Escaped the Vampire Squid, surviving in the wasteland. Investing in bottlecaps, US UK EU & global assets. Also, jokes. Liking is not endorsing. Do your own DD.

6 subscribers

How to get URL link on X (Twitter) App

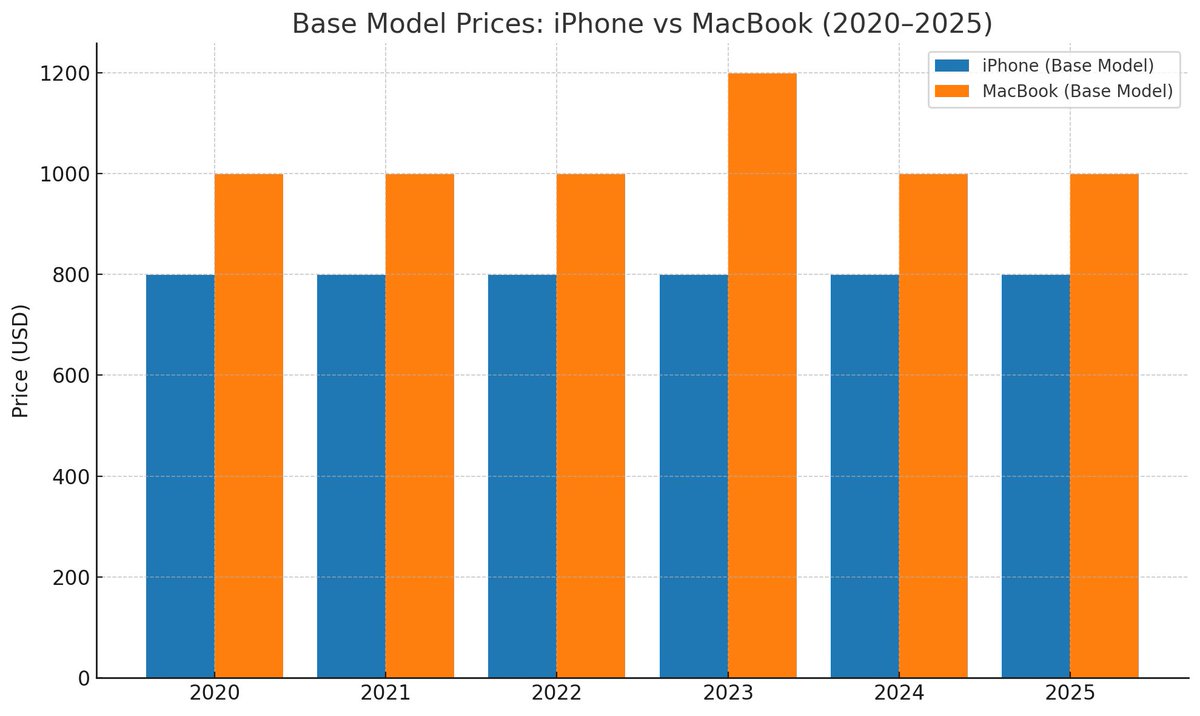

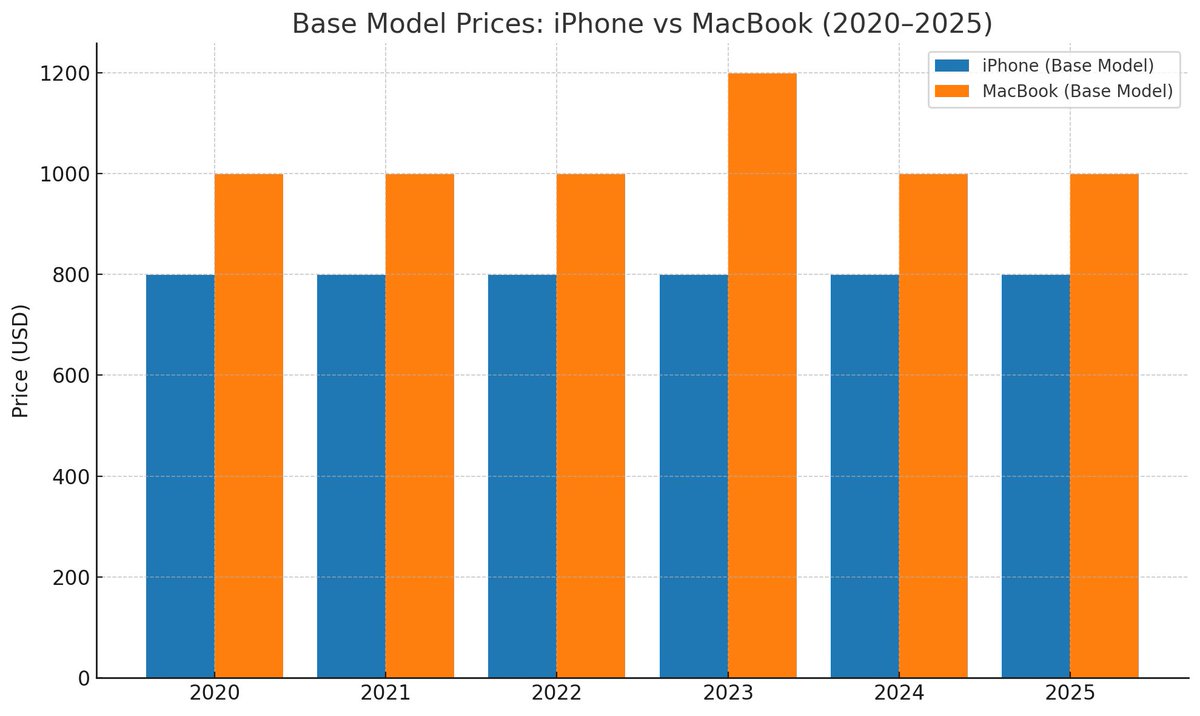

Apple’s products last for a very long time, get six years+ of OS updates & have high resale value, so the right way to see an iPhone has always been “per month”.

Apple’s products last for a very long time, get six years+ of OS updates & have high resale value, so the right way to see an iPhone has always been “per month”.

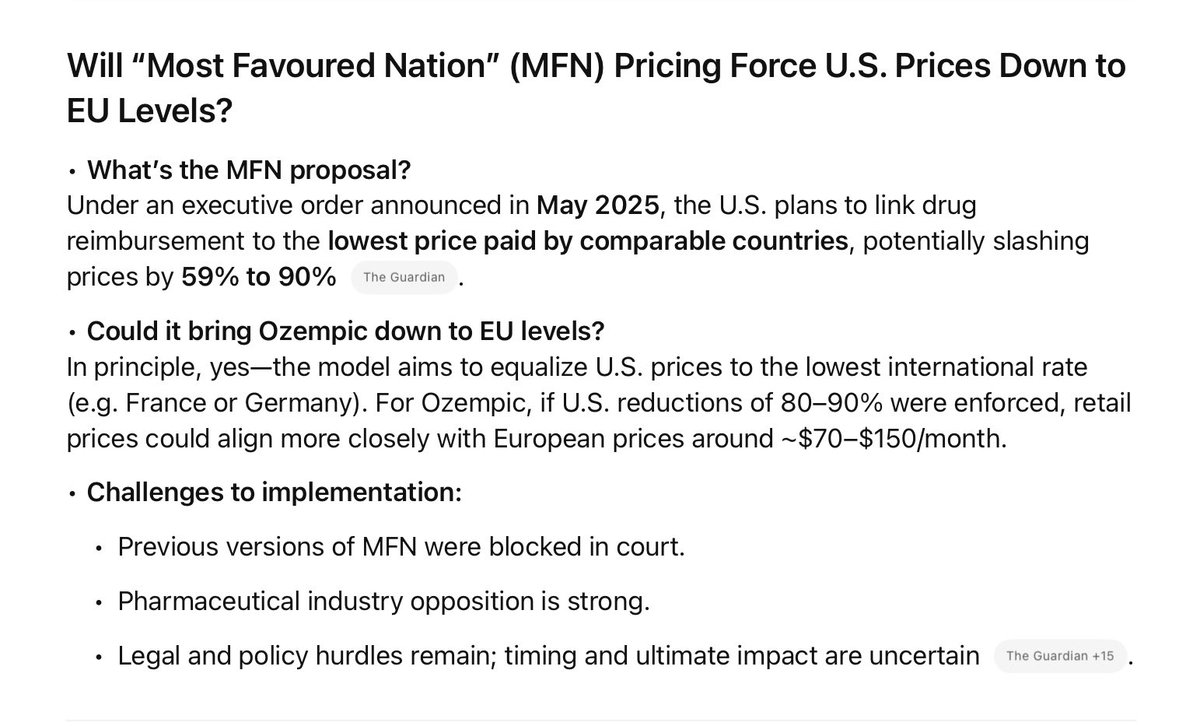

Now, what are the chances it happens? Hard to say.

Now, what are the chances it happens? Hard to say.

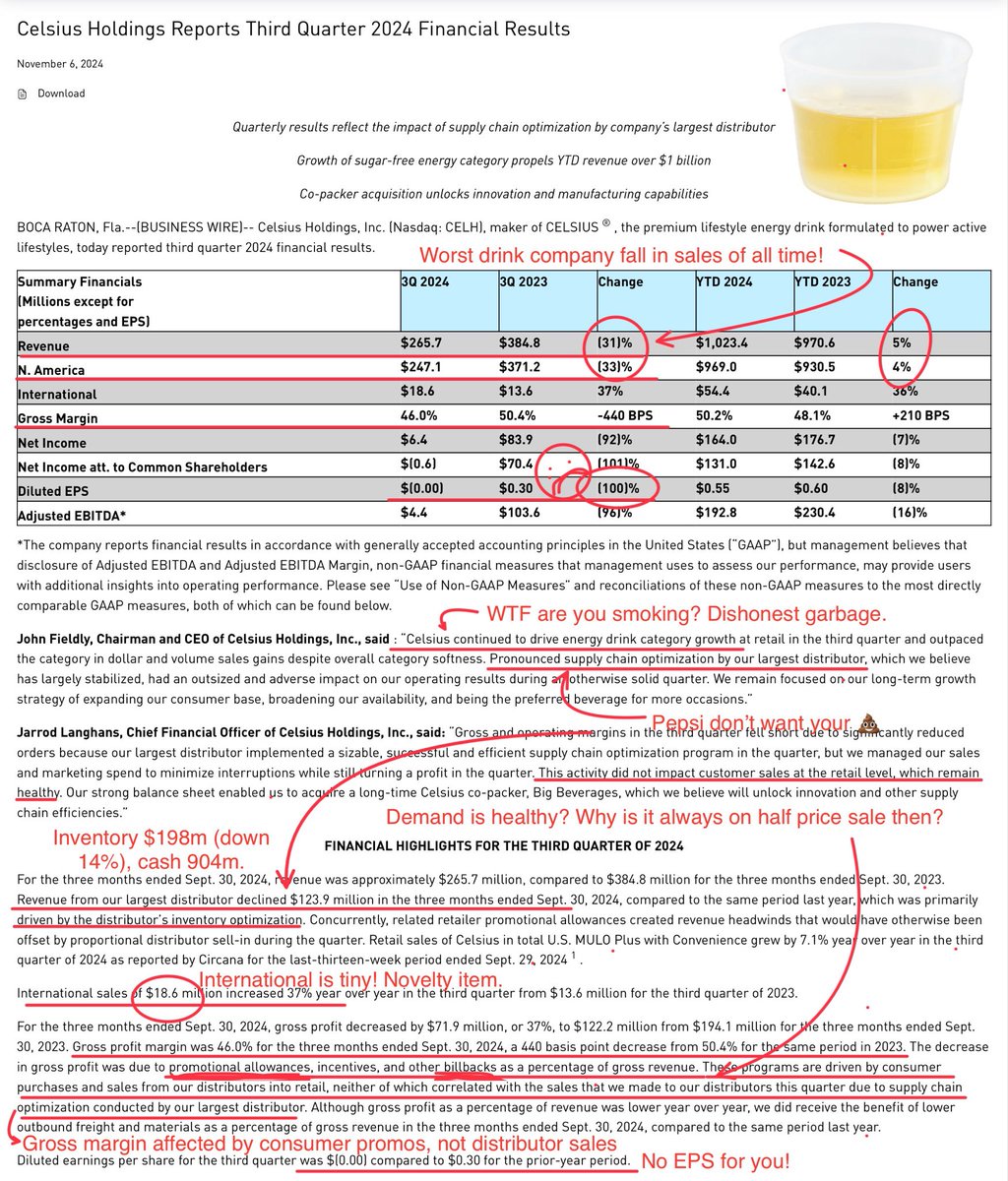

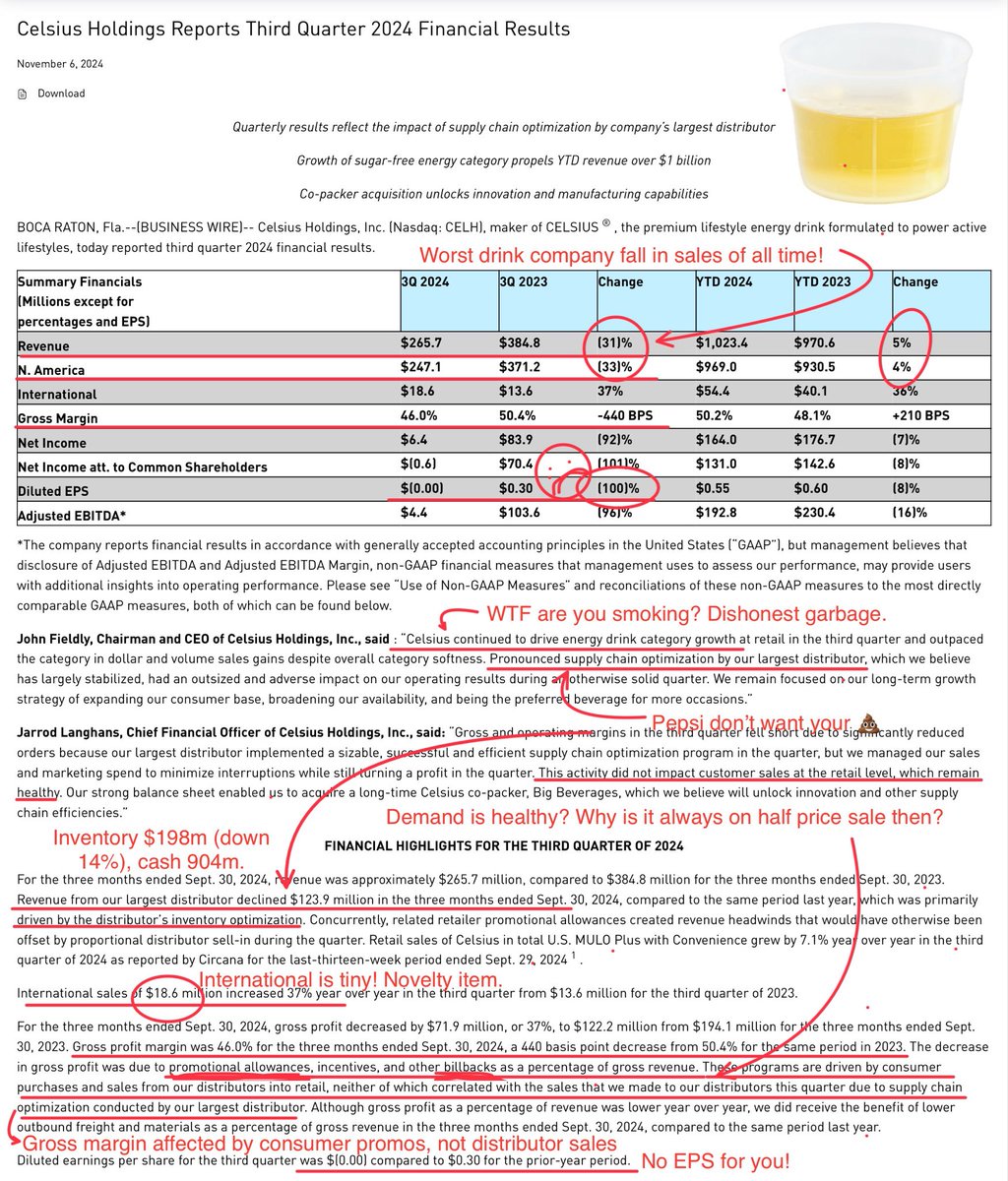

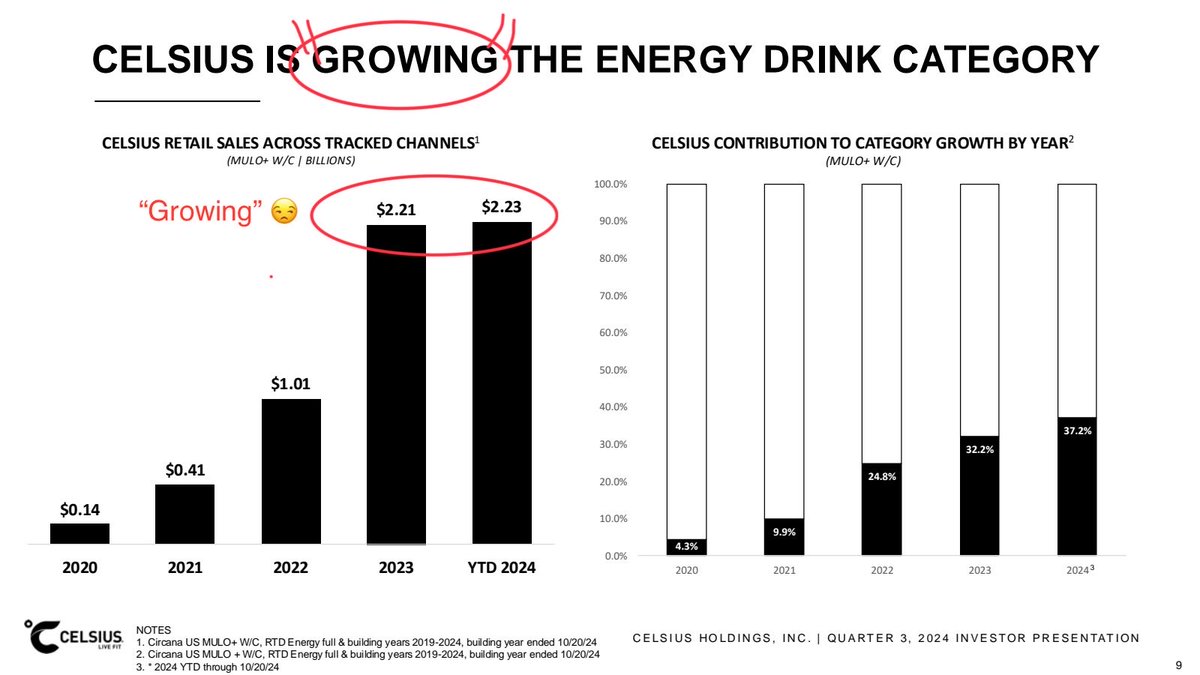

Just remember that they recognise revenue when it goes to the distributor, not when the stuff actually sells. Plus there are rebates and consumer promotion shenanigans affecting margins. So unclear when growth will return, or what they’ll do here exactly. 🤷♂️

Just remember that they recognise revenue when it goes to the distributor, not when the stuff actually sells. Plus there are rebates and consumer promotion shenanigans affecting margins. So unclear when growth will return, or what they’ll do here exactly. 🤷♂️

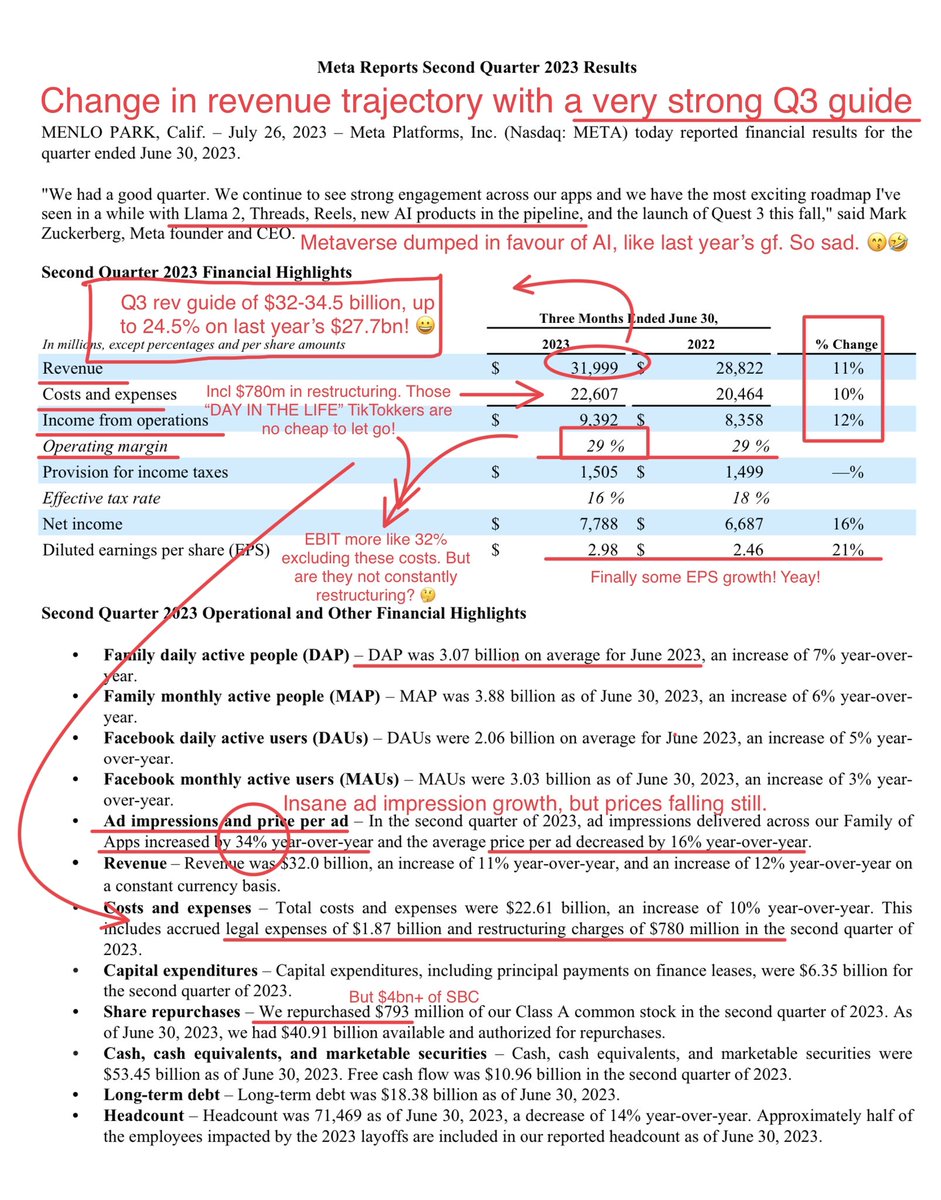

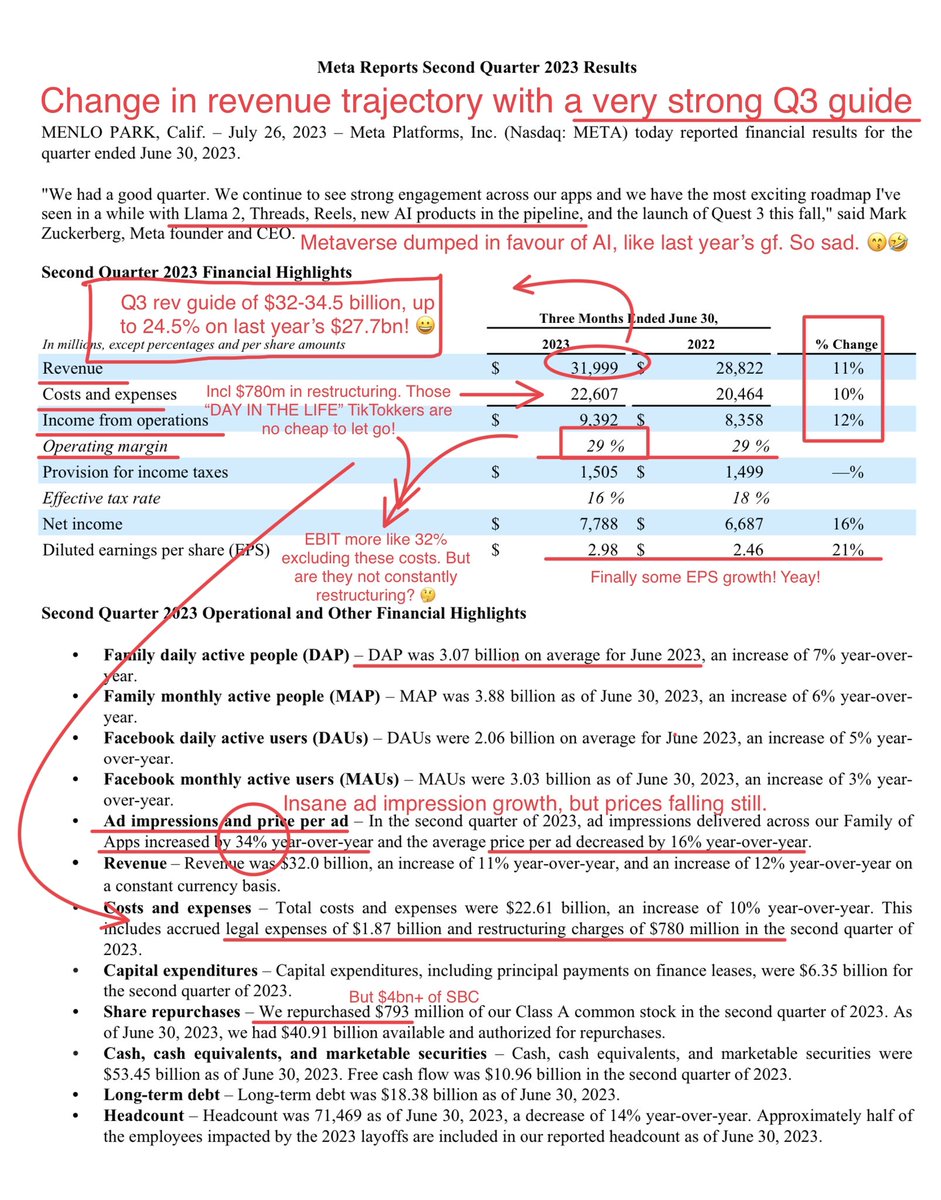

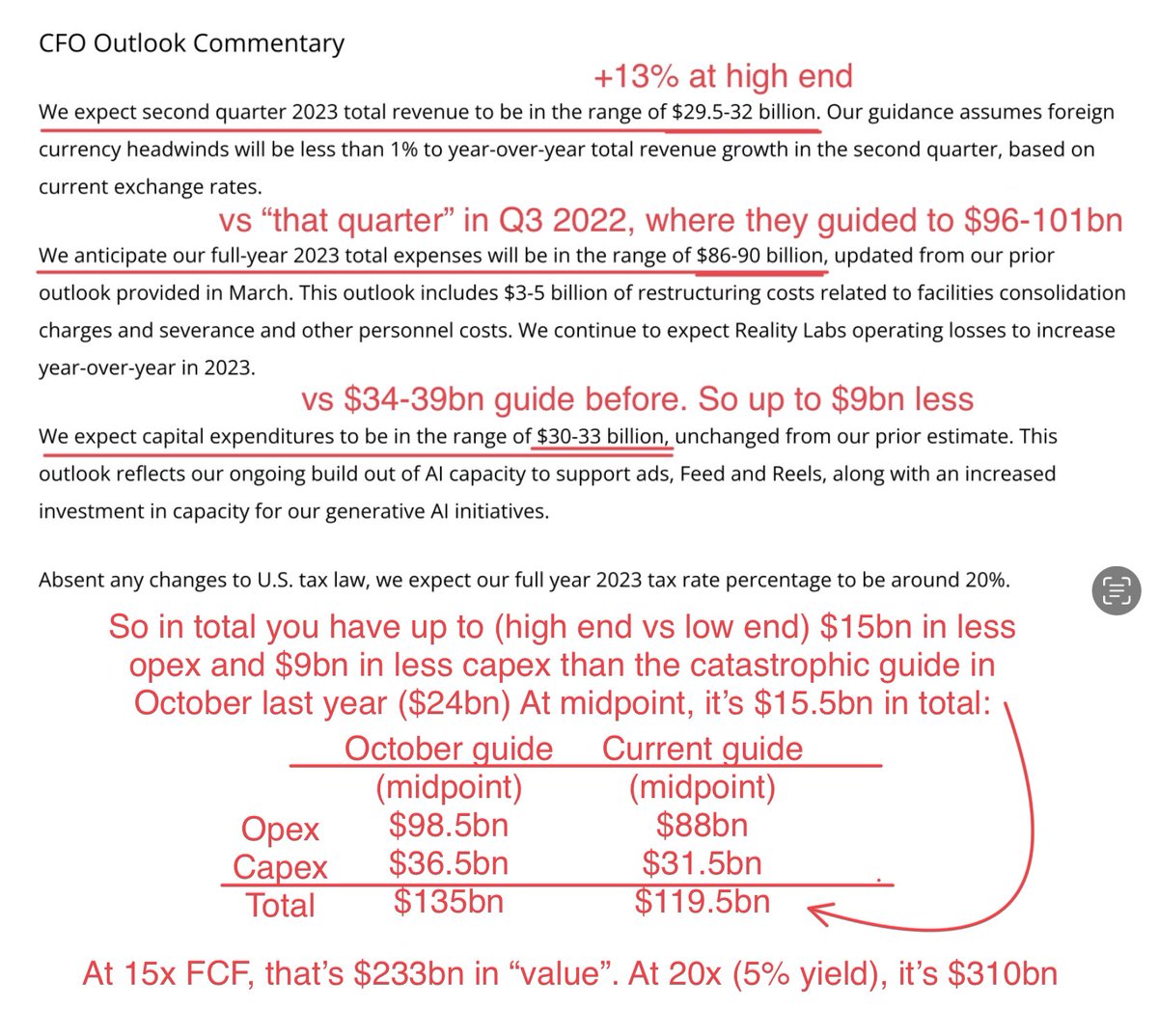

The bad: FCF was $11bn but a meagre $7bn post the simply yuuge $4.1bn SBC print this Q (and only $5.3bn post the stock withholding taxes, IRS gang gang!). On current $800bn cap, $7bn is 3.5% annualised FCF yield. If capex has moved to ‘24, how much FCF in ‘24? Key question!!! 🤔

The bad: FCF was $11bn but a meagre $7bn post the simply yuuge $4.1bn SBC print this Q (and only $5.3bn post the stock withholding taxes, IRS gang gang!). On current $800bn cap, $7bn is 3.5% annualised FCF yield. If capex has moved to ‘24, how much FCF in ‘24? Key question!!! 🤔

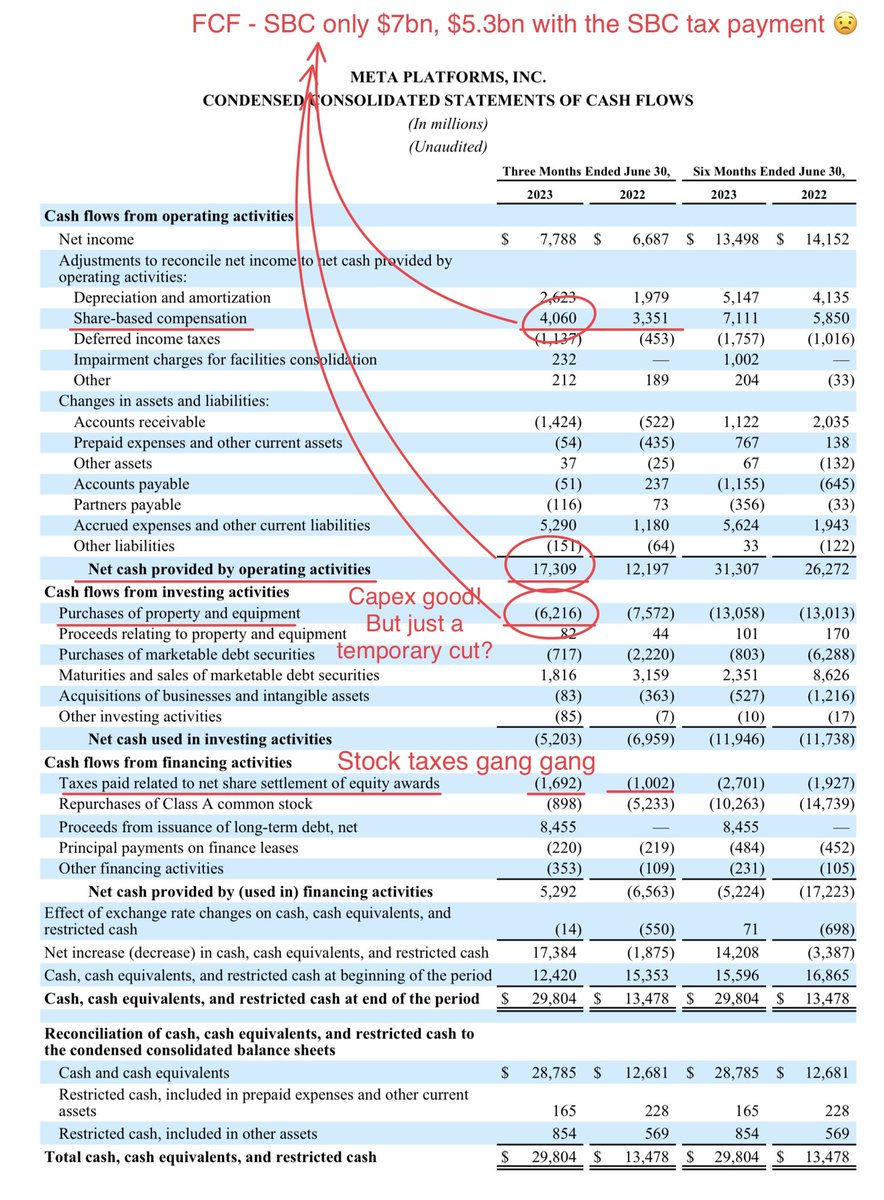

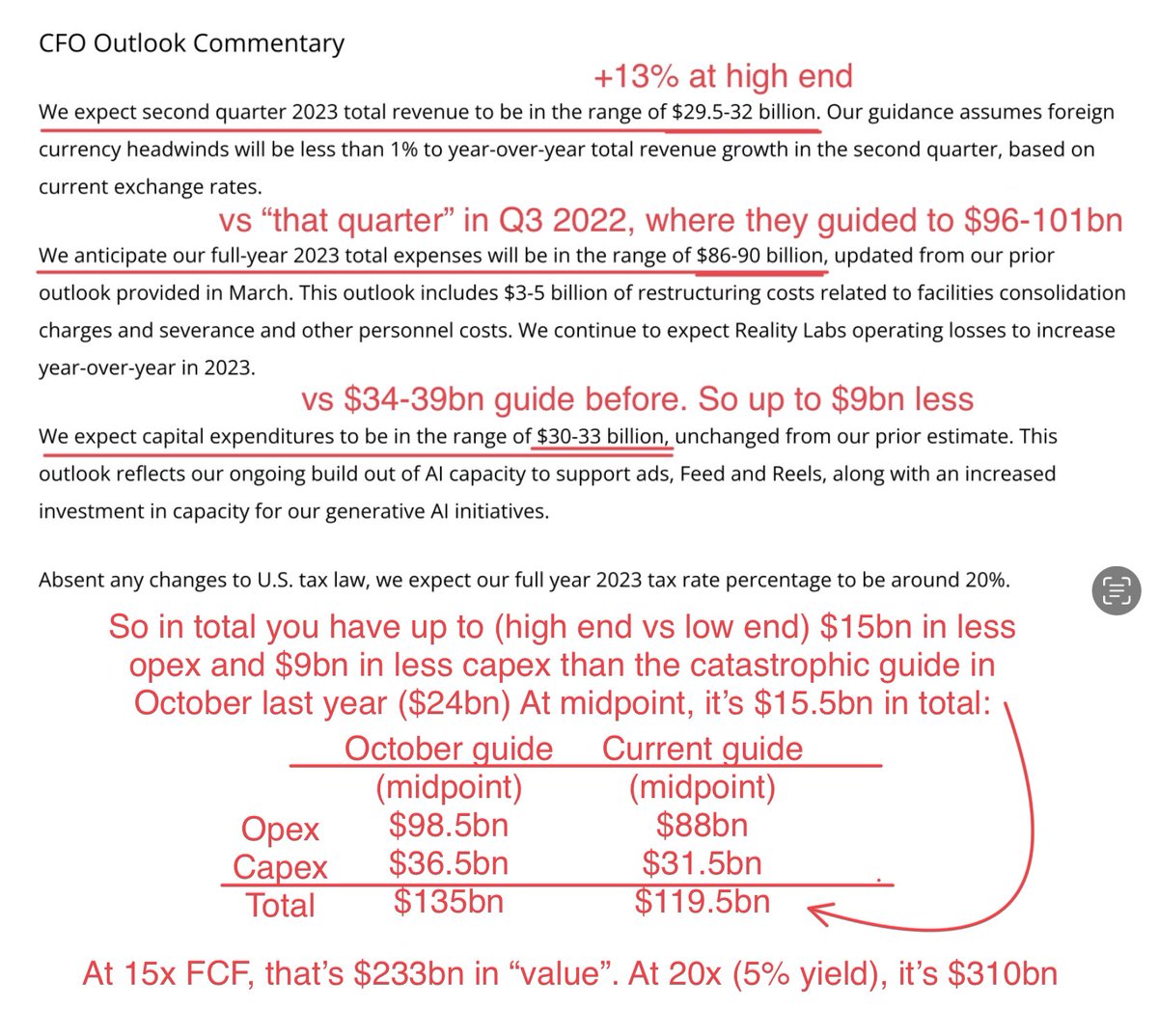

On the capex side they now guided to $30bn at the low end, vs up to $39bn in Q3, so up $9bn in less spend. Add that to $15bn, and you have UP TO $24bn in more FCF vs their guide in Q3 ‘22!

On the capex side they now guided to $30bn at the low end, vs up to $39bn in Q3, so up $9bn in less spend. Add that to $15bn, and you have UP TO $24bn in more FCF vs their guide in Q3 ‘22!

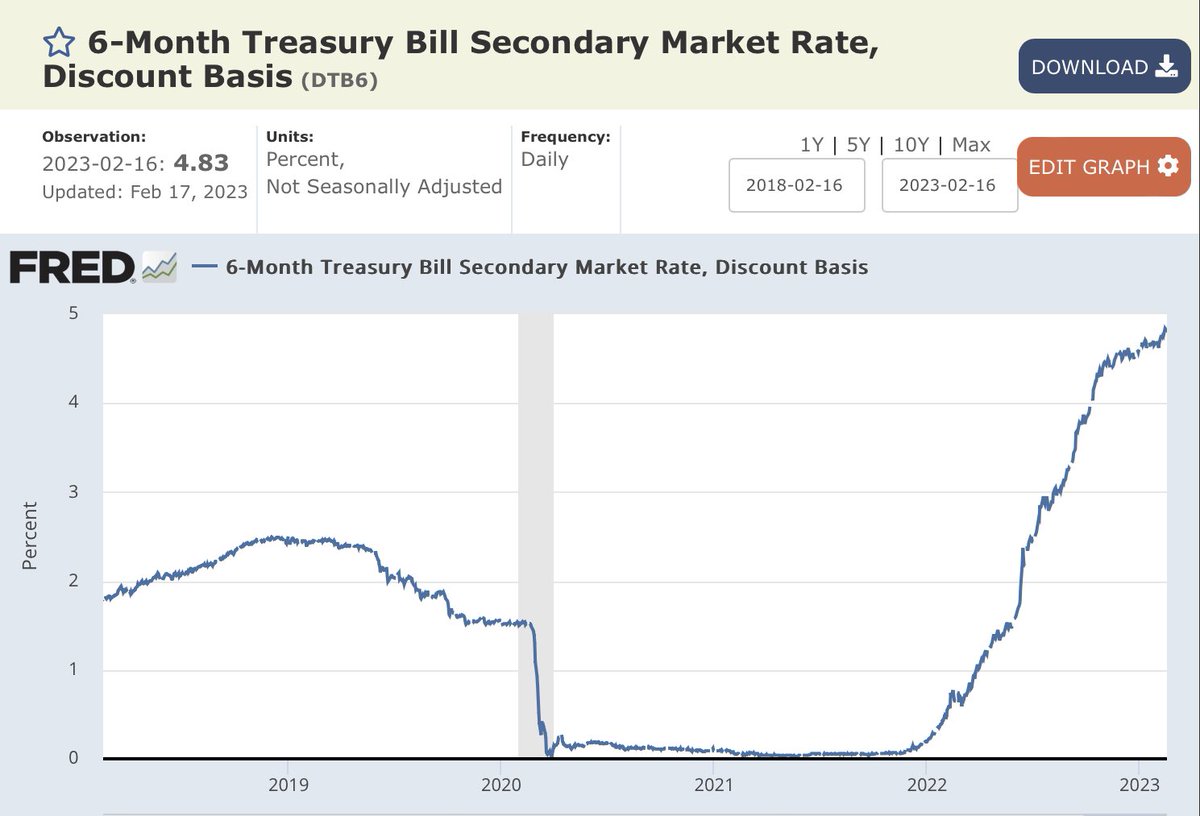

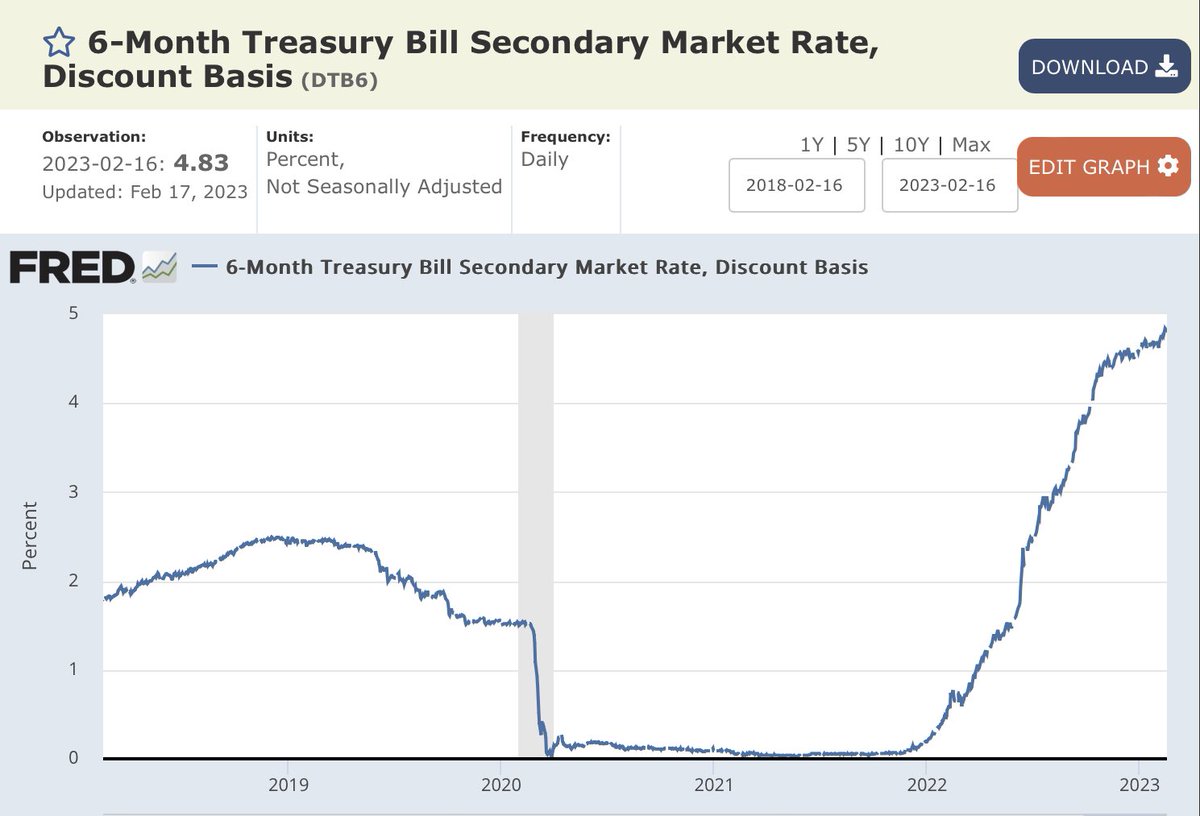

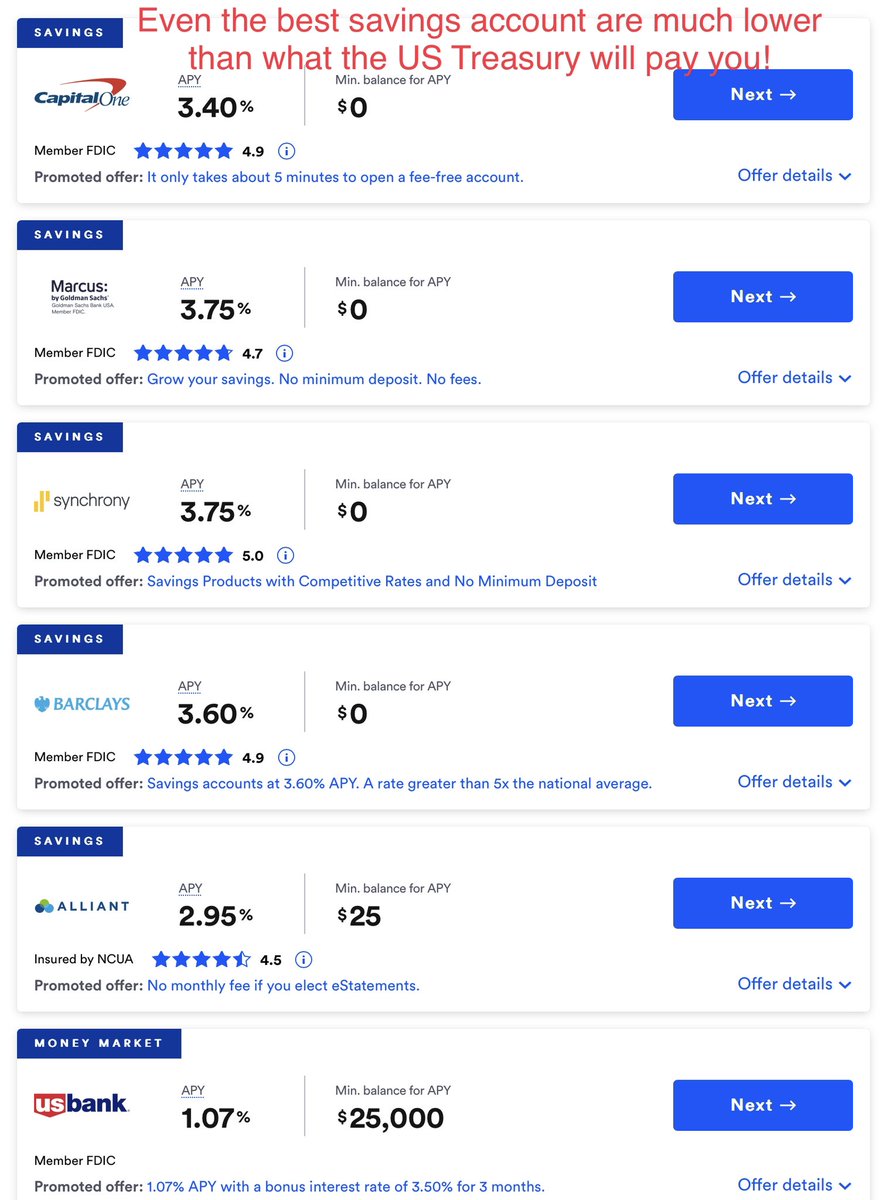

A Treasury Bill is a U.S. government bond that has 1 year or less to maturity (3, 6, 12 months). T-Bills (and the find who hold them) are very liquid and as safe as they can be. Uncle Sam short term IOUs!

A Treasury Bill is a U.S. government bond that has 1 year or less to maturity (3, 6, 12 months). T-Bills (and the find who hold them) are very liquid and as safe as they can be. Uncle Sam short term IOUs!

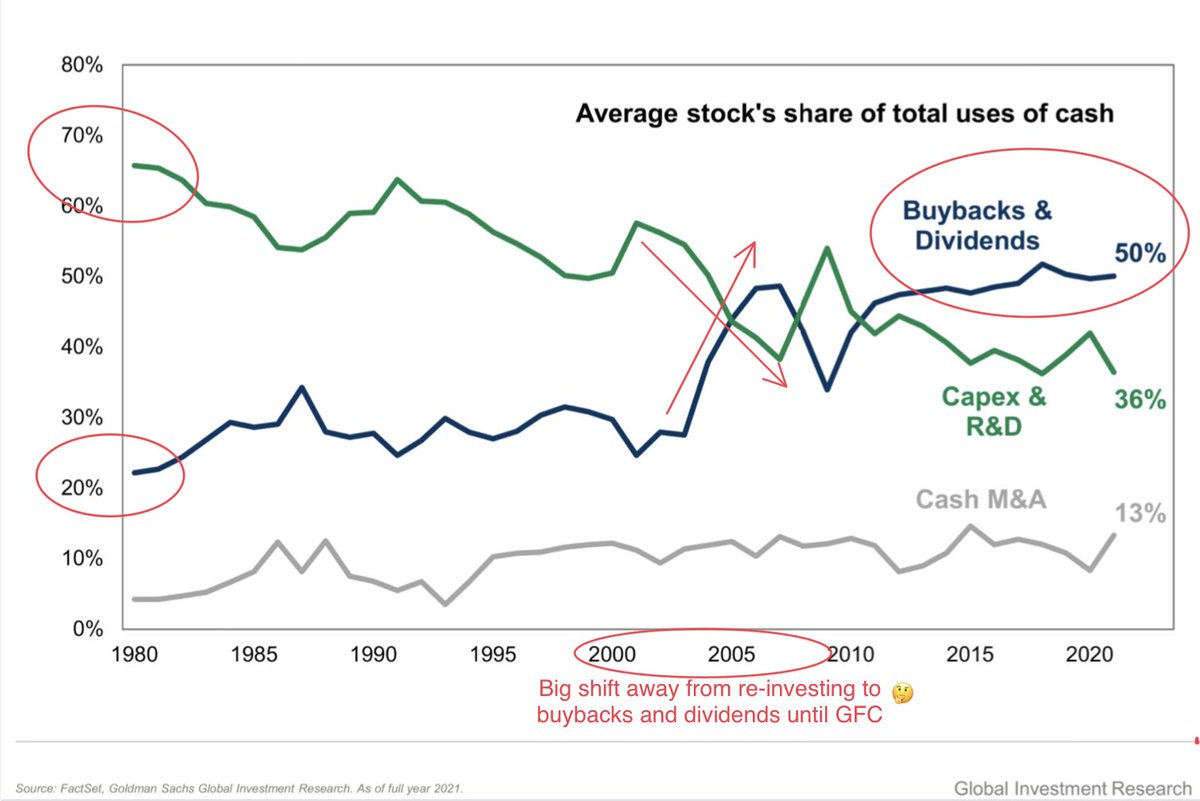

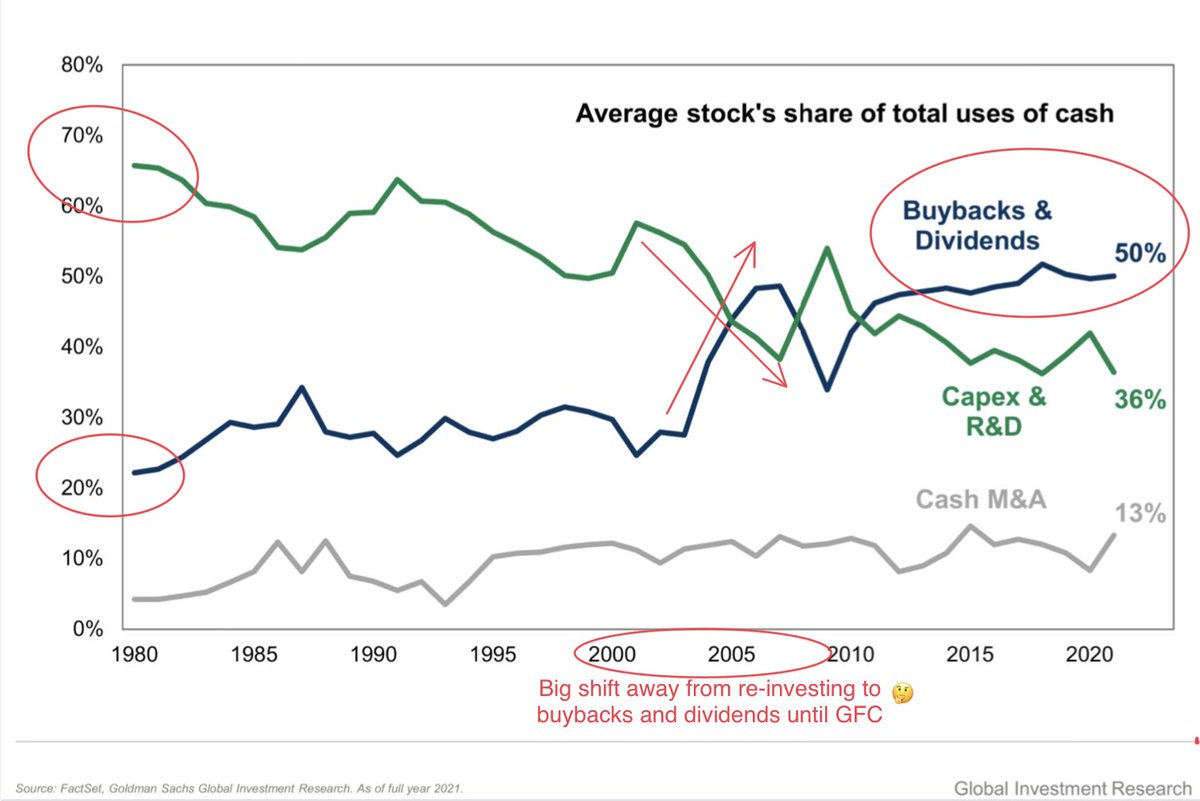

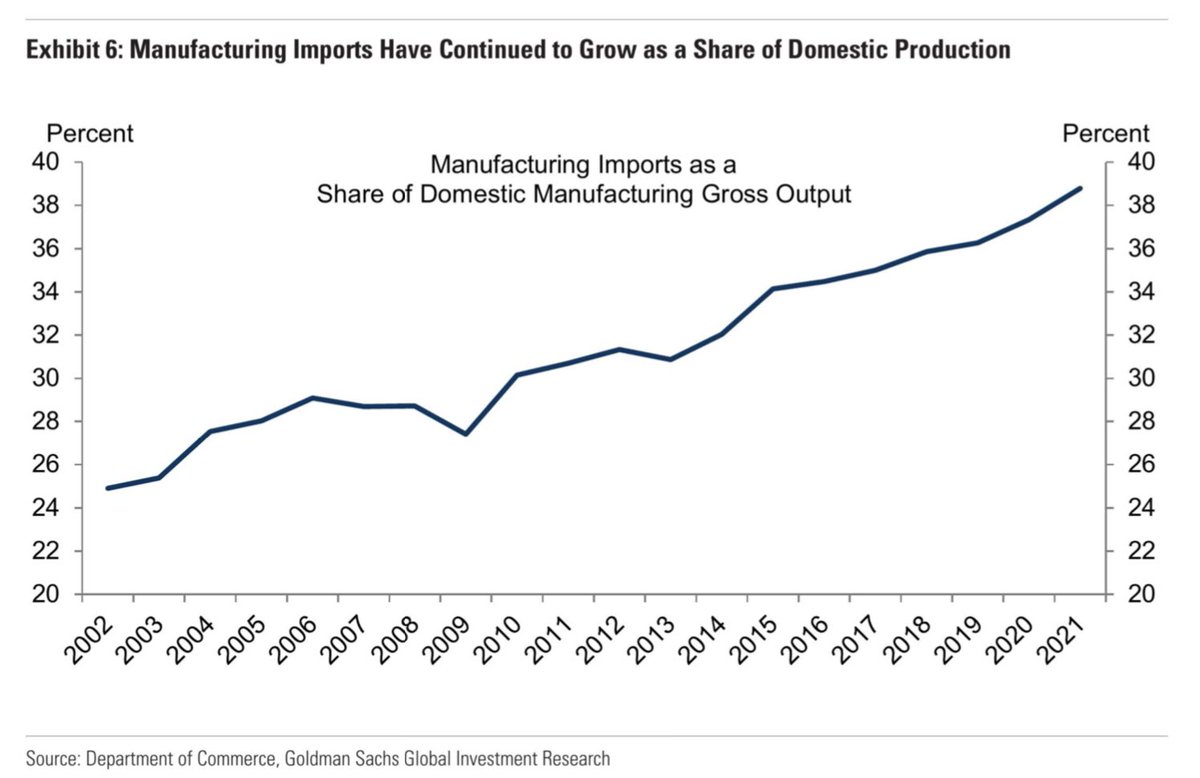

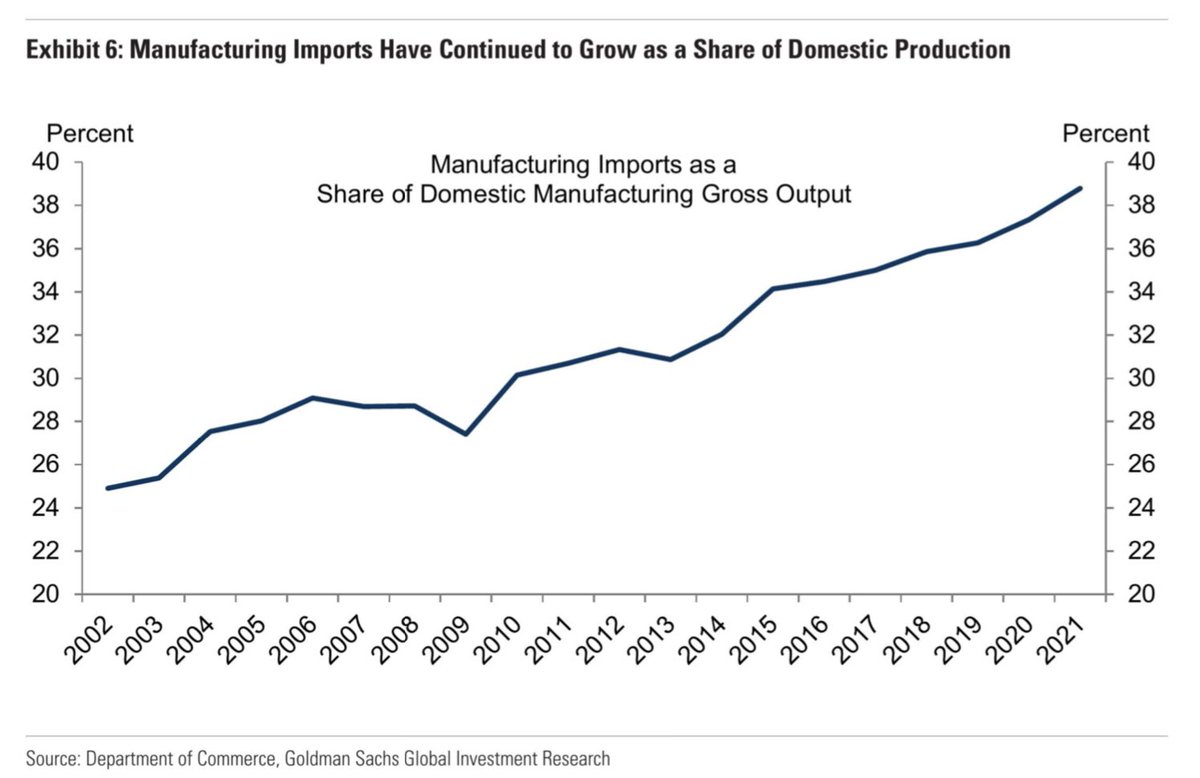

As you can see in the previous chart, US companies used to re-invest a LOT more into capex & R&D (>65% in the early 1980’s)! Something big happened post 2000: there was a huge drop in re-investment, which coincided with a shift of manufacturing to China & elsewhere. Good or bad?

As you can see in the previous chart, US companies used to re-invest a LOT more into capex & R&D (>65% in the early 1980’s)! Something big happened post 2000: there was a huge drop in re-investment, which coincided with a shift of manufacturing to China & elsewhere. Good or bad?

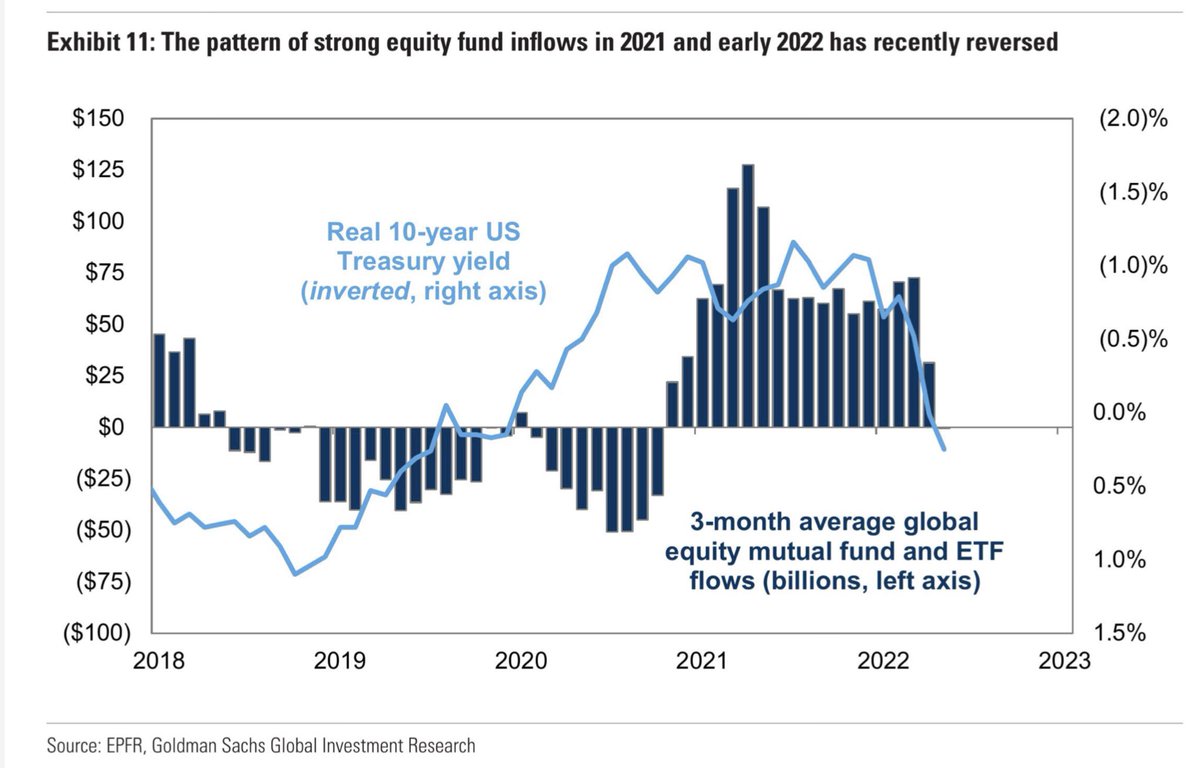

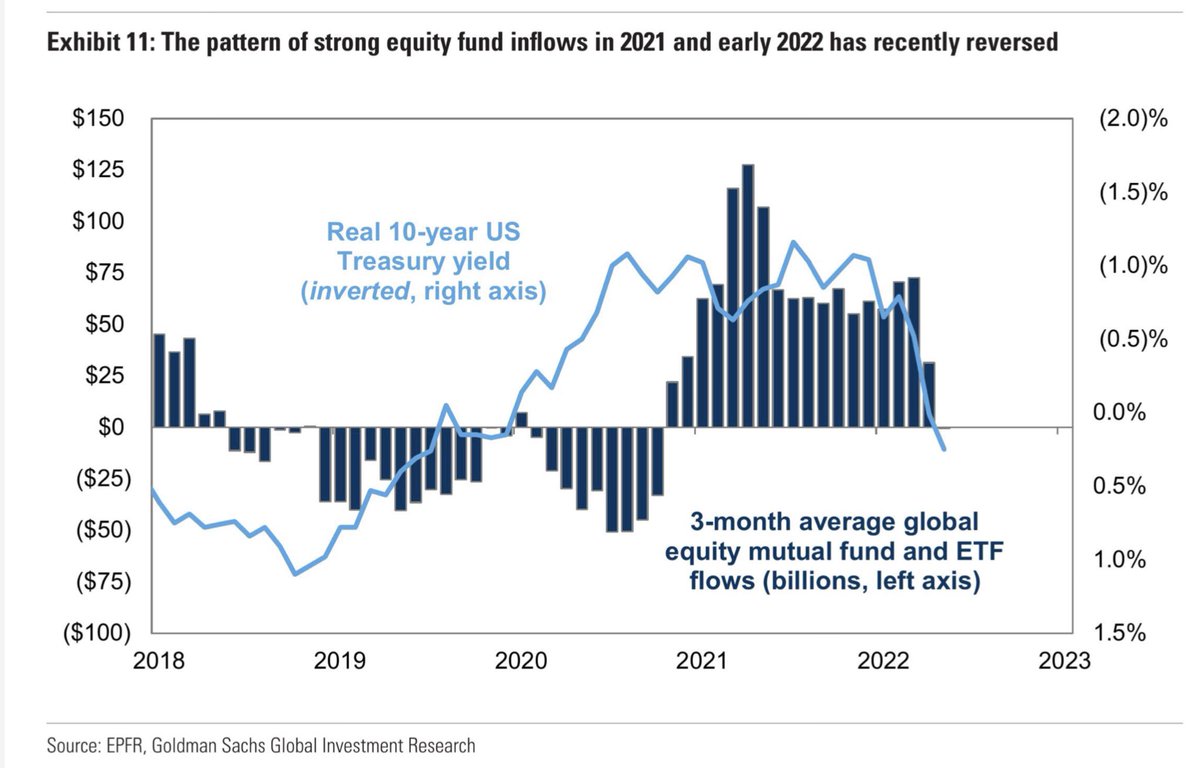

1. Passive pension flows happen every day, whether we like it or not. People don’t often change their pension allocation, and thus money coming keeps coming in to stocks. The 401k (or equivalent), as long as people get a salary, the employer contributions keep flowing in.

1. Passive pension flows happen every day, whether we like it or not. People don’t often change their pension allocation, and thus money coming keeps coming in to stocks. The 401k (or equivalent), as long as people get a salary, the employer contributions keep flowing in.

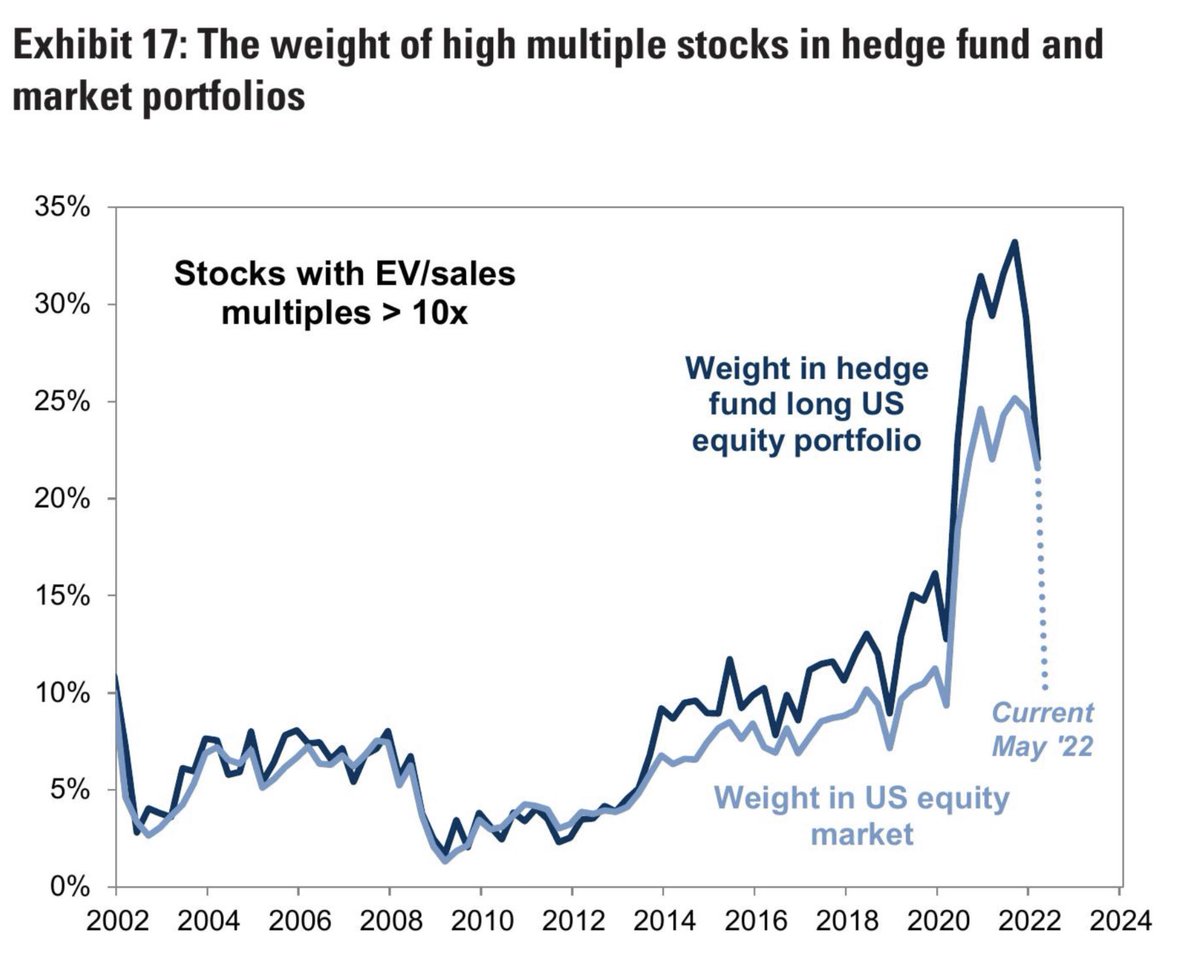

Despite the tech selloff, the weight of high multiple stocks (>10 EV/Sales) in both the indices and hedge fund portfolios is still extremely high compared to recent history, although HF’s are now inline with the index. Still >22% weight, vs ~3% for a few years post the GFC.

Despite the tech selloff, the weight of high multiple stocks (>10 EV/Sales) in both the indices and hedge fund portfolios is still extremely high compared to recent history, although HF’s are now inline with the index. Still >22% weight, vs ~3% for a few years post the GFC.

Oops. Miss on revenues and miss on EPS. Guidance 😱🚨🚨🚨.

Oops. Miss on revenues and miss on EPS. Guidance 😱🚨🚨🚨.

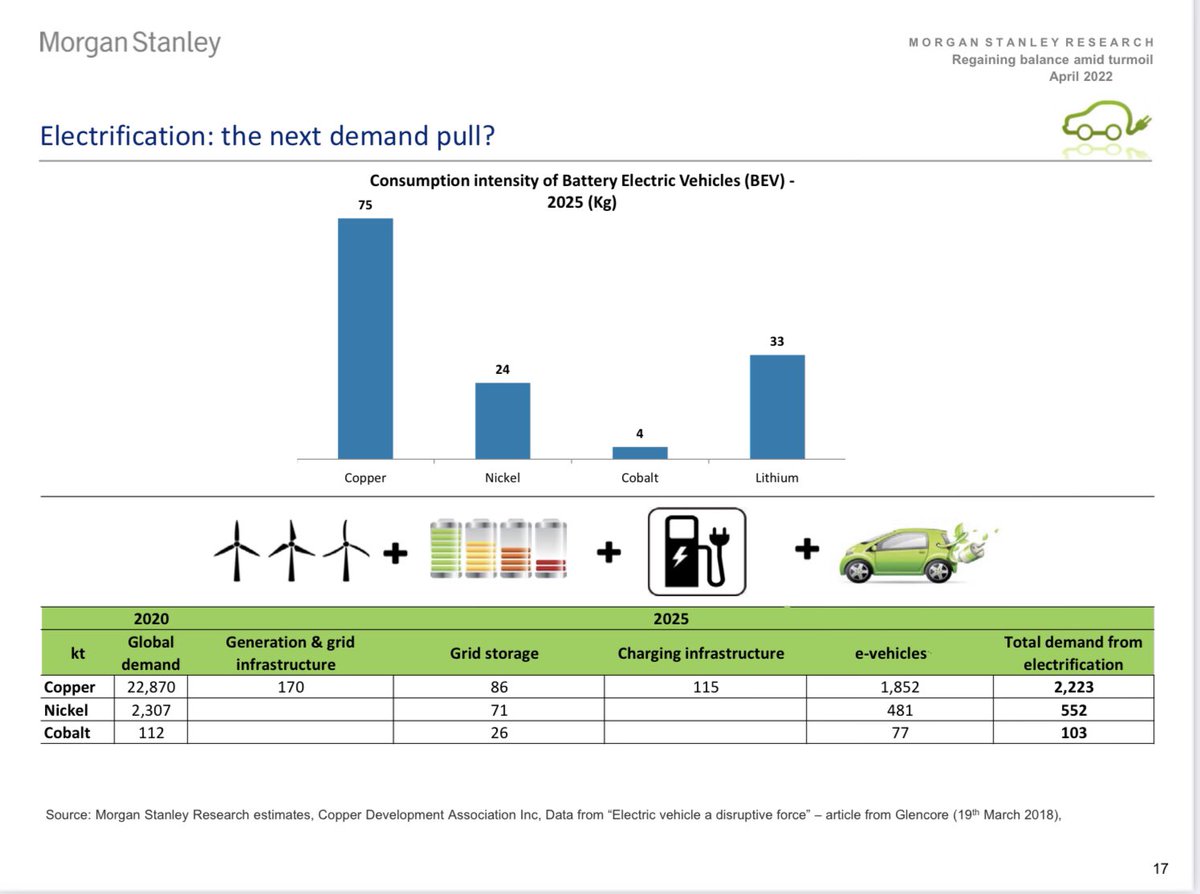

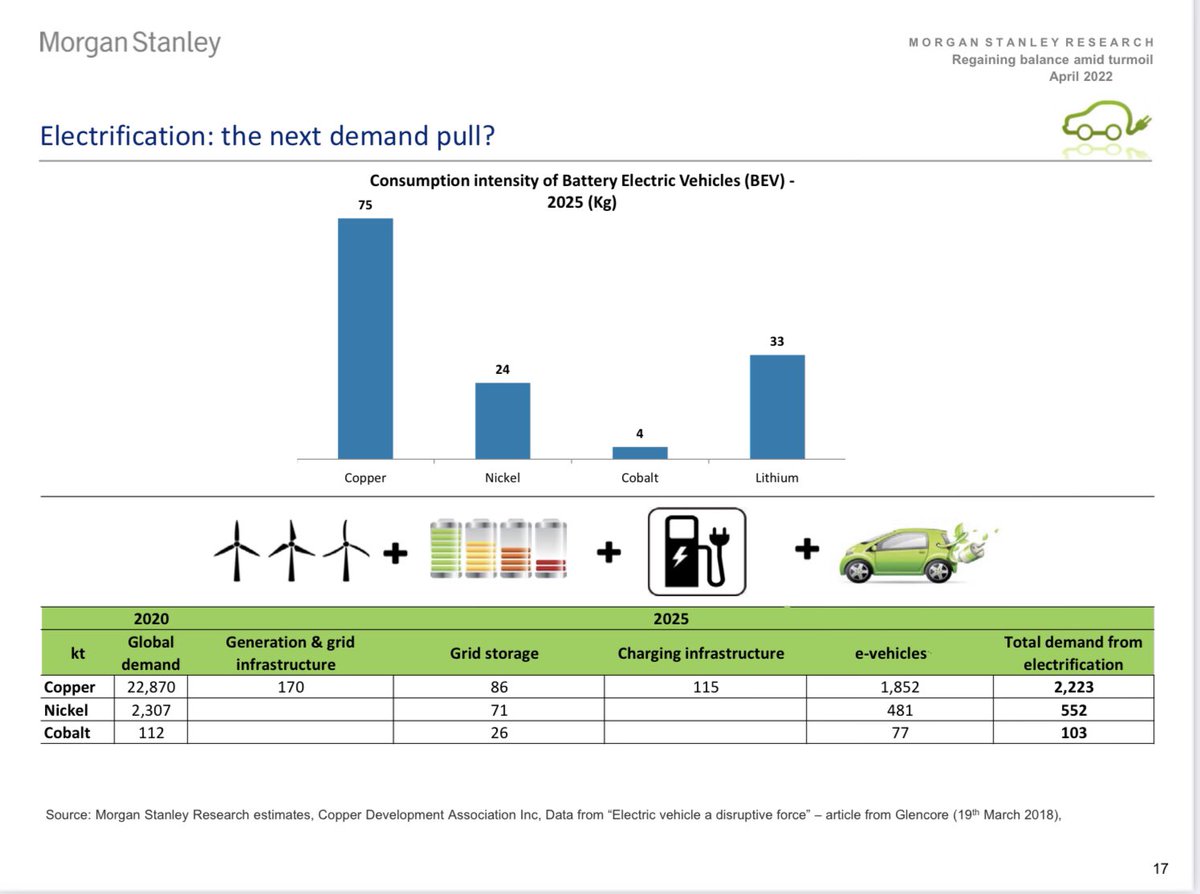

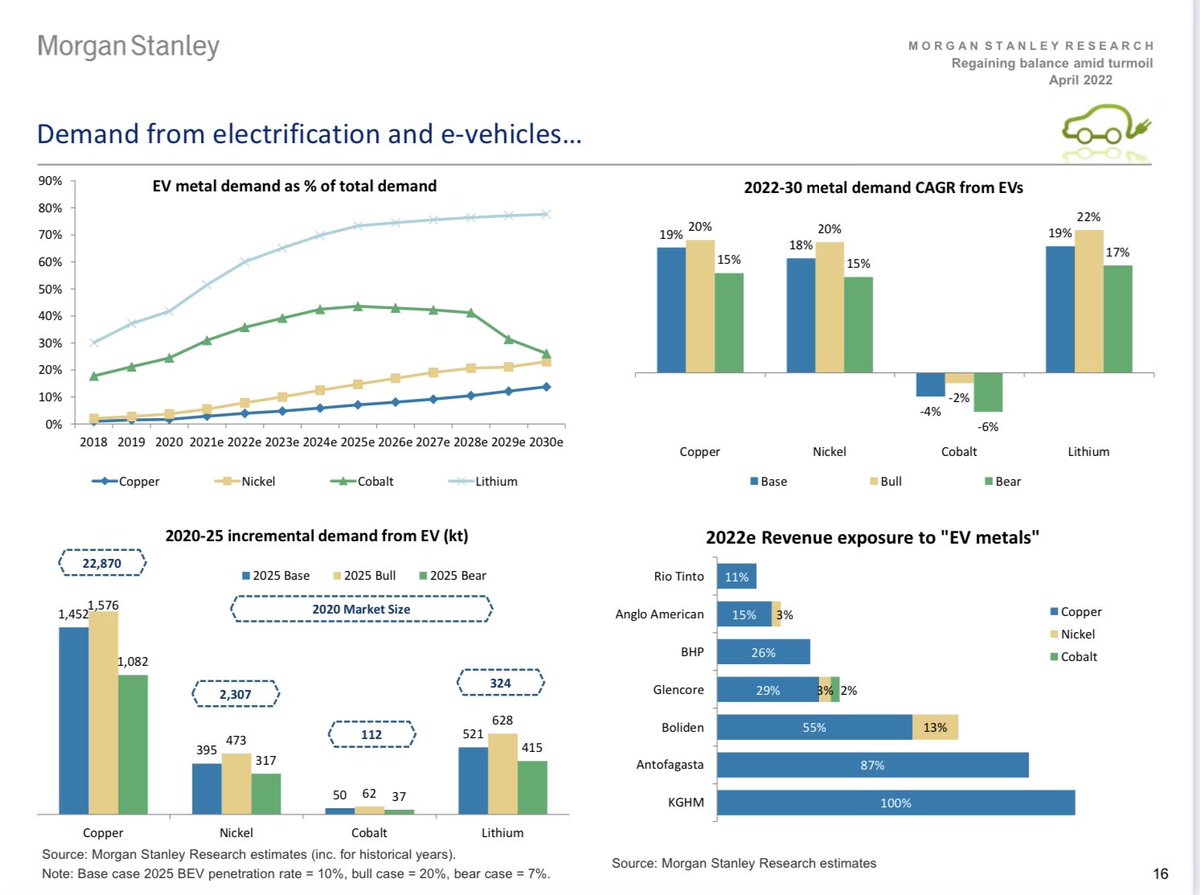

…although copper demand from EV’s themselves is a small portion of total copper demand, it’s very fast growing and large as an absolute amount.

…although copper demand from EV’s themselves is a small portion of total copper demand, it’s very fast growing and large as an absolute amount.

During the pandemic, US companies with supplier exposure to locked down markets experienced the largest pandemic related revenue declines. Quite obvious that this would happen. Suppliers can’t supply you quickly if they’re far away and locked down.

During the pandemic, US companies with supplier exposure to locked down markets experienced the largest pandemic related revenue declines. Quite obvious that this would happen. Suppliers can’t supply you quickly if they’re far away and locked down.