§72(t) is one of the most powerful sections in the tax code.

It allows you to pull money out of 401k/IRA at ANY age w/o the 10% early withdrawal penalty by creating a "SoSEPP"

Here's exactly how it works:

It allows you to pull money out of 401k/IRA at ANY age w/o the 10% early withdrawal penalty by creating a "SoSEPP"

Here's exactly how it works:

First, you shouldn't touch your 401k/IRAs before retiring.

But what if someone wants to retire at 50 and majority of their assets are in a 401k?

Withdrawing would come with a 10% penalty.

But there's a way...

But what if someone wants to retire at 50 and majority of their assets are in a 401k?

Withdrawing would come with a 10% penalty.

But there's a way...

72(t) allows you to create "a series of substantially equal periodic payments" over your life expectancy.

You need 4 things to determine how much you can pull:

• Interest rate

• Life expectancy

• Method

• Balance

I will also include an example in a bit...

You need 4 things to determine how much you can pull:

• Interest rate

• Life expectancy

• Method

• Balance

I will also include an example in a bit...

1. Interest

Not greater than the higher of:

• 5% or

• 120% of the federal mid-term rate published in IRS Revenue Rulings

Not greater than the higher of:

• 5% or

• 120% of the federal mid-term rate published in IRS Revenue Rulings

2. Life expectancy

The life expectancy is calculated by a few methods:

→ Uniform Lifetime Table

→ Single Life Table

Generally, the single life table usually results in the highest amount you can withdraw.

The life expectancy is calculated by a few methods:

→ Uniform Lifetime Table

→ Single Life Table

Generally, the single life table usually results in the highest amount you can withdraw.

3. Method

Few different methods:

• Amortization Method (static withdrawals)

• Annuity Method (static withdrawals)

• RMD

It's best to choose the static withdrawal method for equal amount for every year.

Few different methods:

• Amortization Method (static withdrawals)

• Annuity Method (static withdrawals)

• RMD

It's best to choose the static withdrawal method for equal amount for every year.

By the way, you can change the payment method only once during the entire SoSEPP period.

From amortization/annuity to RMD.

This could be especially helpful during downturns or change of circumstances.

From amortization/annuity to RMD.

This could be especially helpful during downturns or change of circumstances.

4. Balance

You can determine how much $$ you want to be subject to SoSEPP withdrawal.

You accomplish this by creating another IRA and rolloing over some amount into this account.

You can determine how much $$ you want to be subject to SoSEPP withdrawal.

You accomplish this by creating another IRA and rolloing over some amount into this account.

Importantly, no contributions or withdrawals (except those subject to the plan) can be made from the account.

You also must withdraw that amount EVERY year for five years or until you reach age 59½, whichever is LONGER.

You also must withdraw that amount EVERY year for five years or until you reach age 59½, whichever is LONGER.

For example, say you quit your job at age 50 and have $1,000,000 in a 401(k) account.

You roll the entire $1,000,000 into an IRA.

But you don't need a lot and only want $600,000 subject to the SoSEPP, so you transfer that amount into a separate IRA.

You roll the entire $1,000,000 into an IRA.

But you don't need a lot and only want $600,000 subject to the SoSEPP, so you transfer that amount into a separate IRA.

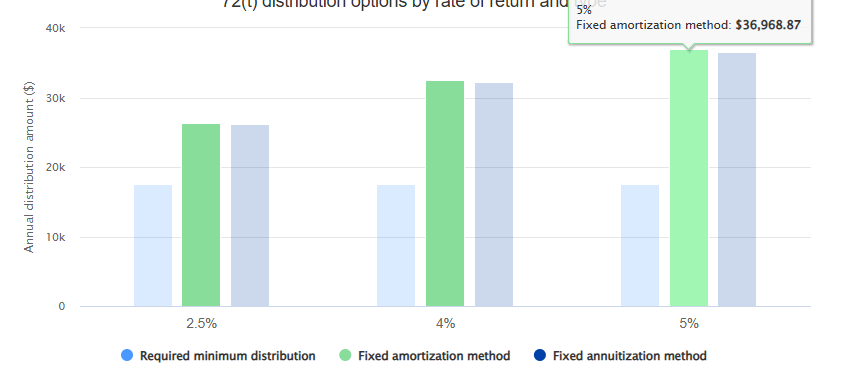

Let's run through example:

1. Interest - 5%

2. Single life table

3. Amortization

4. $600,000

Your age - 50.

It shows that you can pull $36,968 per year w/o 10% penalty.

1. Interest - 5%

2. Single life table

3. Amortization

4. $600,000

Your age - 50.

It shows that you can pull $36,968 per year w/o 10% penalty.

The best way to achieve this withdrawal is to schedule an automatic pull from an IRA on a date (i.e. 9/1/2025) and continue doing so.

Make sure to contact a licensed professional to help you create the paperwork and calculations related to the plan.

Make sure to contact a licensed professional to help you create the paperwork and calculations related to the plan.

So many people don't know that this section exists.

Please help spread the message by:

1. reposting this post

2. sharing it with your friends

3. following me @money_cruncher for more strategies

Please help spread the message by:

1. reposting this post

2. sharing it with your friends

3. following me @money_cruncher for more strategies

• • •

Missing some Tweet in this thread? You can try to

force a refresh