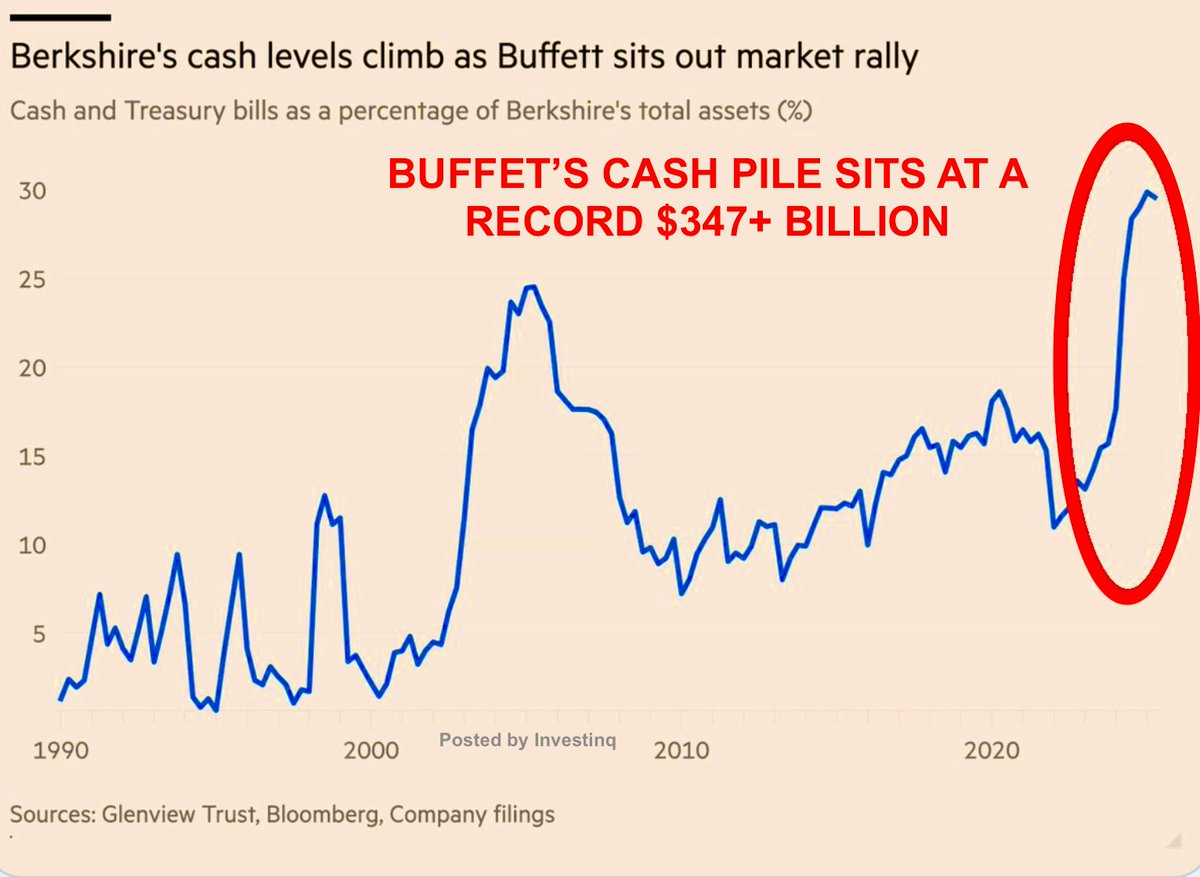

🚨 Warren Buffett is sitting on a record $347.7 BILLION in cash.

Nearly 30% of Berkshire Hathaway’s assets are just cash and T-bills.

This is the largest cash pile in U.S. corporate history.

(a thread)

Nearly 30% of Berkshire Hathaway’s assets are just cash and T-bills.

This is the largest cash pile in U.S. corporate history.

(a thread)

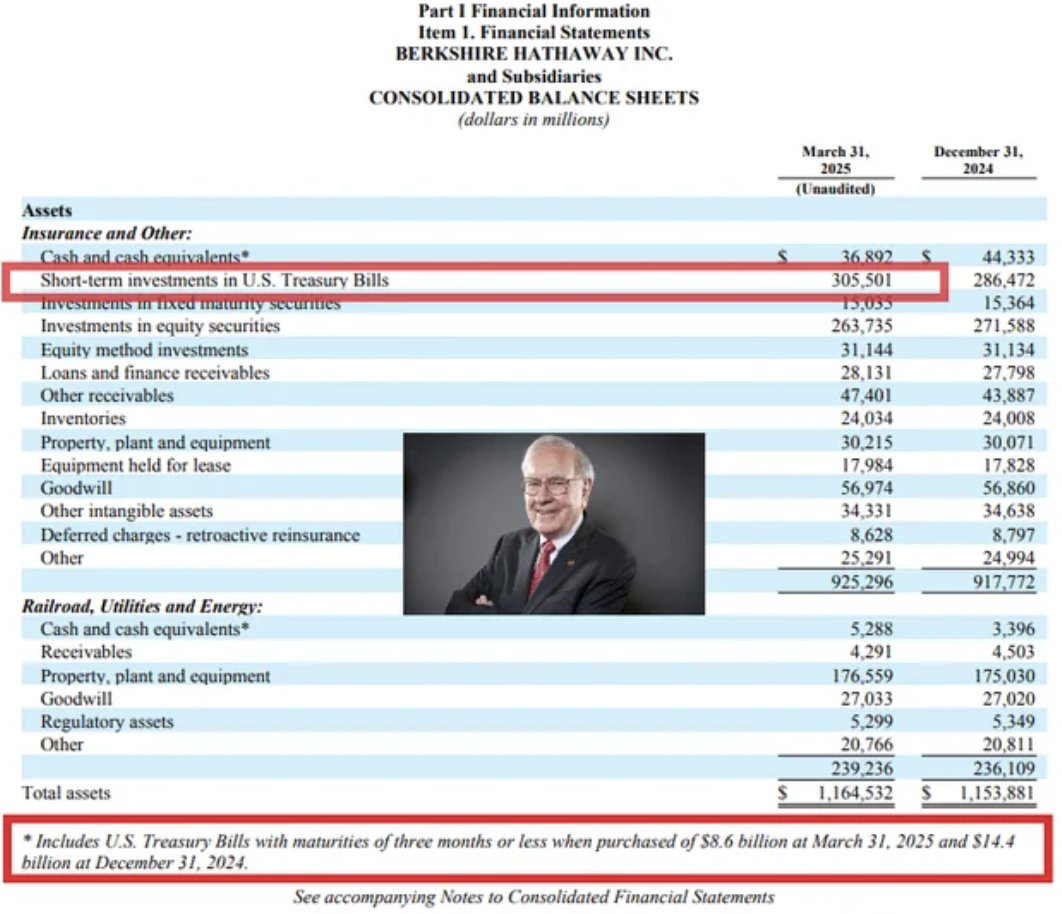

Buffett’s cash isn’t just “extra.” It’s intentional.

He’s parked over $305B in short-term U.S. Treasury bills, 3–6 month maturities and $42B in pure bank cash.

That’s the most liquid, safest spot you can put money. At today’s 5%+ yields, that pile earns $12–15B a year risk-free.

He’s parked over $305B in short-term U.S. Treasury bills, 3–6 month maturities and $42B in pure bank cash.

That’s the most liquid, safest spot you can put money. At today’s 5%+ yields, that pile earns $12–15B a year risk-free.

This strategy means Buffett gets paid handsomely to wait. A few years ago, cash was a drag because T-bills yielded near 0%.

Now? He’s making more in interest than most S&P 500 companies earn in profit.

And if the market tanks tomorrow, that cash can be deployed instantly.

Now? He’s making more in interest than most S&P 500 companies earn in profit.

And if the market tanks tomorrow, that cash can be deployed instantly.

So why wait? Buffett thinks almost everything is overpriced. He’s been net selling stocks for 10 straight quarters.

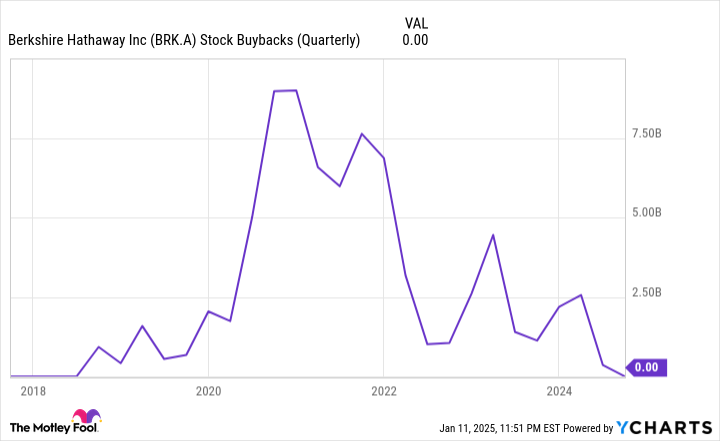

Even Berkshire’s own stock buybacks have stopped meaning he thinks even Berkshire isn’t cheap right now.

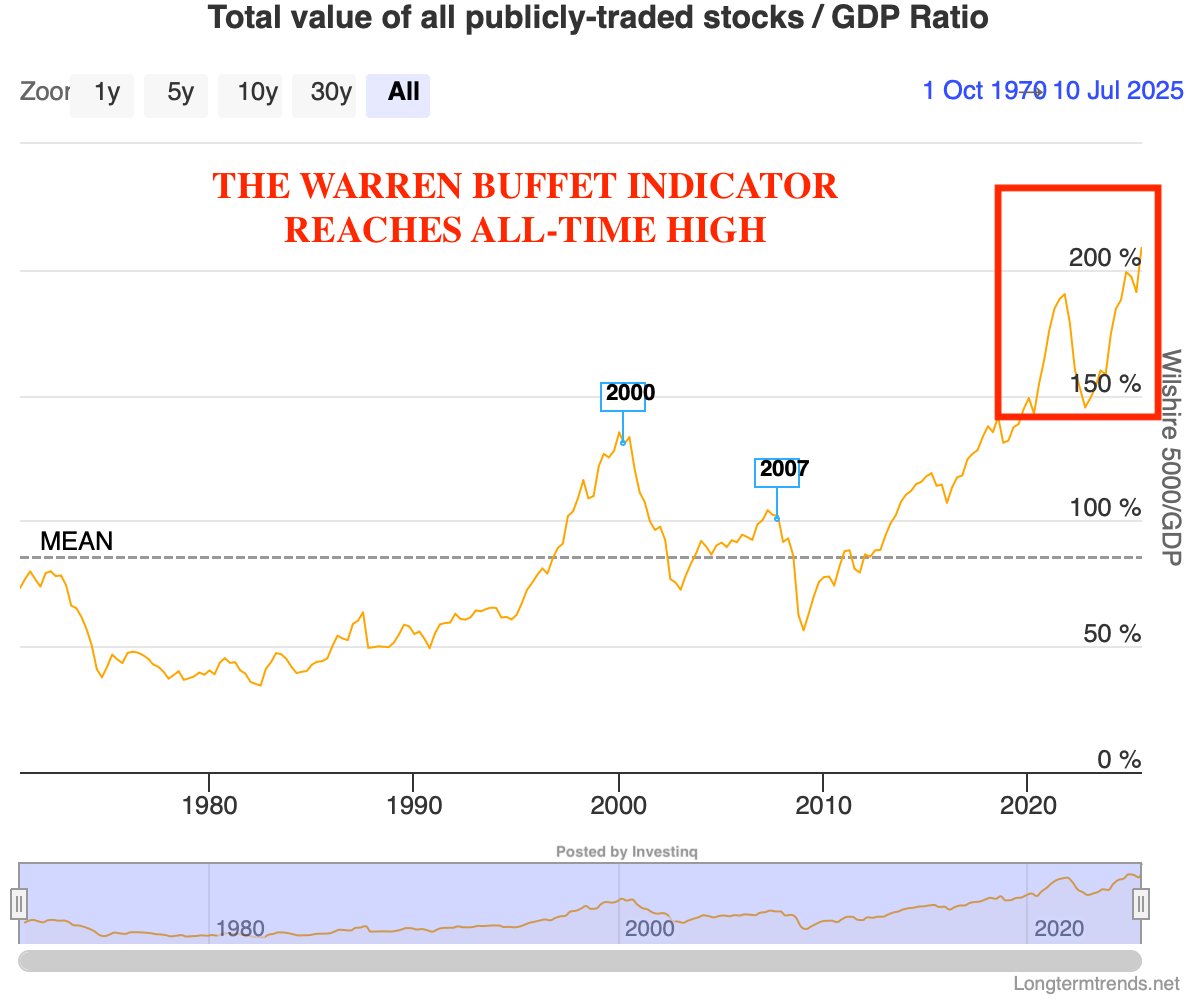

His favorite valuation gauge, the Buffett Indicator is flashing red.

Even Berkshire’s own stock buybacks have stopped meaning he thinks even Berkshire isn’t cheap right now.

His favorite valuation gauge, the Buffett Indicator is flashing red.

The Buffett Indicator = total U.S. stock market value ÷ GDP.

Today, it’s over 200%, an all-time high.

Buffett’s said when it’s near this level, “you are playing with fire.” The last time it happened? 1999–2000. The dot-com bubble burst and the market dropped ~50%.

Today, it’s over 200%, an all-time high.

Buffett’s said when it’s near this level, “you are playing with fire.” The last time it happened? 1999–2000. The dot-com bubble burst and the market dropped ~50%.

In Buffett’s view, the higher the price you pay for a good business, the lower your future return and right now, quality companies cost a fortune.

Tech giants dominate market caps like never before.

Charlie Munger has even said this boom is “crazier than the dot-com era.”

Tech giants dominate market caps like never before.

Charlie Munger has even said this boom is “crazier than the dot-com era.”

This isn’t just about valuations. Buffett’s also thinking about macro risks.

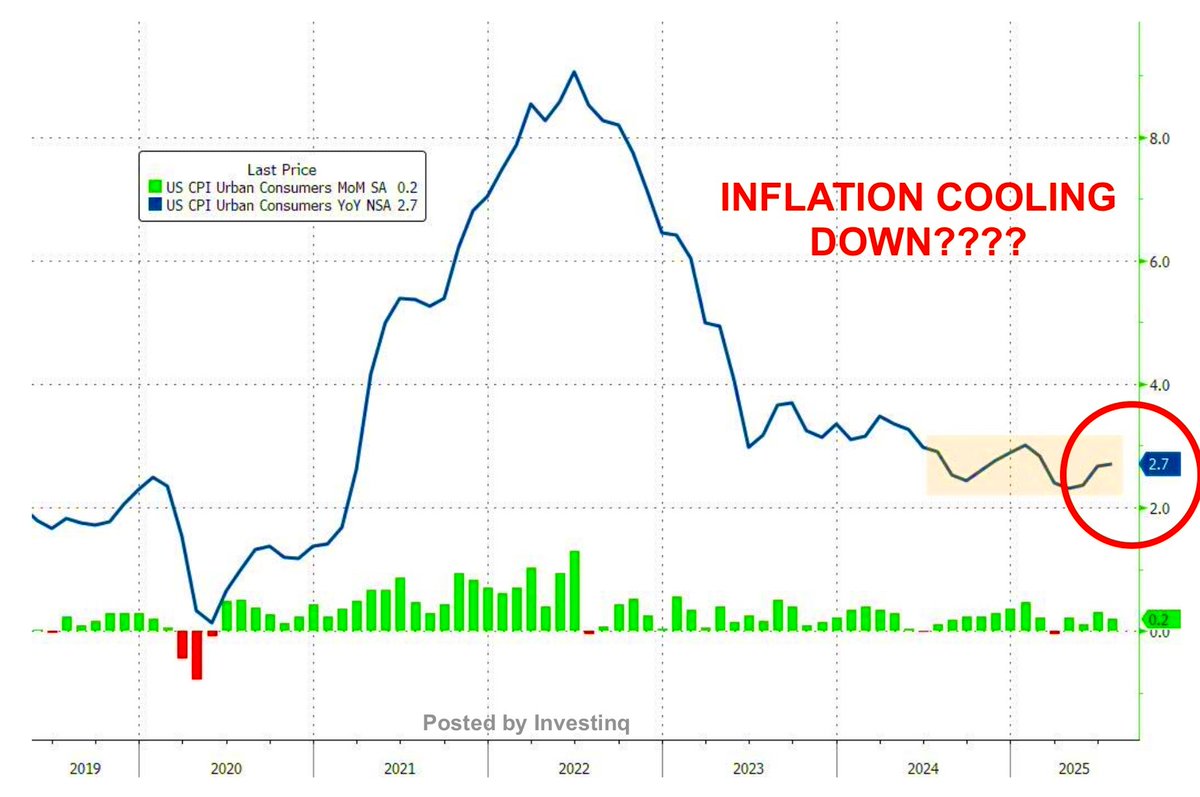

High inflation, elevated interest rates, slowing growth, U.S.–China tensions, wars in Europe none of this screams “back up the truck.”

He doesn’t predict recessions, but his actions scream: be ready.

High inflation, elevated interest rates, slowing growth, U.S.–China tensions, wars in Europe none of this screams “back up the truck.”

He doesn’t predict recessions, but his actions scream: be ready.

Berkshire’s cash grew by $60B in the last 15 months, a buildup that’s happened before major downturns.

Historically, when Buffett piles cash like this, it’s because he sees better deals coming after a correction.

He calls it keeping “powder dry” for the fat pitch.

Historically, when Buffett piles cash like this, it’s because he sees better deals coming after a correction.

He calls it keeping “powder dry” for the fat pitch.

A “fat pitch” = the rare moment when a great business is selling for a dirt-cheap price.

Buffett would rather do nothing for years than swing at mediocre pitches.

In 2008–09, after years of cash buildup, he struck massive rescue deals with Goldman Sachs, GE, and BNSF Railway.

Buffett would rather do nothing for years than swing at mediocre pitches.

In 2008–09, after years of cash buildup, he struck massive rescue deals with Goldman Sachs, GE, and BNSF Railway.

And he’s ready to do it again. He likes to “fish in troubled waters.”

Translation: wait for markets to panic, then use his fortress balance sheet to buy what no one else can afford.

In crises, Berkshire becomes a lender and acquirer of last resort.

Translation: wait for markets to panic, then use his fortress balance sheet to buy what no one else can afford.

In crises, Berkshire becomes a lender and acquirer of last resort.

The other piece? Insurance.

Berkshire’s insurance operations produce $100B+ in “float” money from premiums that may be paid out as claims later.

Regulators require a big chunk of this to stay liquid. Buffett’s hard rule: never let cash fall below $30B, no matter what.

Berkshire’s insurance operations produce $100B+ in “float” money from premiums that may be paid out as claims later.

Regulators require a big chunk of this to stay liquid. Buffett’s hard rule: never let cash fall below $30B, no matter what.

In fact, holding huge cash keeps Berkshire’s AA+ credit rating rock-solid.

It means they can handle a mega-catastrophe AND a financial crisis at the same time.

If a $15B insurance loss and a market crash happened together, Buffett could still buy assets the next day.

It means they can handle a mega-catastrophe AND a financial crisis at the same time.

If a $15B insurance loss and a market crash happened together, Buffett could still buy assets the next day.

And he doesn’t just keep cash for safety. It gives him speed.

If tomorrow he wants to buy a $50B company, he can wire the money without raising a dime.

No debt, no delay, no market risk. That’s a huge edge in deal-making.

If tomorrow he wants to buy a $50B company, he can wire the money without raising a dime.

No debt, no delay, no market risk. That’s a huge edge in deal-making.

Critics say cash loses value in inflation.

Buffett’s answer: yes, but overpriced stocks can lose far more and at 5% T-bill yields, the opportunity cost of

is minimal.

He can afford to wait for conditions where stocks offer double-digit returns again.

Buffett’s answer: yes, but overpriced stocks can lose far more and at 5% T-bill yields, the opportunity cost of

is minimal.

He can afford to wait for conditions where stocks offer double-digit returns again.

History shows his timing isn’t random.

In the late ’90s, he sat out the dot-com bubble, then scooped up bargains after the crash.

In 2005, he built cash before the financial crisis, then deployed billions into distressed assets. Today’s cash pile is even bigger than those peaks.

In the late ’90s, he sat out the dot-com bubble, then scooped up bargains after the crash.

In 2005, he built cash before the financial crisis, then deployed billions into distressed assets. Today’s cash pile is even bigger than those peaks.

This cash stance sends a message.

Buffett isn’t calling a crash, but he’s signaling: opportunities are scarce, risk is high, patience is essential.

Many investors from hedge funds to pension funds are quietly following his lead, raising cash and cutting risk.

Buffett isn’t calling a crash, but he’s signaling: opportunities are scarce, risk is high, patience is essential.

Many investors from hedge funds to pension funds are quietly following his lead, raising cash and cutting risk.

When Buffett finally spends this $347B, it will be a market event in itself.

In past downturns, news of him buying boosted confidence and even marked bottoms in sectors.

Until then, his war chest looms over the market, a silent vote for caution.

In past downturns, news of him buying boosted confidence and even marked bottoms in sectors.

Until then, his war chest looms over the market, a silent vote for caution.

The takeaway: Buffett isn’t bearish on America.

He’s bullish on value. He’ll act when the math works, and right now it doesn’t.

His discipline is a reminder: the best investors know when not to play. In his words: “When there is nothing to do, do nothing.”

He’s bullish on value. He’ll act when the math works, and right now it doesn’t.

His discipline is a reminder: the best investors know when not to play. In his words: “When there is nothing to do, do nothing.”

And when the fat pitch comes, he won’t bring a bat.

He’ll bring a $347.7B cannon.

And history says that when Buffett fires it, fortunes are made.

He’ll bring a $347.7B cannon.

And history says that when Buffett fires it, fortunes are made.

If you found these insights valuable: Sign up for my FREE newsletter! thestockmarket.news

I hope you've found this thread helpful.

Follow me @_Investinq for more.

Like/Repost the quote below if you can:

Follow me @_Investinq for more.

Like/Repost the quote below if you can:

https://x.com/_investinq/status/1954960956158579094?s=46

I just wanted to give a bit of context on the Charlie Munger quote, he said this a few years ago, around the time Berkshire started really stockpiling cash.

• • •

Missing some Tweet in this thread? You can try to

force a refresh