At some point, you just need 8-15% no leverage, no fees to enter, no fees to exit, and consistency.

Beat T-Bills, beat REITs, beat high-yield savings, and sleep well.

This thread is for that.

🌱Best non-leveraged stablecoin yields🌱

🧵👇

Beat T-Bills, beat REITs, beat high-yield savings, and sleep well.

This thread is for that.

🌱Best non-leveraged stablecoin yields🌱

🧵👇

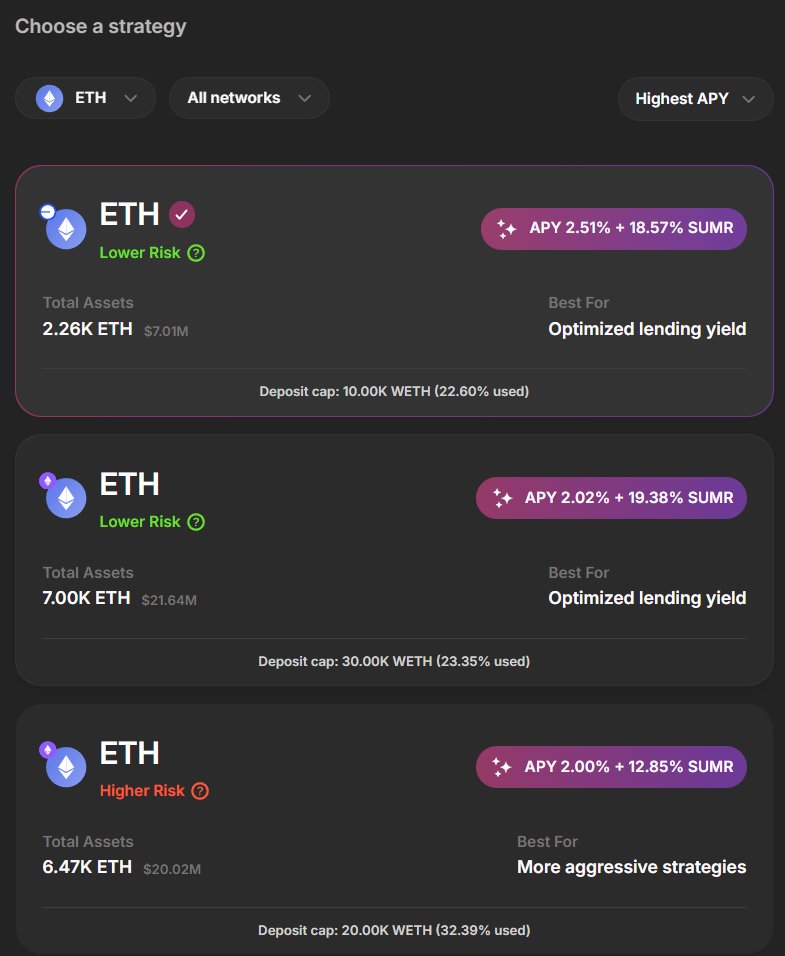

1) @summerfinance_

I love lend aggregators. I've written threads and done videos on this.

SummerFi is one of the best.

► 8-11% base APR in USDC

► +10-20% $SUMR APR (est sept/oct)

Enter or Exit whenever you want.

Get higher SUMR yield w/ this link:

summer.fi/earn?referralC…

I love lend aggregators. I've written threads and done videos on this.

SummerFi is one of the best.

► 8-11% base APR in USDC

► +10-20% $SUMR APR (est sept/oct)

Enter or Exit whenever you want.

Get higher SUMR yield w/ this link:

summer.fi/earn?referralC…

2) @infiniFi_

My largest stablecoin positions are in infinifi.

It's effectively a @pendle_fi PT ETF with full liquidity on siUSD or you can choose when to exit with liUSDs.

► 9.3% on liquid siUSD

► 13-16% on liUSD (1-8 wk)

► Points

Exit into USDC 1:1 😤

My largest stablecoin positions are in infinifi.

It's effectively a @pendle_fi PT ETF with full liquidity on siUSD or you can choose when to exit with liUSDs.

► 9.3% on liquid siUSD

► 13-16% on liUSD (1-8 wk)

► Points

Exit into USDC 1:1 😤

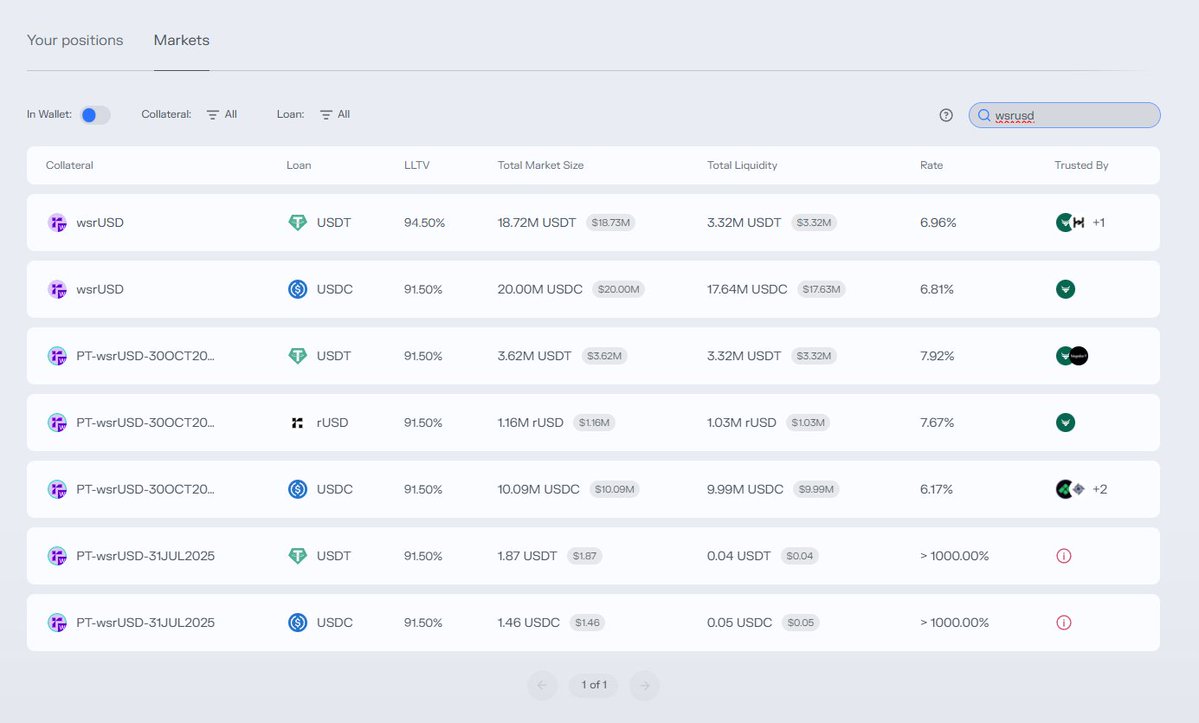

3) @reservoir_xyz

► 8.25% APY

► Redeem into USDC 1:1 whenever

► No fee to redeem wsrUSD

► S2 Points

If you want to get a little cute, check out Morpho on Plume...

► 8.25% APY

► Redeem into USDC 1:1 whenever

► No fee to redeem wsrUSD

► S2 Points

If you want to get a little cute, check out Morpho on Plume...

4) @ResolvLabs

Best way to get basis trade exposure.

► 6.5% 7d Senior Tranche wsrUSR Yield

► 10.7 7d Junior Tranche RLP Yield

Both of these will be higher next week.

The fact that wstUSR has >6% yield and a $230M loss buffer is insane to me.

Best way to get basis trade exposure.

► 6.5% 7d Senior Tranche wsrUSR Yield

► 10.7 7d Junior Tranche RLP Yield

Both of these will be higher next week.

The fact that wstUSR has >6% yield and a $230M loss buffer is insane to me.

5) @gauntlet_xyz

Gauntlet is the king of curation. Their vault on @base is the best way to get exposure to their expertise.

Like I said, I love lend aggregation.

8.5% 7d APY, exciting updates coming soon.

Gauntlet is the king of curation. Their vault on @base is the best way to get exposure to their expertise.

Like I said, I love lend aggregation.

8.5% 7d APY, exciting updates coming soon.

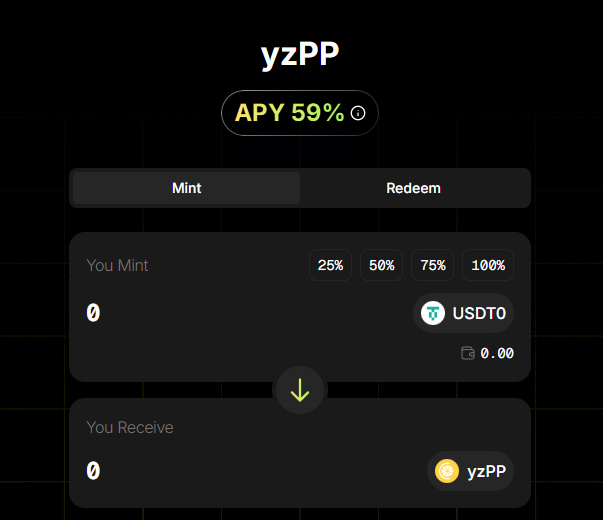

6) @pendle_fi

Obviously, you can just use pendle.

➤ Tens of millions in liquidity

➤ 8-16% FIXED rate APRs

➤ Billions in protocol TVL

Pendle is the definition of sleep adjusted returns.

Obviously, you can just use pendle.

➤ Tens of millions in liquidity

➤ 8-16% FIXED rate APRs

➤ Billions in protocol TVL

Pendle is the definition of sleep adjusted returns.

7) @yield

I've been checking out Yo since they've hit 75M in TVL and I actually like their mechanism a lot.

They have an independent risk-assessment system from Exponential, which then runs yields through their grading algo to adjust the weighting of their yields.

10.5% APY

I've been checking out Yo since they've hit 75M in TVL and I actually like their mechanism a lot.

They have an independent risk-assessment system from Exponential, which then runs yields through their grading algo to adjust the weighting of their yields.

10.5% APY

9) @MidasRWA

@EdgeCapitalMgmt and @MEVCapital run strategy vaults that are currently averaging 17% APY.

You can now exit these over a two-day period WITH NO EXIT FEES.

Granted, if you wanted to exit immediately with no fees, you can if you're a member of the DeFi Dojo.

@EdgeCapitalMgmt and @MEVCapital run strategy vaults that are currently averaging 17% APY.

You can now exit these over a two-day period WITH NO EXIT FEES.

Granted, if you wanted to exit immediately with no fees, you can if you're a member of the DeFi Dojo.

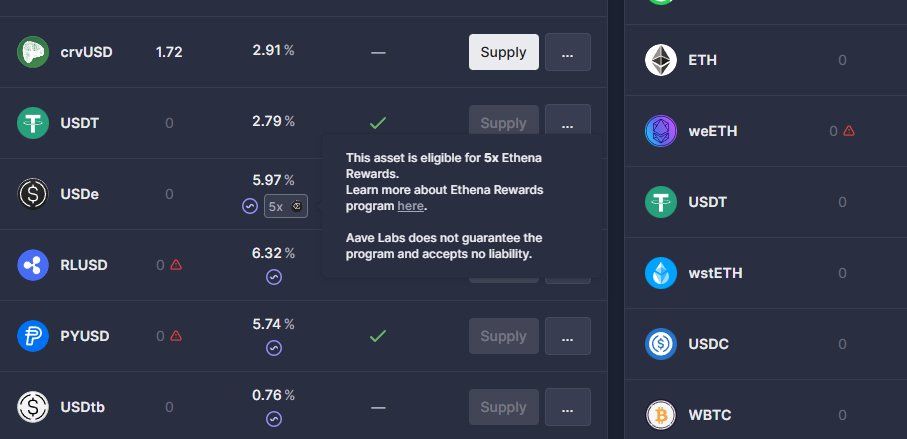

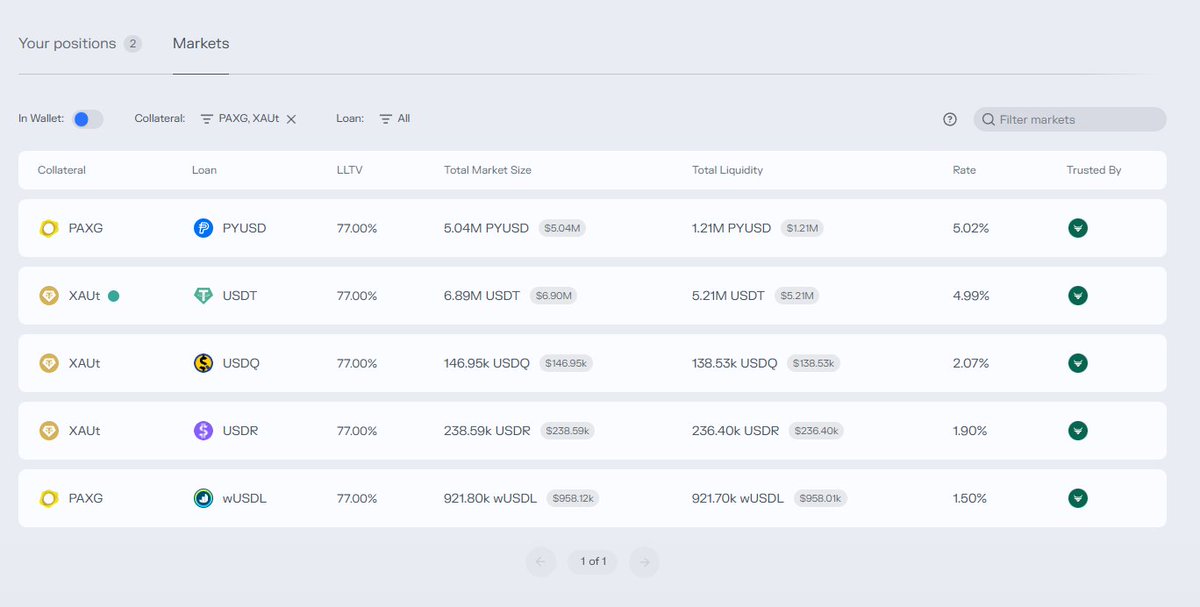

10) Lending on @plumenetwork on @MorphoLabs

Highly incentivized via @merkl_xyz, you can mint and redeem pUSD 1:1 with USDC.

14.75% APY.

Highly incentivized via @merkl_xyz, you can mint and redeem pUSD 1:1 with USDC.

14.75% APY.

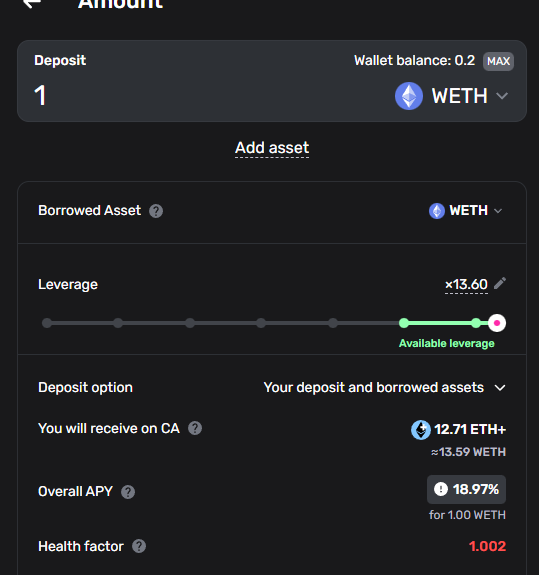

11) Lending on @GearboxProtocol

► 20% USDC to lend on the Invariant Group market

► Incentives in GEAR and USDf

► 20% USDC to lend on the Invariant Group market

► Incentives in GEAR and USDf

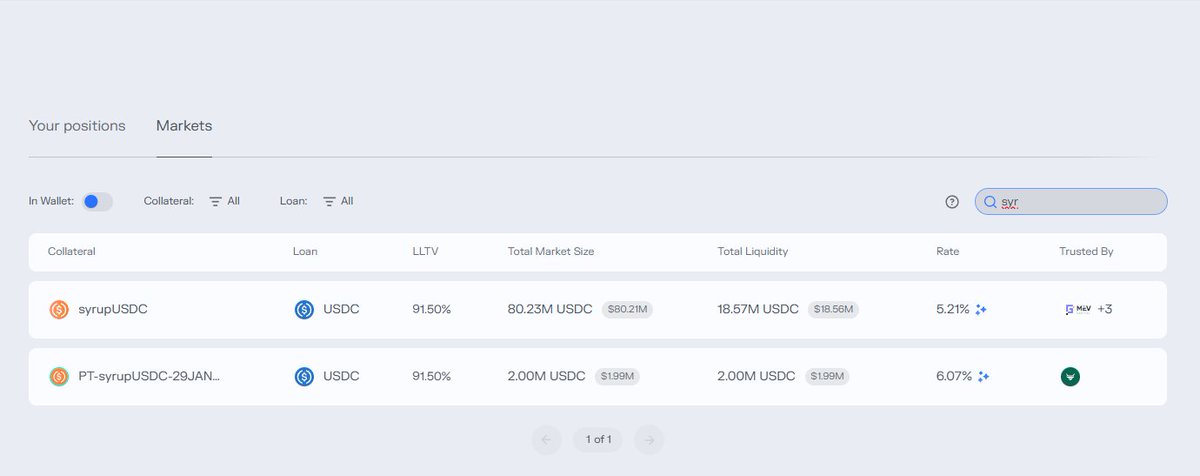

12) Last but not least, @syrupfi

► 6.8% for no lockup

► 9-11% for 6mo lockup

These positions have also been a great way to get exposure to $SYRUP which has done great this cycle.

You can always exit locked positions through @CoWSwap.

► 6.8% for no lockup

► 9-11% for 6mo lockup

These positions have also been a great way to get exposure to $SYRUP which has done great this cycle.

You can always exit locked positions through @CoWSwap.

13) @StreamDefi

Let the experts farm for you.

► 13.29% APY,

► ~24hr redeem period

Mint / Redeem with USDC

Let the experts farm for you.

► 13.29% APY,

► ~24hr redeem period

Mint / Redeem with USDC

We'll leave it there.

Most of your stablecoins SHOULD NOT BE LEVERAGED. This allows you to enter and exit other positions rapidly when you need to.

Why not get 8-15% on those liquid stables.

Ambassadors Mentioned:

► Gearbox

► SummerFi

► Infinifi

► Pendle

► Reservoir

Most of your stablecoins SHOULD NOT BE LEVERAGED. This allows you to enter and exit other positions rapidly when you need to.

Why not get 8-15% on those liquid stables.

Ambassadors Mentioned:

► Gearbox

► SummerFi

► Infinifi

► Pendle

► Reservoir

• • •

Missing some Tweet in this thread? You can try to

force a refresh