The first 30 minutes can make or break your day. ⏰

Most traders lose more here than they make all week.

Here’s how to use it for better trades — not blowups 👇

Most traders lose more here than they make all week.

Here’s how to use it for better trades — not blowups 👇

1) Know the Flow

The open is a liquidity event — funds adjust, day traders chase, spreads widen.

Tip: Use smaller size early. oder wait 5-15 minutes. If the stock proves itself, you can always add.

The open is a liquidity event — funds adjust, day traders chase, spreads widen.

Tip: Use smaller size early. oder wait 5-15 minutes. If the stock proves itself, you can always add.

2) Pre-Market Leaders

Focus on stocks already showing strength:

1. High relative pre-market volume (10-20% above avg.)

2. Strong leading theme or catalyst

3. Clean setups

Tip: Avoid stocks that act choppy or trade on low volume — they often fade fast.

Focus on stocks already showing strength:

1. High relative pre-market volume (10-20% above avg.)

2. Strong leading theme or catalyst

3. Clean setups

Tip: Avoid stocks that act choppy or trade on low volume — they often fade fast.

3) Avoid the FOMO Chase

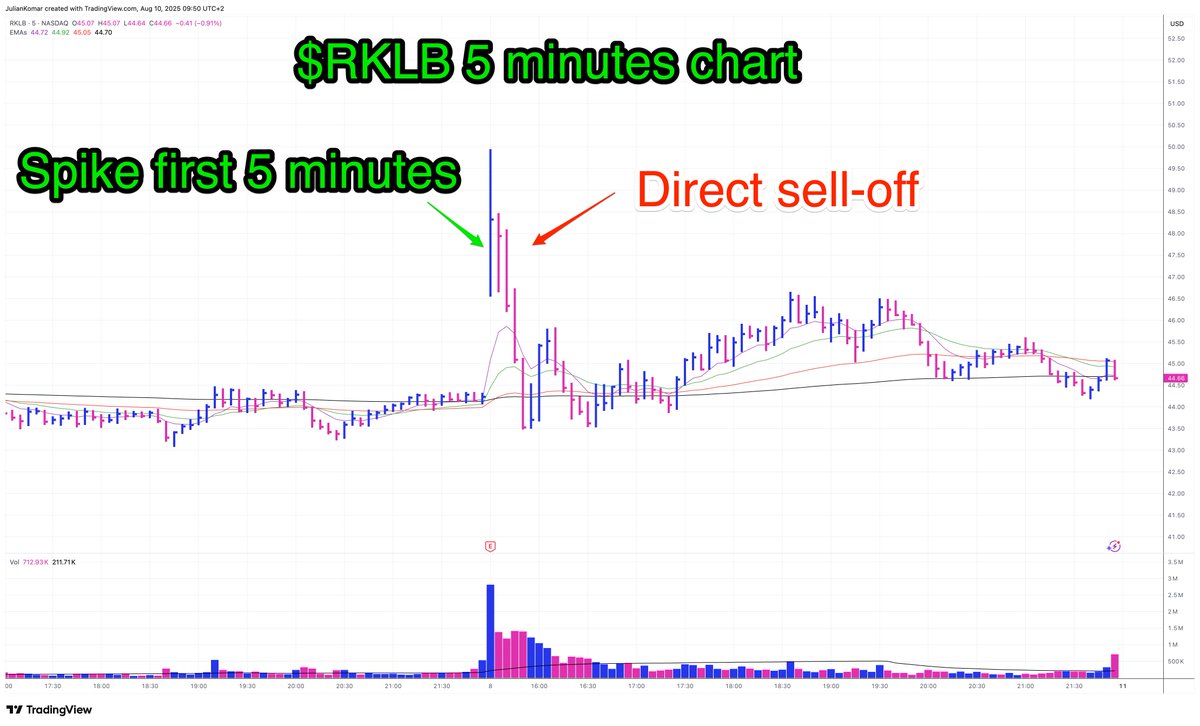

That first green candle? Often bait.

Tip: Let the first pullback happen or wait 5-15 minutes. If it holds near the open-range high, that’s your confirmation — not the first spike.

That first green candle? Often bait.

Tip: Let the first pullback happen or wait 5-15 minutes. If it holds near the open-range high, that’s your confirmation — not the first spike.

4) Open Range Breakout

Mark the high/low from the first 5–15 minutes.

Tip: Only take the breakout if a stocks follows through — patience is key.

Mark the high/low from the first 5–15 minutes.

Tip: Only take the breakout if a stocks follows through — patience is key.

5) Follow Your Rules

If your system says “no trades in the first 10 minutes” — obey it.

Tip: Use that time to log your top 3 watchlist stocks and plan exact entry/stop before touching the buy button.

If your system says “no trades in the first 10 minutes” — obey it.

Tip: Use that time to log your top 3 watchlist stocks and plan exact entry/stop before touching the buy button.

The open isn’t about more trades.

It’s about better trades.

Master those first 30 minutes and you’ll stop bleeding early — and start catching the real moves.

It’s about better trades.

Master those first 30 minutes and you’ll stop bleeding early — and start catching the real moves.

• • •

Missing some Tweet in this thread? You can try to

force a refresh