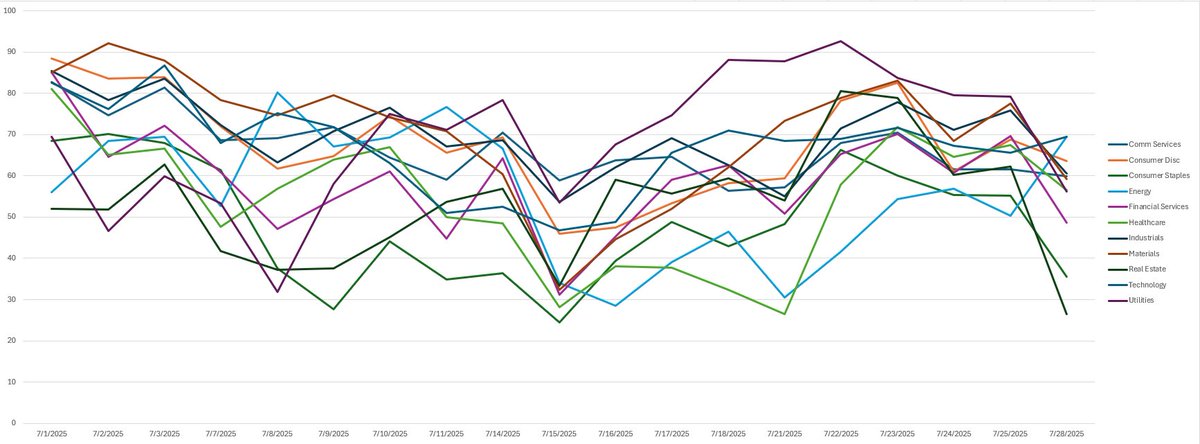

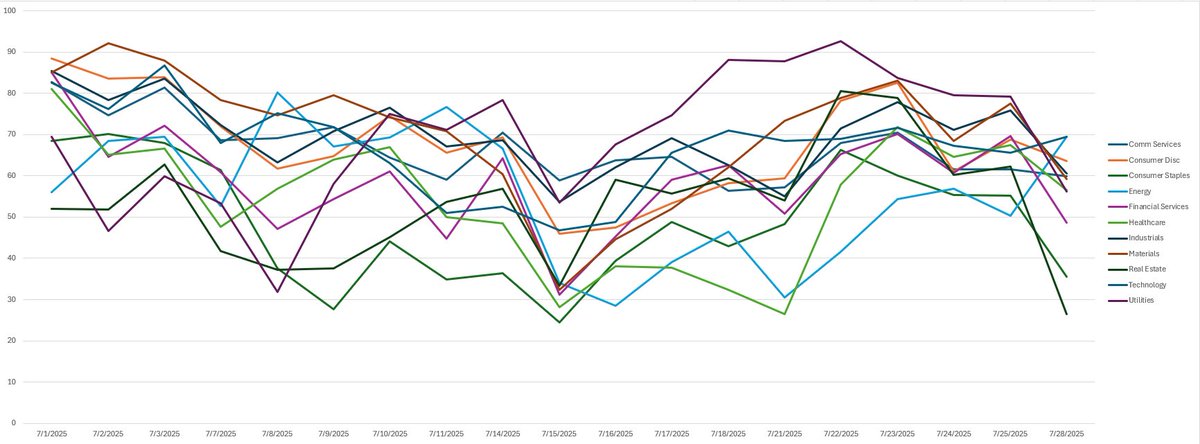

ICS is VolumeLeaders’ proprietary measure of institutional positioning. It's tracked on a name-by-name basis and can be rolled-up into aggregate views as we're doing here for sector analysis. When prices are persisting above recent #InstitutionalFlow , the score rises. Rising scores tend to be bullish, falling scores bearish, and extremes often mark #Trading setups for mean reversion.

ICS is VolumeLeaders’ proprietary measure of institutional positioning. It's tracked on a name-by-name basis and can be rolled-up into aggregate views as we're doing here for sector analysis. When prices are persisting above recent #InstitutionalFlow , the score rises. Rising scores tend to be bullish, falling scores bearish, and extremes often mark #Trading setups for mean reversion.