Mainstream macro blames crises on public debt or bad policy.

History tells a different story, The biggest crashes follow private debt booms , when households & firms load up on credit faster than incomes grow.

🧵1/8

History tells a different story, The biggest crashes follow private debt booms , when households & firms load up on credit faster than incomes grow.

🧵1/8

1929, Japan’s 1990s bust, the 2008 GFC, all preceded by surging private debt-to-GDP.

In each case, public debt rose after the crisis, as governments absorbed the fallout.

Cause and effect are backwards in the textbook story.

🧵2/8

In each case, public debt rose after the crisis, as governments absorbed the fallout.

Cause and effect are backwards in the textbook story.

🧵2/8

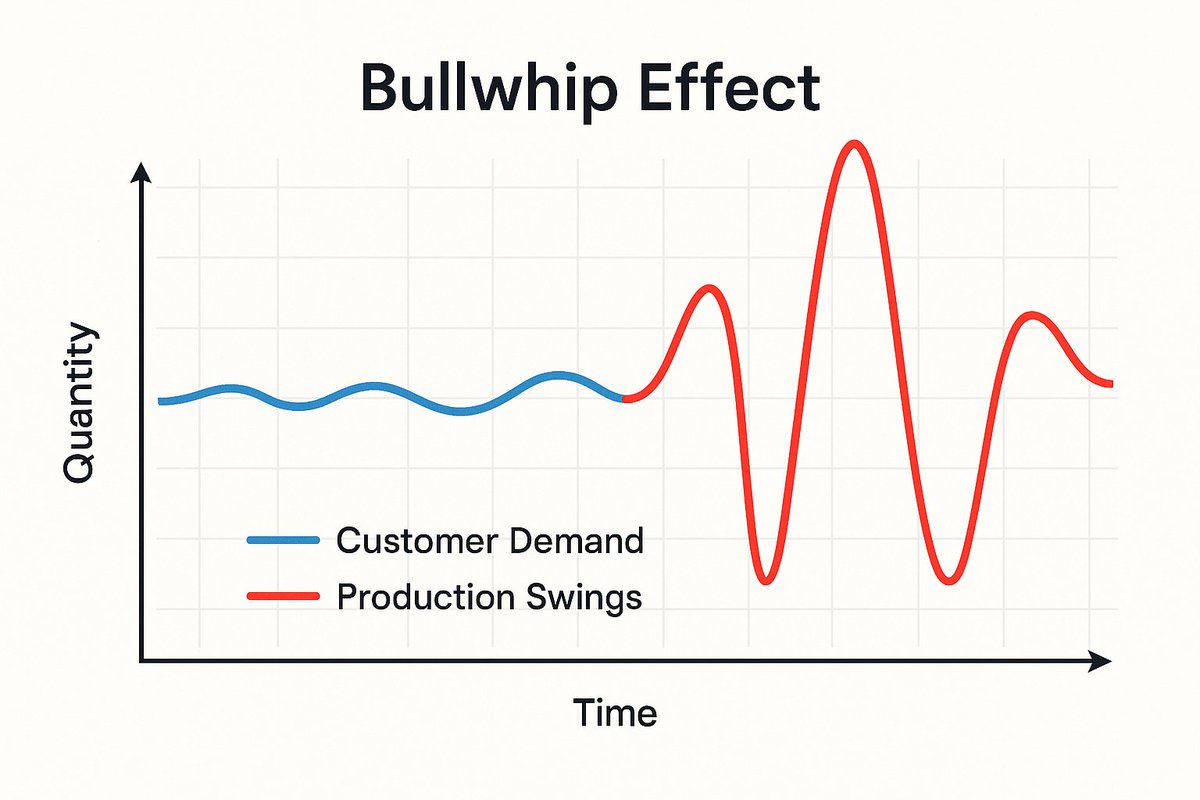

Private debt booms are dangerous because they fuel asset bubbles and fragile balance sheets.

When cashflows falter or rates rise, defaults spike and leverage turns into a chain reaction.

🧵3/8

When cashflows falter or rates rise, defaults spike and leverage turns into a chain reaction.

🧵3/8

Unlike public debt, private debt must be serviced from incomes that can’t be printed.

When repayment strains hit, spending collapses, dragging the economy down.

🧵4/8

When repayment strains hit, spending collapses, dragging the economy down.

🧵4/8

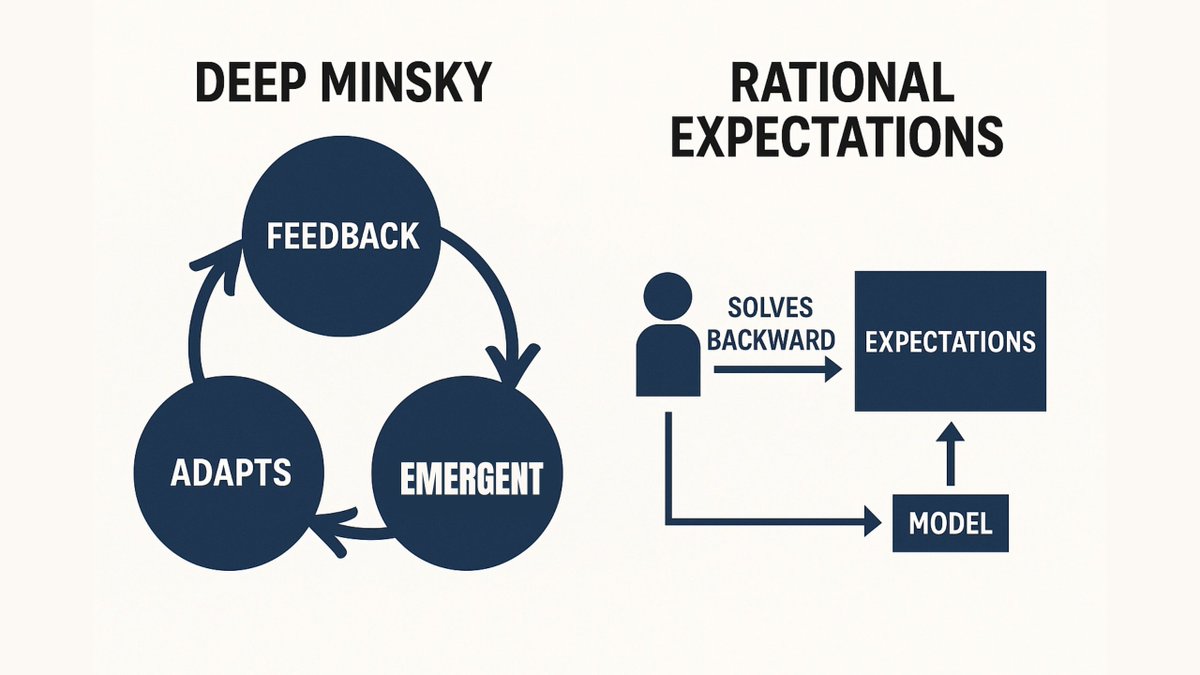

Minsky called it the “financial instability hypothesis”:

Stability breeds complacency, risk-taking rises, debt loads grow, until the system tips.

🧵5/8

Stability breeds complacency, risk-taking rises, debt loads grow, until the system tips.

🧵5/8

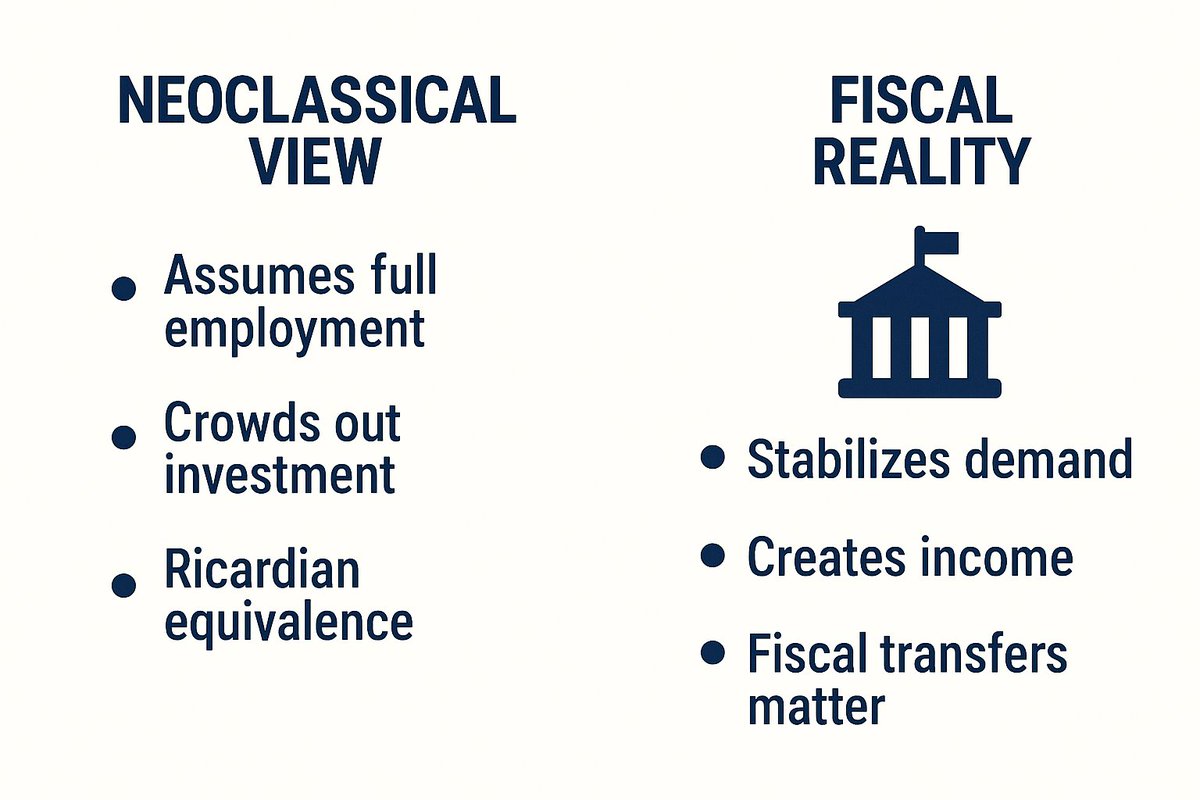

Policy failure #1: ignoring private credit growth in macro models.

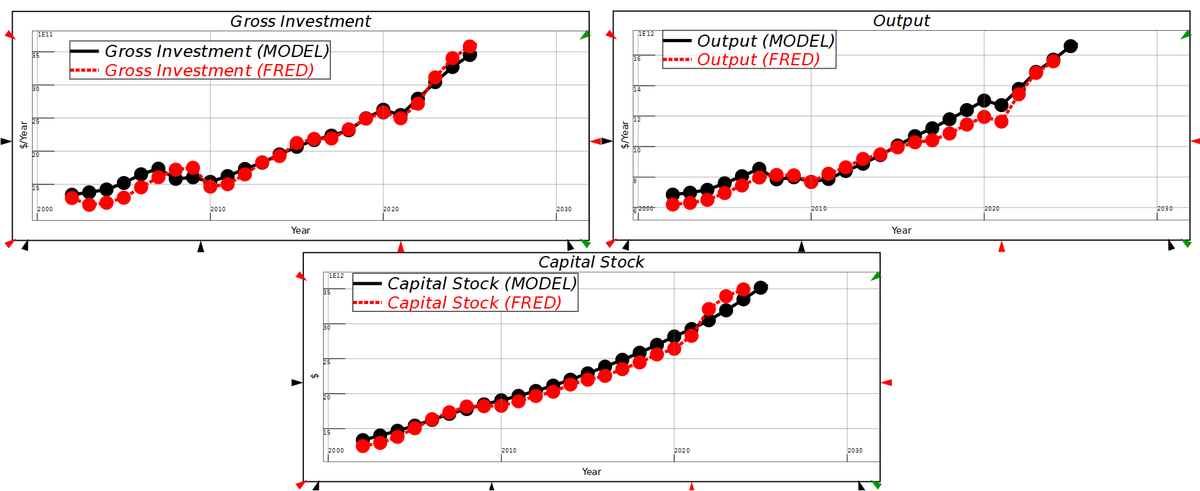

DSGE model frameworks treat debt as neutral or irrelevant.

The cycle is driven by leverage, but the models are blind to it.

🧵6/8

DSGE model frameworks treat debt as neutral or irrelevant.

The cycle is driven by leverage, but the models are blind to it.

🧵6/8

Policy failure #2: obsessing over public debt while letting private debt run wild.

It’s the household mortgage bubble, not the deficit, that crashes economies.

🧵7/8

It’s the household mortgage bubble, not the deficit, that crashes economies.

🧵7/8

If you want to prevent crises, track private debt-to-GDP, not just inflation.

The warning signs are always there if you’re willing to look.

Check out all my blogs out on this topic an more on my Patreon:

🧵8/8

patreon.com/c/relearningec…

The warning signs are always there if you’re willing to look.

Check out all my blogs out on this topic an more on my Patreon:

🧵8/8

patreon.com/c/relearningec…

• • •

Missing some Tweet in this thread? You can try to

force a refresh