HSAs are like a Roth IRA on steroids due to triple tax benefits.

And the new tax bill just made them even more accessible.

Here’s how to take full advantage:

And the new tax bill just made them even more accessible.

Here’s how to take full advantage:

HSA is one of the most powerful accounts.

This is because it offers the most benefits:

> tax deduction

> tax free growth

> tax free withdrawals for medical expenses

That's even better than Roth IRA if used strategically.

This is because it offers the most benefits:

> tax deduction

> tax free growth

> tax free withdrawals for medical expenses

That's even better than Roth IRA if used strategically.

In order to have an HSA account, you need to have a high deductible health plan (HDHP)

A HDPH is a health plan with a deductible of more than $1,650 for self or $3,300 for family coverage.

And the out of pocket max doesn't exceed $8,300 (self) or $16,600 (family)

A HDPH is a health plan with a deductible of more than $1,650 for self or $3,300 for family coverage.

And the out of pocket max doesn't exceed $8,300 (self) or $16,600 (family)

The new tax bill also made changes:

First, all "Bronze" and "Catastrophic" plans offered on the Affordable Care Act exchanges now qualify as HDHPs.

About 30% of all ACA enrollees selected "Bronze" plans, so a lot more people can now use HSAs.

First, all "Bronze" and "Catastrophic" plans offered on the Affordable Care Act exchanges now qualify as HDHPs.

About 30% of all ACA enrollees selected "Bronze" plans, so a lot more people can now use HSAs.

Also, the new bill also allows individuals to maintain HSA eligibility while covered by a "direct primary care arrangement"

This arrangement allows you to pay a flat monthly or annual fee to primary care (capped at $150/mo or $300/mo) for certain services.

This arrangement allows you to pay a flat monthly or annual fee to primary care (capped at $150/mo or $300/mo) for certain services.

One of the best HSA strategies is the "Silent IRA" concept:

There is no deadline to use the money in your HSA for medical expenses.

You can reimburse yourself (transfer from your HSA to your bank) years after incurring medical expenses.

There is no deadline to use the money in your HSA for medical expenses.

You can reimburse yourself (transfer from your HSA to your bank) years after incurring medical expenses.

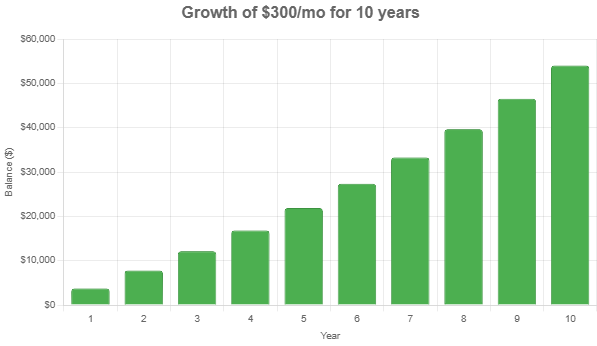

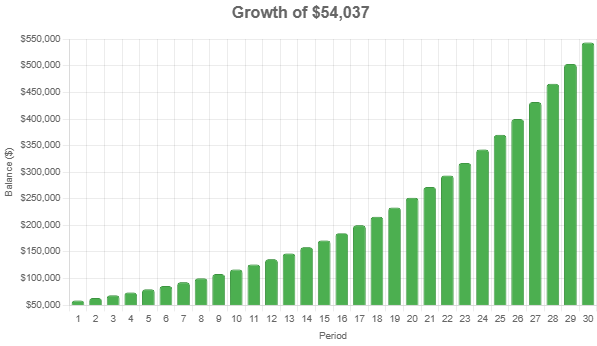

This allows you to invest your HSA in the stock market for the long term, while paying medical expenses out of pocket.

As a result, your HSA can grow tax free for an extended period of time.

Just make sure to save all invoices and receipts for future reimbursement.

As a result, your HSA can grow tax free for an extended period of time.

Just make sure to save all invoices and receipts for future reimbursement.

After age 65, you can also use your HSA for ANY expenses.

But non-medical withdrawals will be subject to income taxes, similar to a traditional IRA or pre-tax 401k.

Here's another thing..

But non-medical withdrawals will be subject to income taxes, similar to a traditional IRA or pre-tax 401k.

Here's another thing..

You own your HSA.

Your HSA belongs to you. Not your employer.

While some employers offer an HSA, you’re not required to use theirs (it's probably best due to 7.65% payroll tax savings).

But if you qualify, you can open your own HSA independently.

Your HSA belongs to you. Not your employer.

While some employers offer an HSA, you’re not required to use theirs (it's probably best due to 7.65% payroll tax savings).

But if you qualify, you can open your own HSA independently.

HSAs can be used not only for the annual check ups. It covers:

> Vision (lasik, glasses)

> Dental (braces, cleanings)

> Family planning

> Others (chiropractor)

See Publication 502 for the full list.

> Vision (lasik, glasses)

> Dental (braces, cleanings)

> Family planning

> Others (chiropractor)

See Publication 502 for the full list.

HSAs are incredibly powerful, but not a lot of people even know about them.

Please help me spread this message by:

1. reposting the first post of this thread

2. sharing this post with a friend

3. following me @money_cruncher for more CPA tips

Please help me spread this message by:

1. reposting the first post of this thread

2. sharing this post with a friend

3. following me @money_cruncher for more CPA tips

• • •

Missing some Tweet in this thread? You can try to

force a refresh