What should I do if the market changes?🧵

This question is full of misunderstandings and problems.

🧵1/5

This question is full of misunderstandings and problems.

🧵1/5

2/5

I have received this question many times, but first, on what basis do you judge that the market has changed? The true essence of what the questioner wants to know is probably, "What should I do if this strategy stops making a profit?".

In that sense, if the strategy truly had an edge to begin with, it would take a very long period to determine that the edge has been lost.

This is because a large sample size is required to determine the disappearance of that edge.

And, whether the strategy truly had an edge in the first place can also only be known through a large sample size.

In other words, the basic premise is that whether a strategy has an edge can only be known through a large sample size, and whether that edge disappears can also only be known through an even larger sample size.

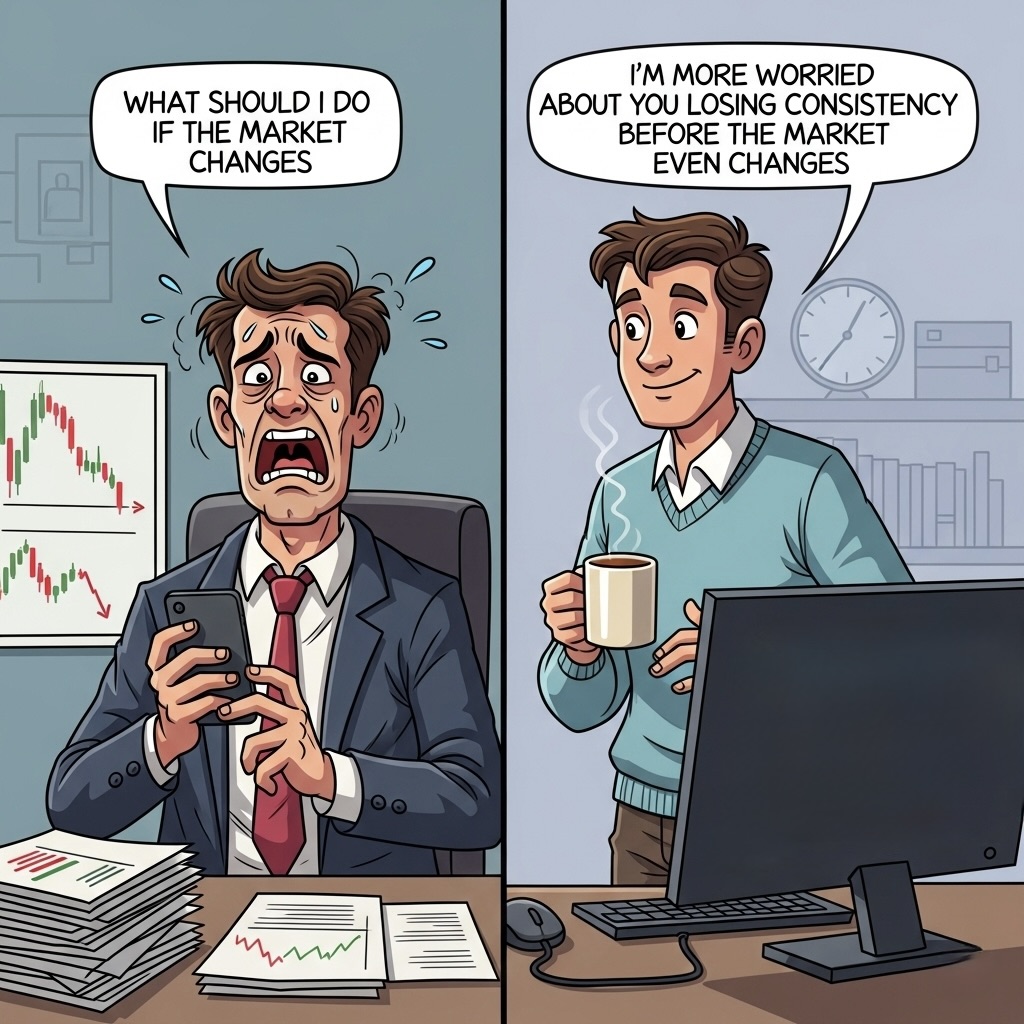

Now, to return to the initial question, the answer to "What should I do if the market changes?" becomes: "You're going to lose your consistency long before you can tell if the market has truly changed, so worry about that first".

You are worrying early on about something that can only be known after a very long time, but in the first place, it is more difficult to maintain consistency until that point is known, and the very fact that you are worrying about it without understanding this means your consistency is likely very fragile.

This is because if you had tested your strategy's edge beforehand with a very large sample size, you would have already experienced numerous losing streaks and drawdowns, overcome them, and then concluded that an edge exists, so you probably wouldn't feel this kind of anxiety.

I have received this question many times, but first, on what basis do you judge that the market has changed? The true essence of what the questioner wants to know is probably, "What should I do if this strategy stops making a profit?".

In that sense, if the strategy truly had an edge to begin with, it would take a very long period to determine that the edge has been lost.

This is because a large sample size is required to determine the disappearance of that edge.

And, whether the strategy truly had an edge in the first place can also only be known through a large sample size.

In other words, the basic premise is that whether a strategy has an edge can only be known through a large sample size, and whether that edge disappears can also only be known through an even larger sample size.

Now, to return to the initial question, the answer to "What should I do if the market changes?" becomes: "You're going to lose your consistency long before you can tell if the market has truly changed, so worry about that first".

You are worrying early on about something that can only be known after a very long time, but in the first place, it is more difficult to maintain consistency until that point is known, and the very fact that you are worrying about it without understanding this means your consistency is likely very fragile.

This is because if you had tested your strategy's edge beforehand with a very large sample size, you would have already experienced numerous losing streaks and drawdowns, overcome them, and then concluded that an edge exists, so you probably wouldn't feel this kind of anxiety.

3/5

The question, "What should I do if the market changes?" is as meaningless as the question, "What should I do after I die?".

You just have to live as best you can until then.

You need to remain consistent no matter what, and to remain consistent "no matter what," you need to build trust in the long-term results in advance.

The problem is that you haven't built that long-term trust.

The more you understand probability, the more you are forced to think about large sample sizes and long-term efforts.

If you prepare your strategy and build trust based on that understanding, you will naturally realize that the short-term randomness along the way is what you truly must overcome, and your commitment to the long-term goal of remaining consistent no matter what becomes crucial.

The question, "What should I do if the market changes?" is as meaningless as the question, "What should I do after I die?".

You just have to live as best you can until then.

You need to remain consistent no matter what, and to remain consistent "no matter what," you need to build trust in the long-term results in advance.

The problem is that you haven't built that long-term trust.

The more you understand probability, the more you are forced to think about large sample sizes and long-term efforts.

If you prepare your strategy and build trust based on that understanding, you will naturally realize that the short-term randomness along the way is what you truly must overcome, and your commitment to the long-term goal of remaining consistent no matter what becomes crucial.

4/5

"But even so, the market does change, right?"

Of course, the market changes every day.

However, you could also say the market hasn't changed.

They say history repeats itself, but every day is a completely different day.

Depending on where your focus is, it can seem like it's changing or not changing, and both are correct.

That is precisely why you need to have a more long-term perspective and not focus on small-scale randomness.

Even if each splash of water is different, if you look from a distance, it is a wave, it is the ocean, it is the same water.

"But even so, the market does change, right?"

Of course, the market changes every day.

However, you could also say the market hasn't changed.

They say history repeats itself, but every day is a completely different day.

Depending on where your focus is, it can seem like it's changing or not changing, and both are correct.

That is precisely why you need to have a more long-term perspective and not focus on small-scale randomness.

Even if each splash of water is different, if you look from a distance, it is a wave, it is the ocean, it is the same water.

5/5

Anxiety and fear about uncertainty are often brought about by that short-term perspective.

What is required of us traders is a long-term perspective and maintaining consistency within it.

What you should worry about is not whether your strategy's effectiveness will be invalidated, but whether you can truly maintain consistency for such a long period.

Thanks for reading!

If you enjoyed this thread, check out my books on trading.

E-book

payhip.com/YumiSakura/col…

Paperback

【THE PATH TO SUCCESS IN TRADING】

a.co/d/fXmRhIa

【Trading Psychology】

a.co/d/d0QJMxK

Hope these insights help your trading journey😊

Anxiety and fear about uncertainty are often brought about by that short-term perspective.

What is required of us traders is a long-term perspective and maintaining consistency within it.

What you should worry about is not whether your strategy's effectiveness will be invalidated, but whether you can truly maintain consistency for such a long period.

Thanks for reading!

If you enjoyed this thread, check out my books on trading.

E-book

payhip.com/YumiSakura/col…

Paperback

【THE PATH TO SUCCESS IN TRADING】

a.co/d/fXmRhIa

【Trading Psychology】

a.co/d/d0QJMxK

Hope these insights help your trading journey😊

• • •

Missing some Tweet in this thread? You can try to

force a refresh