1/

Yes, we’ve discussed this topic before -

but I believe it’s important to bring it up again, this time with details taken directly from Donald Trump’s Executive Order.

What’s written in black and white makes the picture even clearer — and more alarming. 🧵

Yes, we’ve discussed this topic before -

but I believe it’s important to bring it up again, this time with details taken directly from Donald Trump’s Executive Order.

What’s written in black and white makes the picture even clearer — and more alarming. 🧵

2/

🚨 The White House just signed an Executive Order to “Democratize” 401(k) investments.

Sounds nice, right?

Here’s what it really means and why it could turn millions of Americans’ retirement savings into a Wall Street casino.

🚨 The White House just signed an Executive Order to “Democratize” 401(k) investments.

Sounds nice, right?

Here’s what it really means and why it could turn millions of Americans’ retirement savings into a Wall Street casino.

3/

The EO opens the door for 401(k) retirement plans (used by over 90 million Americans) to invest in:

Private equity

Real estate & infrastructure projects

Commodities

Digital assets (including crypto)

“Lifetime income” products

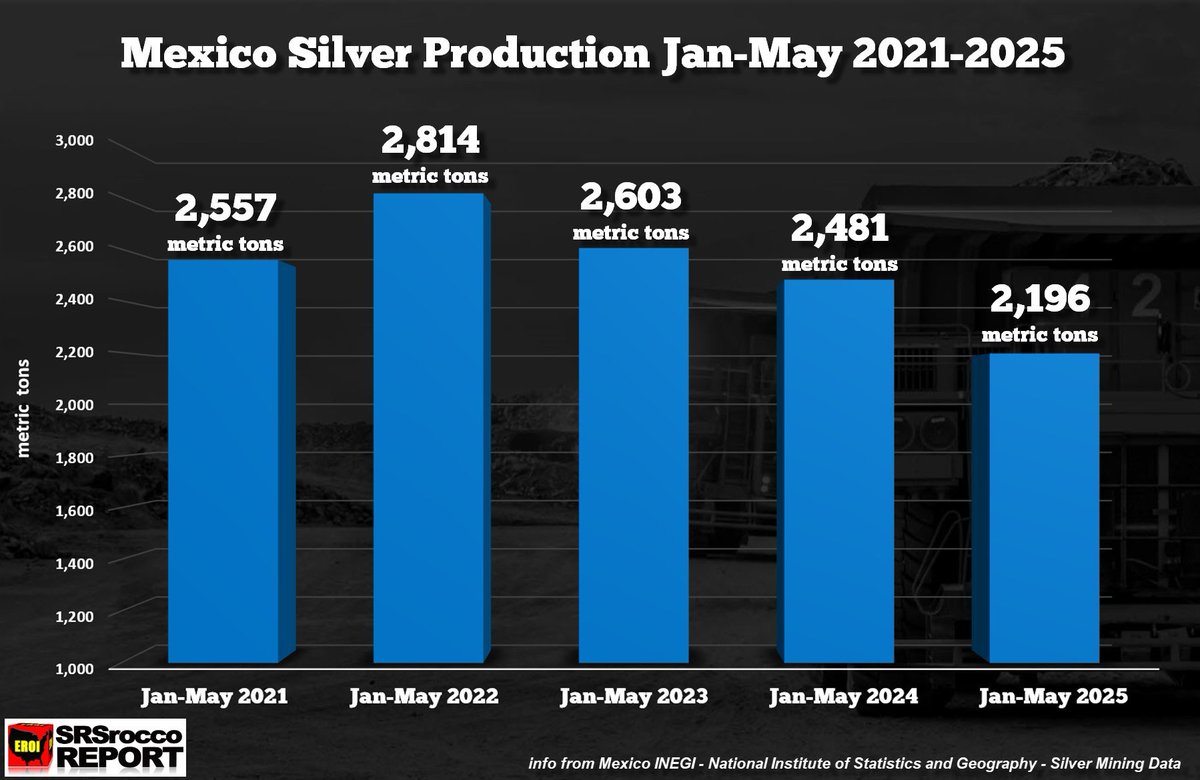

💡 Commodities like gold and silver aren’t that hard to understand.

But why let a fund hold them for you with fees and paper claims - when you can own and manage them yourself?

The EO opens the door for 401(k) retirement plans (used by over 90 million Americans) to invest in:

Private equity

Real estate & infrastructure projects

Commodities

Digital assets (including crypto)

“Lifetime income” products

💡 Commodities like gold and silver aren’t that hard to understand.

But why let a fund hold them for you with fees and paper claims - when you can own and manage them yourself?

4/

From the EO itself:

“Within 180 days… clarify duties… including appropriately calibrated safe harbors.”

Safe harbor = legal protection zone for fund managers.

If they meet a minimum set of rules, you can’t successfully sue them for a bad investment.

From the EO itself:

“Within 180 days… clarify duties… including appropriately calibrated safe harbors.”

Safe harbor = legal protection zone for fund managers.

If they meet a minimum set of rules, you can’t successfully sue them for a bad investment.

5/

Translation: the government gives them a legal umbrella to take your retirement money and put it into illiquid, complex, and often non-transparent investments without fearing lawsuits.

Translation: the government gives them a legal umbrella to take your retirement money and put it into illiquid, complex, and often non-transparent investments without fearing lawsuits.

6/

💸 Once again: Privatize profits, socialize the losses.

401(k)s used to be safe.

Now it’s a casino with private equity, real estate schemes, and digital assets on the table.

And the house always wins - you don’t.

💸 Once again: Privatize profits, socialize the losses.

401(k)s used to be safe.

Now it’s a casino with private equity, real estate schemes, and digital assets on the table.

And the house always wins - you don’t.

7/

Why is this risky?

Because these assets are:

Illiquid (you can’t sell when you need cash)

High-fee (private equity can eat 2–5% per year)

Complex (most retail investors don’t truly understand them)

Why is this risky?

Because these assets are:

Illiquid (you can’t sell when you need cash)

High-fee (private equity can eat 2–5% per year)

Complex (most retail investors don’t truly understand them)

8/

Remember: these “alternative assets” were always reserved for accredited investors who can afford to lose.

Now Main Street retirement accounts could be thrown into the same high-risk pool as hedge funds & venture capital.

Remember: these “alternative assets” were always reserved for accredited investors who can afford to lose.

Now Main Street retirement accounts could be thrown into the same high-risk pool as hedge funds & venture capital.

9/

When these bets go bad, fund managers still collect their fees.

The only ones taking the hit will be the workers relying on these funds for retirement.

When these bets go bad, fund managers still collect their fees.

The only ones taking the hit will be the workers relying on these funds for retirement.

10/

🔐 So what now?

Stop relying on a broken system.

Protect yourself.

✅ Physical silver

✅ No third-party risk

✅ No counterparty risk

✅ You hold it — you own it

🔐 So what now?

Stop relying on a broken system.

Protect yourself.

✅ Physical silver

✅ No third-party risk

✅ No counterparty risk

✅ You hold it — you own it

11/

For me, the answer is physical silver.

– Immune to bankruptcies

– No leverage like ETFs

– No bots playing games

– It’s real — I hold it in my hand

It’s my hedge against financial experiments — like this one.

For me, the answer is physical silver.

– Immune to bankruptcies

– No leverage like ETFs

– No bots playing games

– It’s real — I hold it in my hand

It’s my hedge against financial experiments — like this one.

12/

This executive order isn’t for you.

It’s a golden buffet for predators.

When it all crashes, they’ll say:

“Nobody could have seen it coming.”

But YOU knew.

That’s why YOU hold silver.

This executive order isn’t for you.

It’s a golden buffet for predators.

When it all crashes, they’ll say:

“Nobody could have seen it coming.”

But YOU knew.

That’s why YOU hold silver.

13/

Be smart.

Not everything “modern” is good for you.

Sometimes the biggest act of rebellion is to own something real.

🎯 That’s why silver.

#Silver #401k #Trump #Retirement #Investing #Gold #WallStreet

Be smart.

Not everything “modern” is good for you.

Sometimes the biggest act of rebellion is to own something real.

🎯 That’s why silver.

#Silver #401k #Trump #Retirement #Investing #Gold #WallStreet

• • •

Missing some Tweet in this thread? You can try to

force a refresh