RWAs: US-China's Chess Game for Financial Hegemony

On 6/24: 国泰君安, China’s #1 broker, jumps 300% on Hong Kong’s ok to be the first SOE stablecoin dealer.

7/17: Trump signs Genius Act.

8/1: HK follows quickly w/ Stablecoin Bill.

Among Chinese finance circles, RWA is all anyone's talking about right now.

What’s changed these last 3 months to turn tokenization from the wet dream of on-chain zealots to the queening pawn of Chinese Wall St?

And where do we go next?

👇

🧵

On 6/24: 国泰君安, China’s #1 broker, jumps 300% on Hong Kong’s ok to be the first SOE stablecoin dealer.

7/17: Trump signs Genius Act.

8/1: HK follows quickly w/ Stablecoin Bill.

Among Chinese finance circles, RWA is all anyone's talking about right now.

What’s changed these last 3 months to turn tokenization from the wet dream of on-chain zealots to the queening pawn of Chinese Wall St?

And where do we go next?

👇

🧵

1/ RWA Universe

First, the basics.

What's an RWA anyways?

Literal def: a “real world asset”, aka any qty of anything wrapped as a crypto so as to:

(a) increase access or

(b) skirt KYC

My def: a synechdoche for stablecoins, aka the tug of war for dollar dominance.

Not to throw shade, but here's my corrected market map (Labubu is rapidly upping China's soft power so it can stay 🙃).

First, the basics.

What's an RWA anyways?

Literal def: a “real world asset”, aka any qty of anything wrapped as a crypto so as to:

(a) increase access or

(b) skirt KYC

My def: a synechdoche for stablecoins, aka the tug of war for dollar dominance.

Not to throw shade, but here's my corrected market map (Labubu is rapidly upping China's soft power so it can stay 🙃).

2/ Stablecoins - the only RWA that matters

Stablecoins = Currency = 99% USD-linked

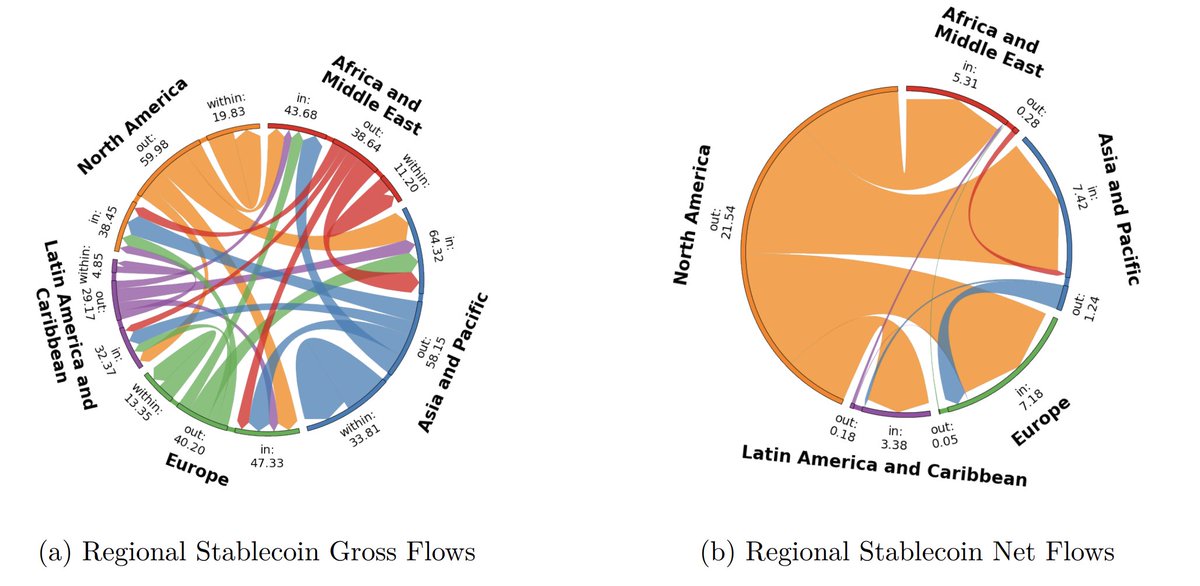

i.e. the story of stablecoins is currently the story of supply and demand for US dollar; different countries' people reveal their preferences through the net inflows/outflows of USDT and USDC

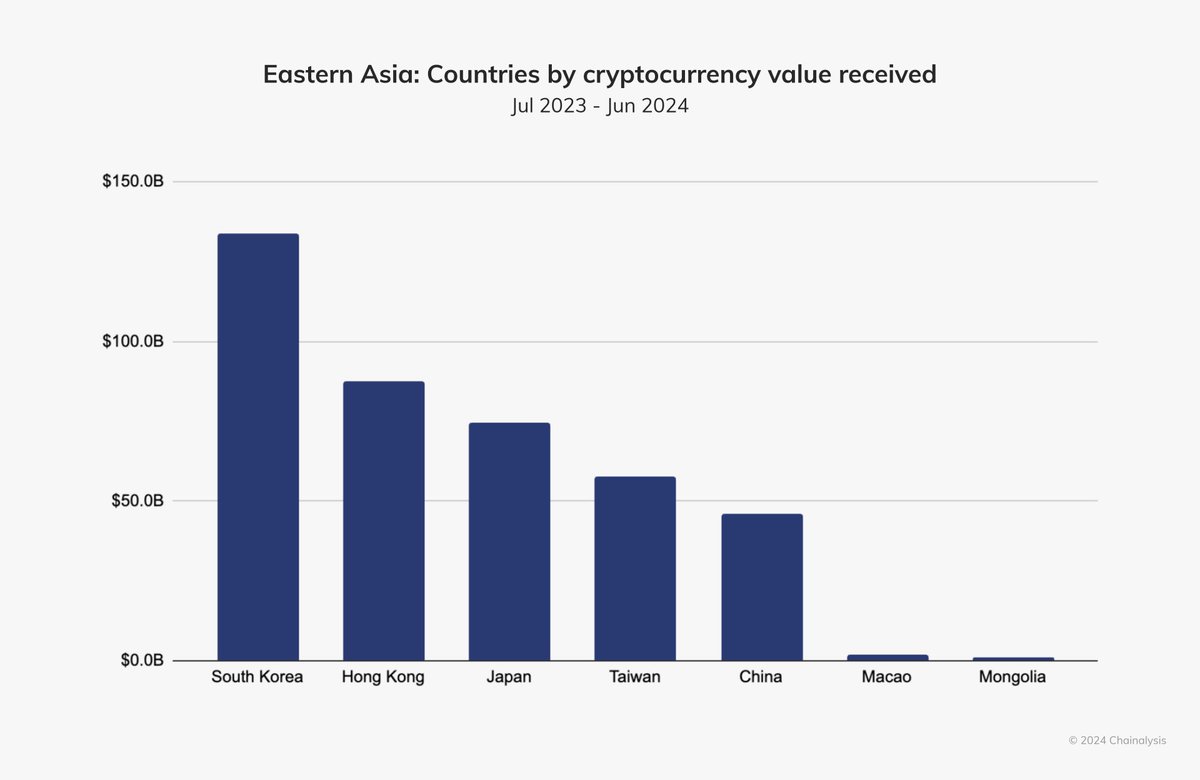

What's critical to realize is that stablecoin trading volumes are still VASTLY DOMINATED BY MARKET PARTICIPANTS IN ASIA (esp. Korea, HK, China, India, Japan, Taiwan).

As shown below, USDT accounts >62% of transaction volumes and is >2.5X USDC, and is by far the most dominant coin used in APAC.

Stablecoins = Currency = 99% USD-linked

i.e. the story of stablecoins is currently the story of supply and demand for US dollar; different countries' people reveal their preferences through the net inflows/outflows of USDT and USDC

What's critical to realize is that stablecoin trading volumes are still VASTLY DOMINATED BY MARKET PARTICIPANTS IN ASIA (esp. Korea, HK, China, India, Japan, Taiwan).

As shown below, USDT accounts >62% of transaction volumes and is >2.5X USDC, and is by far the most dominant coin used in APAC.

Even more interestingly, if u look at the gross flows vs. net inflows, it's obvious just how one-sided the direction of flow is: 21% net outpour of USDT/USDC to APAC, EU, and MENA.

Source: IMF report released July 11 estimating stablecoin flows around the world.

Also mentioned, 31% of wallets belong to APAC vs. only 20% to US holders.

To read more: imf.org/en/Publication…

Source: IMF report released July 11 estimating stablecoin flows around the world.

Also mentioned, 31% of wallets belong to APAC vs. only 20% to US holders.

To read more: imf.org/en/Publication…

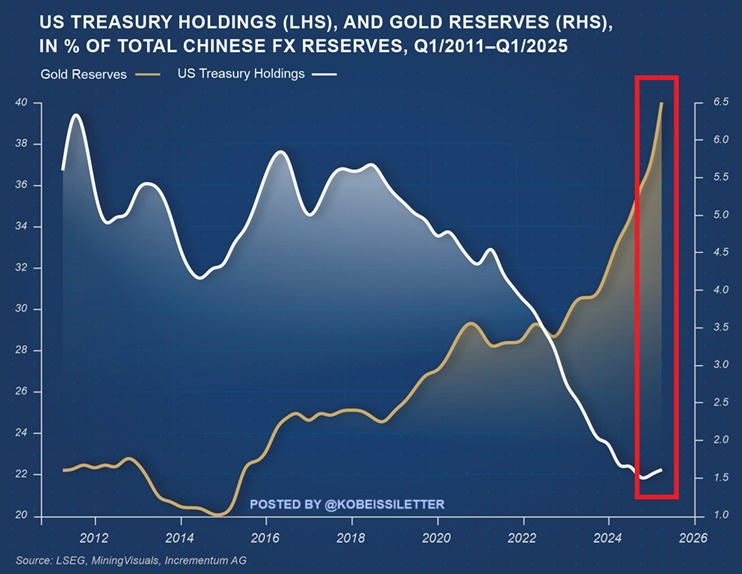

3/ Stablecoins as a backstop to USD reserve dumping?

From 2020 on, many signals have pointed to rest of world's fatigue at USD dominance (e.g. from Russia and China pushing oil trade settlements in yuan, to Beijing offloading $8.2B of USD reserves in April 2025)

But for every dollar that Beijing dumps, APAC retail ants are making back the reserves 100%+. See chart below. Over the last year, CRCL's reserves grew from 36B → 60B, and Tether from 119 Bn → 156 Bn, i.e. retail is effectively injecting $5Bn+ per month straight into US treasury coffers.

From 2020 on, many signals have pointed to rest of world's fatigue at USD dominance (e.g. from Russia and China pushing oil trade settlements in yuan, to Beijing offloading $8.2B of USD reserves in April 2025)

But for every dollar that Beijing dumps, APAC retail ants are making back the reserves 100%+. See chart below. Over the last year, CRCL's reserves grew from 36B → 60B, and Tether from 119 Bn → 156 Bn, i.e. retail is effectively injecting $5Bn+ per month straight into US treasury coffers.

4/ How exactly does buying stablecoin help the US treasury?

The flow is quite direct really:

Step 1: Retail in APAC exchanges RMB for USDT on Binance P2P.

Step 2: That USDT can be swapped for USDC via exchanges or OTC desks.

Step 3: Circle issues USDC against USD reserves — mostly short-term US Treasuries.

Step 4: Those reserves = capital inflows to the US, with Circle earning yield and indirectly helping fund the US gov.

The flow is quite direct really:

Step 1: Retail in APAC exchanges RMB for USDT on Binance P2P.

Step 2: That USDT can be swapped for USDC via exchanges or OTC desks.

Step 3: Circle issues USDC against USD reserves — mostly short-term US Treasuries.

Step 4: Those reserves = capital inflows to the US, with Circle earning yield and indirectly helping fund the US gov.

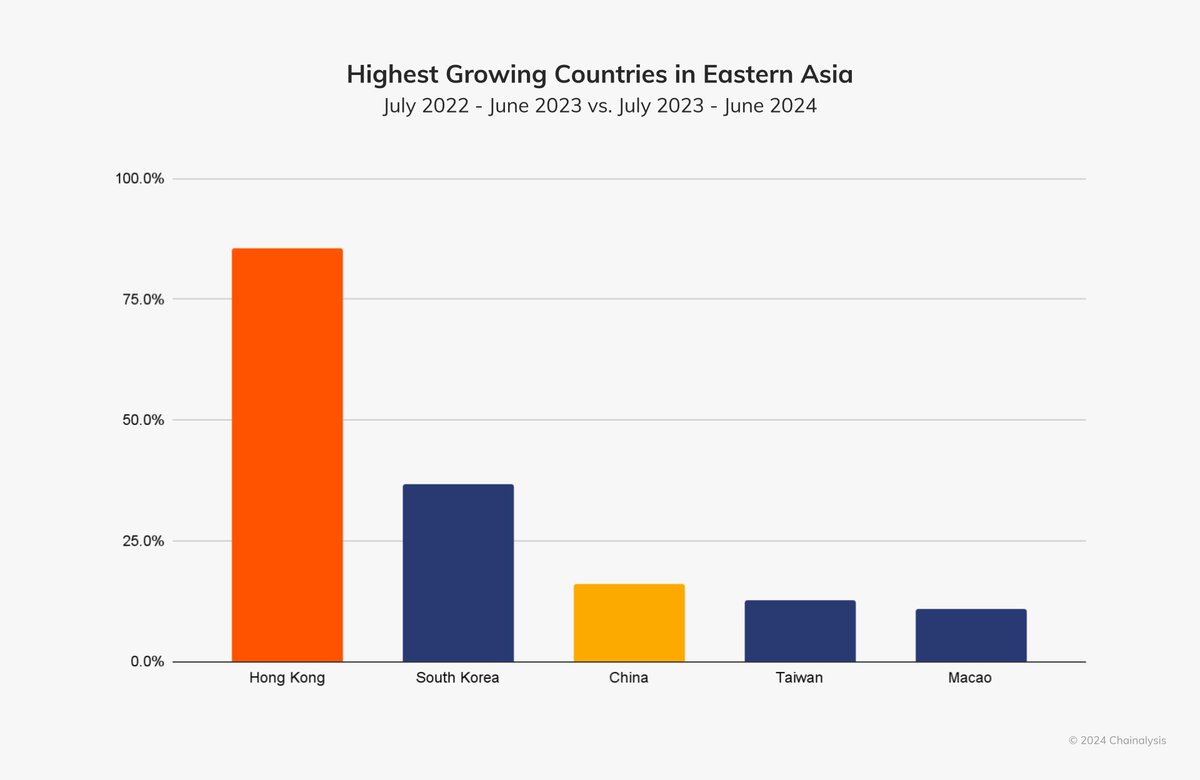

5/ Recent market happenings: HK's emergence as #1 growing crypto hub

Throughout 2024, at 85.6% YoY growth, HK (aka China + HK) became the most active hub by transaction volume ( 👋 🇰🇷 hello Seoul, we'll talk about u another time), and together received >$140B in net crypto transaction value between mid 2023 - mid 2024.

To put things into perspective, US accounts only 20% of transaction volumes and it’s pretty neck-to-neck with East Asia.

Throughout 2024, at 85.6% YoY growth, HK (aka China + HK) became the most active hub by transaction volume ( 👋 🇰🇷 hello Seoul, we'll talk about u another time), and together received >$140B in net crypto transaction value between mid 2023 - mid 2024.

To put things into perspective, US accounts only 20% of transaction volumes and it’s pretty neck-to-neck with East Asia.

6/ Governments’ response: HK’s Stablecoin Bill

On Aug 1, on the backs of its increasingly buzzy retail base and activity, HK’s Stablecoin Bill took effect — the 1st such framework in Asia.

Key points: - first regulated stablecoins (HKD-backed) anticipated to launch in Q4 2025

- all fiat-referenced stablecoin issuers (domestic & overseas) must be licensed by HKMA

- first licenses coming early 2026 (HKMA intentionally slow-rolling)

On Aug 1, on the backs of its increasingly buzzy retail base and activity, HK’s Stablecoin Bill took effect — the 1st such framework in Asia.

Key points: - first regulated stablecoins (HKD-backed) anticipated to launch in Q4 2025

- all fiat-referenced stablecoin issuers (domestic & overseas) must be licensed by HKMA

- first licenses coming early 2026 (HKMA intentionally slow-rolling)

7/ Chinese tech giants' response: Get in on HK’s Stablecoin Sandbox

Even before / leading up to the Stablecoin Bill, HKMA (HK Monetary Authority)’s pre-existing regulatory sandbox already had 3 main participants:

(1) JD: e-commerce behemoth; on July 30 filed trademarks for “Jcoin” & “Joycoin.” Q: What's in it for JD? A: As one of China’s biggest cross-border logistics & payment players, JD needs frictionless settlement rails for global suppliers & customers—own coin = direct control over FX, fees, and flow.

(2) RD Inno – backed by ZA Bank (HK’s largest virtual bank), whose UBOs trace back to Alibaba, Tencent & Ping An. Q: What's in it for ZA? A: Banks crave end-to-end control—taking deposits, issuing interest-bearing products, and now issuing the settlement layer itself. Stablecoins lock users inside that loop.

(3) SC + Animoca + HKT – an odd mash-up of a global bank, a Web3 gaming giant, and a telco. Q: Why team up? A: Each brings a missing piece: SC’s regulatory credibility & custody network, Animoca’s crypto-native distribution & dev muscle, HKT’s massive payments/user base. Together, they can launch, distribute & settle a coin at scale—without relying on mainland SOEs.

Even before / leading up to the Stablecoin Bill, HKMA (HK Monetary Authority)’s pre-existing regulatory sandbox already had 3 main participants:

(1) JD: e-commerce behemoth; on July 30 filed trademarks for “Jcoin” & “Joycoin.” Q: What's in it for JD? A: As one of China’s biggest cross-border logistics & payment players, JD needs frictionless settlement rails for global suppliers & customers—own coin = direct control over FX, fees, and flow.

(2) RD Inno – backed by ZA Bank (HK’s largest virtual bank), whose UBOs trace back to Alibaba, Tencent & Ping An. Q: What's in it for ZA? A: Banks crave end-to-end control—taking deposits, issuing interest-bearing products, and now issuing the settlement layer itself. Stablecoins lock users inside that loop.

(3) SC + Animoca + HKT – an odd mash-up of a global bank, a Web3 gaming giant, and a telco. Q: Why team up? A: Each brings a missing piece: SC’s regulatory credibility & custody network, Animoca’s crypto-native distribution & dev muscle, HKT’s massive payments/user base. Together, they can launch, distribute & settle a coin at scale—without relying on mainland SOEs.

8/ Mainland China Pushes Back Against Big Tech:

As of August 2025, new guidance from Beijing says only ONE of the SOEs (e.g. 国泰君安 or CITIC 中信) is currently expected to get approval.

Deliberately left out are the Chinese tech titans who've been lobbying almost a year. The message is clear:

Stablecoin issuance is now a core financial infrastructure play. Control stays firmly in Beijing’s hands via SOEs with direct state oversight.

This is consistent with the mainland’s approach in other sectors: allow private innovation at the edges, but keep the central rails state-owned.

As of August 2025, new guidance from Beijing says only ONE of the SOEs (e.g. 国泰君安 or CITIC 中信) is currently expected to get approval.

Deliberately left out are the Chinese tech titans who've been lobbying almost a year. The message is clear:

Stablecoin issuance is now a core financial infrastructure play. Control stays firmly in Beijing’s hands via SOEs with direct state oversight.

This is consistent with the mainland’s approach in other sectors: allow private innovation at the edges, but keep the central rails state-owned.

9/ Meanwhile, PBOC pushing hard to promote e-CNY

In Q2, China ramped up efforts to globalize the digital yuan, announcing a new operations center in Shanghai to drive cross-border adoption.

But e-CNY ≠ stablecoin.

e-CNY is basically WeChat pay under a new name + some extra bells/whistles (like programmability)

In practice, people outside mainland China can’t get or use e-CNY the way anyone, anywhere can buy USDT.

In Q2, China ramped up efforts to globalize the digital yuan, announcing a new operations center in Shanghai to drive cross-border adoption.

But e-CNY ≠ stablecoin.

e-CNY is basically WeChat pay under a new name + some extra bells/whistles (like programmability)

In practice, people outside mainland China can’t get or use e-CNY the way anyone, anywhere can buy USDT.

10/ What's next?

China's incentives are & have always been quite clear:

(1) Promote Yuan, counteract US dollar dominance

and

(2) Prevent capital outflows from its own 1Bn+ people.

Only problem is: these two objectives tend to be diametrically opposed.

Thus China is left vacillating between full-on pushing stablecoin Yuan down on its people to aggressively fight against USDT/USDC the same way WeChat forced out the credit card market ....

vs.

Or it could just... not...

Capital outflow may be after all and even bigger 800-lb 🦍 than reserve currency glory.

Current winds seem to indicate the latter, but to implement the former would only take a few short months.

China's incentives are & have always been quite clear:

(1) Promote Yuan, counteract US dollar dominance

and

(2) Prevent capital outflows from its own 1Bn+ people.

Only problem is: these two objectives tend to be diametrically opposed.

Thus China is left vacillating between full-on pushing stablecoin Yuan down on its people to aggressively fight against USDT/USDC the same way WeChat forced out the credit card market ....

vs.

Or it could just... not...

Capital outflow may be after all and even bigger 800-lb 🦍 than reserve currency glory.

Current winds seem to indicate the latter, but to implement the former would only take a few short months.

• • •

Missing some Tweet in this thread? You can try to

force a refresh