Tom Engle has lived off of his portfolio for 40 years (!!!)

How? He's an incredible investor with a BRILLIANT cash management strategy.

Here's exactly how it works (step by step):

How? He's an incredible investor with a BRILLIANT cash management strategy.

Here's exactly how it works (step by step):

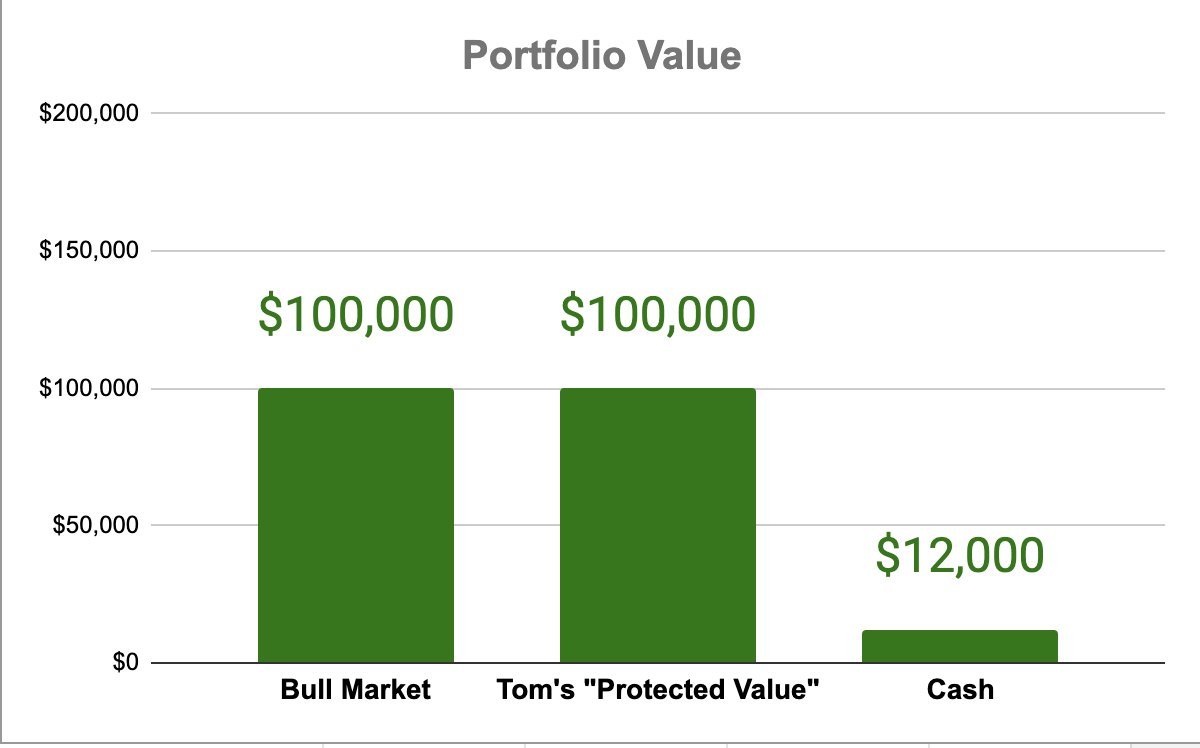

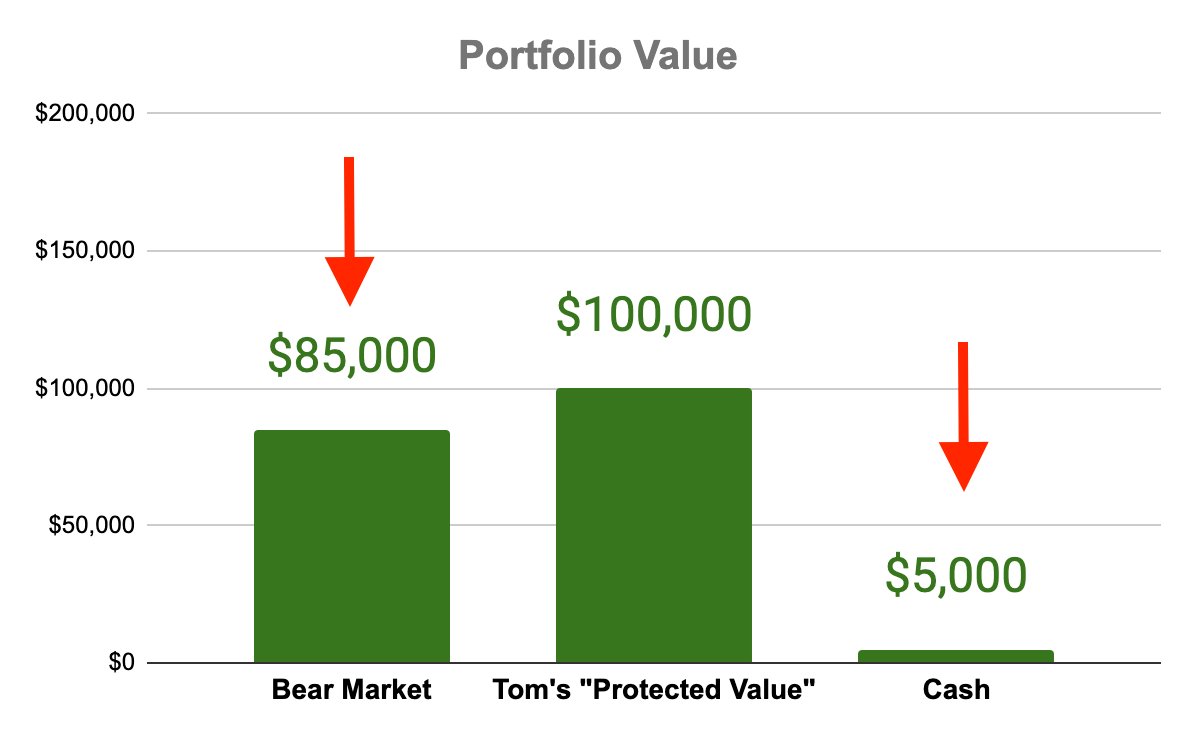

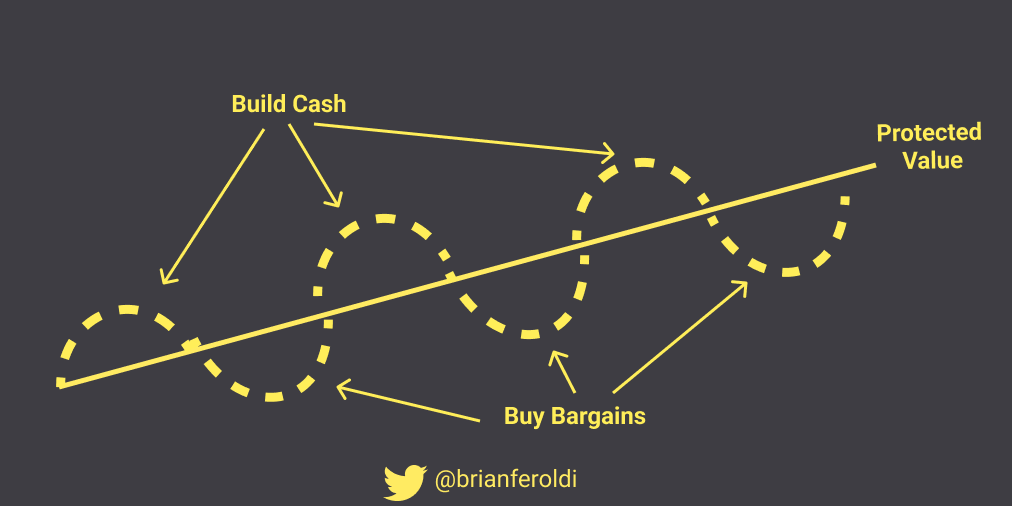

Let's say Tom's portfolio is worth $100,000 in the middle of a bull market.

Tom is happy with this number and wants to protect it.

He mentally calls this $100,000 his "protected value."

All his cash management decisions are based on this number.

Tom is happy with this number and wants to protect it.

He mentally calls this $100,000 his "protected value."

All his cash management decisions are based on this number.

Tom always keeps an eye on the macro and has a feel for if the market is:

▪️Under-valued

▪️Fairly-valued

▪️Over-valued

Tom keeps ~12% of his "protected value" in cash in a fairly-valued market.

That's $12,000

▪️Under-valued

▪️Fairly-valued

▪️Over-valued

Tom keeps ~12% of his "protected value" in cash in a fairly-valued market.

That's $12,000

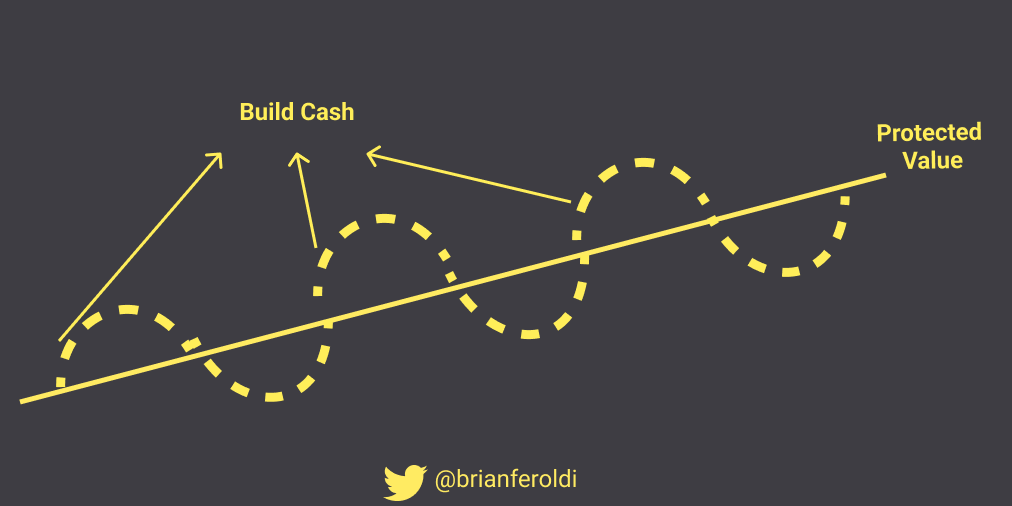

Let's say the bull market continues.

Tom's portfolio continues to grow.

He trims some of his holdings as valuations expand and his net worth grows.

Tom's portfolio continues to grow.

He trims some of his holdings as valuations expand and his net worth grows.

If valuations continue to expand, Tom can't find any stocks trading at bargain prices.

He concludes the market is over-valued.

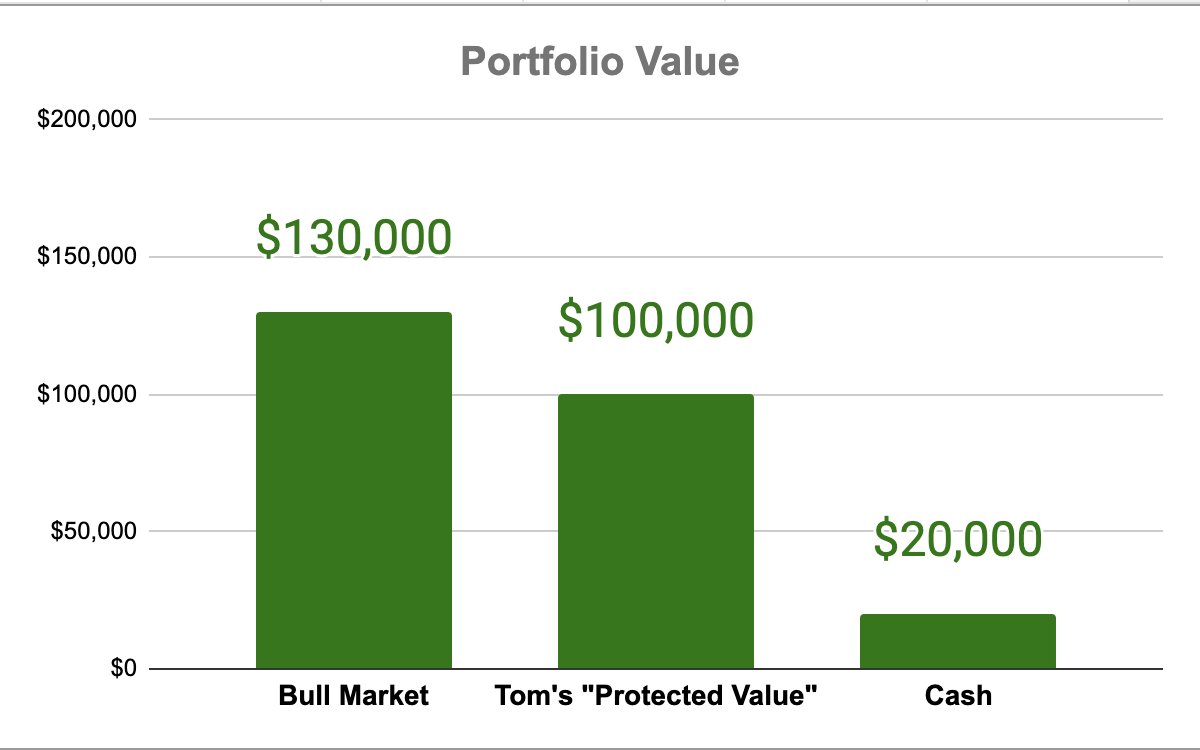

Let's say Tom's portfolio is worth $130,000 at that point.

He'd continue to trim & build cash, but he stops at 20% of the "protected value" ($20,000)

He concludes the market is over-valued.

Let's say Tom's portfolio is worth $130,000 at that point.

He'd continue to trim & build cash, but he stops at 20% of the "protected value" ($20,000)

Join @Brian_Stoffel_ for a free masterclass tomorow at noon EST:

How a Writing Teacher Beat Wall Street (and You Can Too)

RSVP: longtermmindset.co/teacher

How a Writing Teacher Beat Wall Street (and You Can Too)

RSVP: longtermmindset.co/teacher

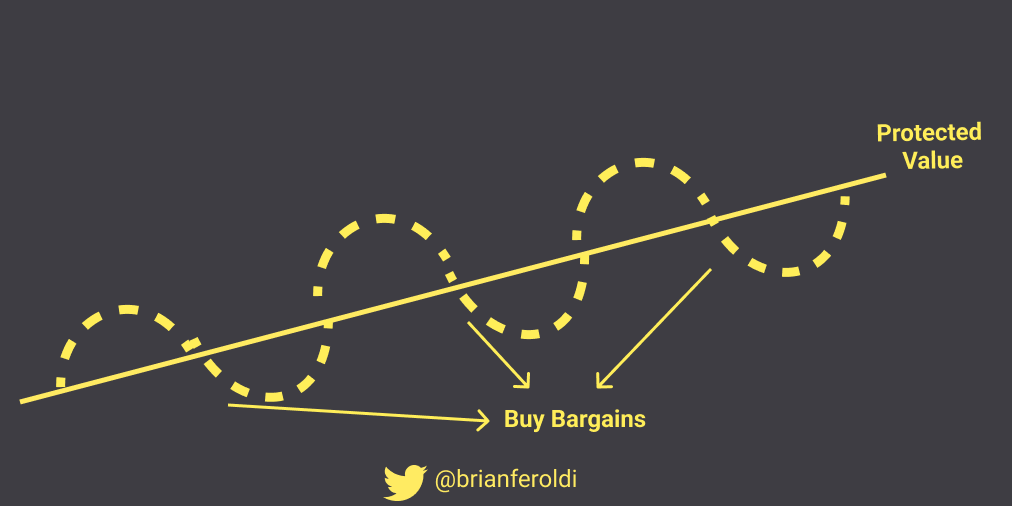

@Brian_Stoffel_ The bull market eventually stalls out.

Prices start to fall. Tom noticed bargains are beginning to appear.

Tom slowly buys back his favorite stocks at "better and better valuations" as prices begin to favor buyers.

Prices start to fall. Tom noticed bargains are beginning to appear.

Tom slowly buys back his favorite stocks at "better and better valuations" as prices begin to favor buyers.

@Brian_Stoffel_ Tom continues to buy more as valuations improve.

Tom is OK with his portfolio value falling hard, even below his "protected value."

If that happens, he knows he's buying TONS of bargains.

Tom is OK with his portfolio value falling hard, even below his "protected value."

If that happens, he knows he's buying TONS of bargains.

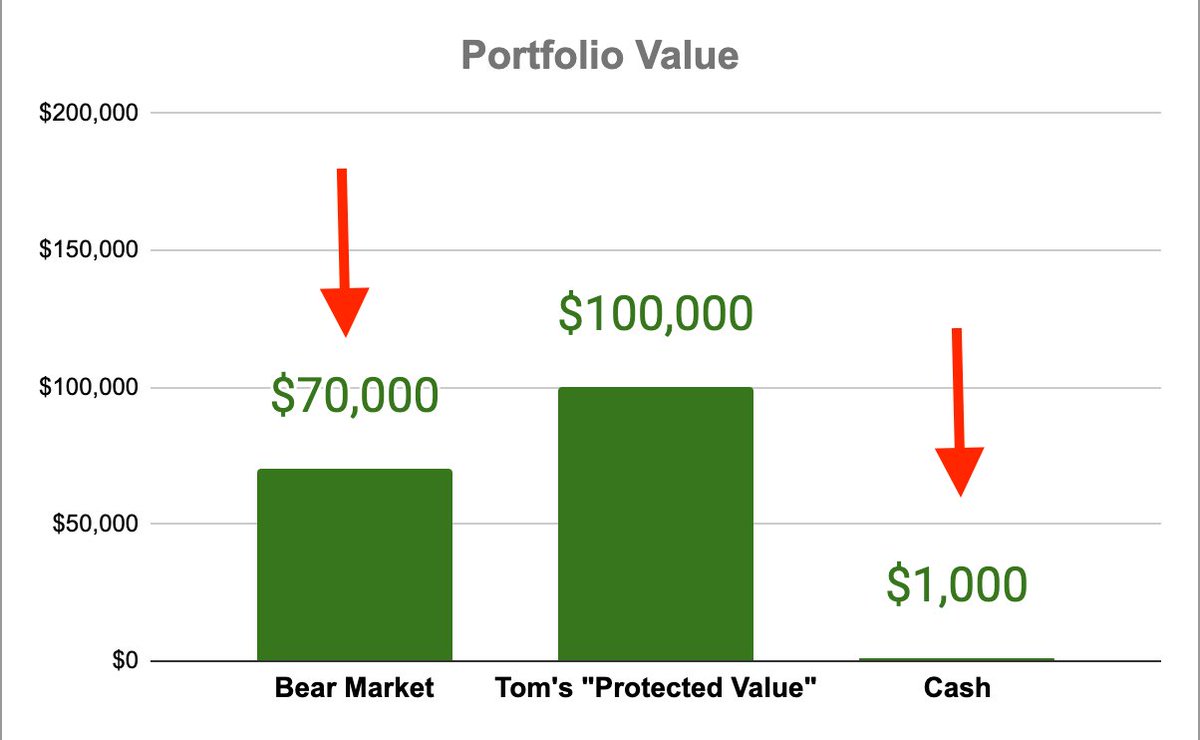

@Brian_Stoffel_ Let's say the bear market is awful, like 2008 or 2020.

Tom's portfolio falls to $70,000, below his $100,000 protected value.

At that point, bargains are everywhere. He'd know the market is under-valued.

He'd drop his cash position to as low as 1% of the protected value.

Tom's portfolio falls to $70,000, below his $100,000 protected value.

At that point, bargains are everywhere. He'd know the market is under-valued.

He'd drop his cash position to as low as 1% of the protected value.

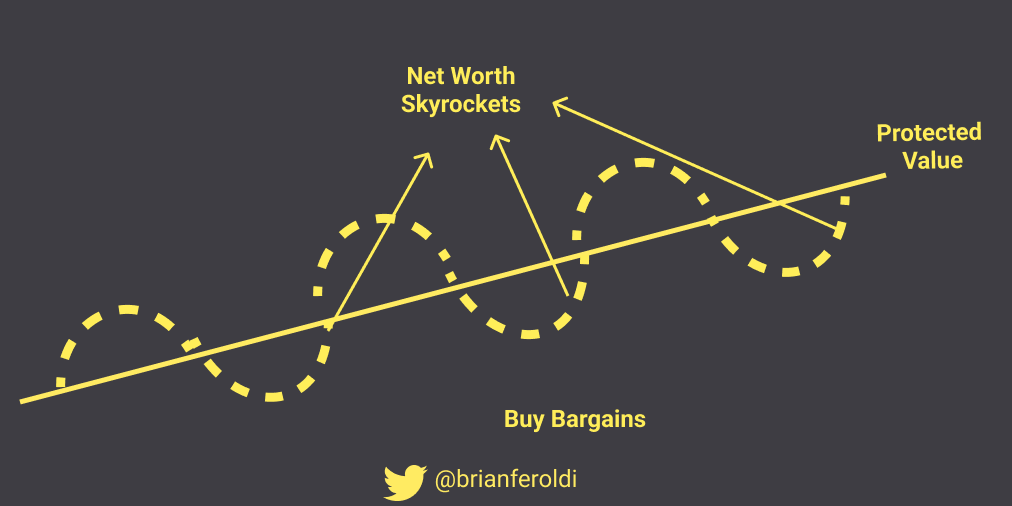

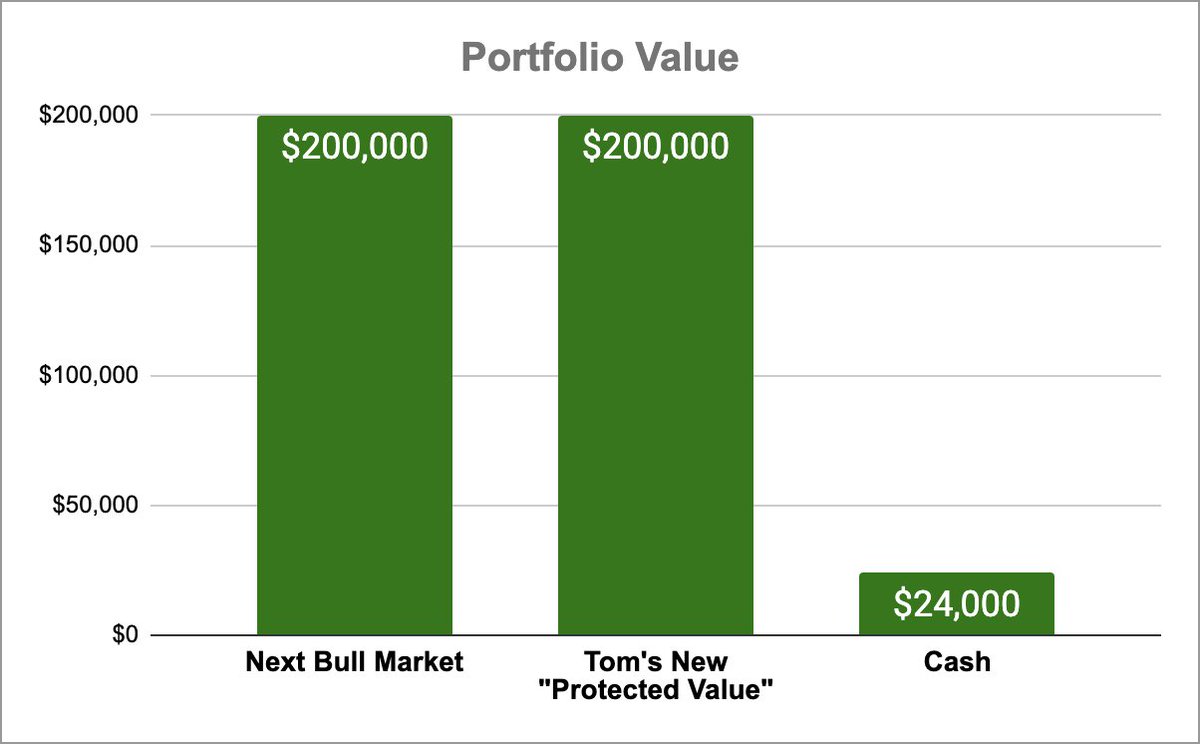

@Brian_Stoffel_ Eventually, the bear market ends, and the next bull market starts.

Tom's returns skyrocket, especially from his bargain purchases when his portfolio was below $100,000.

He slowly rebuilds his cash position as valuations expand.

Tom's returns skyrocket, especially from his bargain purchases when his portfolio was below $100,000.

He slowly rebuilds his cash position as valuations expand.

@Brian_Stoffel_ Within 3 to 5 years, he expects his portfolio to double to $200,000, powered by his bargain buying during the bear market.

Once he feels the market is "fairly valued" again, he creates a new "protected value."

His cash balance target is now $24,000 -- 12% of the $200,000

Once he feels the market is "fairly valued" again, he creates a new "protected value."

His cash balance target is now $24,000 -- 12% of the $200,000

@Brian_Stoffel_ Tom rinses and repeats for each market cycle (every 5-10 years).

He builds cash when valuations are high.

He buys bargains when valuations are low.

He steadily increases his "protected value" when the market is fairly valued.

He builds cash when valuations are high.

He buys bargains when valuations are low.

He steadily increases his "protected value" when the market is fairly valued.

@Brian_Stoffel_ Tom believes cash management is incredibly important.

The stock market is volatile. This strategy allows his cash position to "grow at the same rate as my portfolio."

It helps to take advantage of the inevitable volatility,

The stock market is volatile. This strategy allows his cash position to "grow at the same rate as my portfolio."

It helps to take advantage of the inevitable volatility,

@Brian_Stoffel_ The example above is an exaggerated bull/bear market.

Tom's cash balance has only been <1% once (Feb 2009).

And it's rare for it to be >20% (it was in Jan 2023).

Tom usually keeps between 5% and 15% of the projected value in cash during "normal" market fluctuations.

Tom's cash balance has only been <1% once (Feb 2009).

And it's rare for it to be >20% (it was in Jan 2023).

Tom usually keeps between 5% and 15% of the projected value in cash during "normal" market fluctuations.

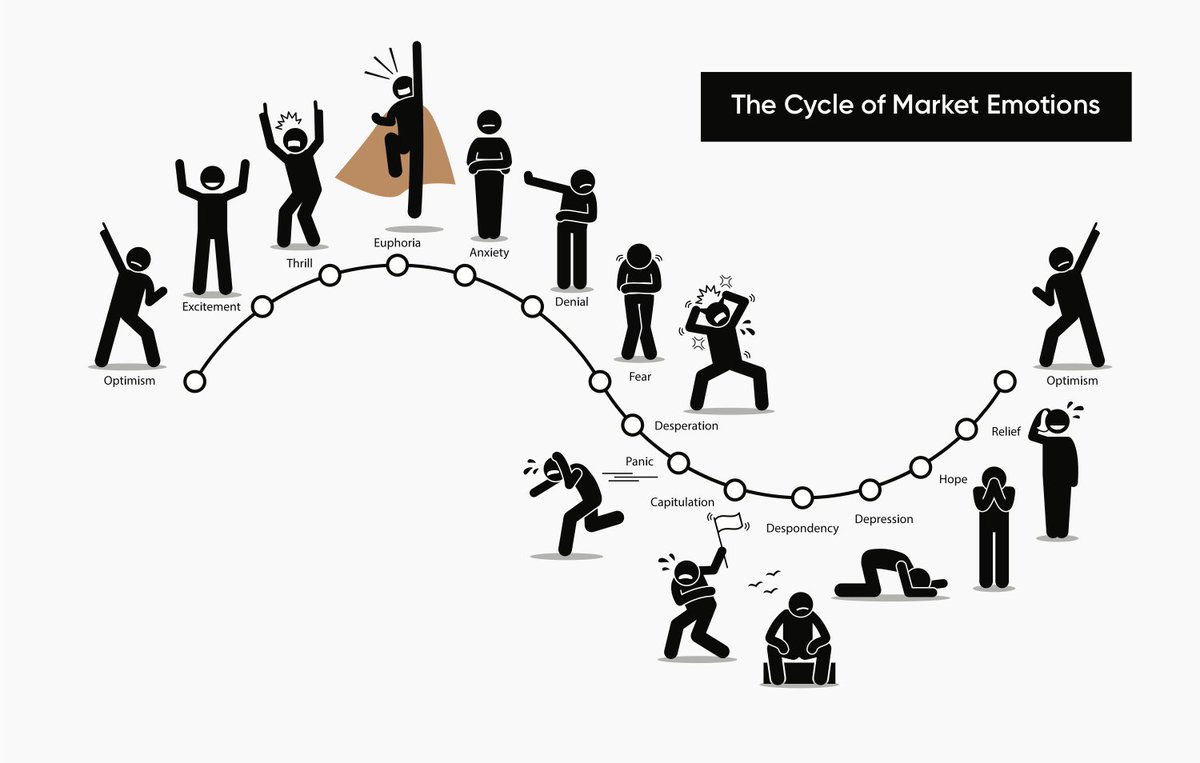

@Brian_Stoffel_ I love Tom's mental model of a "protected value."

It gives him a firm cash target to focus on.

Focusing on the "protected value" makes it easier to handle the cycle of market emotions.

It gives him a firm cash target to focus on.

Focusing on the "protected value" makes it easier to handle the cycle of market emotions.

@Brian_Stoffel_ Like any investing strategy, the theory is easy to understand.

But, putting the strategy into practice is HARD.

Still, I find tremendous value in studying the strategies of successful investors like Tom.

But, putting the strategy into practice is HARD.

Still, I find tremendous value in studying the strategies of successful investors like Tom.

@Brian_Stoffel_ Thanks, Tom, for being a fountain of investing wisdom and for dropping gem quotes like this:

@Brian_Stoffel_ Tom's strategy shows that individual investors MUST understand valuation.

Join @Brian_Stoffel_ for a free masterclass tomorow at noon EST:

How a Writing Teacher Beat Wall Street (and You Can Too)

RSVP: longtermmindset.co/teacher

Join @Brian_Stoffel_ for a free masterclass tomorow at noon EST:

How a Writing Teacher Beat Wall Street (and You Can Too)

RSVP: longtermmindset.co/teacher

@Brian_Stoffel_ If you enjoyed it, follow me @BrianFeroldi.

I demystify the stock market.

Want to share it with your audience?

♻️ Retweet the first tweet below:

I demystify the stock market.

Want to share it with your audience?

♻️ Retweet the first tweet below:

https://twitter.com/61558281/status/1955208489694801979

• • •

Missing some Tweet in this thread? You can try to

force a refresh