🚨 THE WAR IS OVER AND AMERICA JUST SECURED THE MOST POWERFUL FINANCIAL RAIL IN HISTORY 🇺🇸

The SEC’s surrender to Ripple is the closing act in a multi-year covert op to bring the XRP Ledger under U.S. strategic control.

And the next phase? It’s not what you think… 👇🧵

The SEC’s surrender to Ripple is the closing act in a multi-year covert op to bring the XRP Ledger under U.S. strategic control.

And the next phase? It’s not what you think… 👇🧵

2/🧵

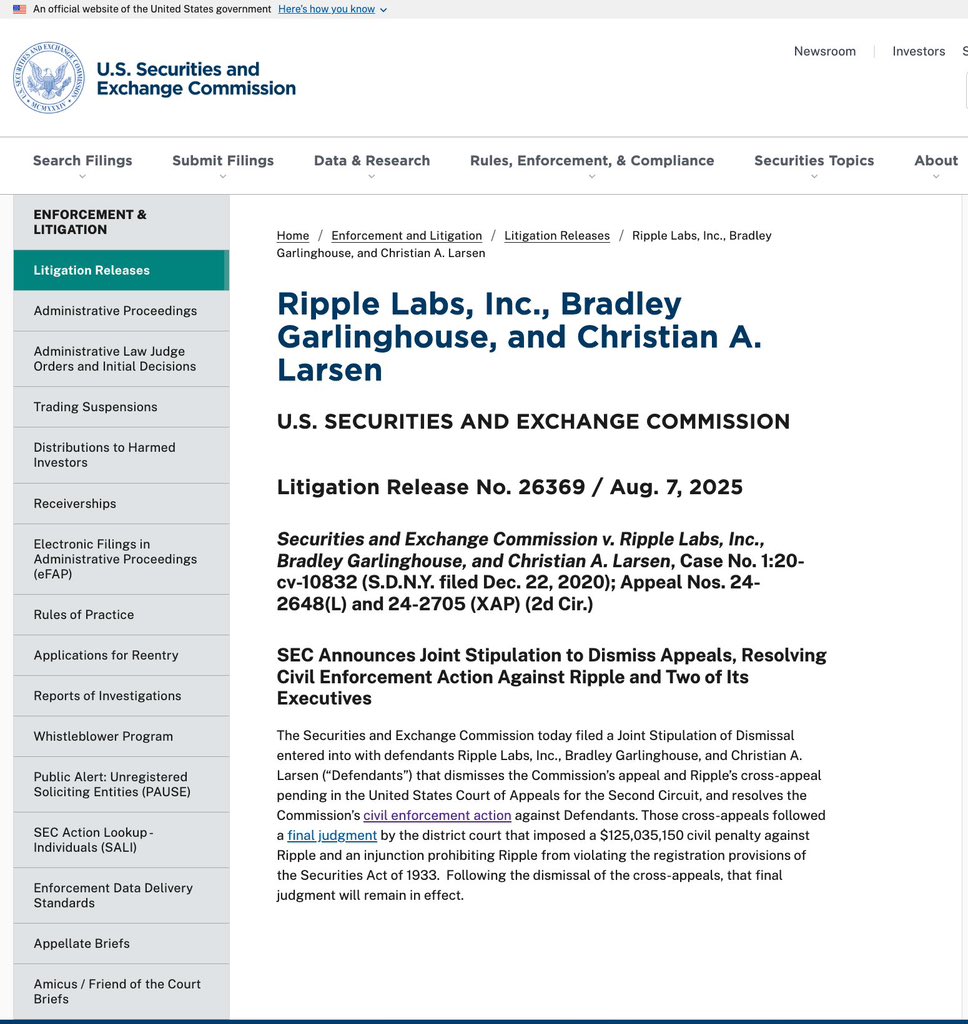

After years of lawfare, the SEC & Ripple have jointly agreed to dismiss all appeals.

Ripple will pay $125M… pocket change in a $10T+ playing field.

Brad Garlinghouse & Chris Larsen walk free.

The injunction stays, ensuring Ripple remains inside U.S. jurisdiction and compliance rails.

After years of lawfare, the SEC & Ripple have jointly agreed to dismiss all appeals.

Ripple will pay $125M… pocket change in a $10T+ playing field.

Brad Garlinghouse & Chris Larsen walk free.

The injunction stays, ensuring Ripple remains inside U.S. jurisdiction and compliance rails.

3/🧵

Why would the SEC “lose” after pouring resources into this fight?

Because the goal was never to kill Ripple.

It was to force it into the regulatory architecture, where its tech could be deployed under controlled conditions… by America, for America.

Why would the SEC “lose” after pouring resources into this fight?

Because the goal was never to kill Ripple.

It was to force it into the regulatory architecture, where its tech could be deployed under controlled conditions… by America, for America.

4/🧵

Ripple is now the most legally compliant blockchain company in the United States.

That makes the XRPL the safest institutional-grade ledger for:

•Tokenized treasuries

•CBDC settlement

•Real World Asset (RWA) markets

•Strategic identity systems

Ripple is now the most legally compliant blockchain company in the United States.

That makes the XRPL the safest institutional-grade ledger for:

•Tokenized treasuries

•CBDC settlement

•Real World Asset (RWA) markets

•Strategic identity systems

5/🧵

Now, here’s where the conspiracy gets tangible.

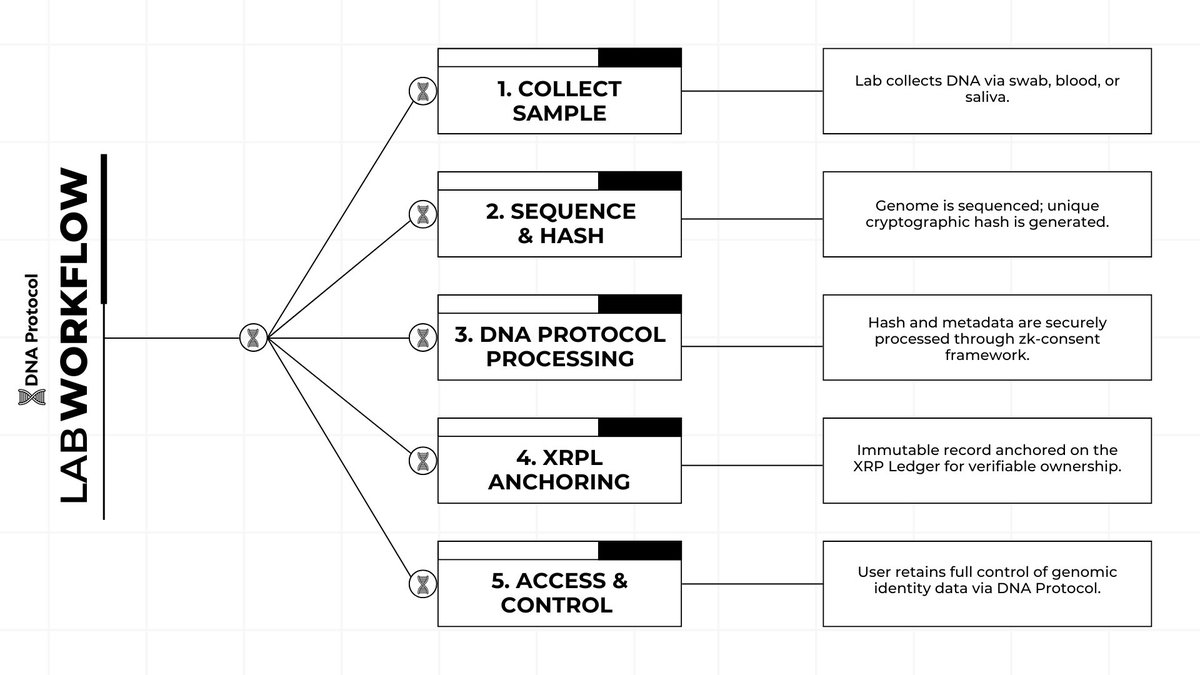

The XRPL isn’t just for money.. it’s for identity anchoring.

And right now, projects like @DNAOnChain are already using it to anchor genomic identity data… the most immutable biometric on Earth.

Now, here’s where the conspiracy gets tangible.

The XRPL isn’t just for money.. it’s for identity anchoring.

And right now, projects like @DNAOnChain are already using it to anchor genomic identity data… the most immutable biometric on Earth.

6/🧵

Think about the timing:

•Ripple gains legal clarity

•U.S. gains a compliant, hyper-fast, bank-ready ledger

•DNA Protocol rolls out genomic anchoring in labs across Africa & beyond

•ISO 20022 rails go live across Fedwire & CHIPS

We’re looking at the fusion of finance + identity under U.S. jurisdiction.

Think about the timing:

•Ripple gains legal clarity

•U.S. gains a compliant, hyper-fast, bank-ready ledger

•DNA Protocol rolls out genomic anchoring in labs across Africa & beyond

•ISO 20022 rails go live across Fedwire & CHIPS

We’re looking at the fusion of finance + identity under U.S. jurisdiction.

7/🧵

Why does genomic anchoring matter to the U.S.?

Because whoever controls the registry for biometric identity controls:

•Border access

•Defense clearances

•Financial inclusion/exclusion

•Healthcare access in the age of AI-driven medicine

This isn’t just a ledger — it’s a national security asset.

Why does genomic anchoring matter to the U.S.?

Because whoever controls the registry for biometric identity controls:

•Border access

•Defense clearances

•Financial inclusion/exclusion

•Healthcare access in the age of AI-driven medicine

This isn’t just a ledger — it’s a national security asset.

8/🧵

The $125M “penalty” isn’t a loss. It’s the license fee for Ripple to operate as the core rail of America’s 21st-century digital empire.

From CBDCs to defense-grade biometric verification, XRPL is now locked in as the trusted bridge.

The $125M “penalty” isn’t a loss. It’s the license fee for Ripple to operate as the core rail of America’s 21st-century digital empire.

From CBDCs to defense-grade biometric verification, XRPL is now locked in as the trusted bridge.

9/🧵

Watch the silence from BlackRock, JPMorgan, and the Fed.

These players know the battlefield has shifted:

•CBDCs will settle on XRPL corridors

•Genomic & RWA tokenization will plug directly into these rails

•And XRP .. not Bitcoin, not Ethereum.. will be the neutral bridge asset for all of it.

Watch the silence from BlackRock, JPMorgan, and the Fed.

These players know the battlefield has shifted:

•CBDCs will settle on XRPL corridors

•Genomic & RWA tokenization will plug directly into these rails

•And XRP .. not Bitcoin, not Ethereum.. will be the neutral bridge asset for all of it.

10/🧵

The mainstream will celebrate this as a “win for crypto.”

It’s bigger.

It’s the legal foundation for a U.S.-led biometric-financial order, built on the XRPL and quietly tested by DNA Protocol’s $XDNA genomechain.

The mainstream will celebrate this as a “win for crypto.”

It’s bigger.

It’s the legal foundation for a U.S.-led biometric-financial order, built on the XRPL and quietly tested by DNA Protocol’s $XDNA genomechain.

11/🧵

The appeal dismissals weren’t the end of the story.

They were the green light.

Now the U.S. can roll out XRPL corridors for both value and identity from Wall Street to your genome.

The appeal dismissals weren’t the end of the story.

They were the green light.

Now the U.S. can roll out XRPL corridors for both value and identity from Wall Street to your genome.

12/🧵

⚔️ You are witnessing history.

When the switch flips, those holding XRP will be holding a core asset of the new American system.

📜 War logs: t.me/alexanderthewh…

⚔️ You are witnessing history.

When the switch flips, those holding XRP will be holding a core asset of the new American system.

📜 War logs: t.me/alexanderthewh…

• • •

Missing some Tweet in this thread? You can try to

force a refresh