FTX victims are about to get 119% of their money back.

But they're not celebrating.

While they suffered for 2 years, someone else got rich off their pain.

And it wasn't Sam Bankman-Fried...

Here's how ONE organization turned tragedy into profit:🧵

But they're not celebrating.

While they suffered for 2 years, someone else got rich off their pain.

And it wasn't Sam Bankman-Fried...

Here's how ONE organization turned tragedy into profit:🧵

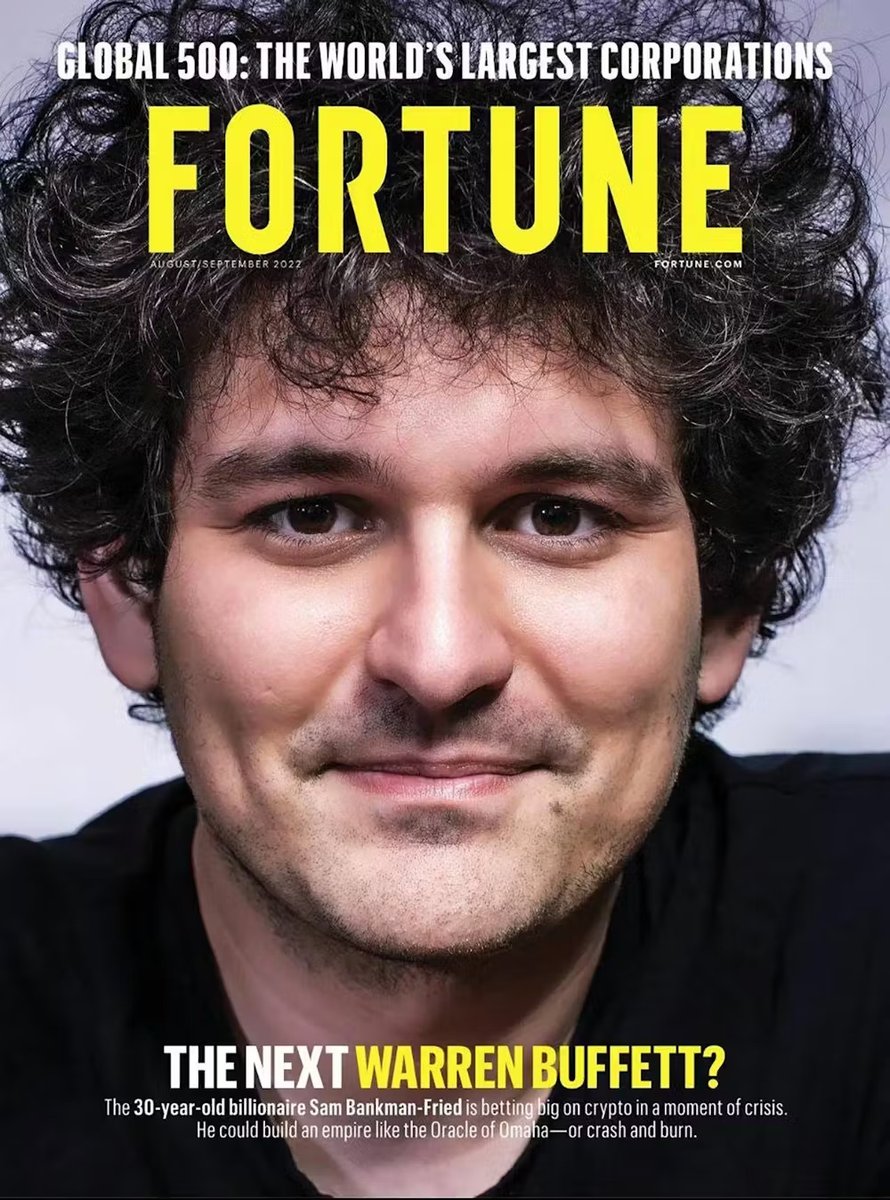

FTX was the crypto world's golden child.

- 3rd largest exchange by volume.

- Over 1 million users trusted it with their Bitcoin and Ethereum.

- Celebrity endorsements from Tom Brady and Stephen Curry.

A $32 billion valuation at its peak.

But who was the owner?

- 3rd largest exchange by volume.

- Over 1 million users trusted it with their Bitcoin and Ethereum.

- Celebrity endorsements from Tom Brady and Stephen Curry.

A $32 billion valuation at its peak.

But who was the owner?

Sam Bankman-Fried was the 30-year-old "crypto king."

MIT graduate turned billionaire overnight.

He promised "effective altruism", making money to save the world.

And even testified before Congress about crypto regulation.

But how did his scam actually work?

MIT graduate turned billionaire overnight.

He promised "effective altruism", making money to save the world.

And even testified before Congress about crypto regulation.

But how did his scam actually work?

Bankman-Fried secretly moved customer funds to his hedge fund, Alameda Research.

He used the money for:

- Risky crypto trades

- Political donations

- Luxury Bahamas real estate

- Personal loans to executives

Then he got exposed:

He used the money for:

- Risky crypto trades

- Political donations

- Luxury Bahamas real estate

- Personal loans to executives

Then he got exposed:

CoinDesk revealed Alameda's balance sheet was propped up by FTX's own token.

Rival exchange Binance announced they'd sell their FTX tokens.

Panic selling began immediately.

Customers rushed to withdraw their money.

Then it all came crashing down:

Rival exchange Binance announced they'd sell their FTX tokens.

Panic selling began immediately.

Customers rushed to withdraw their money.

Then it all came crashing down:

November 2022: FTX collapsed overnight.

FTX had only $900 million in liquid assets against $9 billion in liabilities.

The $8 billion customer funds were gone.

Sam Bankman-Fried resigned in disgrace.

Now there was a question:

How can all the lost money be recovered?

FTX had only $900 million in liquid assets against $9 billion in liabilities.

The $8 billion customer funds were gone.

Sam Bankman-Fried resigned in disgrace.

Now there was a question:

How can all the lost money be recovered?

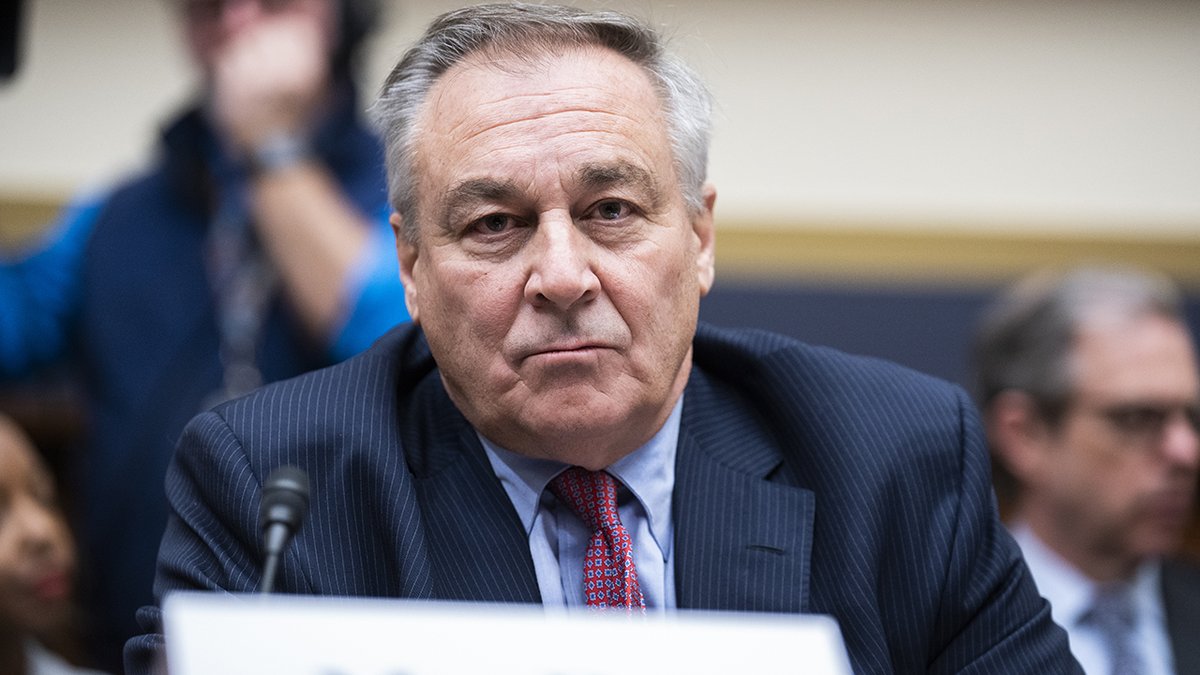

Enter John Ray III.

The same man who cleaned up Enron's mess.

His first discovery was shocking: FTX had only 0.1% of customer Bitcoin and 1.2% of Ethereum.

But buried in the chaos, he found something extraordinary:

The same man who cleaned up Enron's mess.

His first discovery was shocking: FTX had only 0.1% of customer Bitcoin and 1.2% of Ethereum.

But buried in the chaos, he found something extraordinary:

FTX wasn't just a crypto exchange.

It was a massive investment fund in disguise.

Bankman-Fried had secretly used customer money to buy stakes in:

- AI startup Anthropic

- 55.8 million Solana tokens

- Dozens of venture capital investments

How did they turn out?

It was a massive investment fund in disguise.

Bankman-Fried had secretly used customer money to buy stakes in:

- AI startup Anthropic

- 55.8 million Solana tokens

- Dozens of venture capital investments

How did they turn out?

In 2021, Bankman-Fried invested $500 million in the AI startup.

By 2024, that stake was worth $1.4 billion.

The bankruptcy team sold it for $884 million to Abu Dhabi's sovereign wealth fund.

One investment recovered nearly a billion dollars alone.

And the Solana surge?

By 2024, that stake was worth $1.4 billion.

The bankruptcy team sold it for $884 million to Abu Dhabi's sovereign wealth fund.

One investment recovered nearly a billion dollars alone.

And the Solana surge?

FTX held 55.8 million SOL tokens.

When the exchange collapsed, SOL was trading at $20.

By 2024, it hit $40 per token.

That single crypto holding added over $1 billion to the recovery fund.

When the exchange collapsed, SOL was trading at $20.

By 2024, it hit $40 per token.

That single crypto holding added over $1 billion to the recovery fund.

The legal team became financial detectives.

They traced money through:

- 130+ shell companies

- Offshore accounts in the Bahamas

- Luxury real estate purchases

- Political donations

- Personal investments

Every dollar was hunted down and clawed back.

The math was staggering:

They traced money through:

- 130+ shell companies

- Offshore accounts in the Bahamas

- Luxury real estate purchases

- Political donations

- Personal investments

Every dollar was hunted down and clawed back.

The math was staggering:

FTX owed customers: $11.2 billion

Recovery total: $16.5 billion

Surplus: $5.3 billion

For the first time in bankruptcy history, victims would get more than 100% back.

Plus 9% annual interest on their claims.

Recovery total: $16.5 billion

Surplus: $5.3 billion

For the first time in bankruptcy history, victims would get more than 100% back.

Plus 9% annual interest on their claims.

October 2024: Delaware Judge John Dorsey approved the plan.

"This is a model case for complex bankruptcy proceedings," he declared.

98% of customers with claims under $50,000 would get 119% back within 60 days.

The impossible had become reality.

"This is a model case for complex bankruptcy proceedings," he declared.

98% of customers with claims under $50,000 would get 119% back within 60 days.

The impossible had become reality.

Meanwhile, hedge funds made billions.

Distressed asset firms bought customer claims for 10-20 cents on the dollar.

When the 119% payout was announced, those claims became worth $1.19.

Most victims, desperate for cash, sold.

The math?

Distressed asset firms bought customer claims for 10-20 cents on the dollar.

When the 119% payout was announced, those claims became worth $1.19.

Most victims, desperate for cash, sold.

The math?

Buy a $100,000 claim for $20,000.

When the 119% payout was announced, that claim became worth $119,000.

That's a 495% return in under 2 years.

While victims got 19% above their loss.

Fair?

When the 119% payout was announced, that claim became worth $119,000.

That's a 495% return in under 2 years.

While victims got 19% above their loss.

Fair?

1. Follow @InsiderTrackers for more stories like this.

2. Retweet, like, and share the post so more people get aware of stories like this:

2. Retweet, like, and share the post so more people get aware of stories like this:

https://twitter.com/1872841572984758272/status/1955237888716836976

• • •

Missing some Tweet in this thread? You can try to

force a refresh