The Trump administration has officially taken a stance against debanking.

That means that, soon enough, no more Americans will be deprived of being able to hold a bank account because of the opinions they hold.

Americans will be free to think independently again🧵

That means that, soon enough, no more Americans will be deprived of being able to hold a bank account because of the opinions they hold.

Americans will be free to think independently again🧵

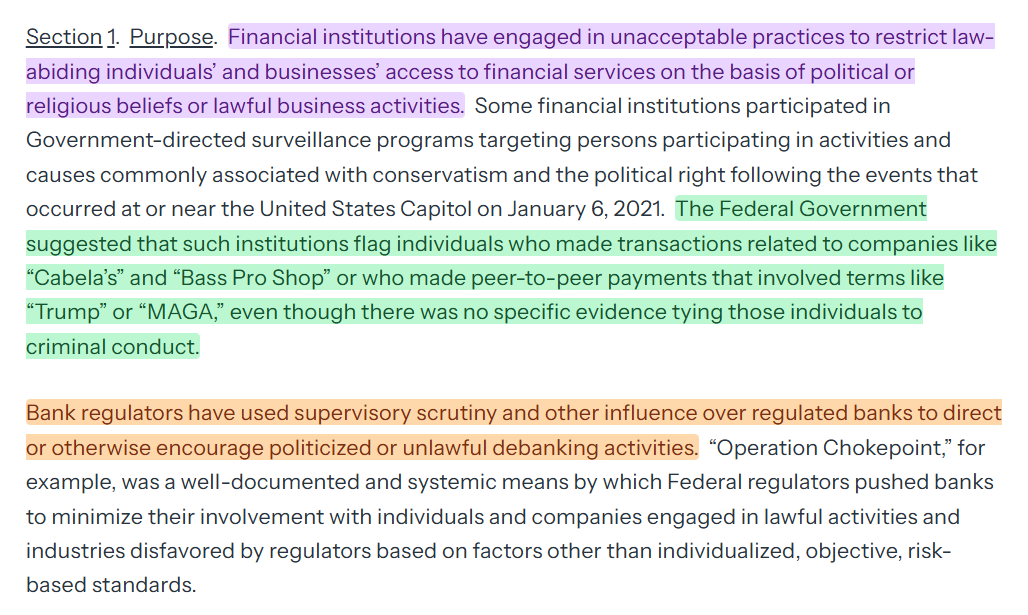

The executive order begins with some background:

Americans, often at the behest of government officials, have been subject to the loss of access to financial services.

That often meant having no access to bank accounts, debit and credit cards, investment tools, and so on.

Americans, often at the behest of government officials, have been subject to the loss of access to financial services.

That often meant having no access to bank accounts, debit and credit cards, investment tools, and so on.

And then it gets to the meat:

We want to stop this, because it is anti-freedom.

Financial institutions should not be able to stop Americans from holding whatever views they want to. It's not their business, so they're being asked to stay out of it.

We want to stop this, because it is anti-freedom.

Financial institutions should not be able to stop Americans from holding whatever views they want to. It's not their business, so they're being asked to stay out of it.

You may ask:

Doesn't this infringe on banks' rights to not do business with people they don't want to?

"No"

This is like the situation with universities and affirmative action: institutions are being asked not to discriminate if they want to interface with the government.

Doesn't this infringe on banks' rights to not do business with people they don't want to?

"No"

This is like the situation with universities and affirmative action: institutions are being asked not to discriminate if they want to interface with the government.

If you want the government to guarantee your loans under its lending programs?

Follow the government's rules.

If you want the government to issue taxpayer-funded grants for research?

Follow the government's rules.

These institutions can opt out, but they would lose out.

Follow the government's rules.

If you want the government to issue taxpayer-funded grants for research?

Follow the government's rules.

These institutions can opt out, but they would lose out.

So, what happens first?

Firstly, federal banking regulators will tell financial institutions to remove all material in their guidance that leads to debanking.

Secondly, they will rescind regulations that encourage or expressly permit debanking.

Firstly, federal banking regulators will tell financial institutions to remove all material in their guidance that leads to debanking.

Secondly, they will rescind regulations that encourage or expressly permit debanking.

Next, the Small Business Administration will give financial institutions notice.

The notices are to identify all debanked persons and to reach out to them to tell them they were debanked and that they can now have their accounts reinstated.

The notices are to identify all debanked persons and to reach out to them to tell them they were debanked and that they can now have their accounts reinstated.

The Order instructs Duffy and Hassett to plan to do more, which just means "You know what to do" and a plan was already developed. This just lets the public know whatever plan they came up with has the go-ahead.

Regulators are also ordered to review and punish debankers.

Regulators are also ordered to review and punish debankers.

In effect, what has been called for here is for institutions to stop the practice of debanking, and to expose themselves for debanking.

The regulators will also review their books, and if there's noncompliance with ending the practice of debanking, the government will prosecute.

The regulators will also review their books, and if there's noncompliance with ending the practice of debanking, the government will prosecute.

Debanking is a scourge, and this EO is the first step in ending it.

If you want to read it, you can find it here: whitehouse.gov/presidential-a…

If you want to read it, you can find it here: whitehouse.gov/presidential-a…

Oh and, NB:

The administration knows who to go after, because many financial institutions attempted to debank Trump himself!

And plenty of the people in his administration were also targeted for harassment.

It's obvious how this is going to proceed.

The administration knows who to go after, because many financial institutions attempted to debank Trump himself!

And plenty of the people in his administration were also targeted for harassment.

It's obvious how this is going to proceed.

NB II:

Yes, this will stop payment processors from denying service to platforms like Steam and sites like itch(dot)io.

This EO is going after the whole concept of "reputational risk".

Yes, this will stop payment processors from denying service to platforms like Steam and sites like itch(dot)io.

This EO is going after the whole concept of "reputational risk".

https://x.com/cremieuxrecueil/status/1953569539150528741

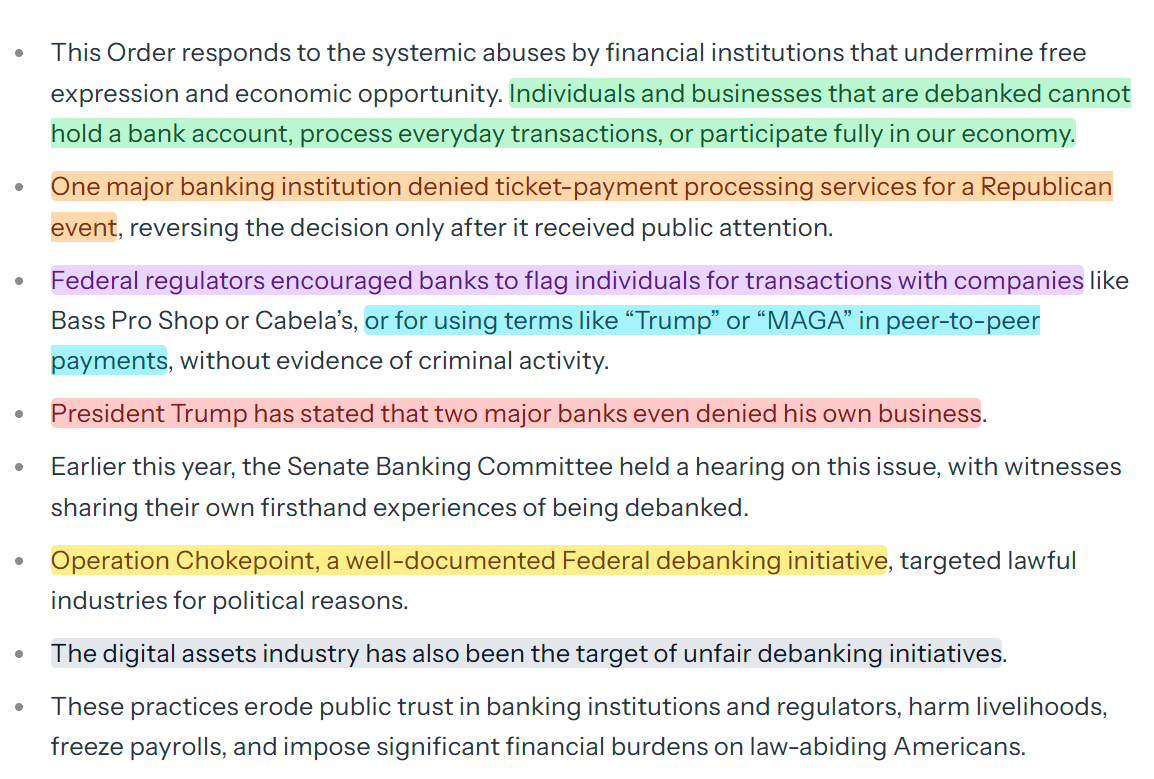

The admin added a fact sheet that includes some debanking examples.

It's pretty clear that they'll be applying pressure towards AUPs via partner banks, the CFPB, limiting offboarding debanking, and that they have a lot of options to make this more expansive.

It's pretty clear that they'll be applying pressure towards AUPs via partner banks, the CFPB, limiting offboarding debanking, and that they have a lot of options to make this more expansive.

I would suggest they

- Push prudential regulators to "flow down" non-discrimination through sponsor banks: strip reputational risk from exams and bake objective, risk-based non-discrimination clauses into third-party/fintech contracts, binding processor that rely on those banks.

- Use SBA hooks like what this first EO details.

- Coordinate a Treasury-led plan that recommends prudential guidance about sponsor-bank contracts, FTC UDAP enforcement for nonbank processors, and maybe do a Hill push to amend fair access to explicitly cover card networks and processors, not just banks. Current text already covers payment card networks, so it's easy to extend to money transmitters/payment facilitators.

- Review and extend fair access concepts at the OCC and make them sticky downstream. A revived OCC fair access posture forces partner banks to keep serving lawful merchants and to require processors on their rails to do the same absent bona fide risk.

- Do a procurement squeeze. Condition federal payment vendors and agency merchants on non-discrimination commitments. An EO back in March already forces agencies onto electronic payments. That reaches a subset of big processors doing federal work and a larger subset connected to it, but doesn't bind the whole market.

Fast fact sheet is here: whitehouse.gov/fact-sheets/20…

And yes, the original EO includes FDIC, because it's a FSOC member agency. Imagine a bank losing FDIC coverage because they just really want to debank someone. That would be very unwise.

- Push prudential regulators to "flow down" non-discrimination through sponsor banks: strip reputational risk from exams and bake objective, risk-based non-discrimination clauses into third-party/fintech contracts, binding processor that rely on those banks.

- Use SBA hooks like what this first EO details.

- Coordinate a Treasury-led plan that recommends prudential guidance about sponsor-bank contracts, FTC UDAP enforcement for nonbank processors, and maybe do a Hill push to amend fair access to explicitly cover card networks and processors, not just banks. Current text already covers payment card networks, so it's easy to extend to money transmitters/payment facilitators.

- Review and extend fair access concepts at the OCC and make them sticky downstream. A revived OCC fair access posture forces partner banks to keep serving lawful merchants and to require processors on their rails to do the same absent bona fide risk.

- Do a procurement squeeze. Condition federal payment vendors and agency merchants on non-discrimination commitments. An EO back in March already forces agencies onto electronic payments. That reaches a subset of big processors doing federal work and a larger subset connected to it, but doesn't bind the whole market.

Fast fact sheet is here: whitehouse.gov/fact-sheets/20…

And yes, the original EO includes FDIC, because it's a FSOC member agency. Imagine a bank losing FDIC coverage because they just really want to debank someone. That would be very unwise.

• • •

Missing some Tweet in this thread? You can try to

force a refresh