🚨 RIPPLE JUST REVEALED THE BLUEPRINT.

Ripple isn’t “testing” tokenization, they’re deploying it.

Treasuries, farmland, trade finance, and even land registries… all being pulled onto the XRP Ledger. 👇🧵

Ripple isn’t “testing” tokenization, they’re deploying it.

Treasuries, farmland, trade finance, and even land registries… all being pulled onto the XRP Ledger. 👇🧵

2/🧵

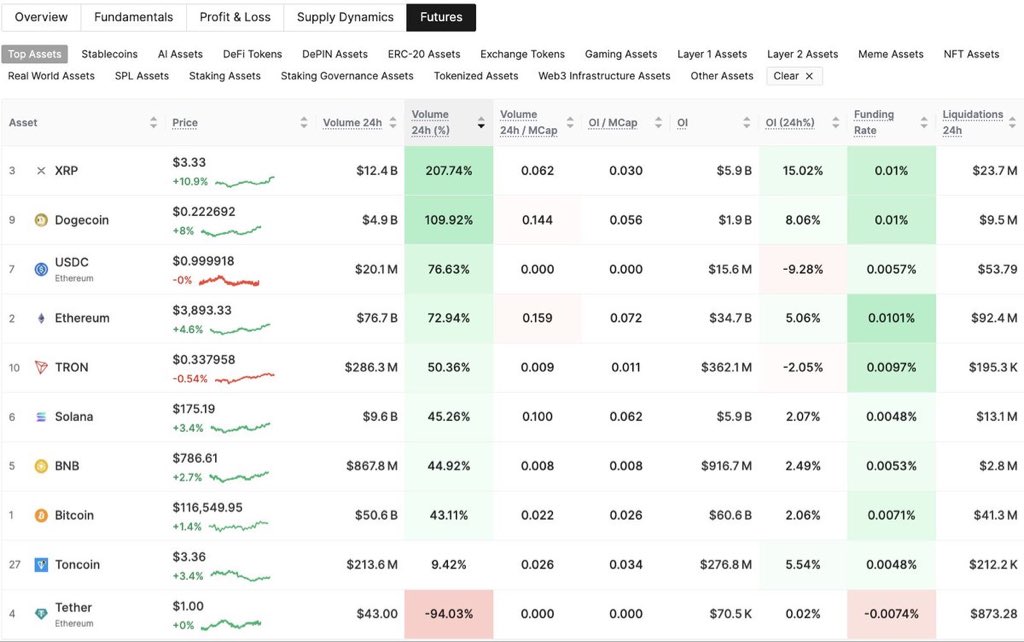

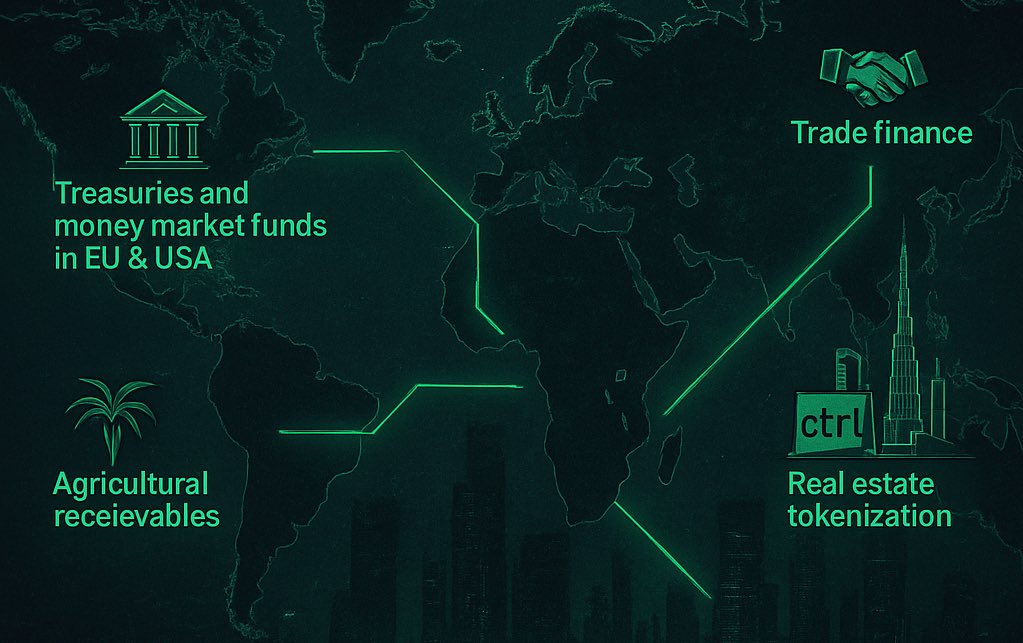

The announcement looks harmless:

— Treasuries in EU & USA

— Agricultural receivables in Latin America

— Trade finance in SE Asia

— Real estate with Dubai’s Land Department

But these are the four pillars of capital:

1️⃣ Sovereign debt

2️⃣ Productive land

3️⃣ Trade routes

4️⃣ Property rights

Control those… and you control the world economy.

The announcement looks harmless:

— Treasuries in EU & USA

— Agricultural receivables in Latin America

— Trade finance in SE Asia

— Real estate with Dubai’s Land Department

But these are the four pillars of capital:

1️⃣ Sovereign debt

2️⃣ Productive land

3️⃣ Trade routes

4️⃣ Property rights

Control those… and you control the world economy.

3/🧵

Why XRP Ledger?

Because it’s ISO 20022-native, settlement-final in seconds, and already connected to global banking middleware like Temenos, Volante, and Finastra.

Meaning:

If a bond in Frankfurt, a soybean farm in Brazil, and a condo in Dubai are all tokenized… they can be swapped in real-time without touching SWIFT.

Why XRP Ledger?

Because it’s ISO 20022-native, settlement-final in seconds, and already connected to global banking middleware like Temenos, Volante, and Finastra.

Meaning:

If a bond in Frankfurt, a soybean farm in Brazil, and a condo in Dubai are all tokenized… they can be swapped in real-time without touching SWIFT.

4/🧵

Look deeper:

— Treasuries & money market funds = access to the safest, most liquid assets on earth

— Agricultural receivables = the backbone of food security

— Trade finance = oil, shipping, commodities

— Real estate = 70% of global wealth

When these are tokenized on XRPL, liquidity is no longer nation-bound. It’s programmable, borderless, and under the control of whoever runs the rails.

Look deeper:

— Treasuries & money market funds = access to the safest, most liquid assets on earth

— Agricultural receivables = the backbone of food security

— Trade finance = oil, shipping, commodities

— Real estate = 70% of global wealth

When these are tokenized on XRPL, liquidity is no longer nation-bound. It’s programmable, borderless, and under the control of whoever runs the rails.

5/🧵

The Dubai Land Department deal is the tell.

Dubai is the testing ground for Shariah-compliant, blockchain-based registries. Once property rights live on XRPL, collateral, loans, and ownership transfers become instant.

That means real estate can be swapped for bonds, commodities, or CBDCs… without lawyers, banks, or escrow agents.

The Dubai Land Department deal is the tell.

Dubai is the testing ground for Shariah-compliant, blockchain-based registries. Once property rights live on XRPL, collateral, loans, and ownership transfers become instant.

That means real estate can be swapped for bonds, commodities, or CBDCs… without lawyers, banks, or escrow agents.

6/🧵

This isn’t innovation. It’s consolidation.

By anchoring RWAs to XRPL, Ripple and its institutional partners are locking the world’s wealth into a single, programmable system.

When the switch is flipped, legacy systems won’t “migrate” gradually. They’ll be swallowed whole.

This isn’t innovation. It’s consolidation.

By anchoring RWAs to XRPL, Ripple and its institutional partners are locking the world’s wealth into a single, programmable system.

When the switch is flipped, legacy systems won’t “migrate” gradually. They’ll be swallowed whole.

7/🧵

The peasants think tokenization is a buzzword.

The elites know it’s the kill switch for the old order.

When the world’s debt, land, trade, and property sit on XRPL rails, you’re either on the bridge… or under it.

⚔️ Follow my war logs: t.me/alexanderthewh…

The peasants think tokenization is a buzzword.

The elites know it’s the kill switch for the old order.

When the world’s debt, land, trade, and property sit on XRPL rails, you’re either on the bridge… or under it.

⚔️ Follow my war logs: t.me/alexanderthewh…

• • •

Missing some Tweet in this thread? You can try to

force a refresh