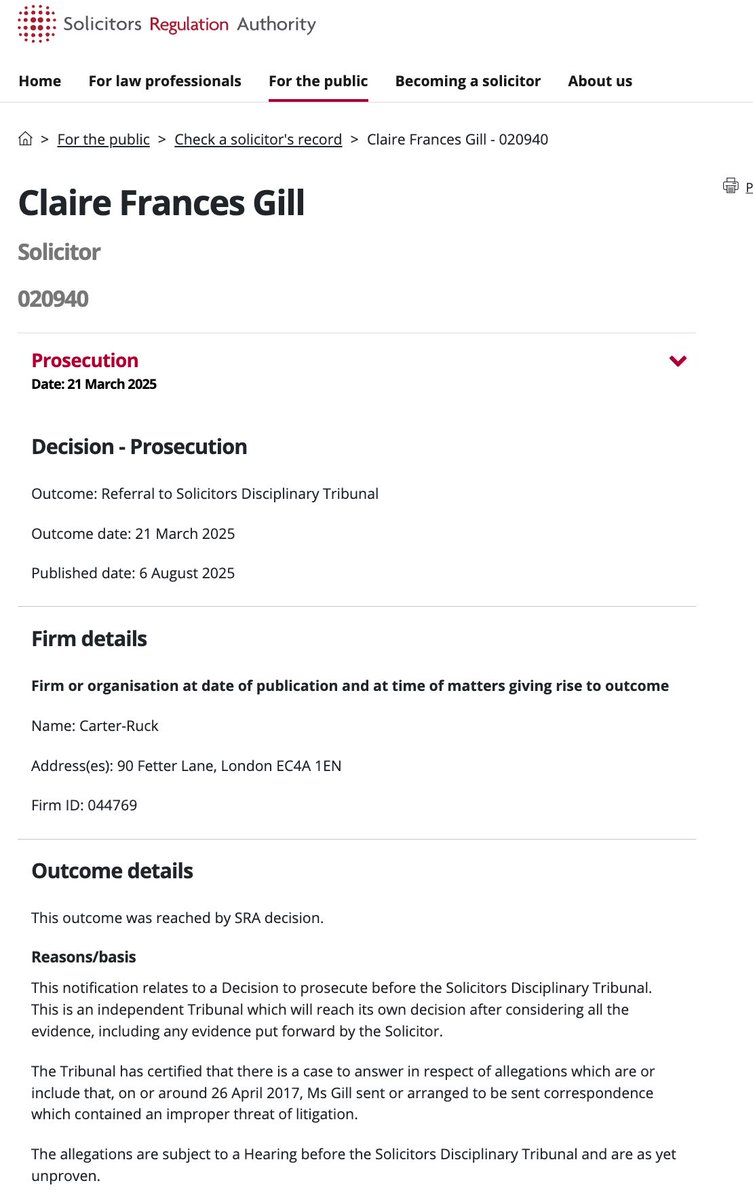

Just a reminder that an individual's national insurance payments do not fund their State pension.

The average person's national insurance payments cover about half the cost of their state pension:

The average person's national insurance payments cover about half the cost of their state pension:

The table is from the Pensions Policy Institute

pensionspolicyinstitute.org.uk/media/1crf4ox5…

pensionspolicyinstitute.org.uk/media/1crf4ox5…

This doesn't mean the state pension is unaffordable, or that it's a Ponzi scheme - it's covered by taxation on a "pay as you go" basis in the same way as every other state pension scheme in the world.

It does mean that it's wrong to think national insurance is different and special. It's just tax.

It would be more honest if national insurance was just rolled into income tax. I'd do it on a cost-neutral basis: retired people on higher incomes would pay more tax, but people of working age would see a tax cut.

• • •

Missing some Tweet in this thread? You can try to

force a refresh