How to get URL link on X (Twitter) App

With "payment currency" assets, you have cryptocurrencies in the most literal sense of the word

With "payment currency" assets, you have cryptocurrencies in the most literal sense of the word

TL;DR

TL;DR

https://twitter.com/lauren_dowling_/status/1758985684340322656

• Bitcoin as a Dominant Asset Class

• Bitcoin as a Dominant Asset Class

https://twitter.com/Shoalresearch/status/1736811526458421378Note that there’s four+ layers of risk

Oracles connect blockchains to external systems, enabling them to execute based on inputs/outputs from the real world

Oracles connect blockchains to external systems, enabling them to execute based on inputs/outputs from the real world

Arta TechFin (HKSE: 0279) is a hybrid financial (HyFi) platform bridging traditional finance with blockchain-based financial system via technology innovations

Arta TechFin (HKSE: 0279) is a hybrid financial (HyFi) platform bridging traditional finance with blockchain-based financial system via technology innovations

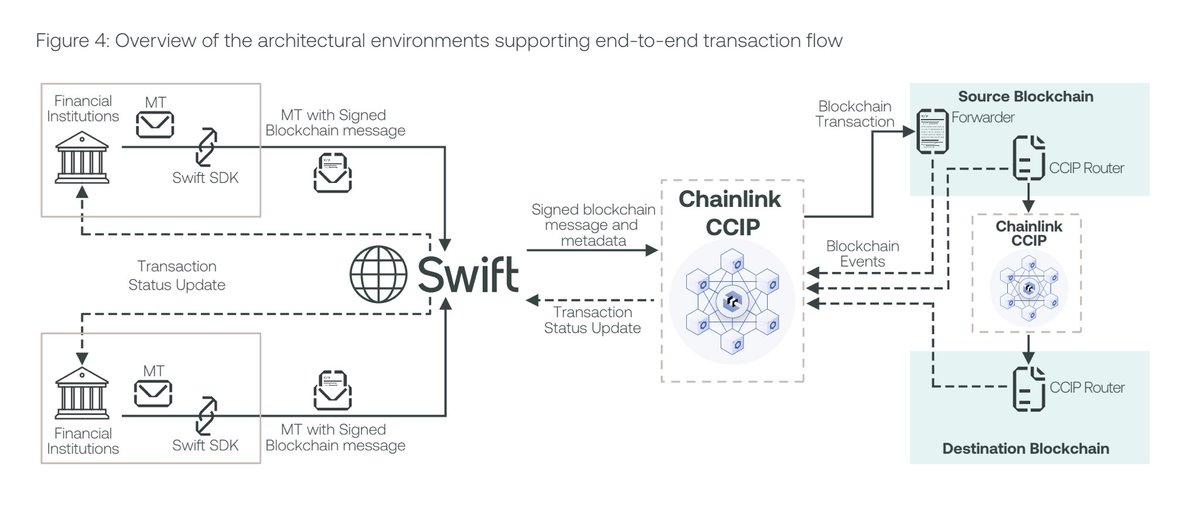

The Society for Worldwide Interbank Financial Telecommunications (@swiftcommunity) on using CCIP for interoperability

The Society for Worldwide Interbank Financial Telecommunications (@swiftcommunity) on using CCIP for interoperability

Participants in the collaboration includes DTCC, Clearstream, Euroclear, Citi, BNY Mellon, BNP Paribas, Lloyds, ANZ Bank, SDX, and more

Participants in the collaboration includes DTCC, Clearstream, Euroclear, Citi, BNY Mellon, BNP Paribas, Lloyds, ANZ Bank, SDX, and morehttps://twitter.com/ChainLinkGod/status/1683232386438565889

1. $PYUSD shows there is clear demand from financial services companies to tokenize assets on blockchains

1. $PYUSD shows there is clear demand from financial services companies to tokenize assets on blockchains

2/ The Society for Worldwide Interbank Financial Telecommunication (Swift) is the primary interbank messaging network for financial institutions globally

2/ The Society for Worldwide Interbank Financial Telecommunication (Swift) is the primary interbank messaging network for financial institutions globally

CCIP is on-track for mainnet early access launch this summer, with general availability planned for later this year

CCIP is on-track for mainnet early access launch this summer, with general availability planned for later this year

Web3 represents a global movement focused on replacing prone-to-failure trusted intermediaries with decentralized trust-minimized infrastructure

Web3 represents a global movement focused on replacing prone-to-failure trusted intermediaries with decentralized trust-minimized infrastructure

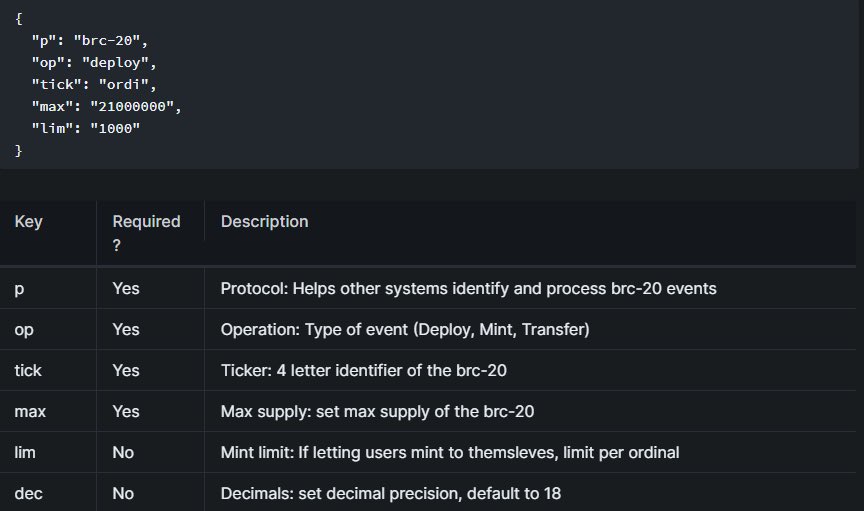

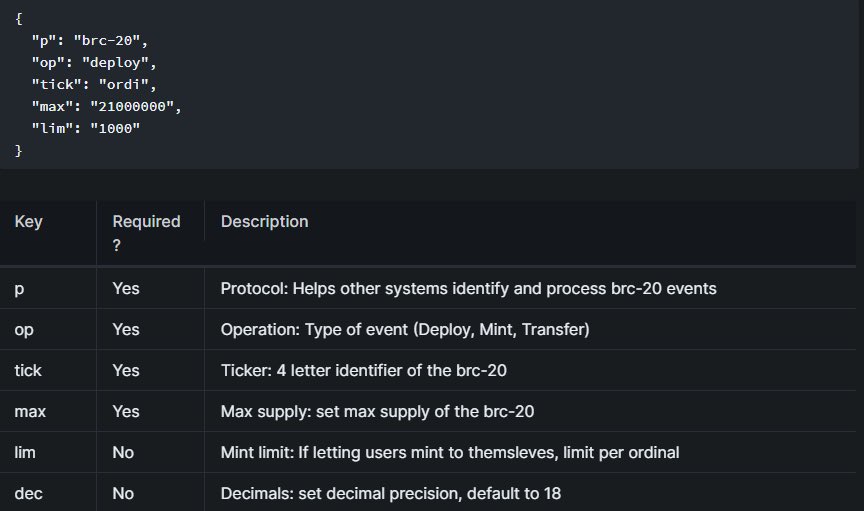

You can get a sense of the very high quality BRC20 tokens that are currently being traded here

You can get a sense of the very high quality BRC20 tokens that are currently being traded here

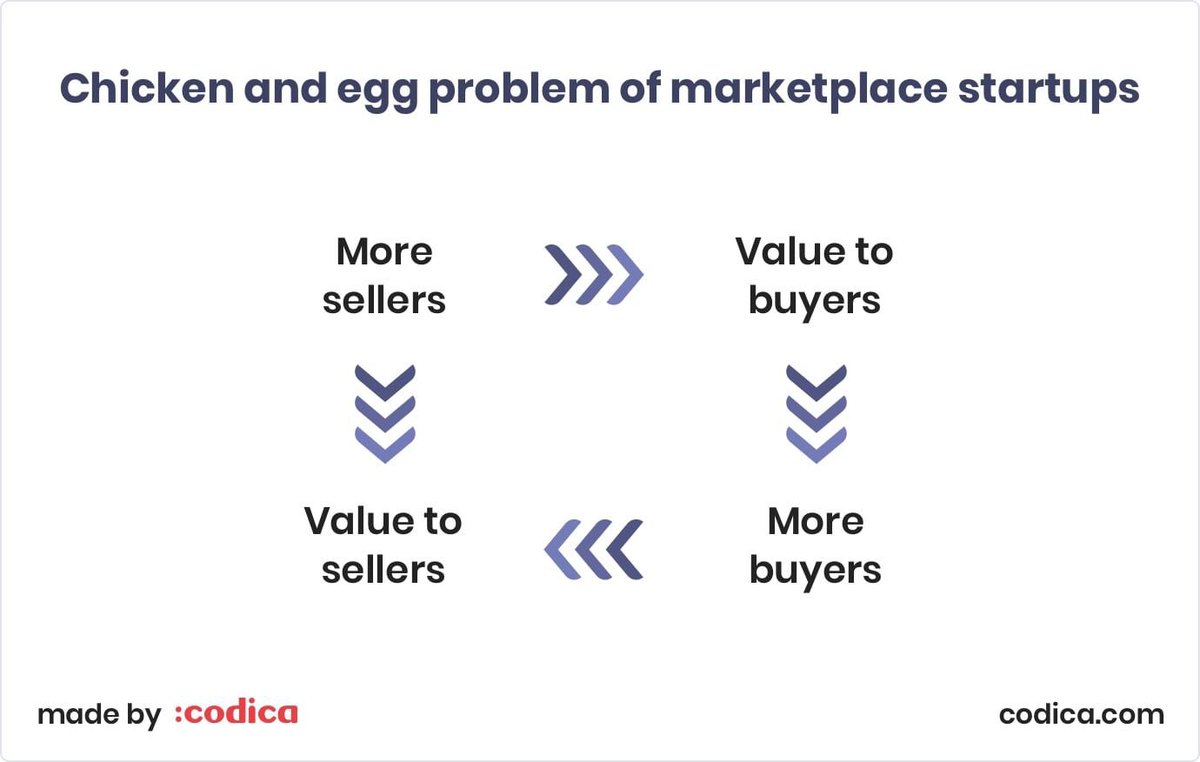

Tokens solve the chicken or egg problem

Tokens solve the chicken or egg problem