There exists two different categories of crypto assets which accrue value in different ways

The first are the "payment currency" assets and the second are "protocol equity" assets

What's the difference and what does this mean for you?

👇🧵

The first are the "payment currency" assets and the second are "protocol equity" assets

What's the difference and what does this mean for you?

👇🧵

With "payment currency" assets, you have cryptocurrencies in the most literal sense of the word

Crypto meant to be used like a currency

Being a new form of decentralized money that serve as an alternative to traditional government-backed fiat currencies

Crypto meant to be used like a currency

Being a new form of decentralized money that serve as an alternative to traditional government-backed fiat currencies

What we have seen in practice is that nobody really wants to use cryptocurrencies as a form of payment (medium of exchange)

This is mainly due to volatility

Nobody wants to spend an asset that could go up in value in the future

And nobody wants to receive payment in an asset that goes down in value

This is mainly due to volatility

Nobody wants to spend an asset that could go up in value in the future

And nobody wants to receive payment in an asset that goes down in value

So rather than being used for day-to-day payments, most "payment currency" cryptos have pivoted to focusing more on being a store of value

The most obvious example of this is $BTC, which is increasingly being recognized by society as being "digital gold" (via its $2.3T mcap)

The most obvious example of this is $BTC, which is increasingly being recognized by society as being "digital gold" (via its $2.3T mcap)

These assets accrue value through their sound money properties (e.g., scarcity, predictable issuance policy) and word of mouth memetics

Essentially convincing as many people as possible that your crypto is good money, so they're more willing to buy and hold the asset

Essentially convincing as many people as possible that your crypto is good money, so they're more willing to buy and hold the asset

This class of crypto is focused on mindshare and increasing utility in the sense of being able to do more things with the assets

Not just payments (e.g., crypto-funded debit cards), but use cases that benefit from a SoV like lending applications, liquidity, and collateral

Not just payments (e.g., crypto-funded debit cards), but use cases that benefit from a SoV like lending applications, liquidity, and collateral

$ETH is another example of this classification

With declining revenues, $ETH has pivoted to focusing on being the "most pristine, trust-minimized collateral in the Ethereum economy"

We can see this working by the number of Digital Asset Treasury companies that have been created recently to accumulate $ETH

The end goal is to be viewed as being in the same class as $BTC, a unique SoV asset that serves as an alternative to fiat currencies

With declining revenues, $ETH has pivoted to focusing on being the "most pristine, trust-minimized collateral in the Ethereum economy"

We can see this working by the number of Digital Asset Treasury companies that have been created recently to accumulate $ETH

The end goal is to be viewed as being in the same class as $BTC, a unique SoV asset that serves as an alternative to fiat currencies

Another example would be $XRP, whose goal is to be a "bridge currency" for forex and other asset markets

Idea being if assets have deep liquidity against $XRP, you can route trades through this single asset

Another way to put it is that these holders want $XRP to become the world reserve currency (i.e., the most salable asset)

I personally find this thesis to be quite unrealistic compared to $BTC and $ETH, which focus on offering global investors an entirely new alternative asset class, among other reasons

Idea being if assets have deep liquidity against $XRP, you can route trades through this single asset

Another way to put it is that these holders want $XRP to become the world reserve currency (i.e., the most salable asset)

I personally find this thesis to be quite unrealistic compared to $BTC and $ETH, which focus on offering global investors an entirely new alternative asset class, among other reasons

On the other end of this spectrum are the "protocol equity" crypto assets

These are tokens whose value comes from the ability of a protocol to generate revenue and make this revenue available to token holders

These tokens are not traditional equity (i.e. ownership in a corporation), but provide ownership in a decentralized protocol and/or access to the protocol's cash flows

These are tokens whose value comes from the ability of a protocol to generate revenue and make this revenue available to token holders

These tokens are not traditional equity (i.e. ownership in a corporation), but provide ownership in a decentralized protocol and/or access to the protocol's cash flows

These types of tokens accrue value to token holders in two primary ways

- Dividends (i.e., staking rewards)

- Buybacks (i.e., strategic treasuries / burn)

These are tried and true value accrual mechanisms that have been seen in the capital markets for centuries

- Dividends (i.e., staking rewards)

- Buybacks (i.e., strategic treasuries / burn)

These are tried and true value accrual mechanisms that have been seen in the capital markets for centuries

One example would be $AAVE

The token not only grants holders voting rights within the Aave DAO, and therefore its treasury

But Aave is using its revenue to engage in buybacks of $AAVE using protocol revenue it generates from its lending markets

Being used a form of payment is not really a goal with the token, that was never the point

The token not only grants holders voting rights within the Aave DAO, and therefore its treasury

But Aave is using its revenue to engage in buybacks of $AAVE using protocol revenue it generates from its lending markets

Being used a form of payment is not really a goal with the token, that was never the point

Another example would be $HYPE, which has become the poster child example of how a revenue-generating protocol returns value to token holders

Hundreds of millions of dollars in revenue has been used to buyback $HYPE off the market and put into an "Assistance Fund"

$HYPE has a payment use case as a gas token, but its not the primary focus of investors or where its market value comes from

Hundreds of millions of dollars in revenue has been used to buyback $HYPE off the market and put into an "Assistance Fund"

$HYPE has a payment use case as a gas token, but its not the primary focus of investors or where its market value comes from

And what makes crypto so special?

These classifications are not black and white!

Most crypto tokens have some properties of both "payment currencies" and "protocol equity"

This is what fuels endless debates, as people argue which properties are more important to focus on

These classifications are not black and white!

Most crypto tokens have some properties of both "payment currencies" and "protocol equity"

This is what fuels endless debates, as people argue which properties are more important to focus on

For example $ETH is used for gas fee payments and increasingly being seen as a SoV, but revenue also accuses to token holders through staking rewards and a burn mechanism

This has lead to some instances of an identity crisis, latest being just earlier this year, but it's really a mixture of both

With the "payment currency" (read: SoV asset) angle increasing in importance / mindshare over time

This has lead to some instances of an identity crisis, latest being just earlier this year, but it's really a mixture of both

With the "payment currency" (read: SoV asset) angle increasing in importance / mindshare over time

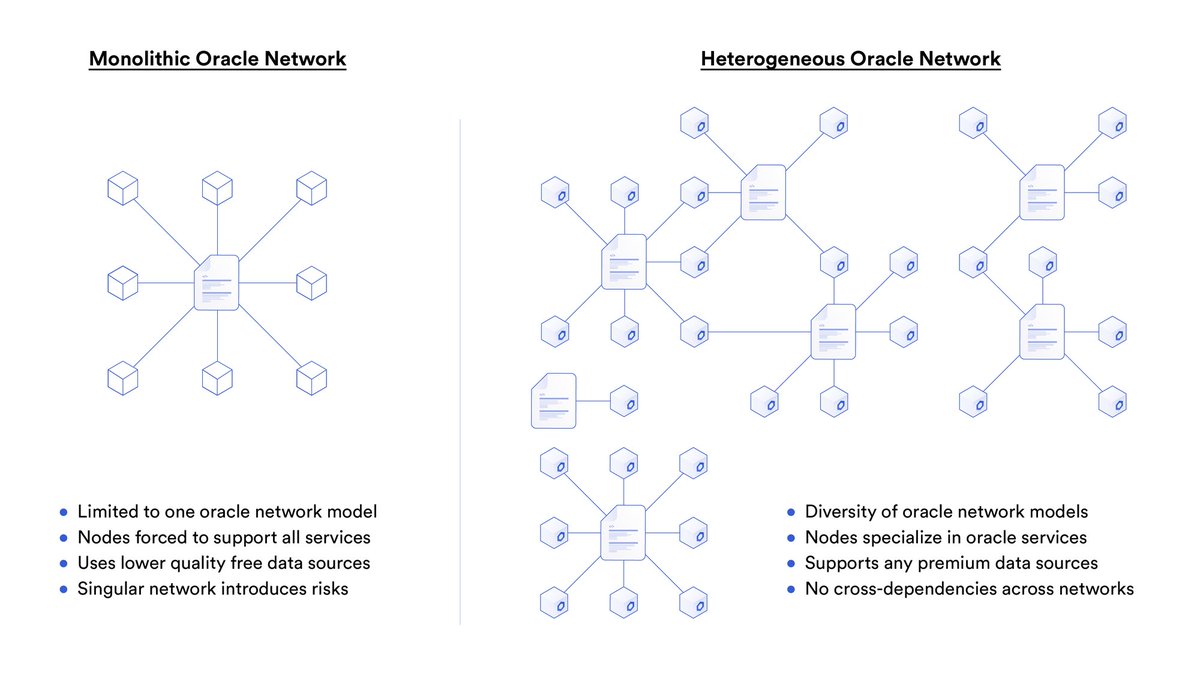

Another example would be $LINK

The token used by users to pay for oracle services as the network's native payment currency

While at the same time, onchain + offchain revenue is being used to buyback the token to grow a strategic reserve

There's also staking which will accrue value via staking rewards

Volatility with payments is solved by allowing users to pay fees in their preferred form of payment, which is programmatically converted to LINK on the backend (driving both payment utility and the buyback mechanism)

The token used by users to pay for oracle services as the network's native payment currency

While at the same time, onchain + offchain revenue is being used to buyback the token to grow a strategic reserve

There's also staking which will accrue value via staking rewards

Volatility with payments is solved by allowing users to pay fees in their preferred form of payment, which is programmatically converted to LINK on the backend (driving both payment utility and the buyback mechanism)

Is either category of crypto asset taking the "correct" or "wrong" approach?

Not really, every token is different with different proportions of "payment currency" and "protocol equity" properties are most important for that asset

That makes 1:1 comparisons difficult as the method to value accrual is not always the same

Not really, every token is different with different proportions of "payment currency" and "protocol equity" properties are most important for that asset

That makes 1:1 comparisons difficult as the method to value accrual is not always the same

But ultimately what does matter, and has proven to matter, is that the protocol is widely adopted for its defined use case

Whether that's strictly being a SoV alternative to fiat currency or being a infrastructure platform for enabling advanced blockchain apps

Whether that's strictly being a SoV alternative to fiat currency or being a infrastructure platform for enabling advanced blockchain apps

So if you see people knocking some token for not having enough payment utility, it's probably because those holders believe its more of a protocol equity asset

Or if you see people knocking some token for not generating fees, it's probably because its holders see it as more of a payment currency

They could be misclassifying the asset, that's up for you to decide

Or if you see people knocking some token for not generating fees, it's probably because its holders see it as more of a payment currency

They could be misclassifying the asset, that's up for you to decide

Your goal as an investor is to understand the market landscape and the different types of protocols and crypto assets that exist

And make your own determination for which protocol is well positioned to become widely adopted and see that value accrued to the token in some manner

And make your own determination for which protocol is well positioned to become widely adopted and see that value accrued to the token in some manner

• • •

Missing some Tweet in this thread? You can try to

force a refresh