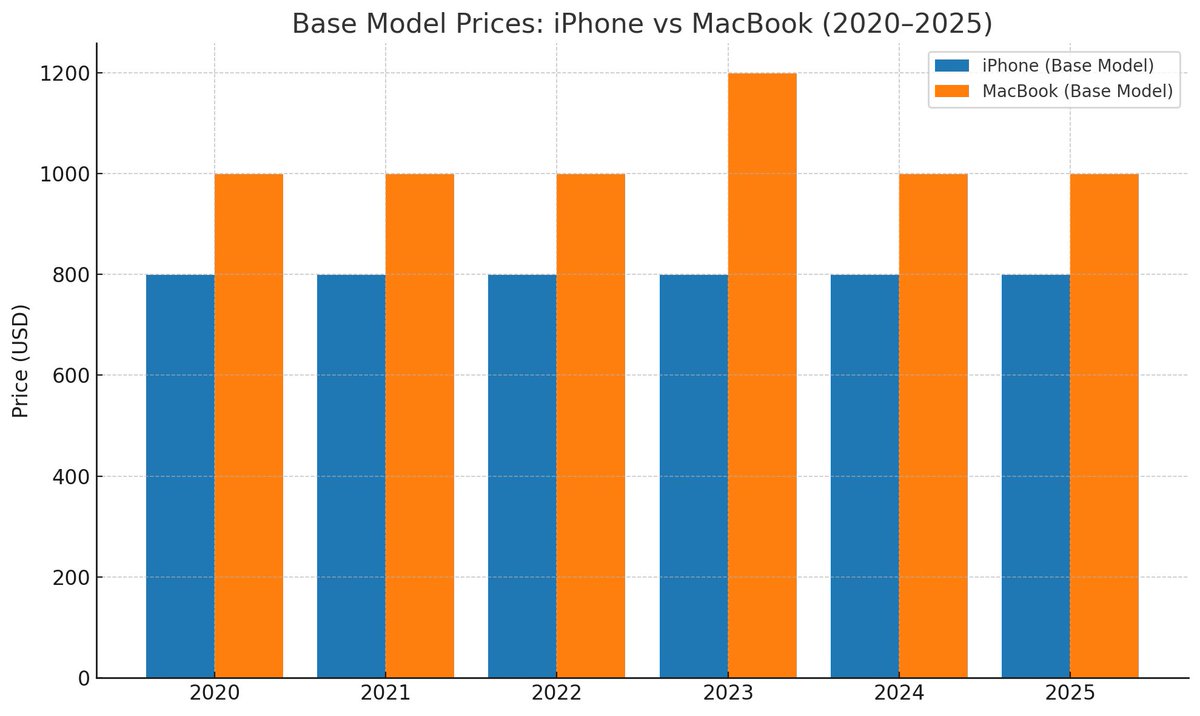

The bullish $AAPL case is price increases.

The latest base iPhone still only costs $799, the latest MacBook $999. That’s the same price since pre-inflation 2020. And the hardware has greatly improved.

Meanwhile Netflix has hiked prices 64%+ since. For the exact same service.

The latest base iPhone still only costs $799, the latest MacBook $999. That’s the same price since pre-inflation 2020. And the hardware has greatly improved.

Meanwhile Netflix has hiked prices 64%+ since. For the exact same service.

Apple’s products last for a very long time, get six years+ of OS updates & have high resale value, so the right way to see an iPhone has always been “per month”.

A $799 iPhone lasting six years is only $11.10/month. Same as in 2020.

Netflix Standard? $10.99 then, $17.99 now.

A $799 iPhone lasting six years is only $11.10/month. Same as in 2020.

Netflix Standard? $10.99 then, $17.99 now.

Now, I’m not saying that Apple should increase prices by 50% overnight. It would create a political blowback.

But Apple has definitely been way too slow to hike, and should have acted much faster.

Being the only business not increasing prices when inflation soared was stupid.

But Apple has definitely been way too slow to hike, and should have acted much faster.

Being the only business not increasing prices when inflation soared was stupid.

We should as consumers & society strongly appreciate Apple’s low per month pricing and their commitment to add many more features, better hardware and higher value while keeping prices fixed.

But from a business & share price perspective, not so much. Price increases will come.

But from a business & share price perspective, not so much. Price increases will come.

• • •

Missing some Tweet in this thread? You can try to

force a refresh