Thread.

The banking crisis in Russia is gaining momentum.

Earlier, Bloomberg published an article that Russian banks are in a terrible situation due to under-formed loan reserves. This information is confirmed.

1/

The banking crisis in Russia is gaining momentum.

Earlier, Bloomberg published an article that Russian banks are in a terrible situation due to under-formed loan reserves. This information is confirmed.

1/

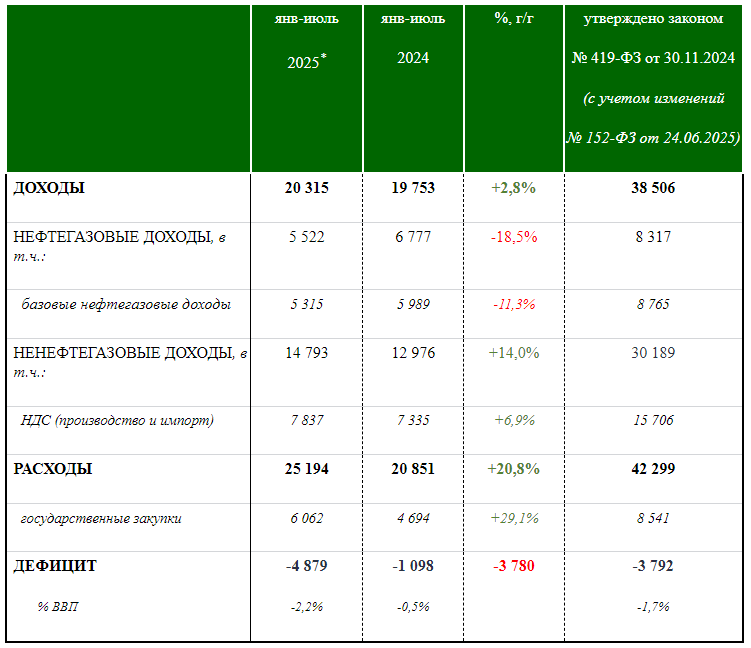

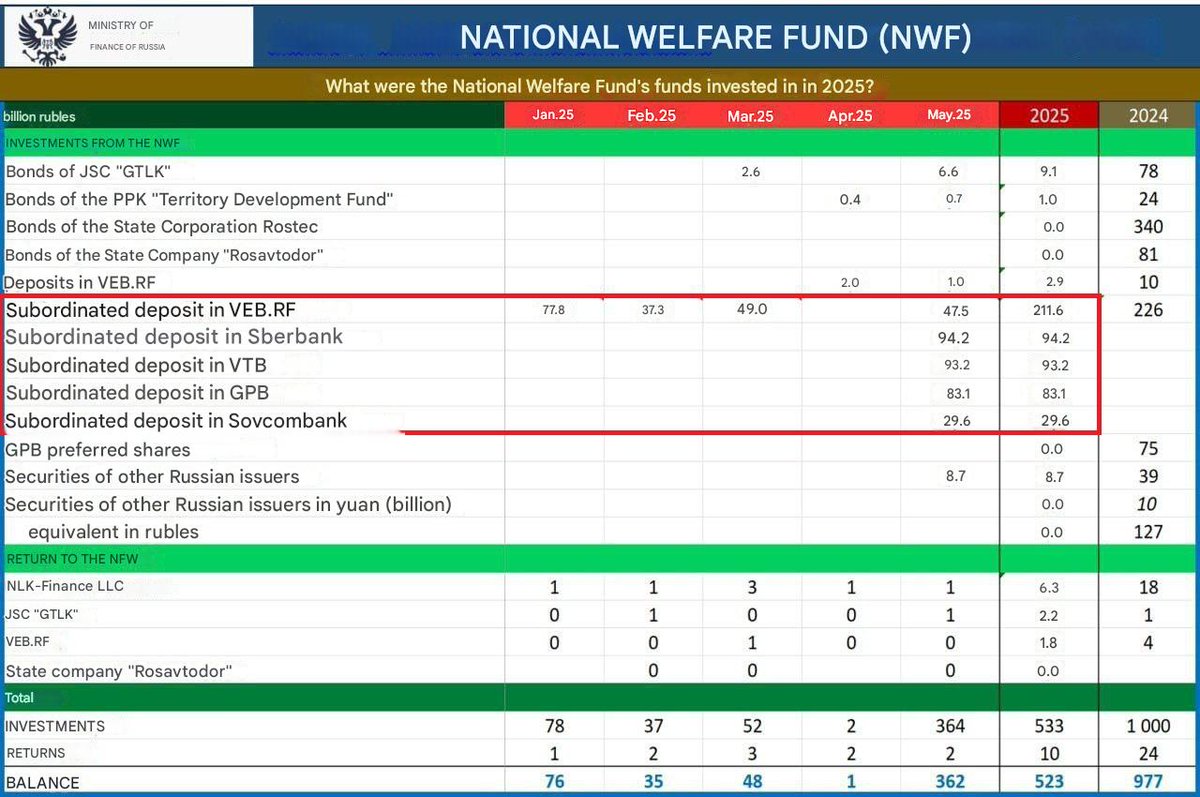

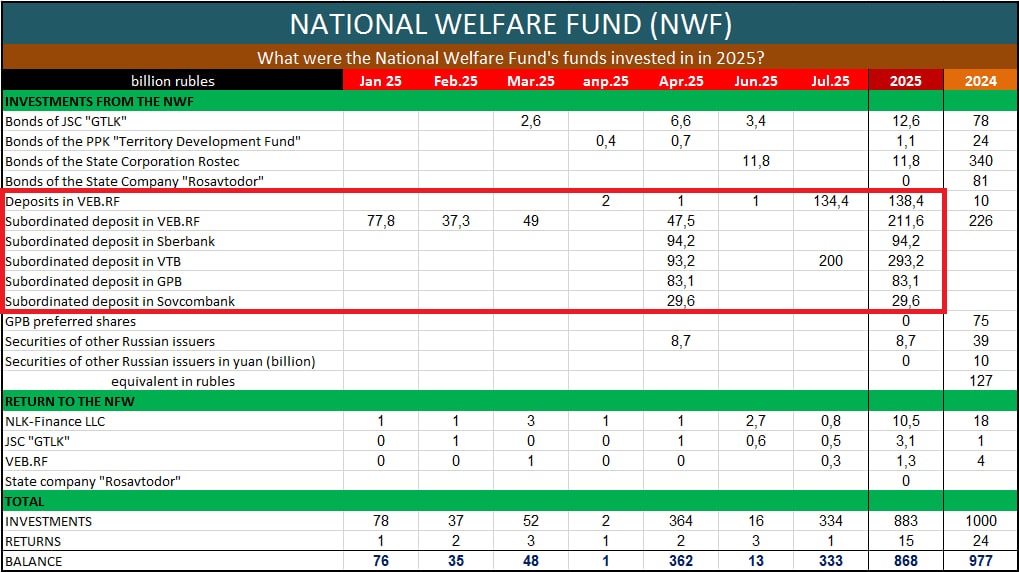

The Ministry of Finance published a report on operations with the National Welfare Fund for July. VEB and VTB received new deposits for 335 billion rubles to improve the liquidity situation.

2/

2/

In just 7 months, the Fund issued 850 billion rubles to banks. This is almost 4 times more than last year. What other confirmation of the terrible situation in these banks is needed?

3/

3/

Moreover, the situation continues to worsen every day. Factories are massively switching to a shortened work week.

Yesterday, the Agency TG channel published information that the layoffs will affect about 800 thousand workers

4/

Yesterday, the Agency TG channel published information that the layoffs will affect about 800 thousand workers

4/

https://x.com/evgen1232007/status/1953193223754789221

In the current conditions, banks' profits are falling.

Gazprombank's decline in 1H2025 was 2 times y/y, from 104 billion to 59 billion

Sovcombank's decline was 6 times, from 28 billion to 4 billion

5/

Gazprombank's decline in 1H2025 was 2 times y/y, from 104 billion to 59 billion

Sovcombank's decline was 6 times, from 28 billion to 4 billion

5/

VEB's profit for the first half of the year was only 0.5 billion. It can be said that it is practically non-existent, while the bank received 135 billion rubles from the Fund in July.

6/

6/

Bankers are constantly running to Putin and asking for money. The heads of VTB and VEB especially like to do this. In my opinion, the situation in these banks is the worst. Although VTB has already received 292 billion rubles, they really need 1-2 trillion rubles.

7/

7/

The situation in VTB is reminiscent of a phantasmagoria. The bank asks the Fund for money to pay dividends to the state, but this money is still not enough, and the bank plans to conduct an additional issue for 90 billion rubles. Complete nonsense. Complete madness.

8/

8/

The situation at VEB is no less funny and critical. In July, the bank received 135 billion rubles, and on August 6, the head of the board ran to Putin to ask for more money.

9/

interfax.ru/russia/1039738

9/

interfax.ru/russia/1039738

When I see another news story in the media about a meeting between bankers and Putin, I understand that they have come to ask for money again.

10/

10/

Another funny moment. The official statement said that deposits are being placed in banks to finance the high-speed highway St. Petersburg-Moscow, but there is not even a project ready for it! LOL

11/

11/

Now the most interesting part will begin. Due to the closure of factories and the reduction of salaries, there will be an outflow from banks, problems with liquidity, and at the same time an even greater deterioration of credit portfolios

12/

12/

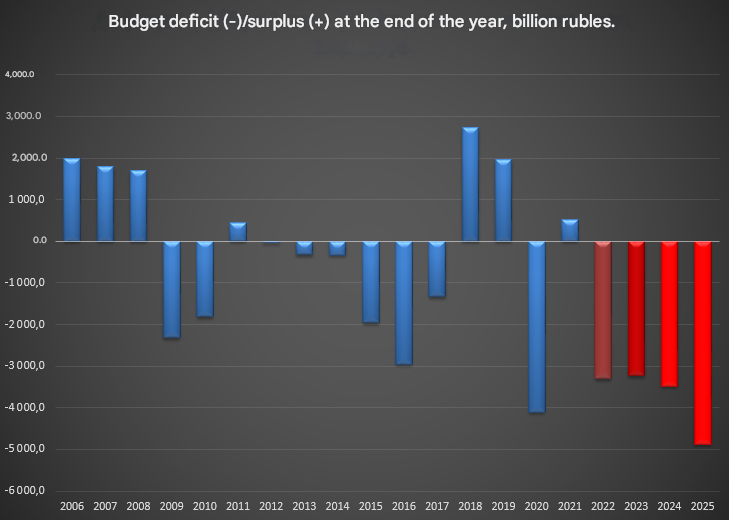

The rate of withdrawal of money from the Fund will increase sharply, and the Fund will simply become empty. And all this against the backdrop of increasing US sanctions pressure. All this will end in a large-scale banking crisis.

13/

13/

• • •

Missing some Tweet in this thread? You can try to

force a refresh