Bitcoin Treasury Companies: The Quiet Superweapon Reshaping Global Capital 🧵

To the untrained eye, Bitcoin treasury companies look like fiat-finance cosplay.

Leverage? Debt? Derivatives?

Sounds like Wall Street LARPing with Bitcoin branding.

Then Preston Pysh explained what they really are. Everything changed.

To the untrained eye, Bitcoin treasury companies look like fiat-finance cosplay.

Leverage? Debt? Derivatives?

Sounds like Wall Street LARPing with Bitcoin branding.

Then Preston Pysh explained what they really are. Everything changed.

He didn’t just explain how they work.

He explained what they are.

Not scams. Not distractions. Not detours.

Bitcoin treasury companies are super spreaders - engineered to infect legacy capital markets with Bitcoin.

He explained what they are.

Not scams. Not distractions. Not detours.

Bitcoin treasury companies are super spreaders - engineered to infect legacy capital markets with Bitcoin.

These aren’t get-rich-quick shells.

They’re transmission systems.

Multi-gear machines designed to accumulate BTC across every macro cycle:

• Loose credit? Issue debt.

• Tight credit? Raise equity.

• Always stack. Always adapt.

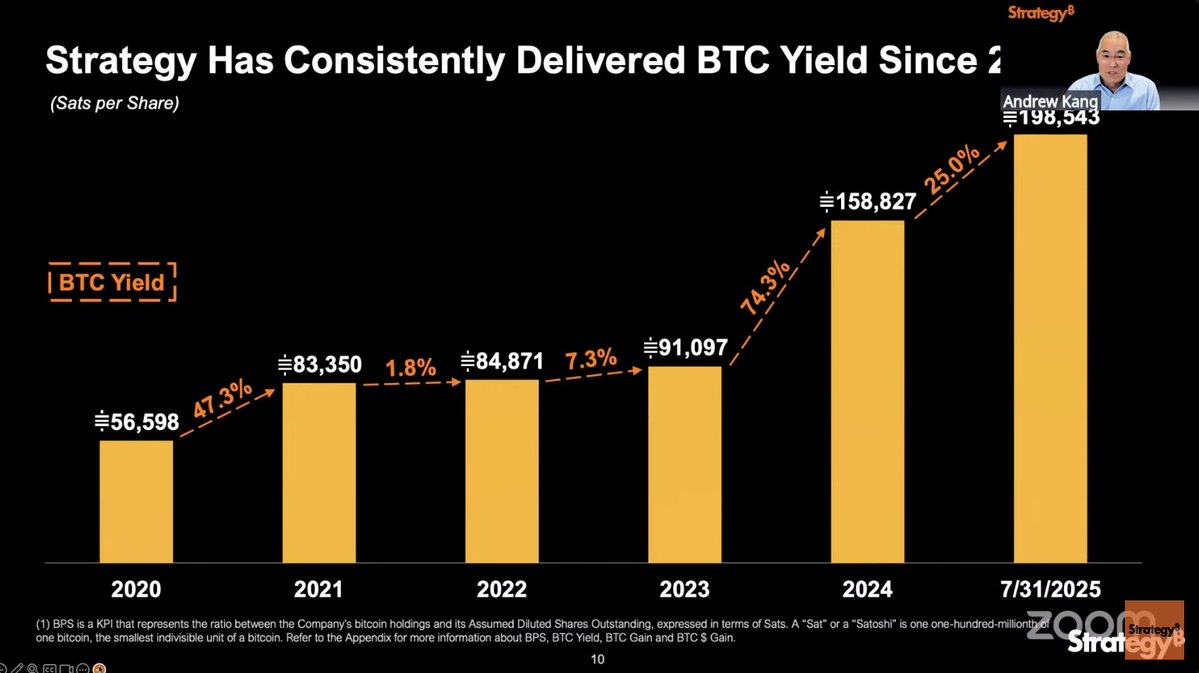

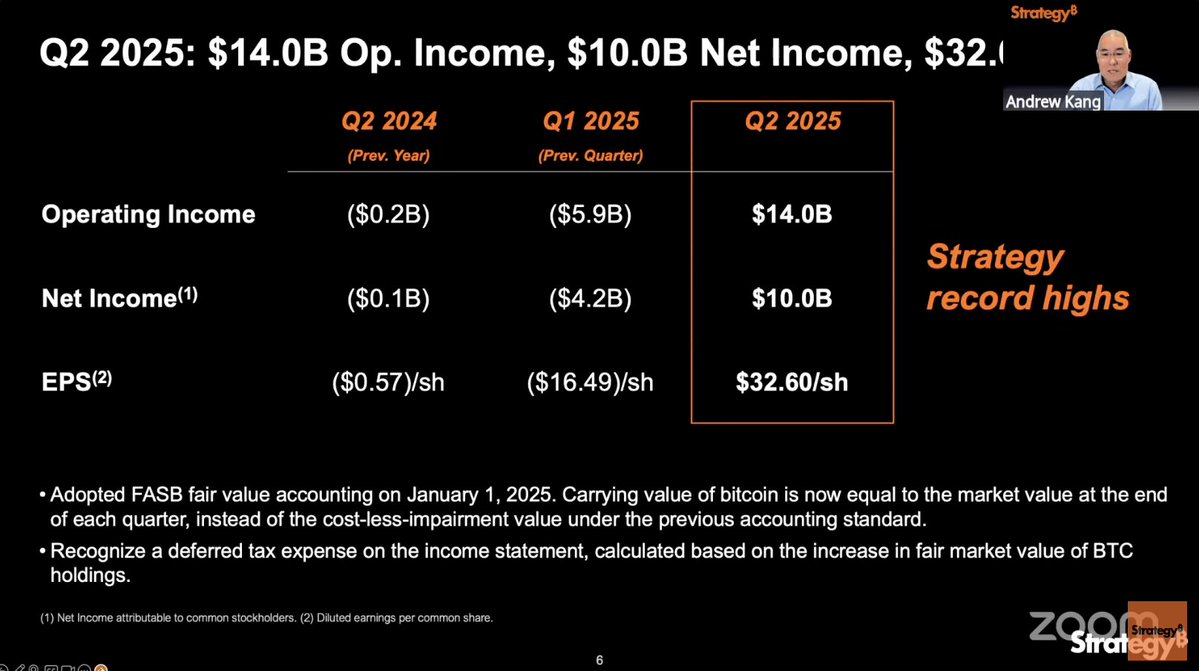

Saylor’s strategy isn’t improvisation - it’s mechanical design.

They’re transmission systems.

Multi-gear machines designed to accumulate BTC across every macro cycle:

• Loose credit? Issue debt.

• Tight credit? Raise equity.

• Always stack. Always adapt.

Saylor’s strategy isn’t improvisation - it’s mechanical design.

Need yield?

Boomers want income?

Institutions demand fixed returns?

Perfect.

The product isn’t Bitcoin.

The product is yield, security, and compliance - wrapped around Bitcoin.

Bitcoin is the engine. Fiat is just the interface.

Boomers want income?

Institutions demand fixed returns?

Perfect.

The product isn’t Bitcoin.

The product is yield, security, and compliance - wrapped around Bitcoin.

Bitcoin is the engine. Fiat is just the interface.

Consider a BTC-backed preferred instrument like STRC:

• 10% yield to investors

• Fiat gets converted to BTC

• Bitcoin compounds at 40–45% annually

• The company pockets the spread

• Shareholders win

This is fixed income, Bitcoinized.

• 10% yield to investors

• Fiat gets converted to BTC

• Bitcoin compounds at 40–45% annually

• The company pockets the spread

• Shareholders win

This is fixed income, Bitcoinized.

The brilliance?

These companies siphon fiat from boomers, funds, and pensions…

…and quietly convert it to Bitcoin on the balance sheet.

To most, it looks like a bond.

In reality, it’s a stealth Bitcoin acquisition pipeline.

These companies siphon fiat from boomers, funds, and pensions…

…and quietly convert it to Bitcoin on the balance sheet.

To most, it looks like a bond.

In reality, it’s a stealth Bitcoin acquisition pipeline.

And it’s all public.

That’s the key.

Private markets hide.

Public markets expose.

Auditors, regulators, shareholders, bots - everyone’s watching.

Everyone’s verifying.

Bitcoin treasury companies bring Bitcoin’s transparency to fiat finance.

That’s the key.

Private markets hide.

Public markets expose.

Auditors, regulators, shareholders, bots - everyone’s watching.

Everyone’s verifying.

Bitcoin treasury companies bring Bitcoin’s transparency to fiat finance.

This isn’t Bitcoin getting financialized.

This is finance getting Bitcoinized.

Just like Hayek foresaw:

Not through revolution,

But through replication - through the cracks in the fiat system.

This is finance getting Bitcoinized.

Just like Hayek foresaw:

Not through revolution,

But through replication - through the cracks in the fiat system.

By 2030?

Bitcoin will be owned via:

• Pensions

• S&P 500 ETFs

• Income funds

• Boomer bond allocations

It’ll seep into cap tables, balance sheets, and dividend checks - unnoticed, inevitable.

Bitcoin will be owned via:

• Pensions

• S&P 500 ETFs

• Income funds

• Boomer bond allocations

It’ll seep into cap tables, balance sheets, and dividend checks - unnoticed, inevitable.

There are risks:

• Overleverage

• Custody models

• Regulatory choke points

• Nationalization

That’s why sizing matters.

Think probabilistically.

Bitcoin is the risk-free rate.

Treasury companies are the convex bet.

• Overleverage

• Custody models

• Regulatory choke points

• Nationalization

That’s why sizing matters.

Think probabilistically.

Bitcoin is the risk-free rate.

Treasury companies are the convex bet.

Here’s the final unlock:

This isn’t just about capital.

It’s about frequency.

Bitcoin settles every 10 minutes.

Legacy finance settles weekly, if at all.

To pass the baton, systems must match pace.

Stablecoins enable that handoff - not evil, but essential.

This isn’t just about capital.

It’s about frequency.

Bitcoin settles every 10 minutes.

Legacy finance settles weekly, if at all.

To pass the baton, systems must match pace.

Stablecoins enable that handoff - not evil, but essential.

The “Great Monetary Reset” won’t look like a revolution.

It’ll be:

• A cap table reshuffle

• A yield curve inversion

• A custody model upgrade

• A thousand quiet conversions on a thousand balance sheets

All hiding in plain sight.

It’ll be:

• A cap table reshuffle

• A yield curve inversion

• A custody model upgrade

• A thousand quiet conversions on a thousand balance sheets

All hiding in plain sight.

Bitcoin isn’t just winning.

It’s colonizing.

Every preferred stock issuance, every BTC balance sheet strategy, every retiree earning yield through the hardest money ever created - wrapped in a fixed-income shell.

It’s colonizing.

Every preferred stock issuance, every BTC balance sheet strategy, every retiree earning yield through the hardest money ever created - wrapped in a fixed-income shell.

This isn’t the early phase.

This is the national anthem.

The game hasn’t even started.

But the playbook?

Already written.

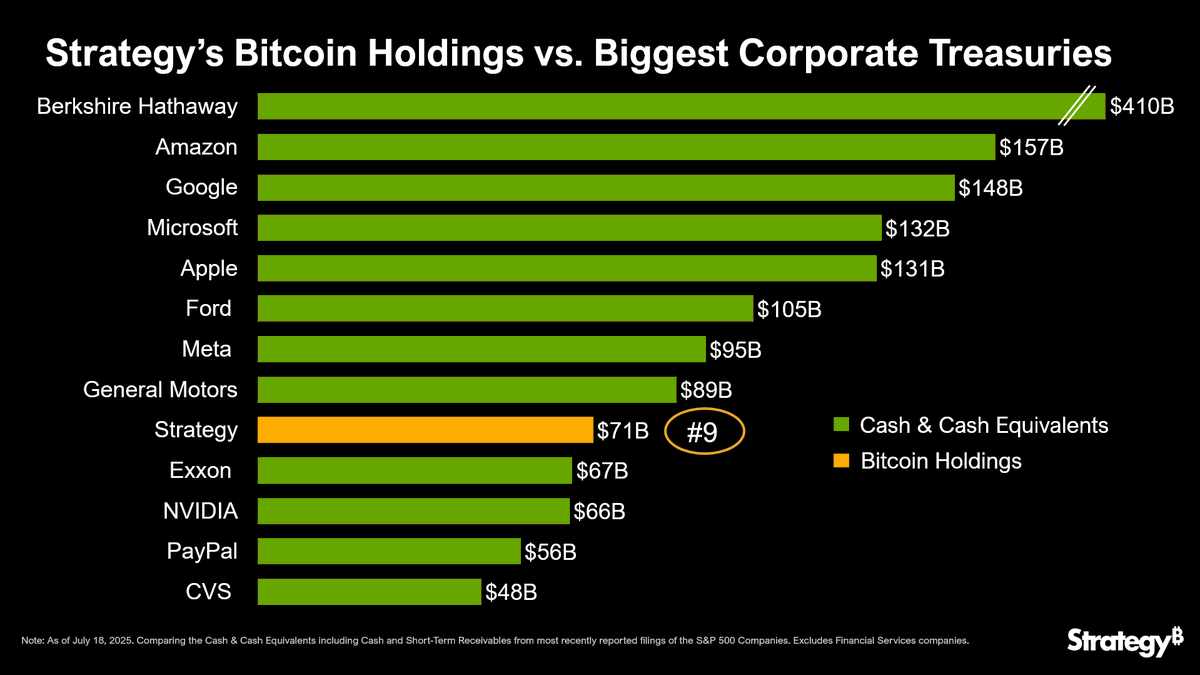

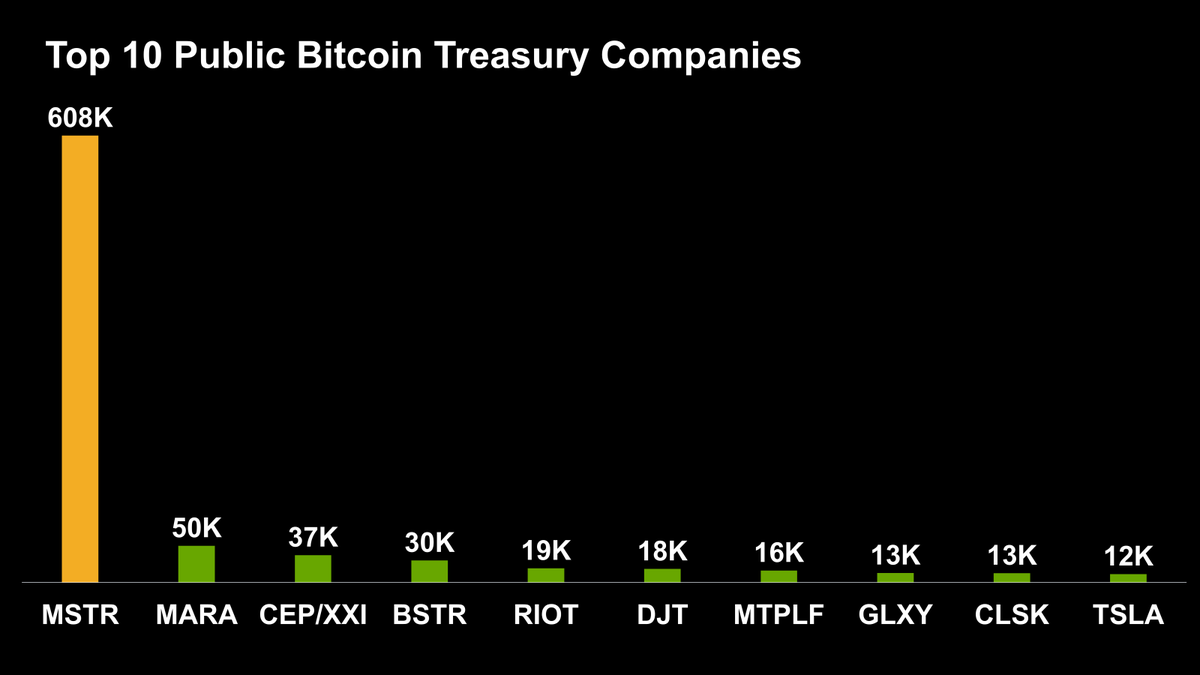

By Strategy.

By Metaplanet.

By Sequans.

By the builders - those who craft transmissions, not just tweets.

This is the national anthem.

The game hasn’t even started.

But the playbook?

Already written.

By Strategy.

By Metaplanet.

By Sequans.

By the builders - those who craft transmissions, not just tweets.

Still think Bitcoin treasury companies are fiat cosplay?

Still think it’s just a gimmick?

Then the signal’s being missed.

Because this is hyperbitcoinization.

It’s happening now.

Quietly. Systematically. From inside the gates.

🧵 / END

Still think it’s just a gimmick?

Then the signal’s being missed.

Because this is hyperbitcoinization.

It’s happening now.

Quietly. Systematically. From inside the gates.

🧵 / END

• • •

Missing some Tweet in this thread? You can try to

force a refresh