When Trump began announcing his tariffs, we at Markets lost our minds for a bit.

This was a sudden reversal of the way the world economy ran for decades — and we found ourselves writing a series of frantic pieces trying to understand what this all meant.

This was a sudden reversal of the way the world economy ran for decades — and we found ourselves writing a series of frantic pieces trying to understand what this all meant.

But now that a 50% tariff is actually in place, we don’t really know what to say. We have no way of analyzing what happens when the world’s largest market slaps double-digit tariffs at a whim. This isn’t serious economic diplomacy; it’s a shakedown.

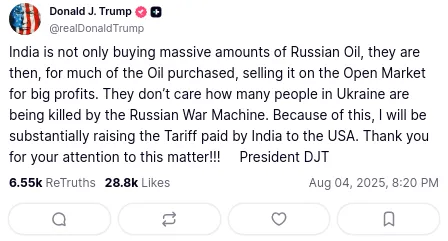

And lately, it seems like India has become Trump’s biggest punching bag. See this post, for instance:

And lately, it seems like India has become Trump’s biggest punching bag. See this post, for instance:

In the world of social media — where most of Trump’s policy-making happens — it’s easy to point fingers at someone and scream “Russia!” It’s infinitely harder to explain complex nuances of geostrategy.

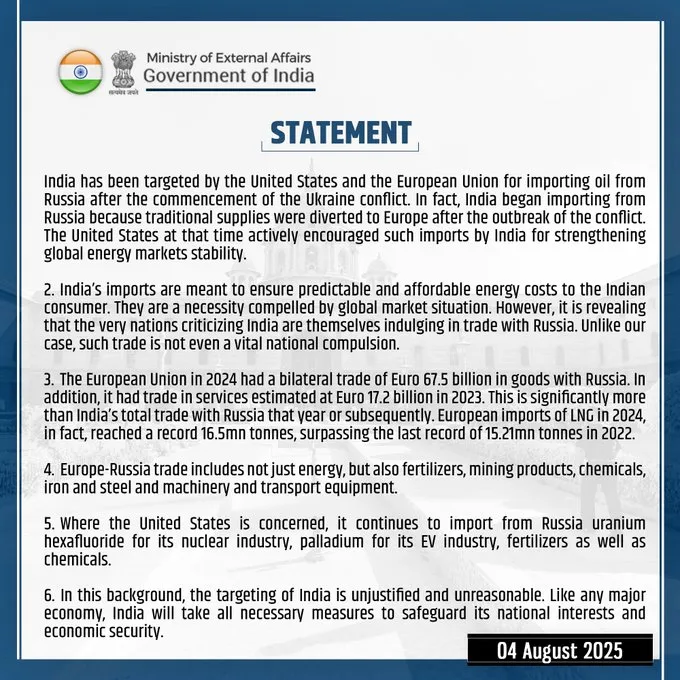

India has tried, though, putting out a fairly strong statement with its point of view:

India has tried, though, putting out a fairly strong statement with its point of view:

Will this convince anyone to see India’s point of view? Of course not. But it’s worth digging into this response, if only to understand India’s perspective on what is genuinely a complex issue.

To begin that, here’s a simple fact: America never tried to ban countries from importing Russian oil. Instead, it went for a price cap of $60 per barrel of Russian oil.

To begin that, here’s a simple fact: America never tried to ban countries from importing Russian oil. Instead, it went for a price cap of $60 per barrel of Russian oil.

In case you’re wondering, countries basically never put price caps on each other. Think of how odd a choice it is: the West was basically telling Russia the price it could sell its oil to completely unrelated third parties. Why choose something so weird? Why not just cut Russia out completely?

Simple: If it cuts the world’s third biggest oil producer out of the global market, there would be chaos across the world.

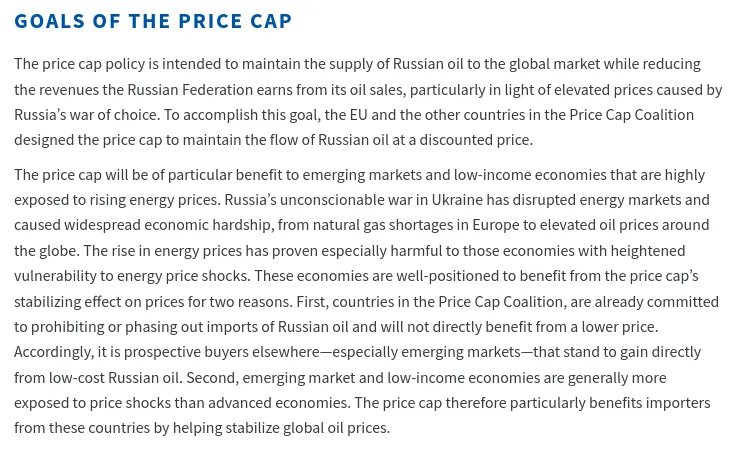

This is what the US Treasury said, back in 2022:

Simple: If it cuts the world’s third biggest oil producer out of the global market, there would be chaos across the world.

This is what the US Treasury said, back in 2022:

It basically said that the price cap keeps Russian oil in global markets at reduced prices, cutting Russia's war revenues. It mainly helps developing countries access cheaper energy while protecting them from price shocks.

But, it’s worth noting two things here: one, that the price cap was designed to “maintain the flow of Russian oil”; and two, that it was meant to be “of particular benefit to emerging markets”. The plan, in short, was to ensure that Russian oil kept flowing into the world, but that it didn’t get to make any profit from it.

But, it’s worth noting two things here: one, that the price cap was designed to “maintain the flow of Russian oil”; and two, that it was meant to be “of particular benefit to emerging markets”. The plan, in short, was to ensure that Russian oil kept flowing into the world, but that it didn’t get to make any profit from it.

India was very much part of this plan. It was one of those that, the US then hoped, would gobble up Russian profits. As US Treasury Secretary Janet Yellen had said, back then:

“If they (India) want to use Western financial services like insurance, the price cap would apply to their purchases. But even if they use other financial services, we believe the price cap will give them leverage to negotiate good discounts from world markets. We would hope to see India benefiting from this programme.”

“If they (India) want to use Western financial services like insurance, the price cap would apply to their purchases. But even if they use other financial services, we believe the price cap will give them leverage to negotiate good discounts from world markets. We would hope to see India benefiting from this programme.”

This wasn’t charity, of course. India is the world’s third-largest importer of oil. Even if we didn’t buy oil from Russia, we would buy oil. If not Russia, we would go to the same markets that Western powers would — the Middle East, the Americas, and so on. That would inevitably push prices higher in all those markets, making things harder for Western countries.

It doesn’t stop there, though.

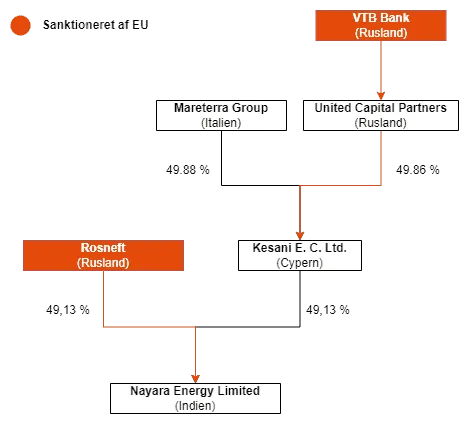

See, there’s a funny thing about international trade: if India buys Russian crude oil, refines it, and sells you diesel, that diesel isn’t considered “Russian”. It’s considered Indian diesel. It might have started in Russia, but going through Indian refineries magically changes it.

It doesn’t stop there, though.

See, there’s a funny thing about international trade: if India buys Russian crude oil, refines it, and sells you diesel, that diesel isn’t considered “Russian”. It’s considered Indian diesel. It might have started in Russia, but going through Indian refineries magically changes it.

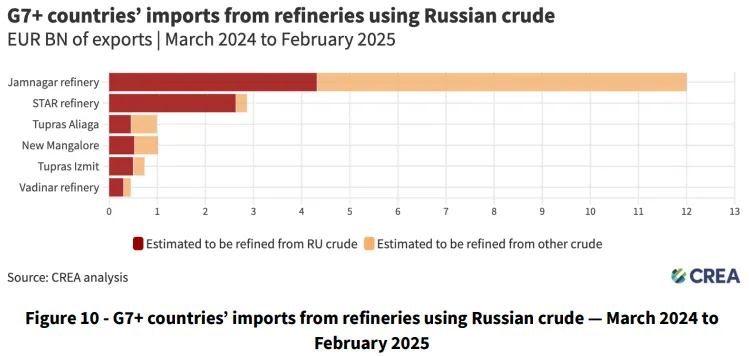

Or that’s at least what many countries chose to think. Because the world’s G7 countries have been happy to buy Russian oil, once it has gone through Indian or Turkish refineries.

According to analysis by CREA, between March 2024 and February 2025, G7 countries imported $9 billion worth of petroleum products from the two countries, which were refined from Russian crude oil. (Although the European Union is finally cracking down on some of this.)

According to analysis by CREA, between March 2024 and February 2025, G7 countries imported $9 billion worth of petroleum products from the two countries, which were refined from Russian crude oil. (Although the European Union is finally cracking down on some of this.)

Did Indian purchases of oil indirectly fund the Russian military? Most probably.

But India’s contention is that we’re being turned into a scapegoat. The rest of the world — the West included — was willing to pay Russia for their own imports. As the MEA pointed out, last year, €67.5 billion of European money entered Russia too. And more was perhaps channeled into Russia via India. This was all by design. It hardly makes sense to point fingers at one country.

But India’s contention is that we’re being turned into a scapegoat. The rest of the world — the West included — was willing to pay Russia for their own imports. As the MEA pointed out, last year, €67.5 billion of European money entered Russia too. And more was perhaps channeled into Russia via India. This was all by design. It hardly makes sense to point fingers at one country.

Now, we want to be fair here. Countries are allowed to change their mind and redraw their plans. Countries that are trying to stop endless wars often do. And India didn’t just buy oil out of necessity; it made windfall profits for a long time by refining Russian oil.

But it makes little sense to paint India as some sort of rogue nation. Everyone knew what a price cap would do — if your primary foreign policy tool was to make Russian oil cheaper, it hardly makes sense to complain when people buy more. That was, indeed, the plan. When the West first chalked out this scheme, it was trying to find win-win solutions for its partners, and in doing so, maintain global stability.

Trump, it appears, cares for neither.

Trump, it appears, cares for neither.

We cover this and two more interesting stories in today's edition of Who said what? Watch on YouTube or read on Substack. All links here:

thedailybriefing.substack.com/p/oil-diamonds…

thedailybriefing.substack.com/p/oil-diamonds…

• • •

Missing some Tweet in this thread? You can try to

force a refresh